What I’m Seeing – September 2021

Confused by the conflicting headlines about whether our market is slowing down or heating up? I’m seeing both – a seasonal slowdown in certain areas/price points and continuing critical inventory shortage/multiple offers in others. August vs July statistics show a small reduction in the median price of homes on the Eastside, but inventory also decreased slightly. The percentage of homes selling above list price dropped from 73% to 68%. What does all this mean? Not much, since it’s impossible to tell if that small decrease was due to more sellers pricing their homes too high or an actual shift in the market. As I’ve mentioned before, August is when we typically see a temporary decline as many people take a last summer vacation and attention turns to preparing for the new school year.

What remains important is for buyers to make their offer as compelling as possible. How do you do that? It typically comes down to price and terms. Being able to pay more than the seller is asking is usually of primary importance, but there are other factors that can help tip the scale. Offering to pay a lot for a property isn’t the same as actually being able to do it, so crafting an offer that reassures the seller that the buyer can perform is critical. The offer could be a hundred thousand higher than the next best offer but if the buyer is making it dependent on conducting an inspection, selling their home, or getting a loan, there is little guarantee (for the seller) that the transaction will close. I have over 16 years of experience in structuring a winning offer that helps my buyers mitigate their risks but still prevail.

For sellers, the three Ps still apply – Preparation, Presentation, and Pricing. Homes that look ill-maintained do not sell quickly unless they are “fire sale” priced. It doesn’t usually take that much to get a home looking its best and I have trusted vendors for everything from landscaping to plumbing to painting. If cost is an issue, Windermere has a program that can provide the funds for qualified sellers. It’s worth the effort and expense of getting your home looking market-ready in order to get the best return. Presentation is also key – staging where possible and top-notch photography are critical. I work with the best in the business and I also have a dedicated graphics professional to promote your home on social media. Finally, there is pricing. This is another area where experience makes a difference. Even in this seller’s market, if a home is priced too high it will sit. Buyers often build in an escalation factor on top of the list price so if a seller prices at the top of the value range, buyers may assume the home will escalate higher and not bother to make an offer. I will work with you to find that sweet spot that will result in the best possible outcome.

What questions do you have about the market? I’d love to hear from you!

