6%

OF HOMES SOLD ABOVE LIST PRICE

43%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.8

MONTHS SUPPLY OF AVAILABLE HOMES*