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

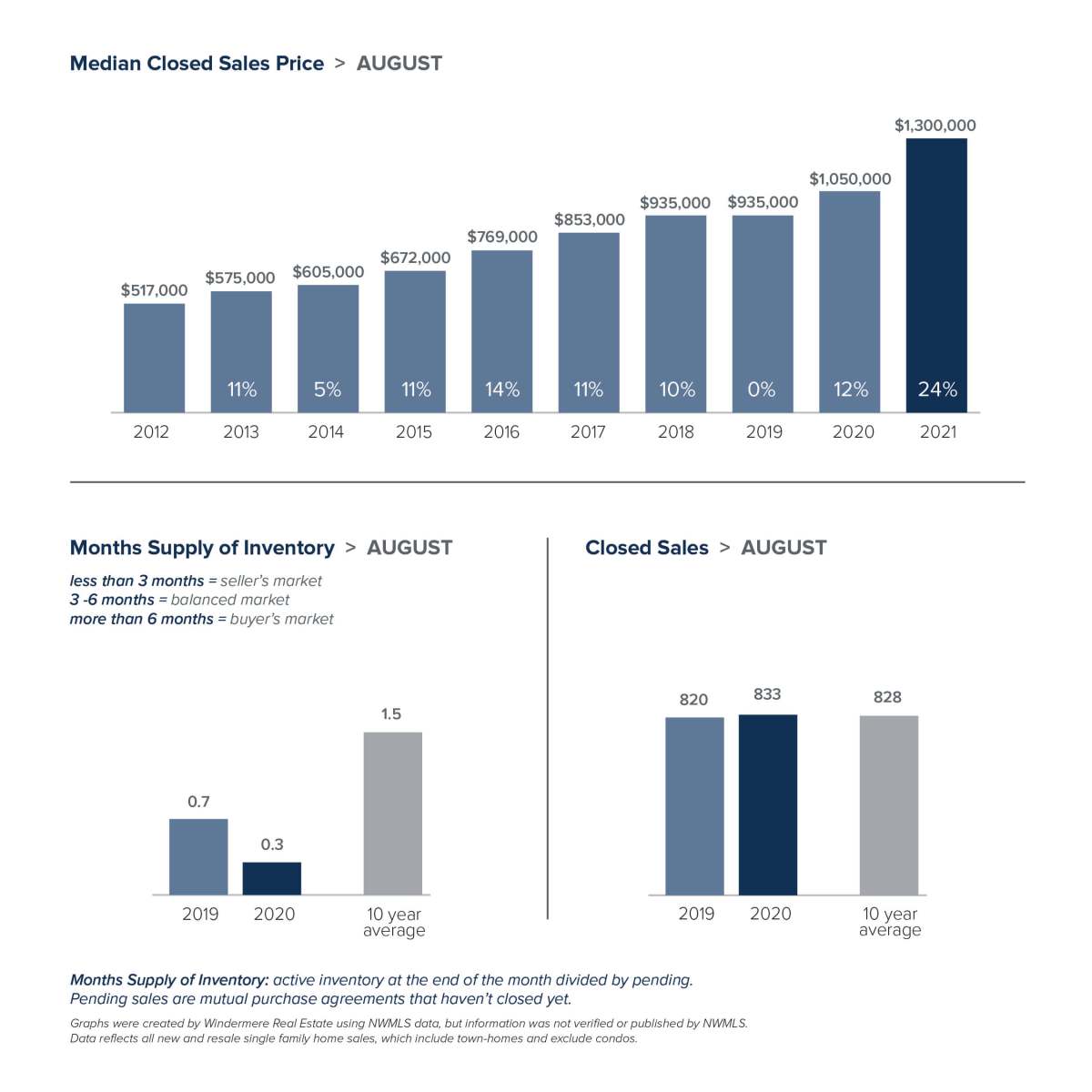

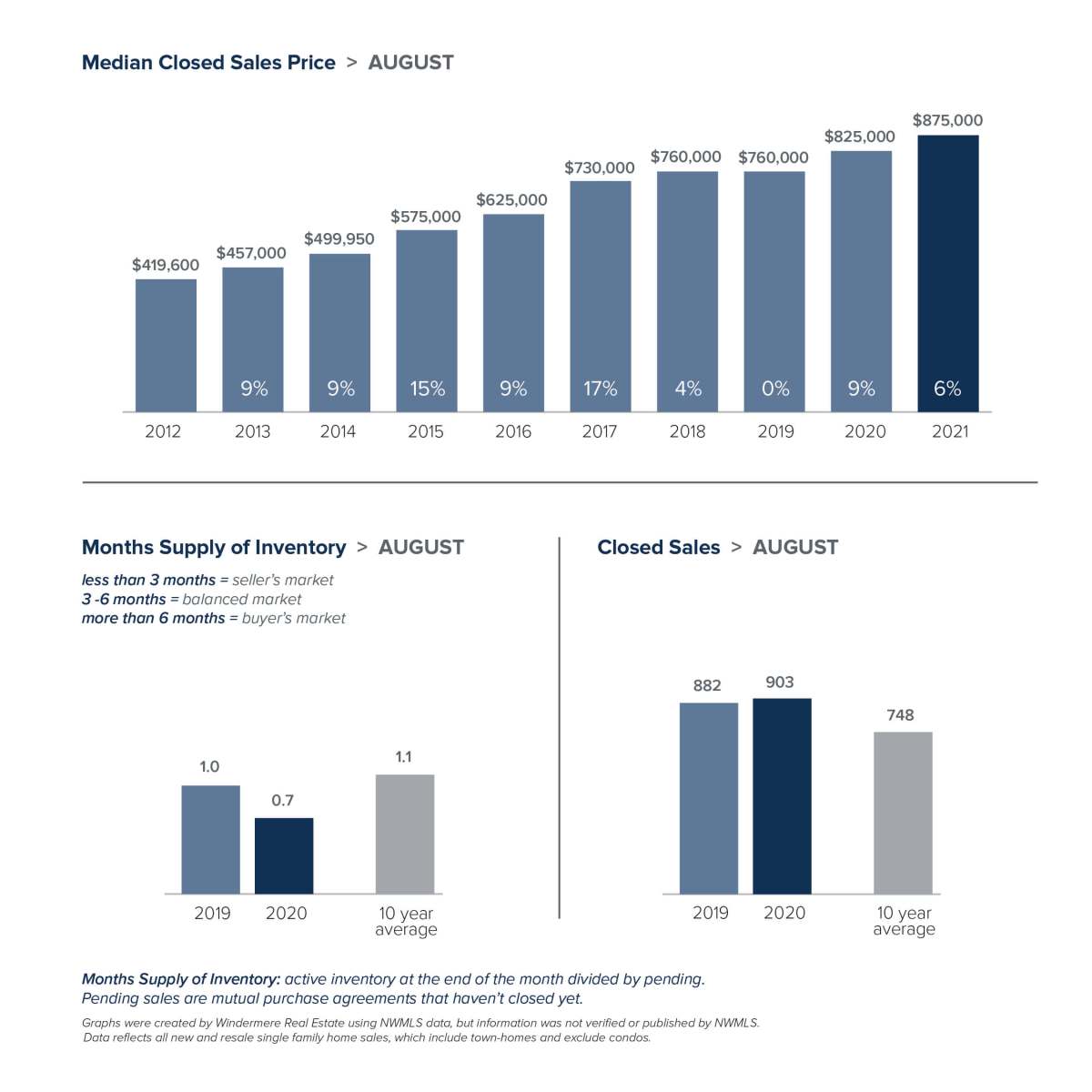

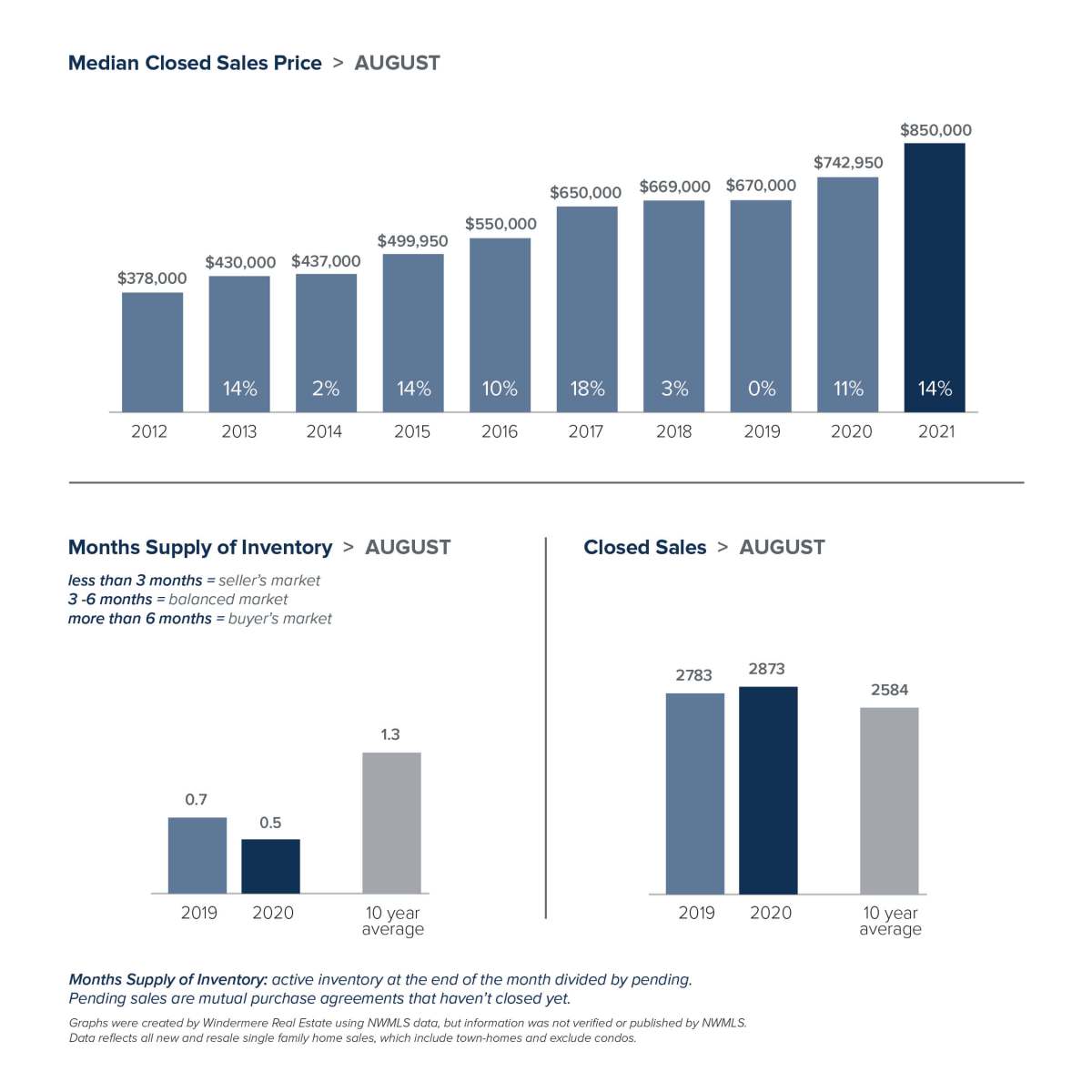

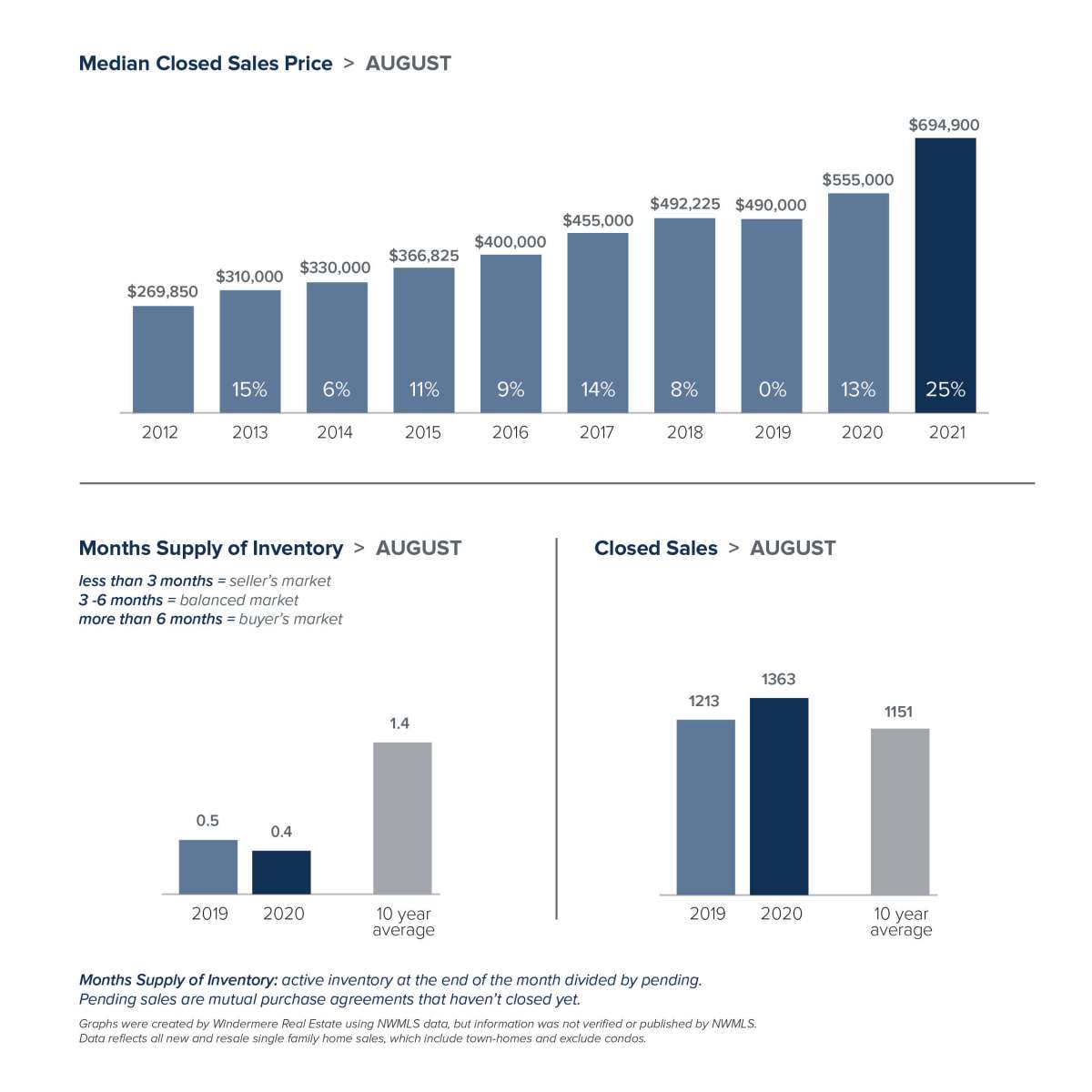

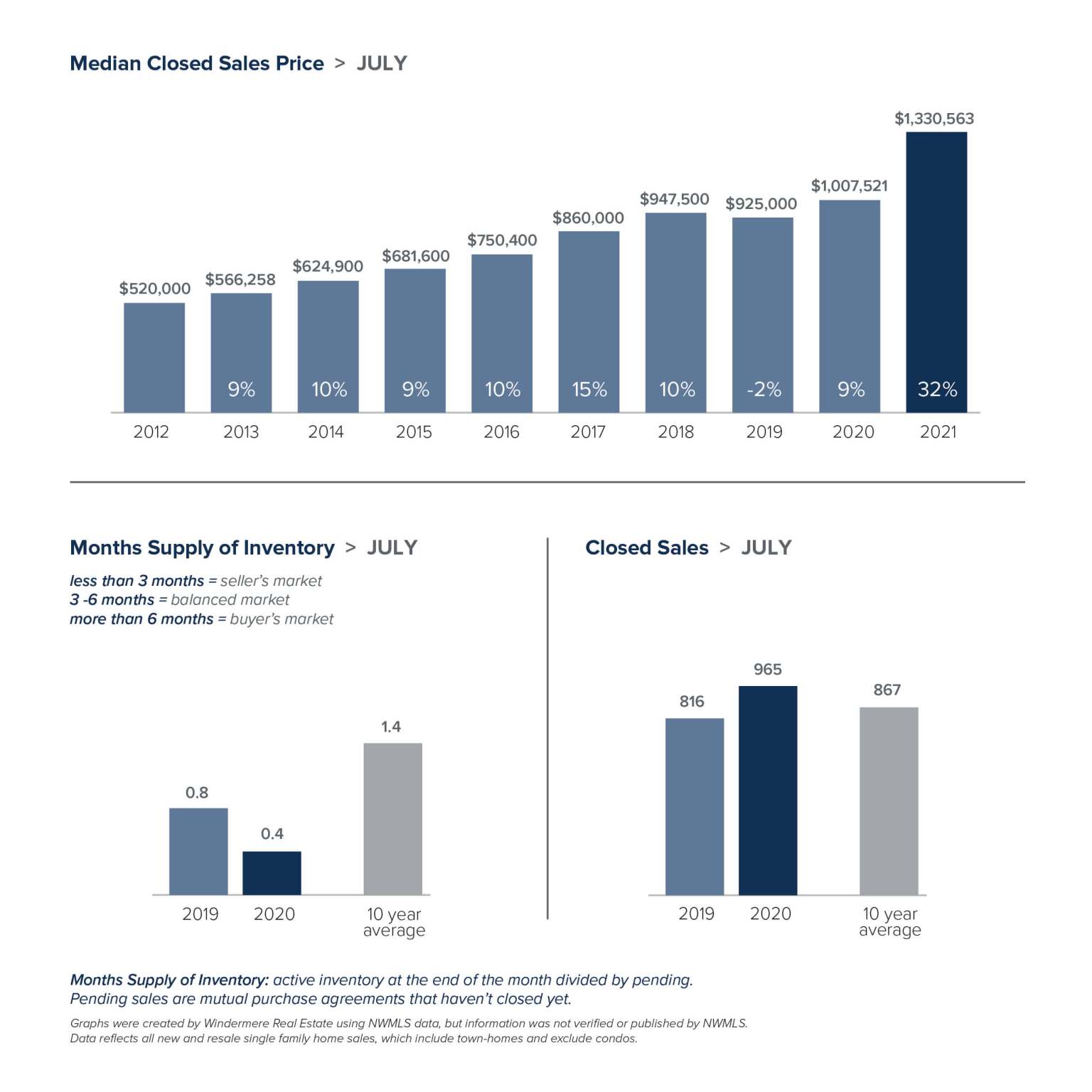

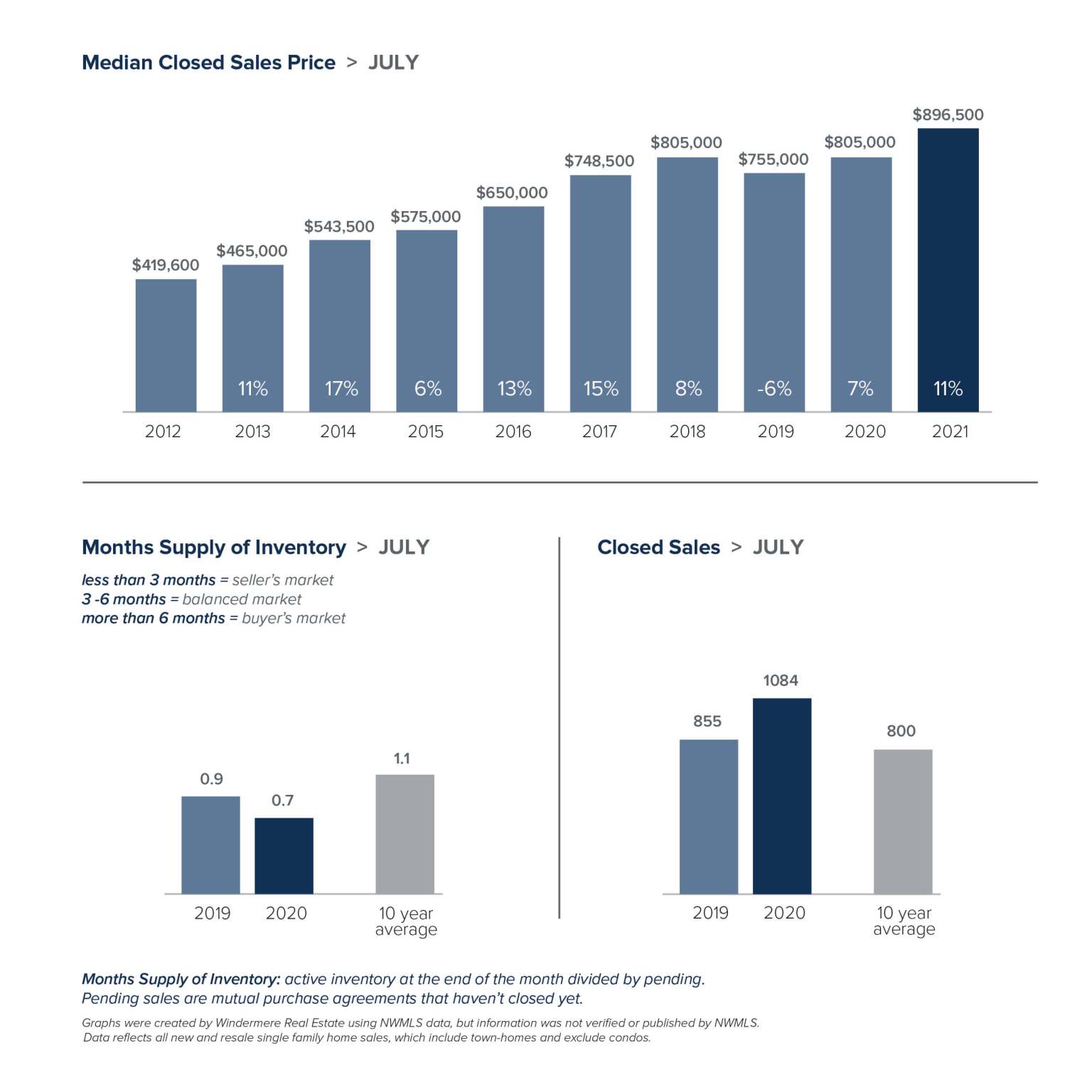

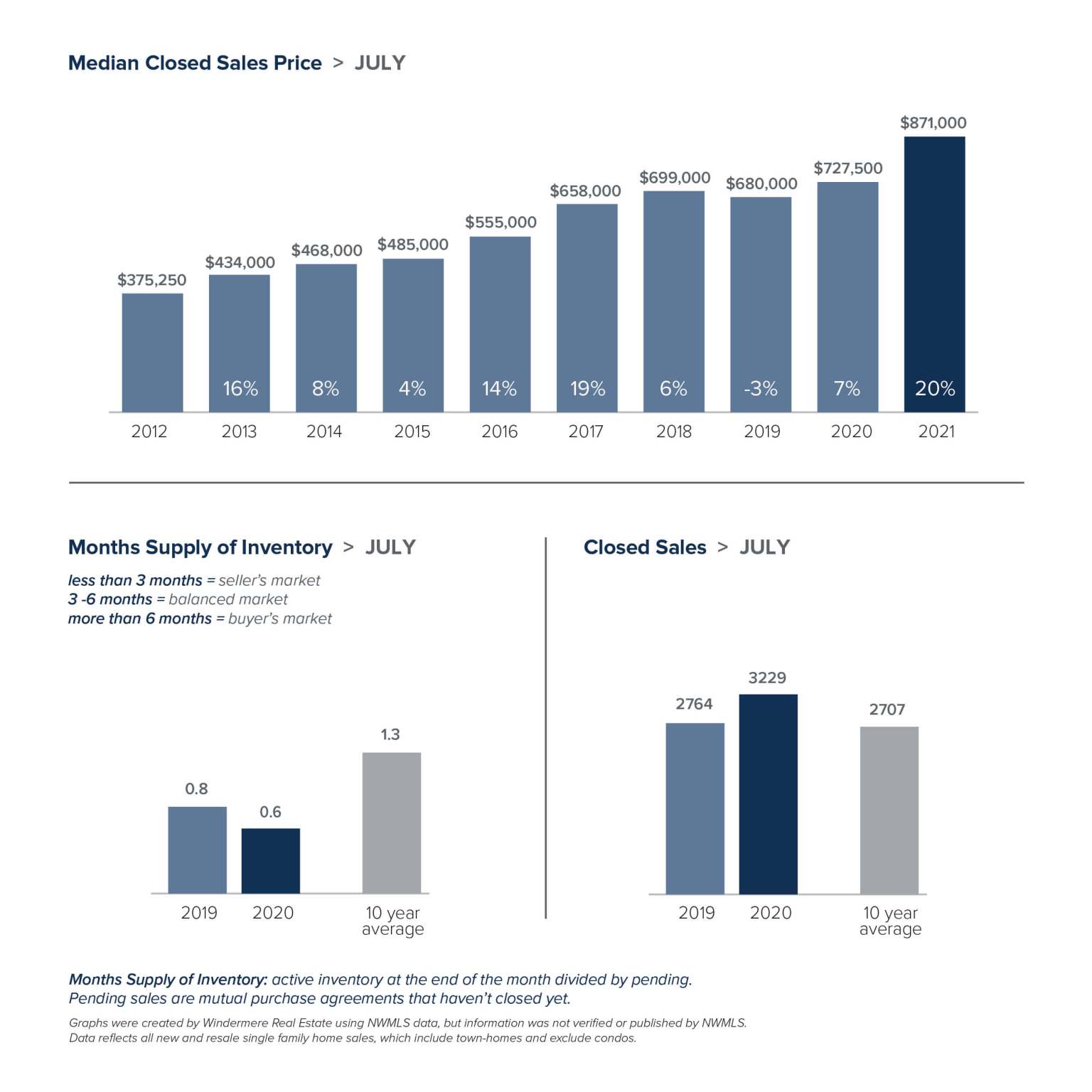

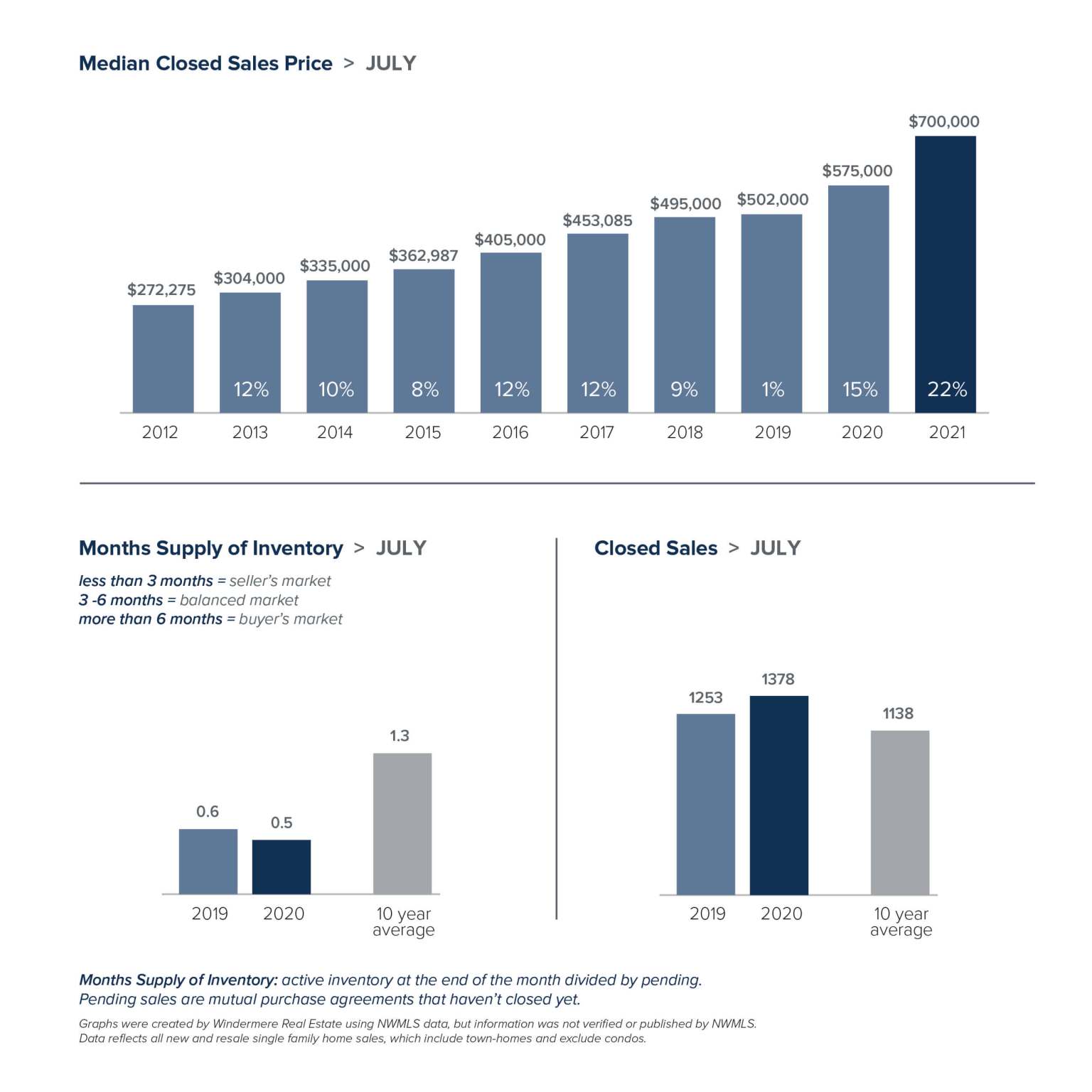

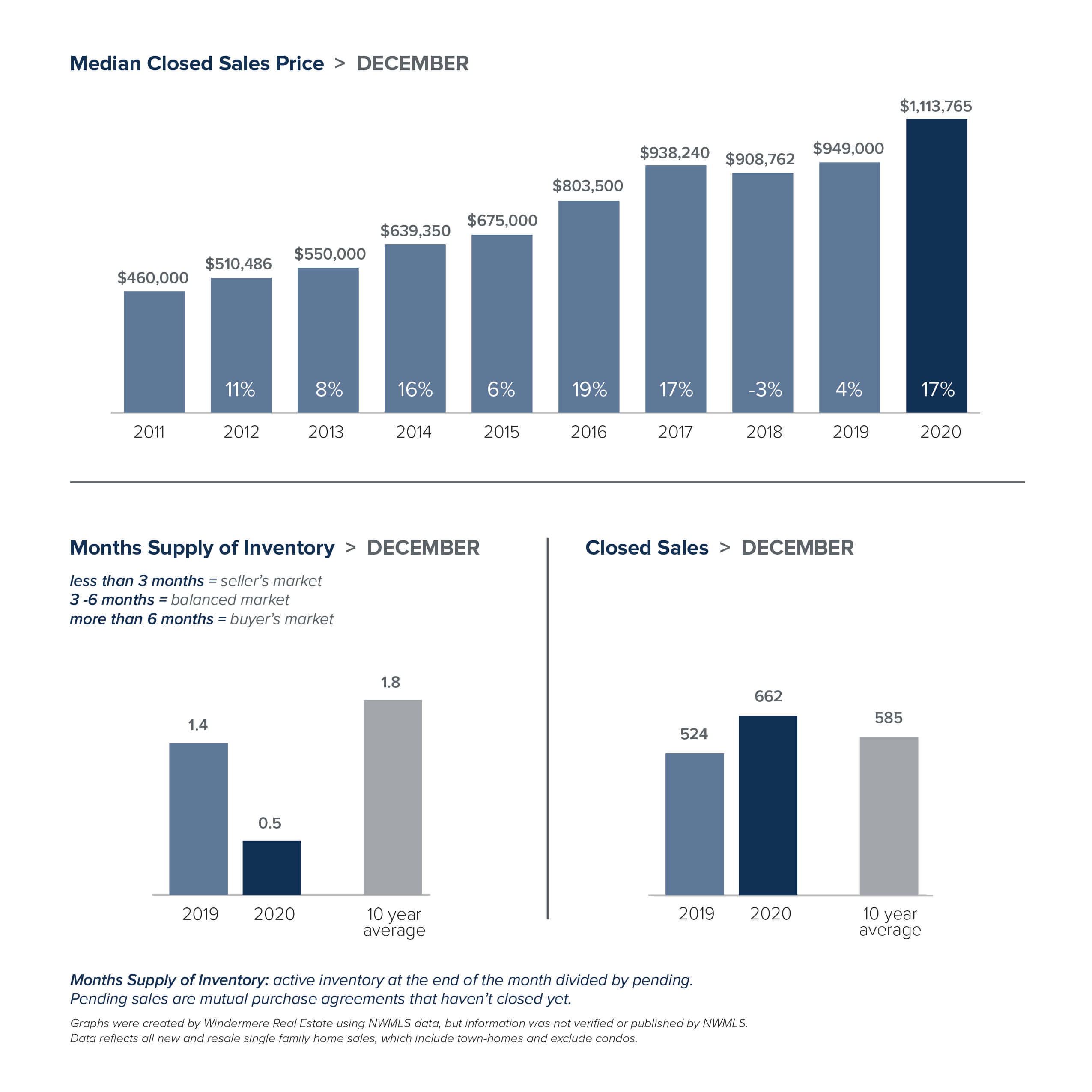

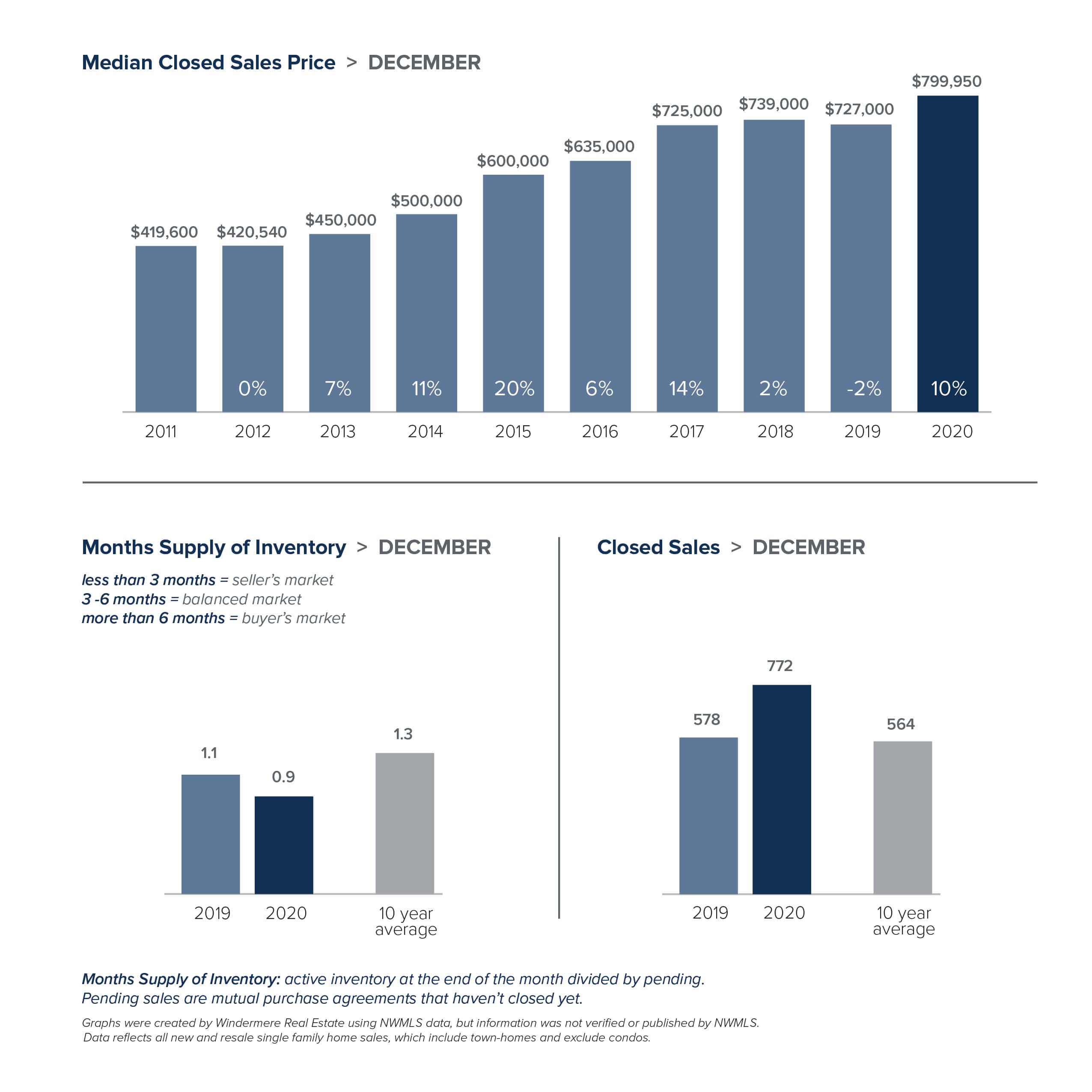

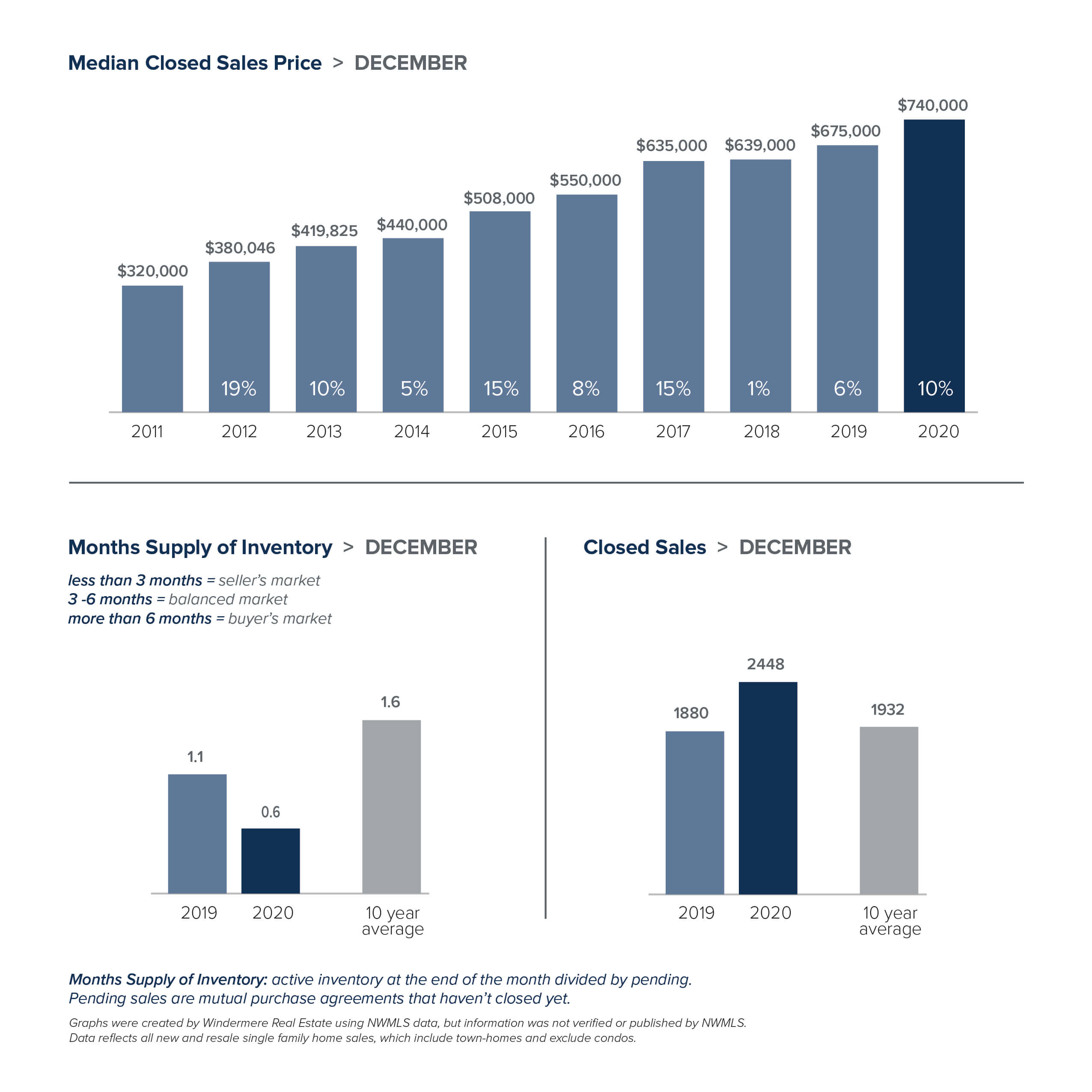

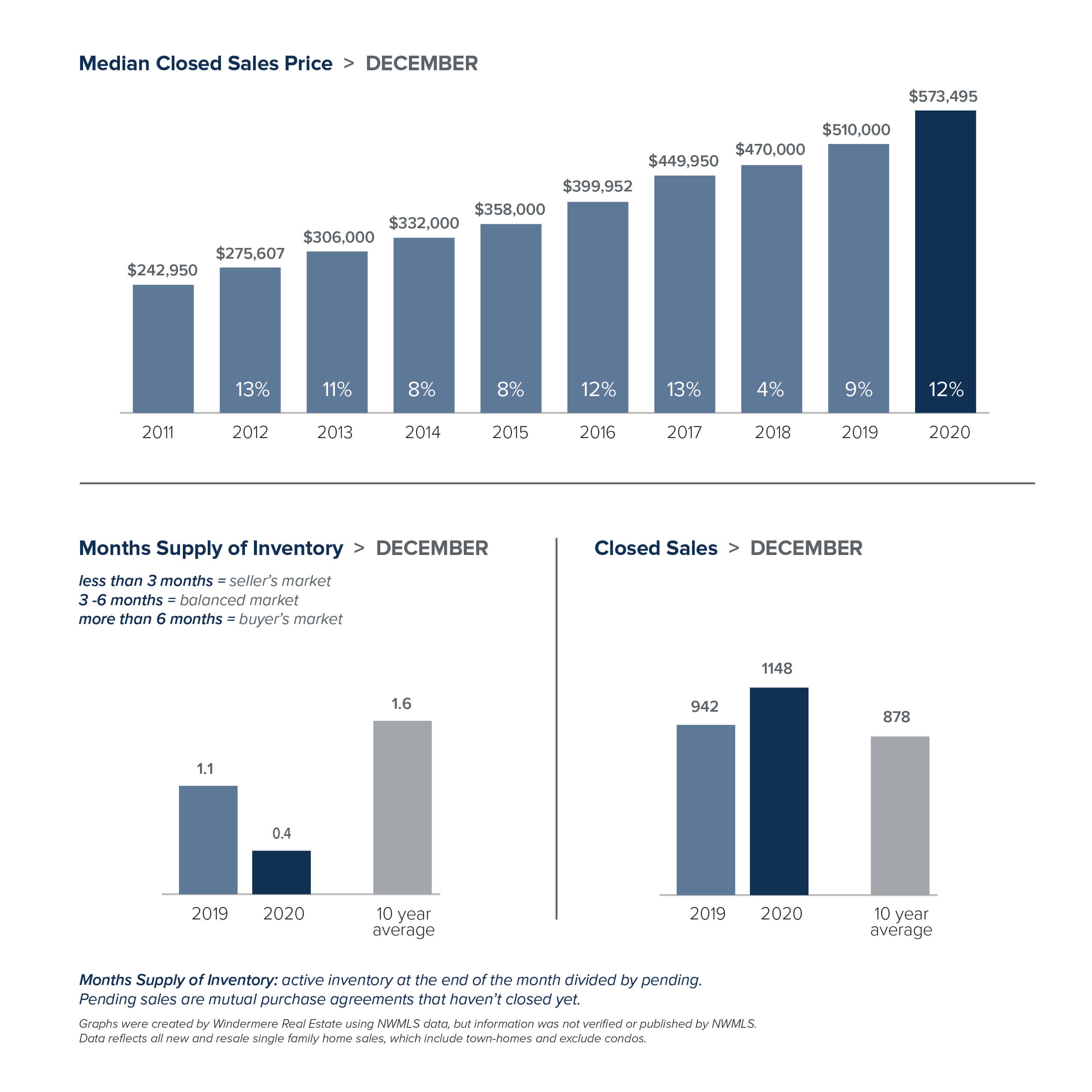

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – August 2021

What an exciting few weeks it’s been! I’ve traveled from Federal Way to Bothell to Duvall and everywhere in between securing homes for 8 of my buyers. It’s definitely not a “one size fits all” scenario out there. My strategy varied depending on the situation – in some cases I knew the competition would be stiff so we made a compelling early offer, in others we negotiated and won despite multiple offers. One situation is worth mentioning both as a caution to sellers regarding pricing and presentation and as encouragement to weary buyers – we saw a great home when it first came on the market, but it was poorly presented and appeared dark and cluttered. It was also priced near the top of its value. It didn’t sell. We were able to come back after it had been on the market a couple of weeks and negotiate a reduced price while preserving my buyer’s financing and inspection contingencies. This is why experience matters. It’s a combination of knowing the various markets, understanding my client’s needs, working with the listing agent to determine the seller’s priorities, and crafting an offer that best meets all of the above.

I also sold my adorable West of Market craftsman and Juanita Beach condo listings this month. I have some great listings coming up for potential investors, second-home buyers, and/or owner-occupants. Curious or want to discuss your real estate goals? Give me a call! I’d love to put my expertise to work for you, too.

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – July 2021

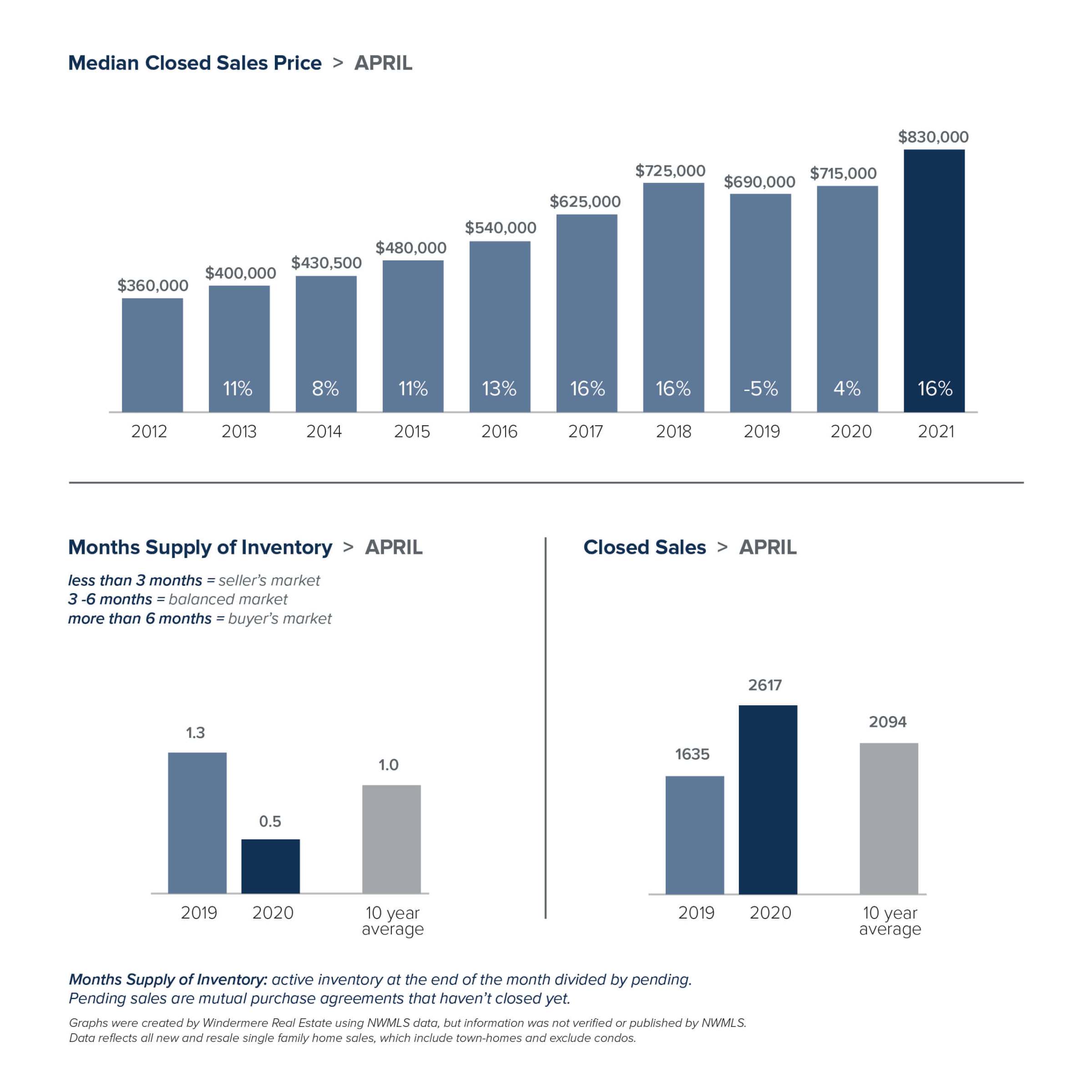

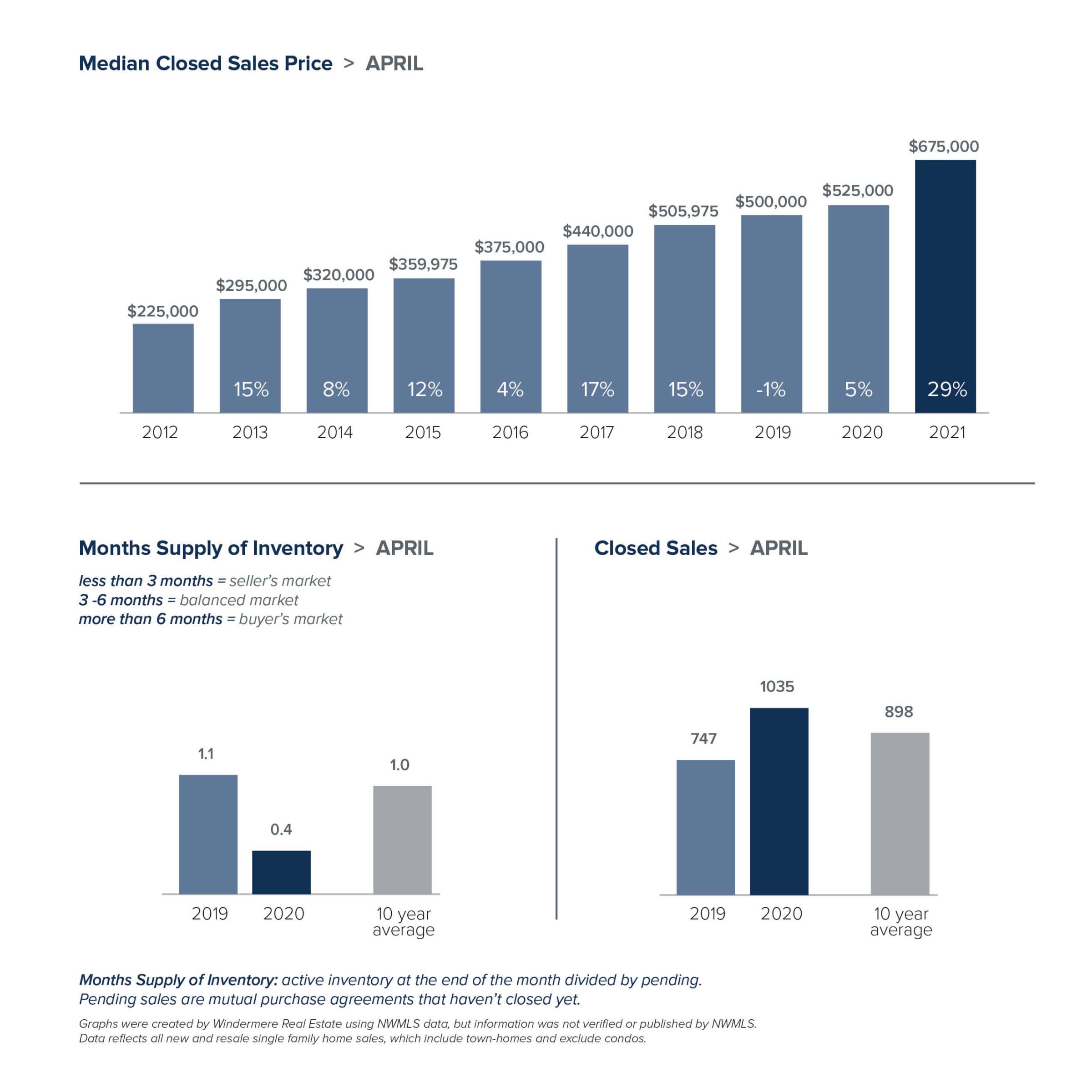

Though inventory eased a little last month, it is still far short of demand across all price points in Seattle and on the Eastside. Flexibility, in terms of criteria, is key for buyers who are committed to finding a home. Even in a balanced market it is rare for a buyer to find a home that is exactly what they want. In our ultra-competitive market, the buyers who succeed are not only well-prepared and responsive but are also willing to give a little on their list of “wants”. Sometimes that means expanding their search to more neighborhoods/communities, a willingness to do some updating, or compromising on that 3 car garage or fully landscaped yard. Buyers otherwise run the risk of even higher prices and lower inventory, which is what we expect by the first quarter of 2022.

How can I help? In addition to having my finger on the pulse of what is happening in all our local markets and working my hardest to help you achieve your goals, Windermere has some terrific programs to help buyers and sellers be more competitive. For qualified buyers, there is the Buyer Capital Program that enables a pre-approved buyer to purchase as if they had cash, often compelling for sellers along with the right offer terms. For Sellers, it may be tempting to throw a “For Sale” sign in the yard in anticipation of multiple offers and an escalated sales price, but it’s not quite that easy. Today’s buyers are busy and most are not interested in a “project”. To get the best price, a home not only has to be professionally presented, photographed, and marketed, it needs to look and be current. The Windermere Ready program provides funds for qualified sellers to have repairs and/or updates done with no upfront cost – the no-interest loan is paid back at closing.

Ready to jump in? Give me a call and let’s talk about how I can help!

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – June 2021 Copy

Apparently I wasn’t the only one who noticed Seattle had good opportunities for buyers – since I wrote about it in April, the median sales price has increased over $90,000 – that’s 20% higher than it was a year ago. The median sales price on the Eastside has remained stable the last few months, but it’s over 30% higher than a year ago. What this means for buyers is that “waiting until things cool down” is proving to be a flawed strategy. On the Eastside, the median price of a home is now over $350,000 higher than a year ago. The vast majority of buyers could never save enough in a year to offset that difference.

No one can predict the future, of course, but I see no reason to expect a significant change in inventory any time soon. We will likely continue see seasonal fluctuations, but with demand continuing to outstrip supply, at best we may see a slower increase, rather than an actual decline, in prices. There is no doubt that it takes persistence and motivation for buyers to prevail in our hot real estate market, but clearly there is a cost associated with waiting. Let’s chat about how I can help you accomplish your goals.

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

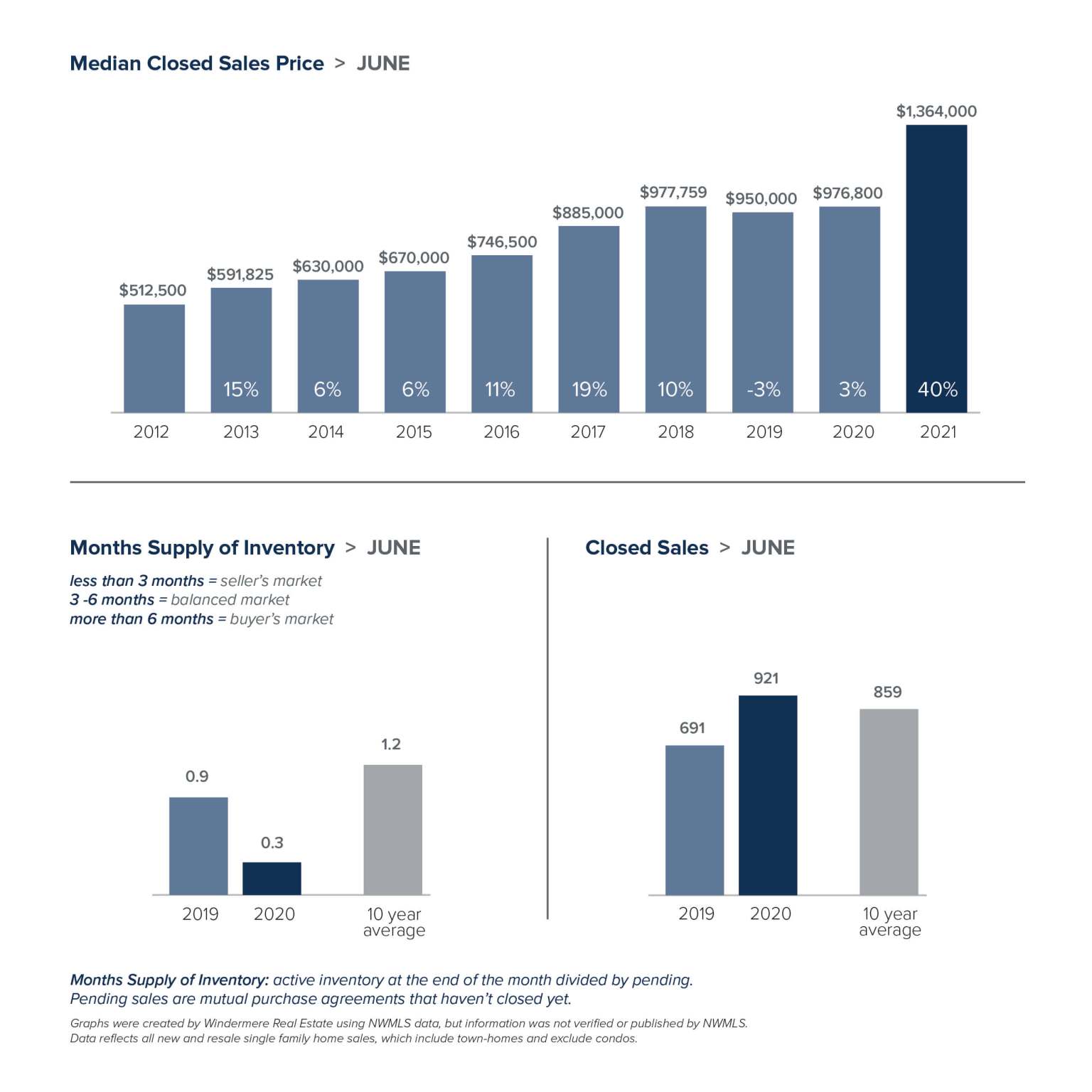

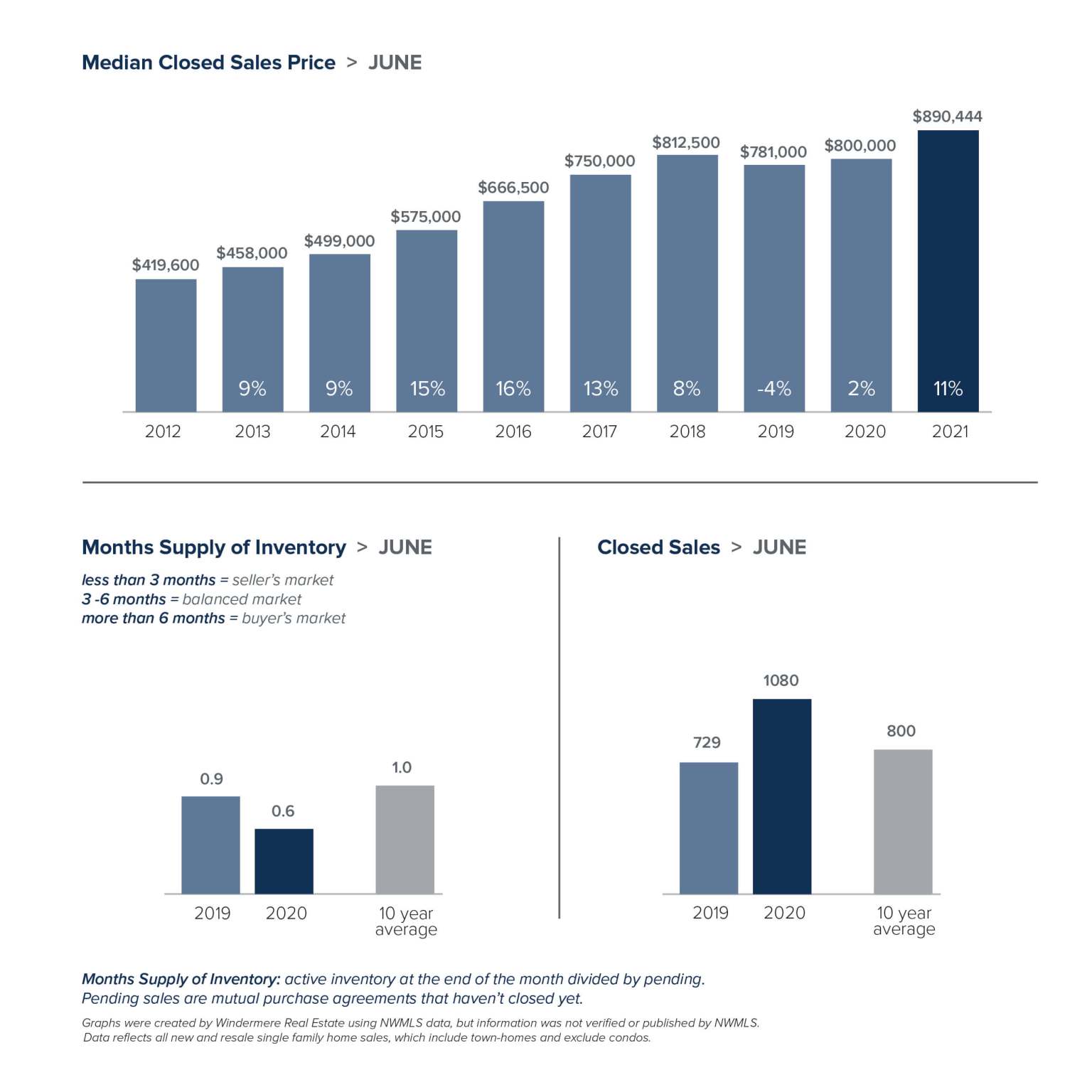

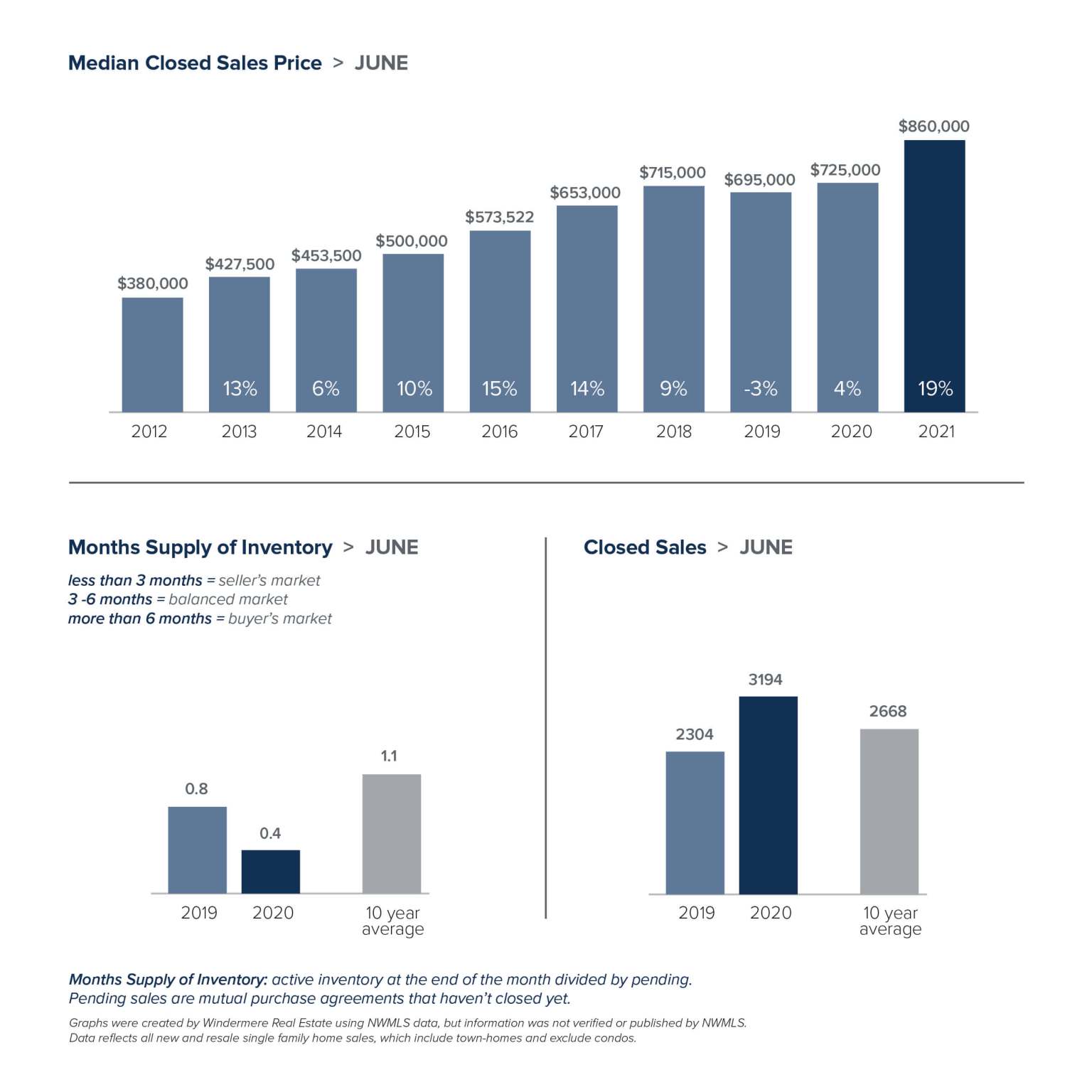

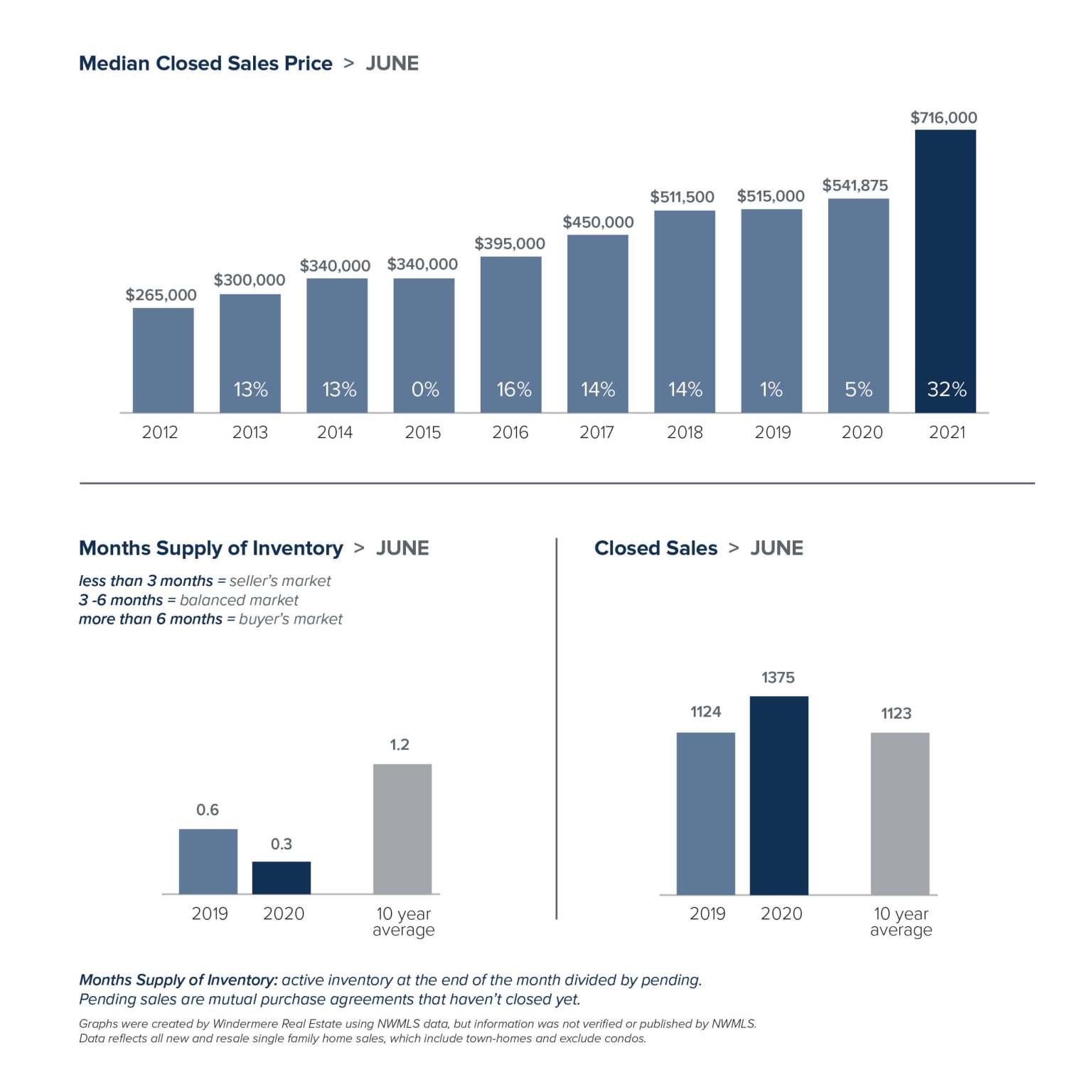

What I’m Seeing – June 2021

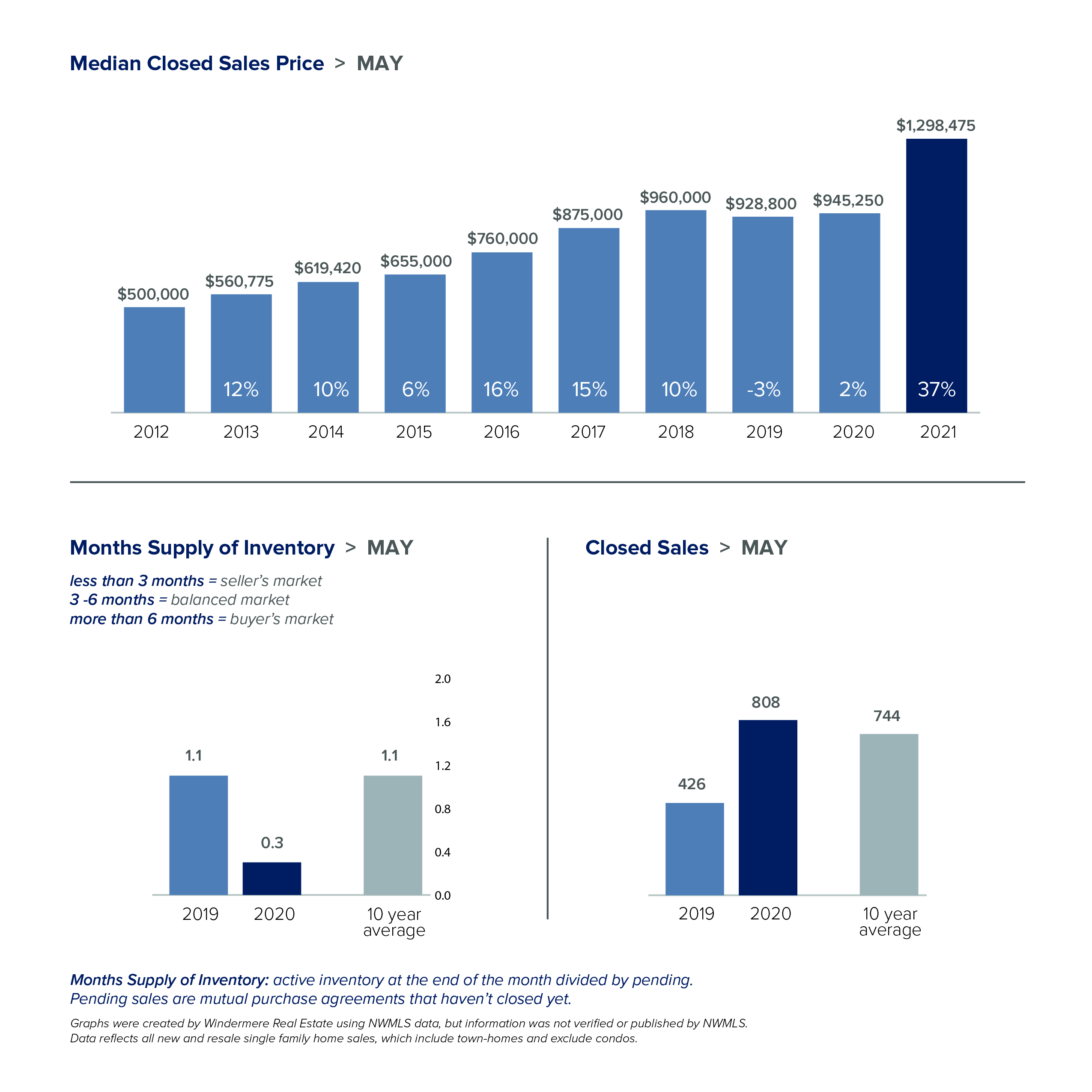

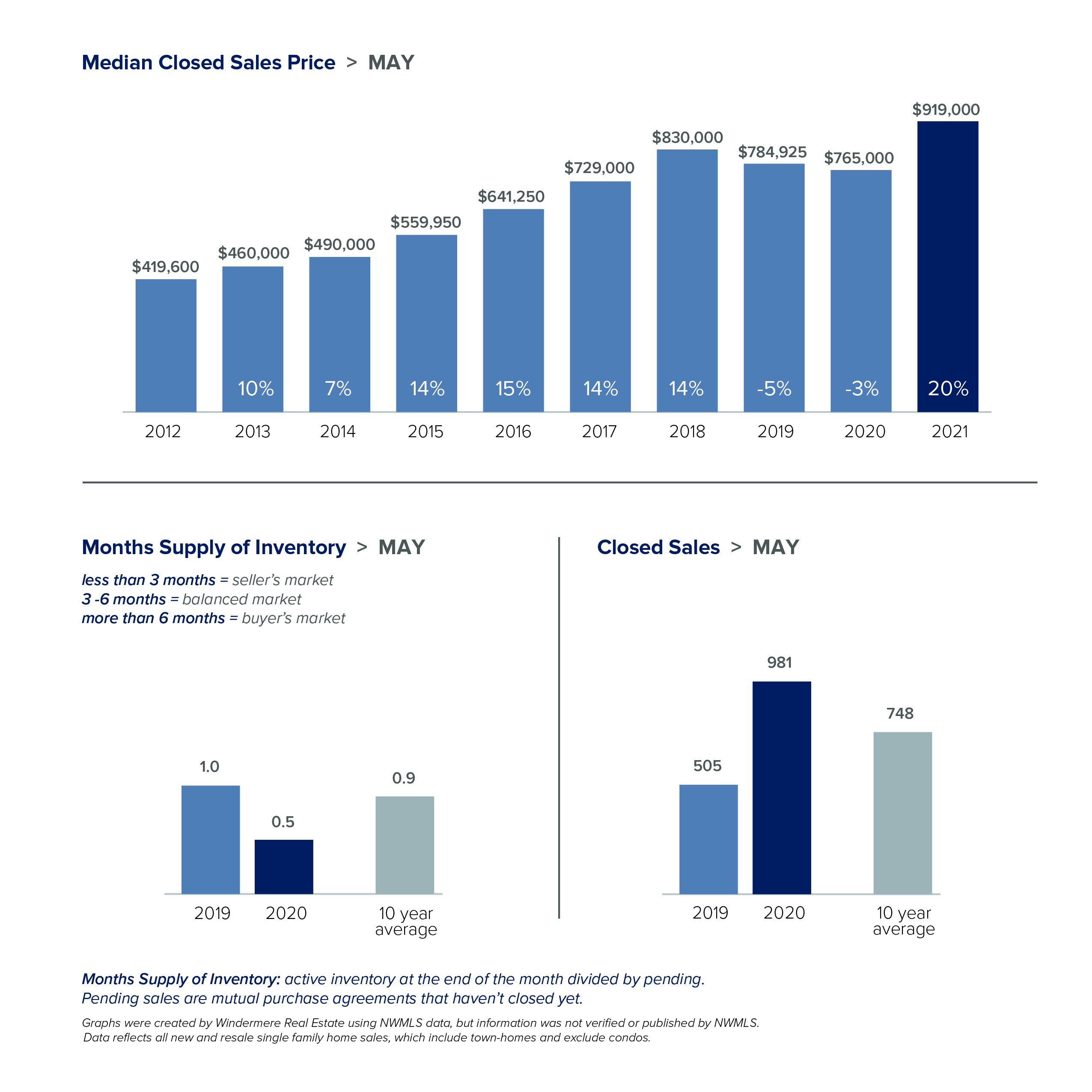

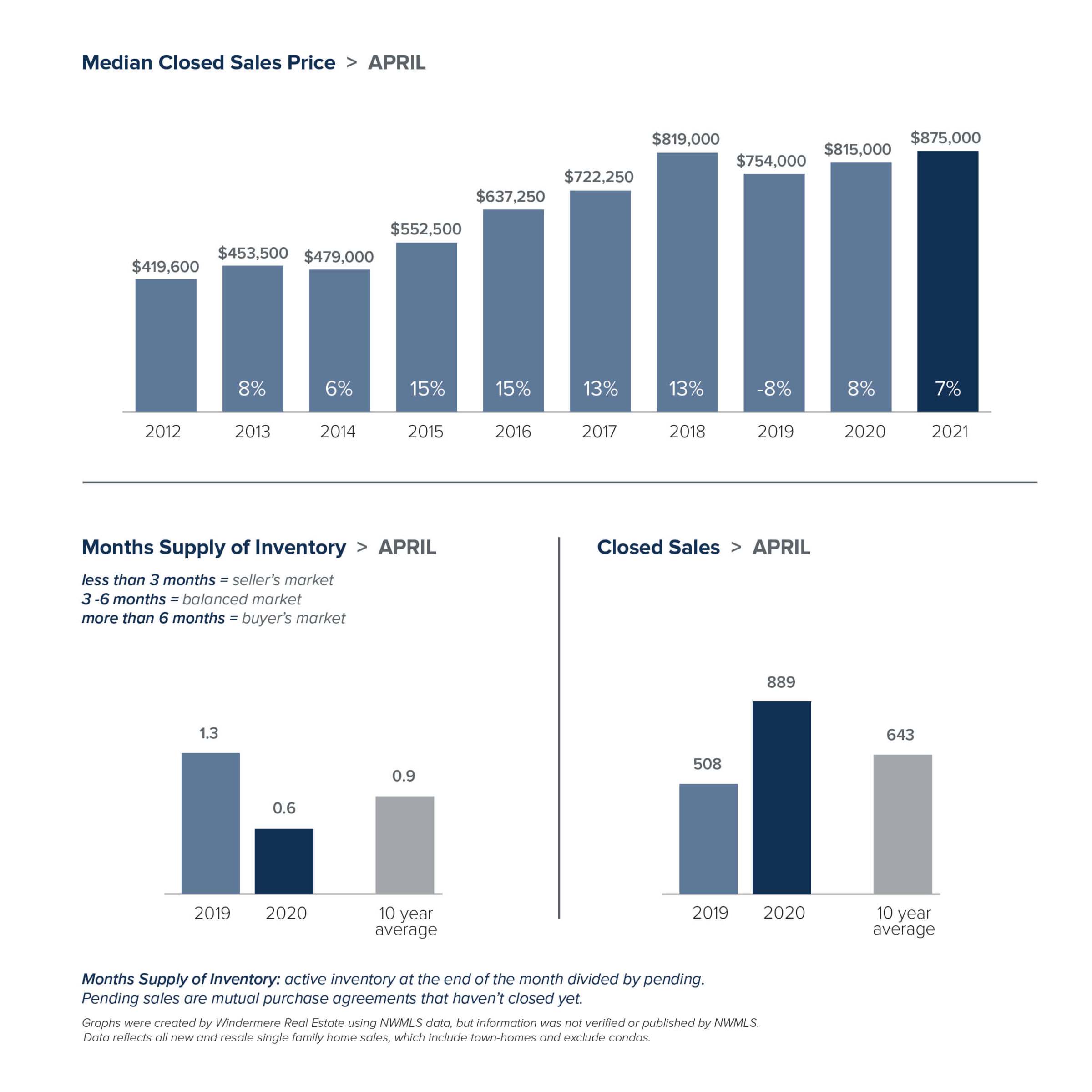

Apparently I wasn’t the only one who noticed Seattle had good opportunities for buyers – since I wrote about it in April, the median sales price has increased over $90,000 – that’s 20% higher than it was a year ago. The median sales price on the Eastside has remained stable the last few months, but it’s over 30% higher than a year ago. What this means for buyers is that “waiting until things cool down” is proving to be a flawed strategy. On the Eastside, the median price of a home is now over $350,000 higher than a year ago. The vast majority of buyers could never save enough in a year to offset that difference.

No one can predict the future, of course, but I see no reason to expect a significant change in inventory any time soon. We will likely continue see seasonal fluctuations, but with demand continuing to outstrip supply, at best we may see a slower increase, rather than an actual decline, in prices. There is no doubt that it takes persistence and motivation for buyers to prevail in our hot real estate market, but clearly there is a cost associated with waiting. Let’s chat about how I can help you accomplish your goals.

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – May 2021

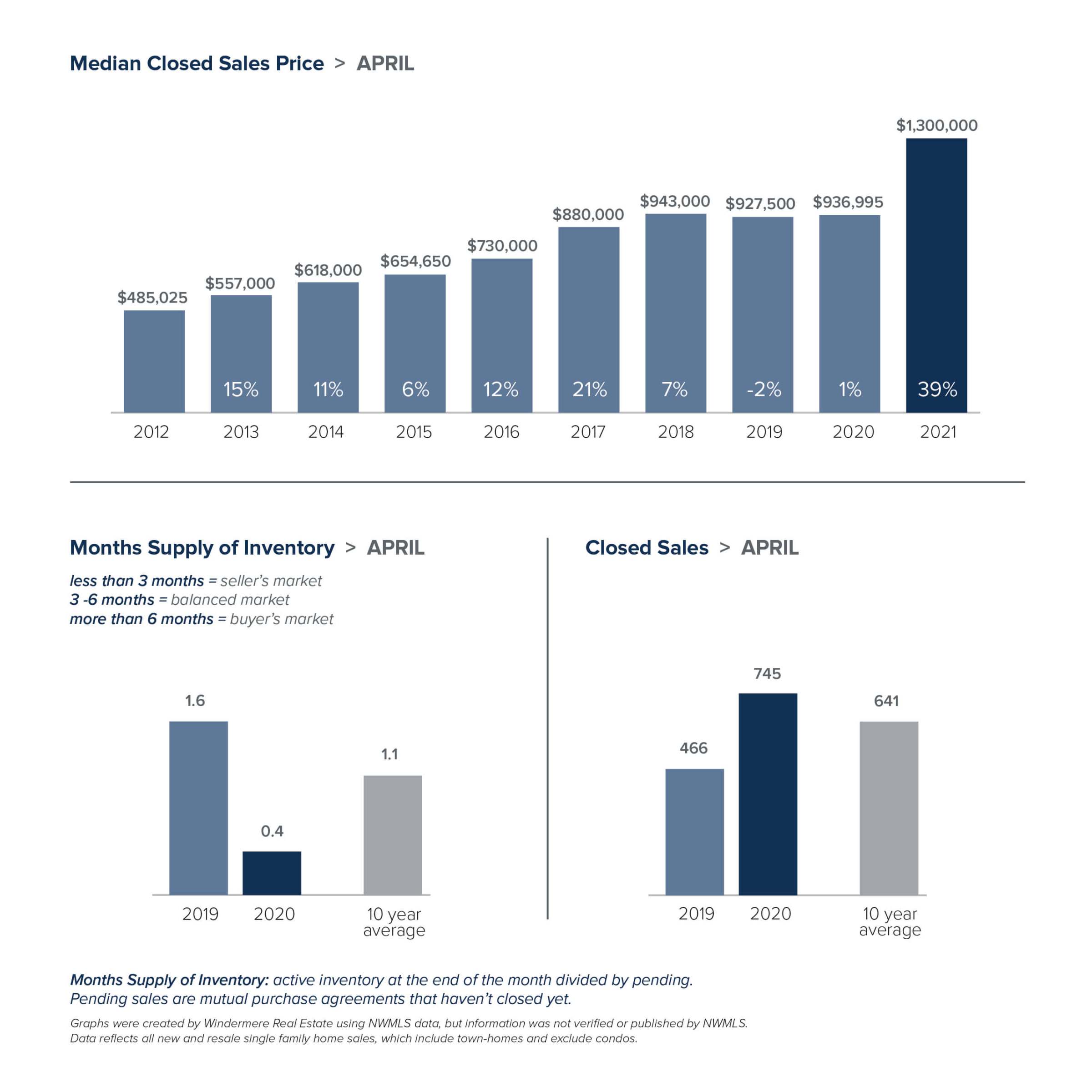

April was an exciting month for sellers on the Eastside as over 80% of homes sold over their list price. On the positive side for buyers, inventory (though still critically low) increased significantly, and the median price of homes dipped a little from $1.35M to $1.3M for single-family homes and from $575,000 to $525,000 for condos. In Seattle, inventory was only slightly higher last month and the median price increased by $50,000.

Strategic pricing is still critical for sellers as Buyers are factoring an increase to the list price in their search and passing on listings that are priced at recent, escalated sales prices. Well-priced, professionally marketed homes sell quickly in most price ranges/areas.

Working with an experienced Realtor matters whether you are buying or selling. I would love to help you achieve your real estate goals – just call, email, or text me.

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – April 2021

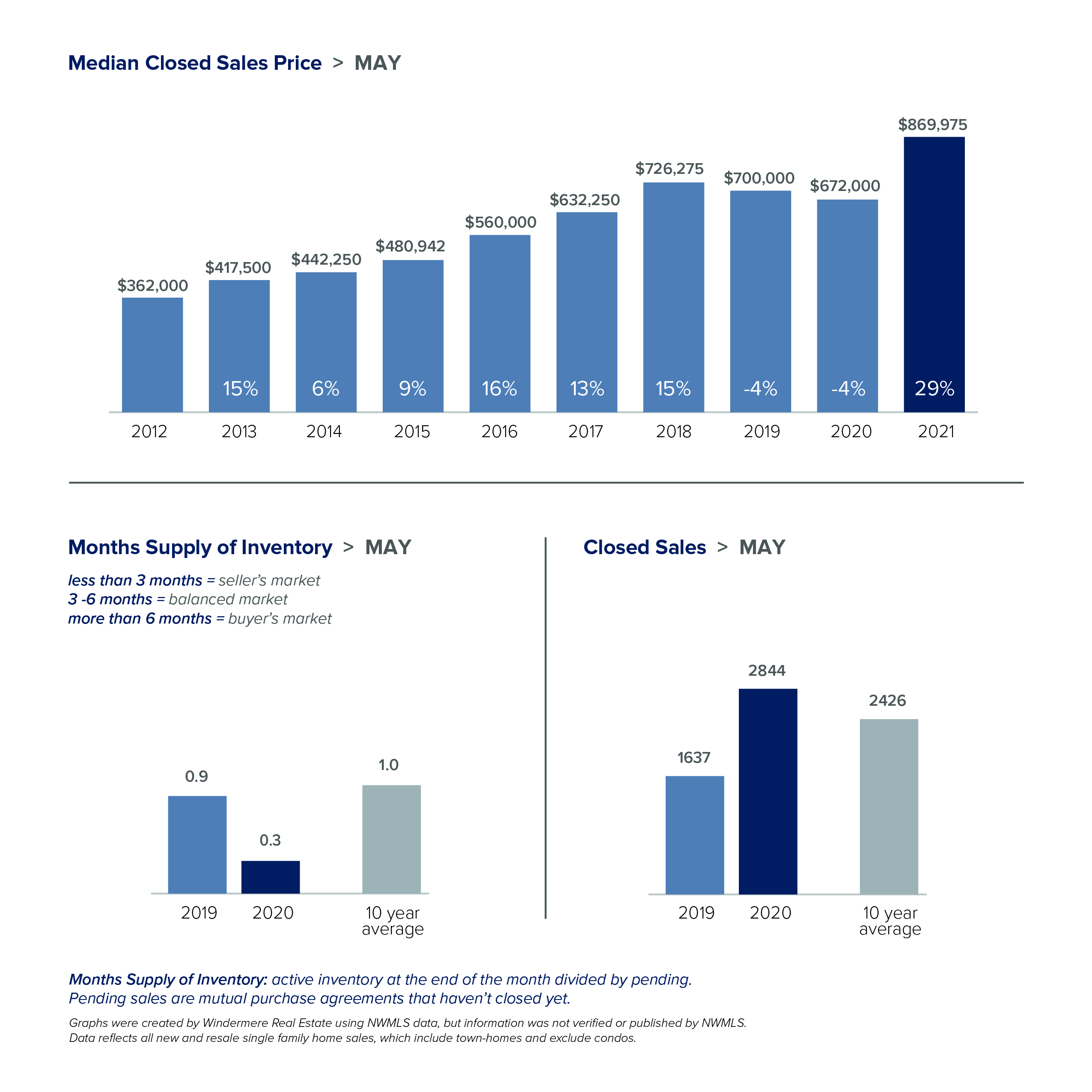

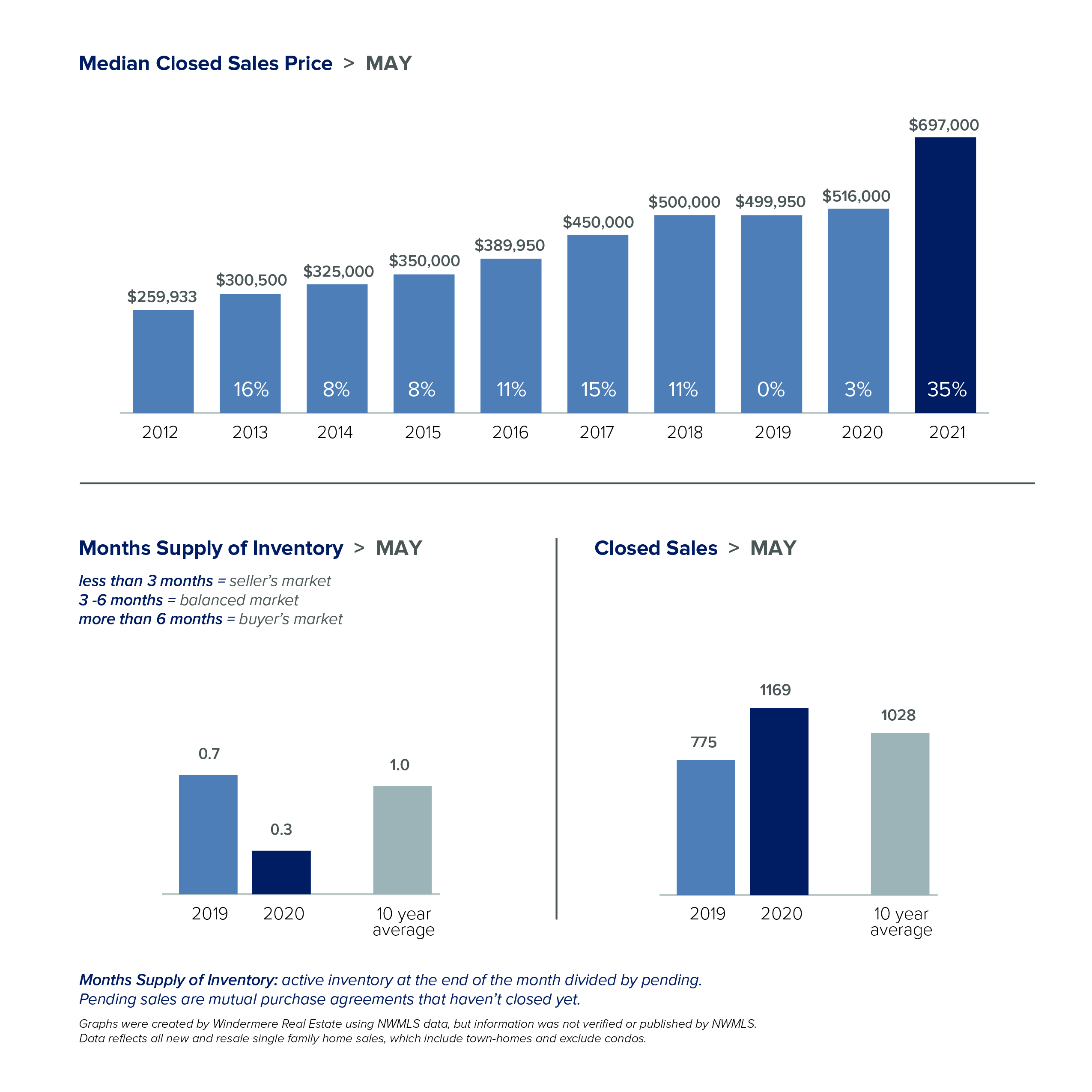

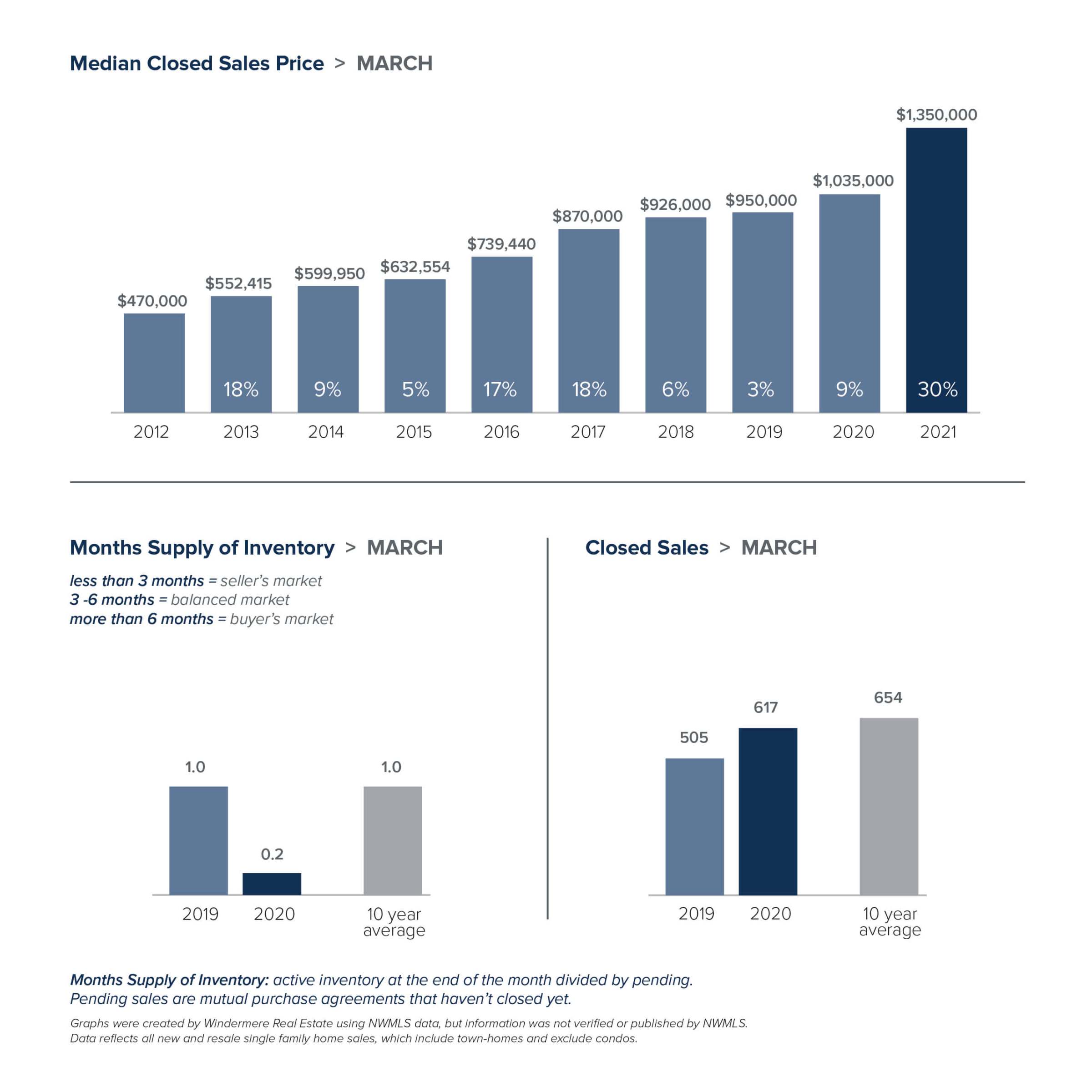

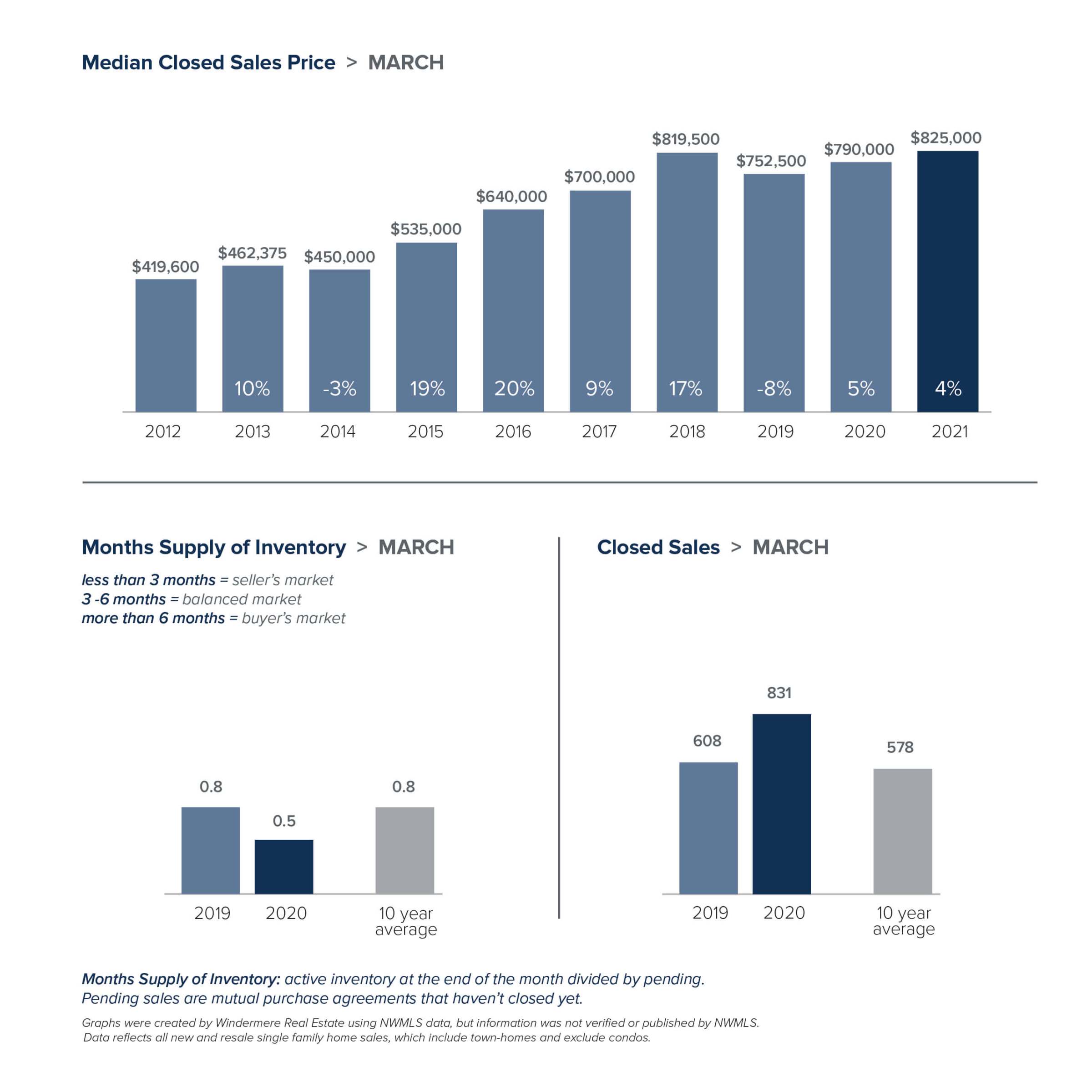

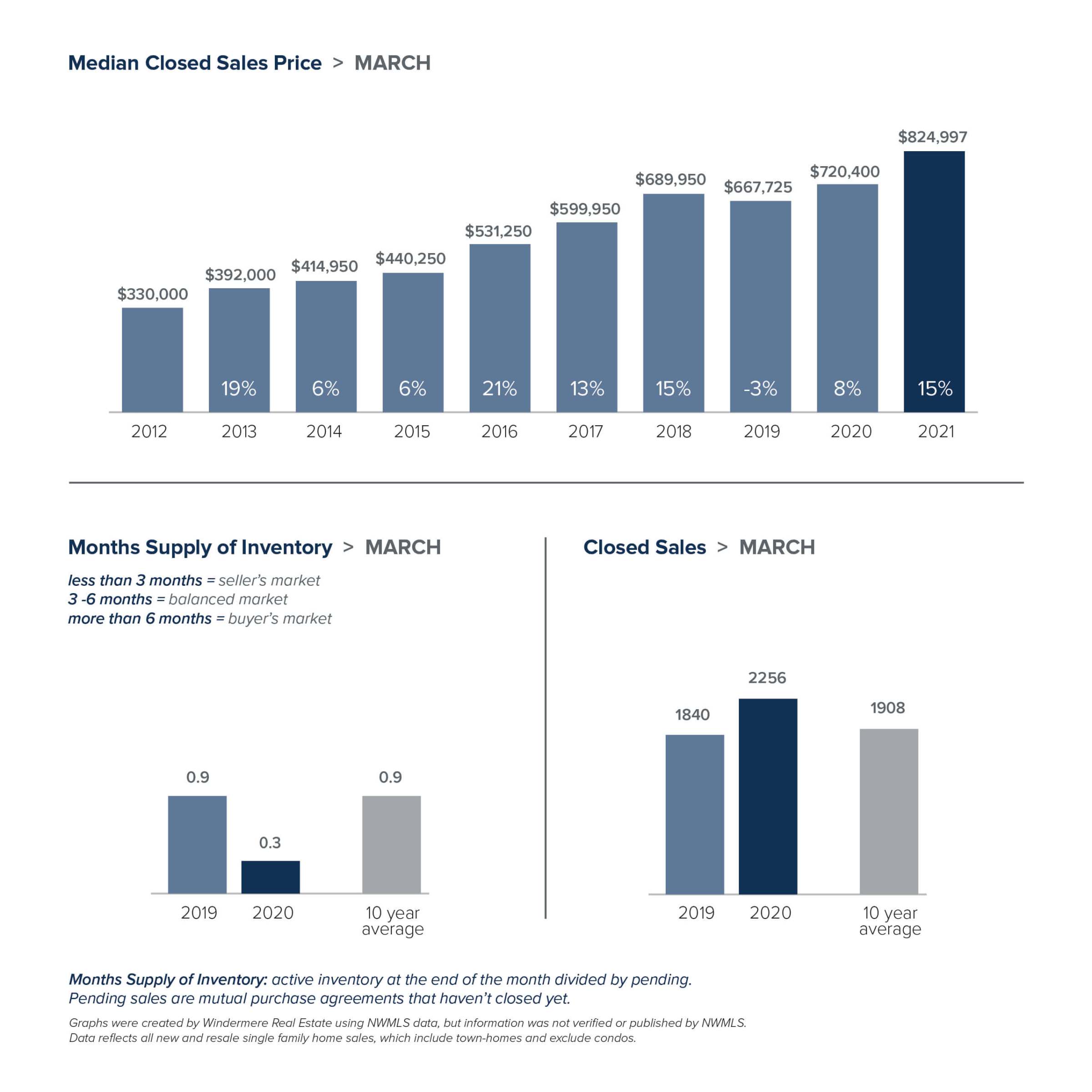

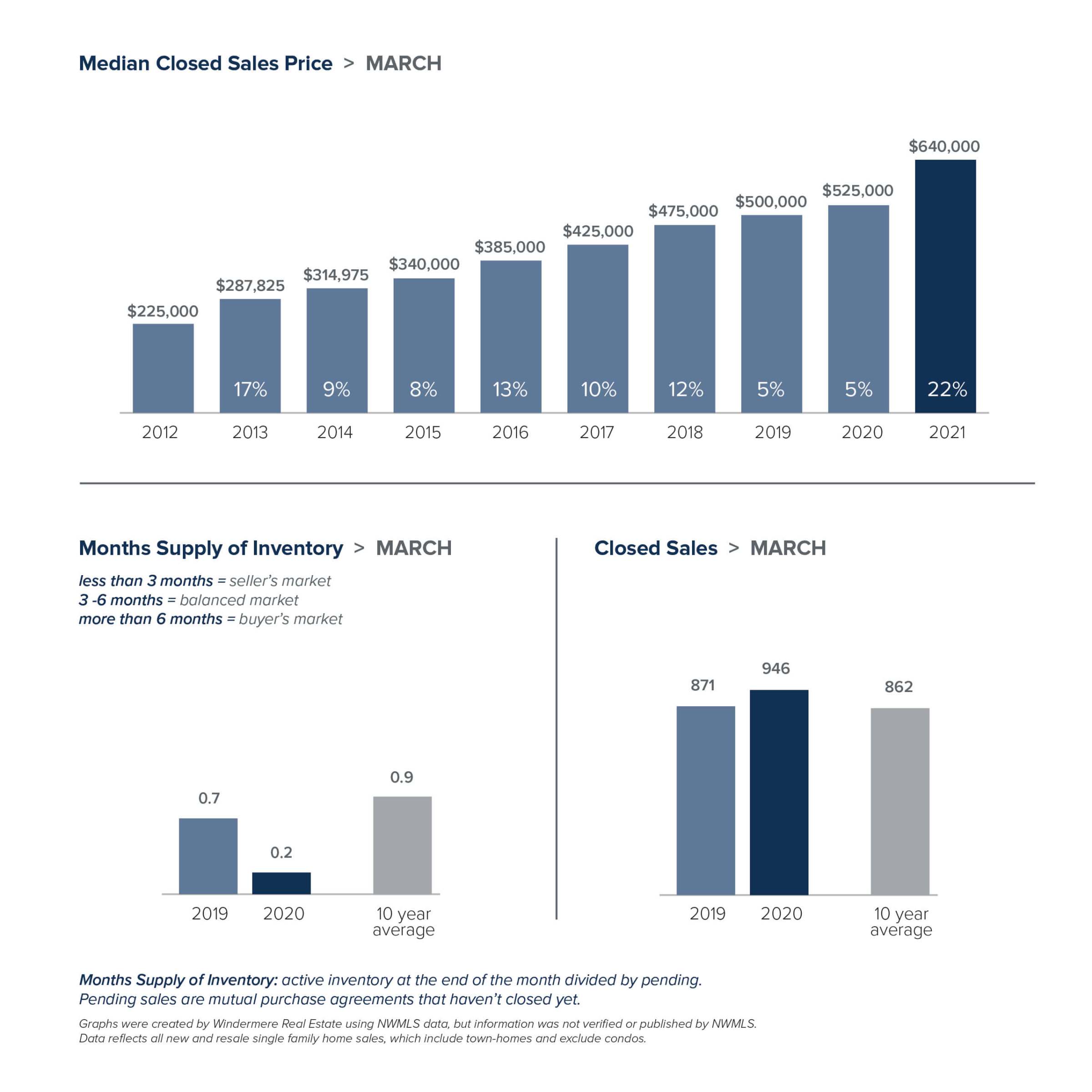

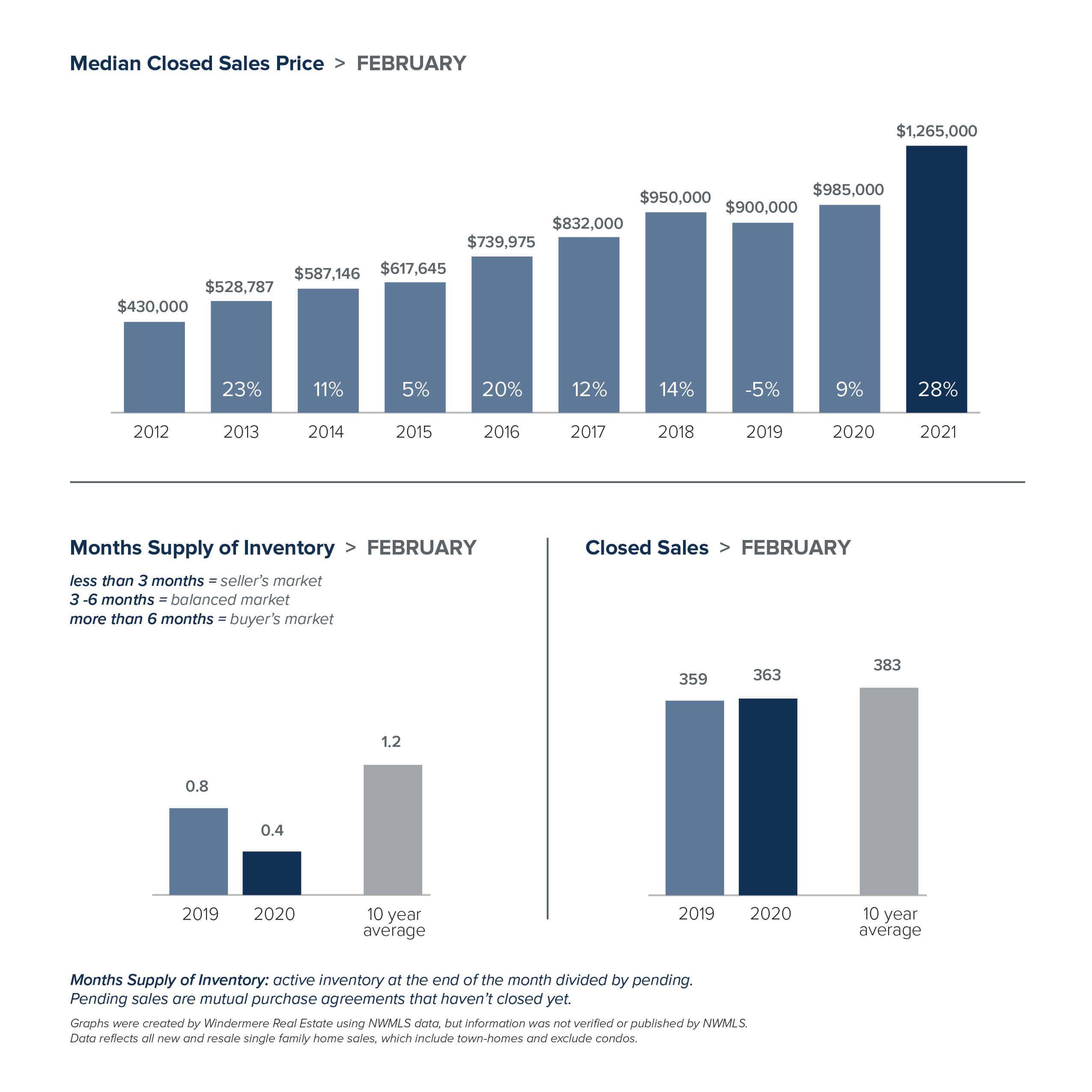

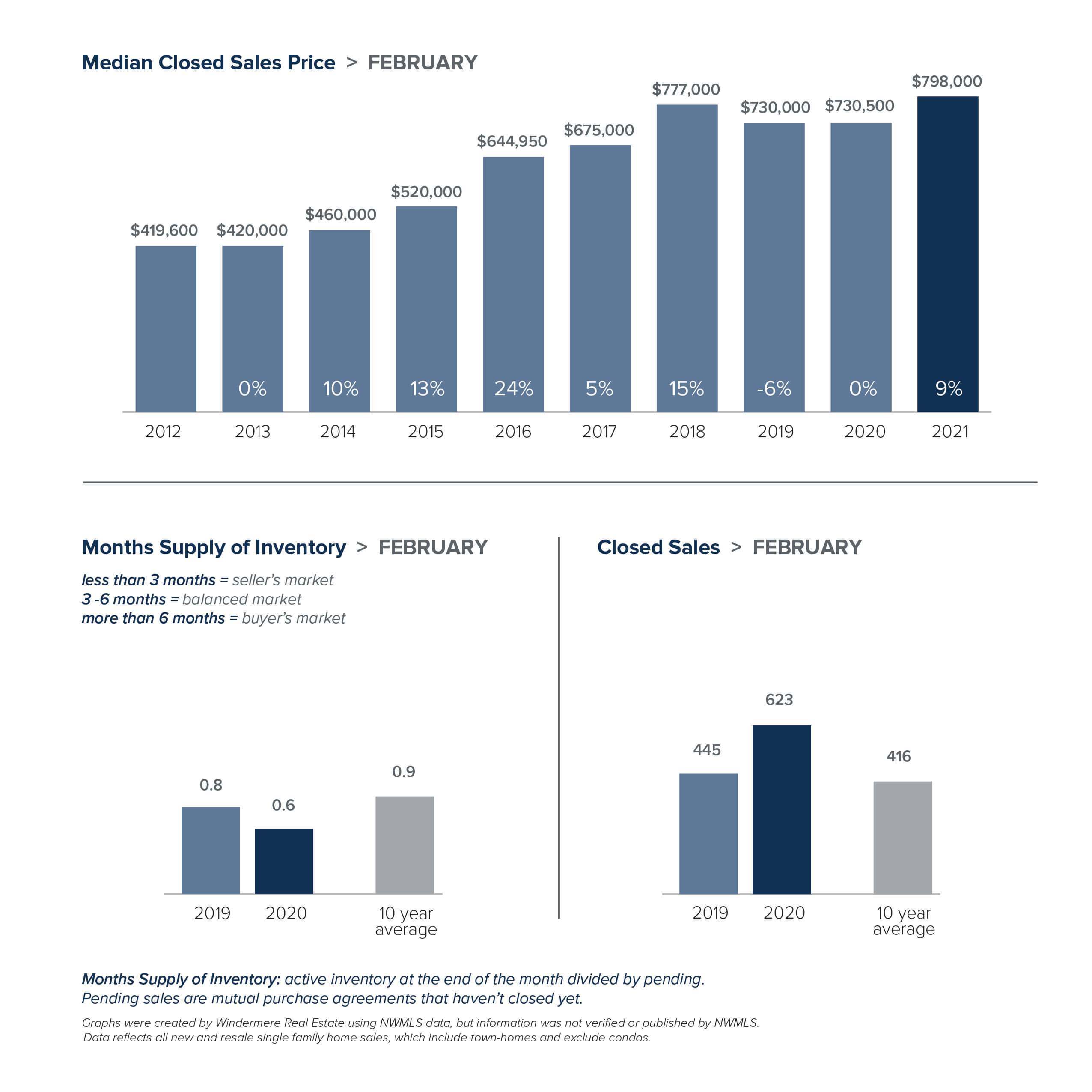

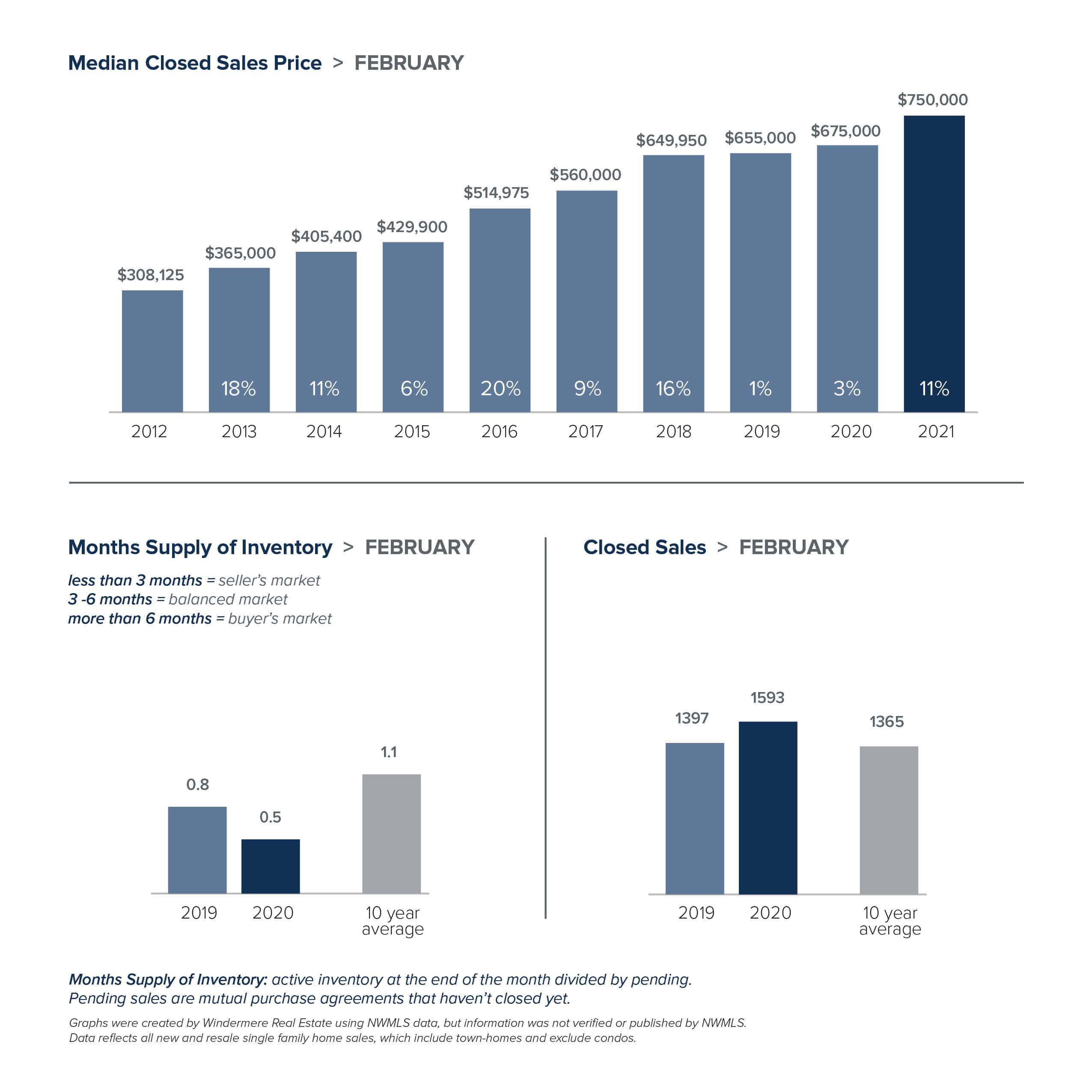

Whether you are a numbers person or not, March statistics are hard to ignore. They mirror what I’m experiencing, working with buyers on both sides of the lake. Seattle is becoming an increasingly attractive option for homebuyers and investors focused on affordability as well as access to employment centers and amenities. Here are a few key stats that illustrate why.

- Active Listings – The Eastside had less than half the number of available homes at the end of March vs a year ago, a record low. Seattle had 20% lower for single-family homes, but the number of available condos was actually 50% higher than last March.

- March Price Escalation – Over ¾ of Eastside closed sales went over the list price. For Seattle, only about half sold for more. The amount they escalated was also higher on the Eastside than in Seattle.

- Affordability – so far this year over 70% of closed sales in Seattle were under $1M vs only 30% on the Eastside.

Waiting for a “better time to buy” is proving costly for buyers as the median price of a home increased $35,000 in Seattle and over $300,000 on the Eastside vs a year ago. Well-prepared, engaged buyers prevail as “casual” buyers are being left by the wayside. Unlike single-family homes, condos continue to be well-priced in both areas. First time home buyers, downsizers, and buyers weary of losing out to bidding wars are finding welcome relief in the less competitive condo market.

Despite the lack of inventory, overpricing a home can cost a seller both time and money. If a listing doesn’t sell within two weeks, it typically does not sell for over the list price and often will sit for weeks without an offer. Well-priced homes sell quickly and for more than list price, usually with multiple offers.

Looking ahead, May is shaping up to be an exciting month as I will be listing several homes at a variety of price points. If you are considering jumping into the market, I’d love to help you procure your dream home or maximize the return on your sale!

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

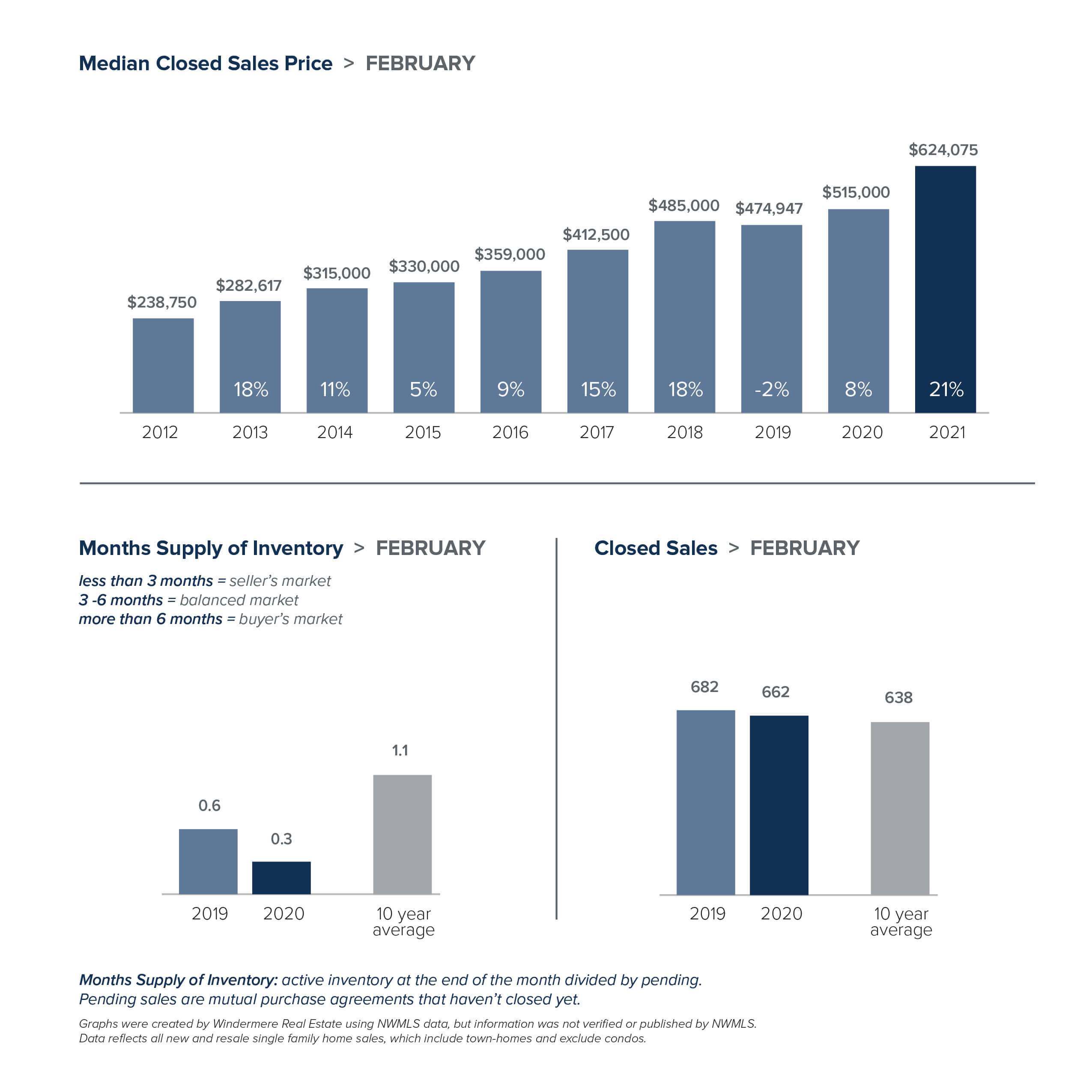

What I’m Seeing – March 2021

In my 15 years as a Realtor, this is the strongest seller’s market I have seen. That said, it is important to understand that there is a significant difference between the condo and single-family markets, particularly in Seattle. For condo sellers, this means it’s important to properly prepare and price your home to get top dollar.

While still low, condo inventory is twice as high as single-family so there are some good opportunities for buyers. For sellers of single-family homes, February numbers reflect what I am experiencing – there is record low inventory and the median price continues to increase. I encourage everyone to look at the stats below and give me a call if I can answer any questions or help you evaluate your options.

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

What I’m Seeing – February 2021

The excitement continues! This past month I helped 2 of my buyers secure their dream homes despite multiple offers, 3 of my new listings sold before hitting the market, and 2 more sold within days with multiple offers. I have several more listings coming this month and I anticipate more of the same.

I’m beginning to feel like a broken record, but my recent experiences have proven again that preparation is key in this fast-paced market. In order to be competitive in a multiple offer situation, buyers often feel the need to waive conducting their own inspection. Therefore, buyers looking to minimize their risk are gravitating toward homes that have been pre-inspected by the seller. From the seller’s perspective, pre-inspecting means more buyers feel confident making an offer.

Interest rates dipped a bit recently making it an excellent time to buy and continuing inventory constraints make it a fabulous time to sell. As always, let me know if I can help!

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

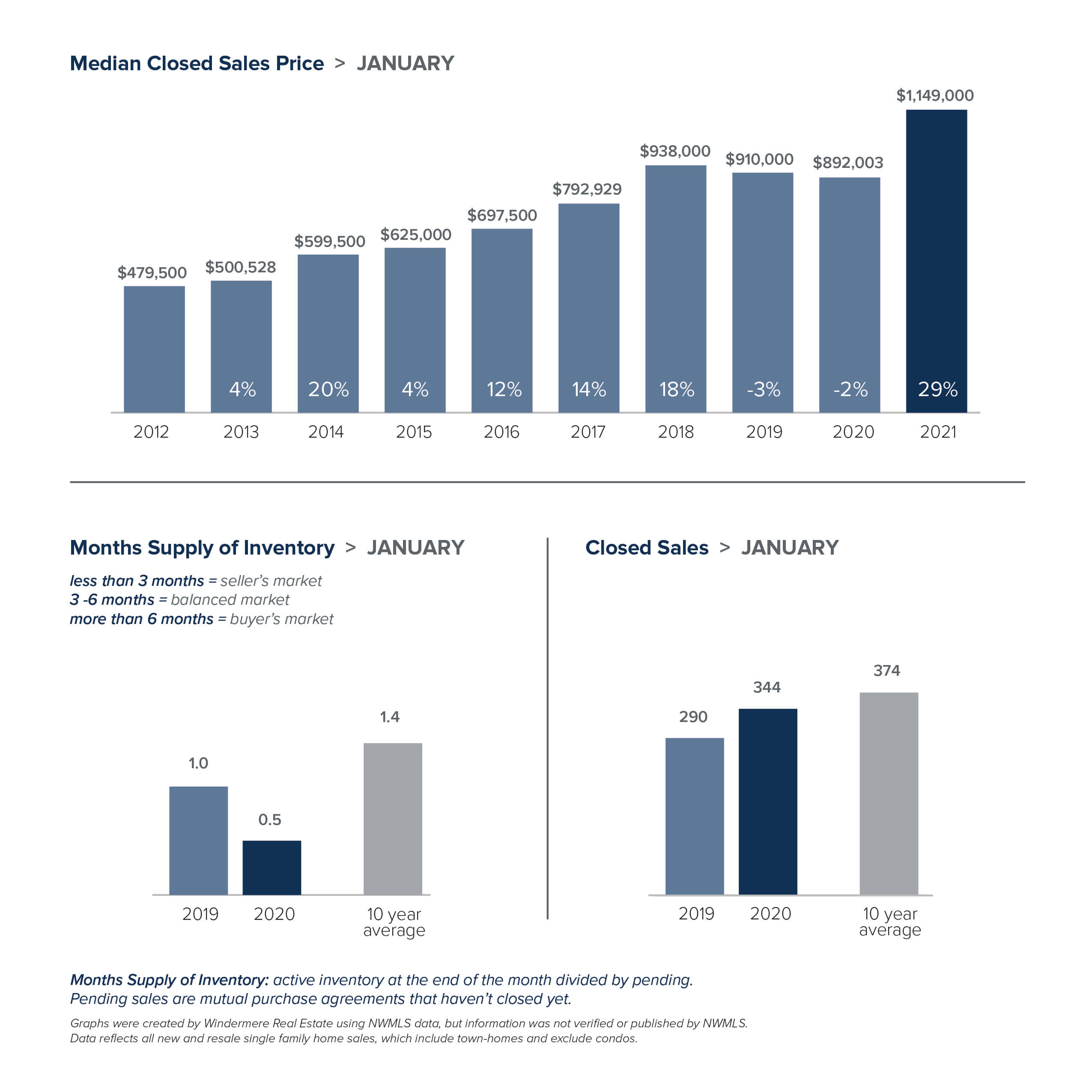

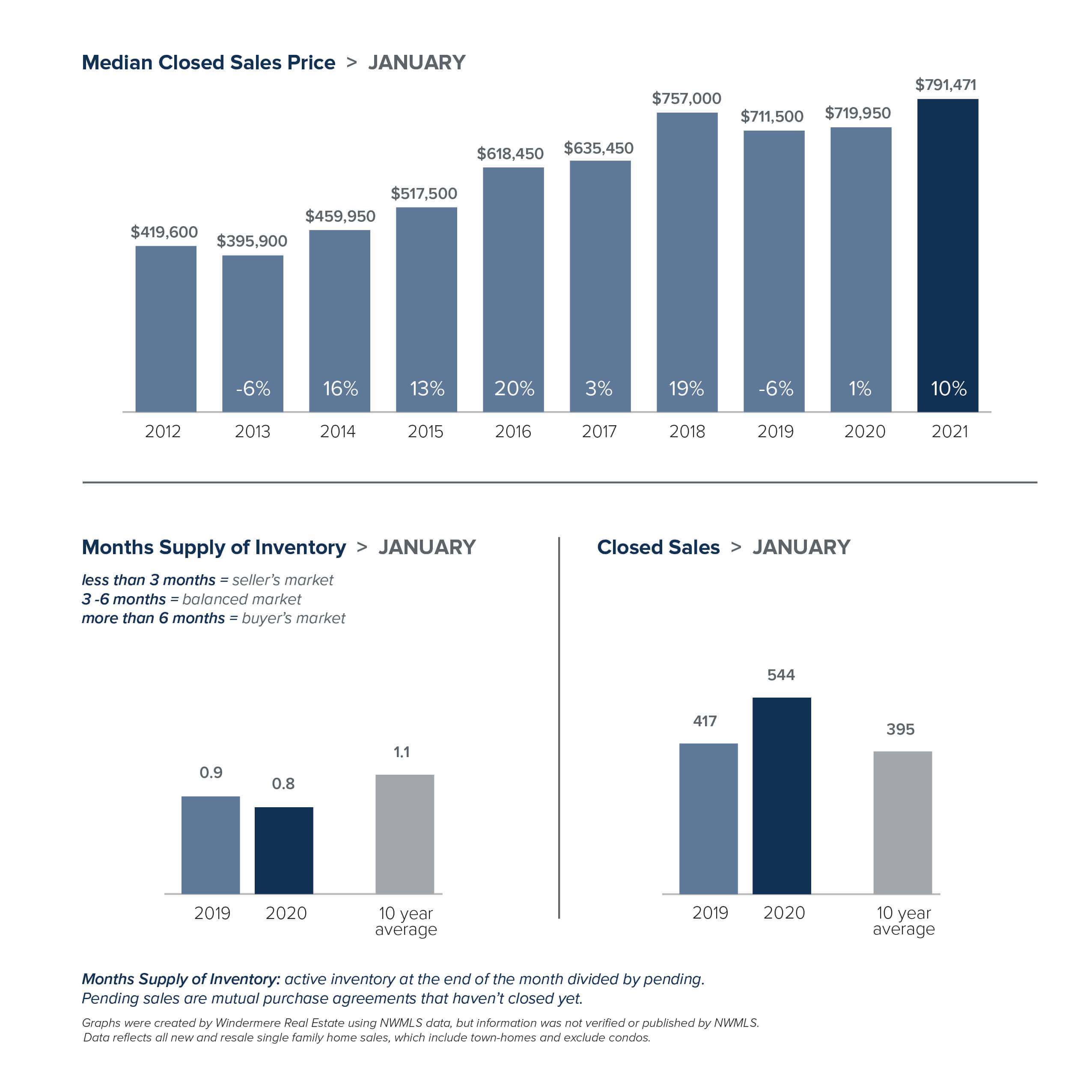

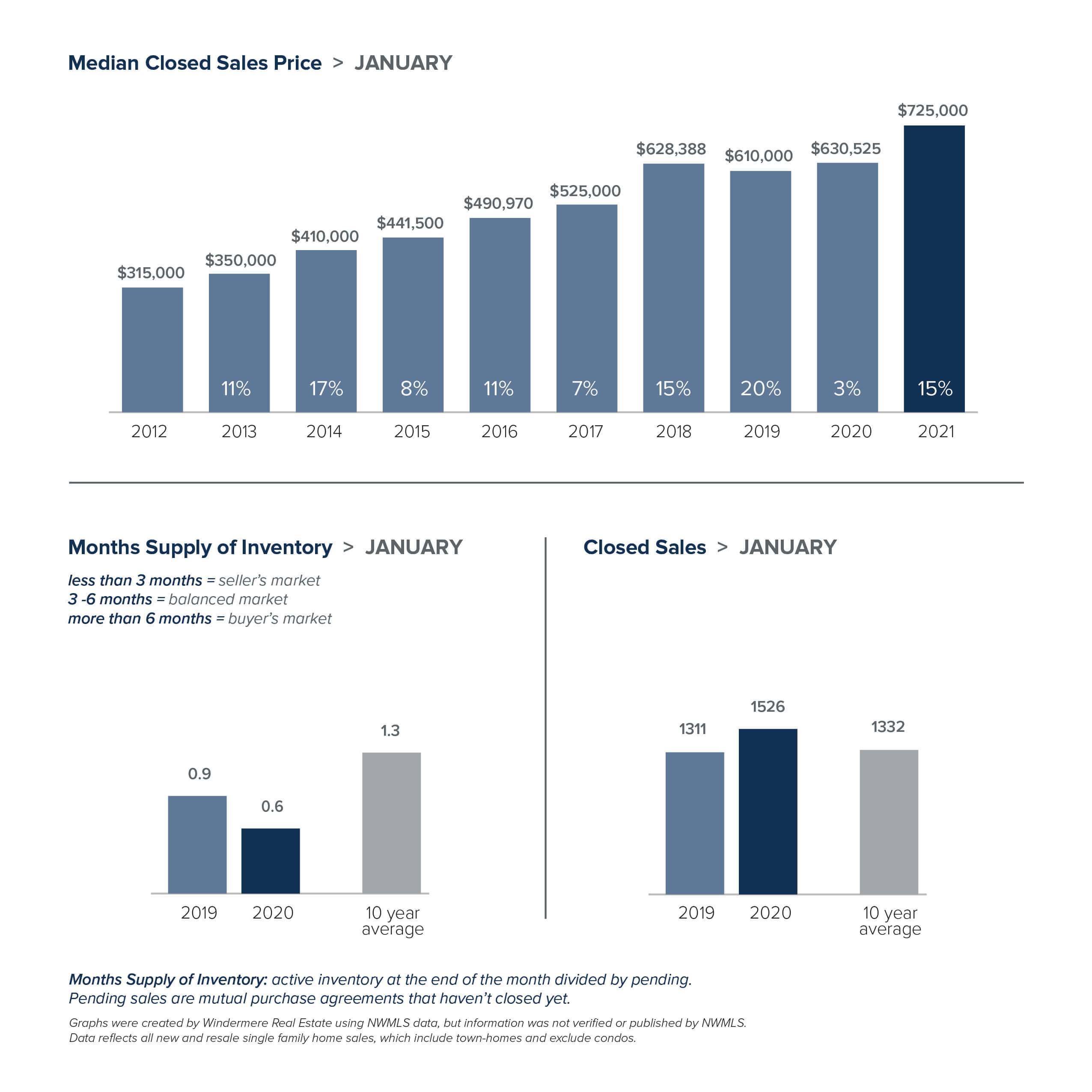

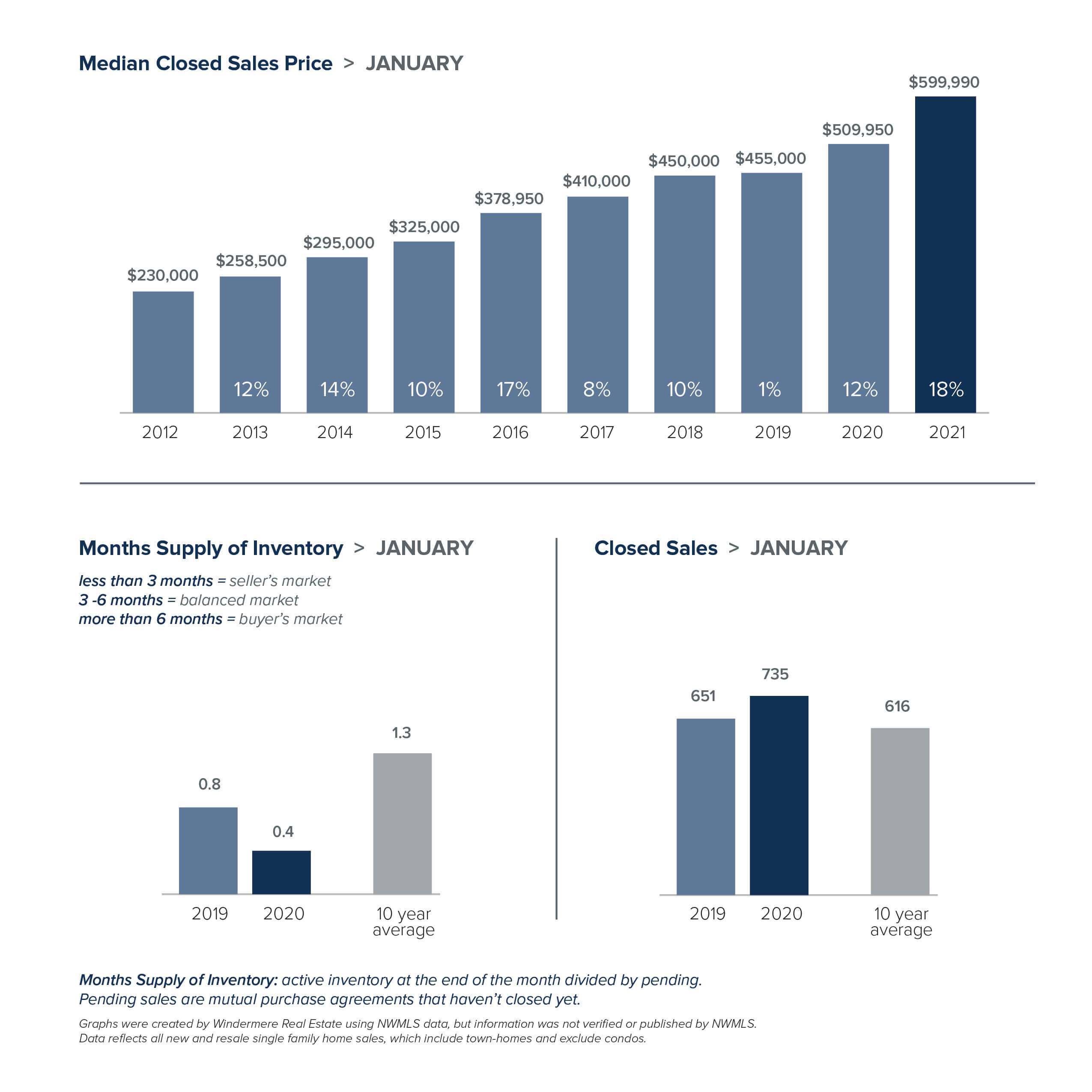

What I’m Seeing – January 2021

As I expected, we are continuing to see a very strong seller’s market with incredible demand from buyers resulting in favorable outcomes for sellers. My two most recent listings sold above list price in less than a week with a total of 35 offers! With such a competitive market for buyers, it’s critical to be well-prepared and use an experienced agent. If you are considering a change, let’s strategize to get the best result for you, too!

BY THE NUMBERS

Click the images below to download your neighborhood’s recent real estate figures!

| EASTSIDE | SEATTLE | KING COUNTY | SNOHOMISH COUNTY |

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link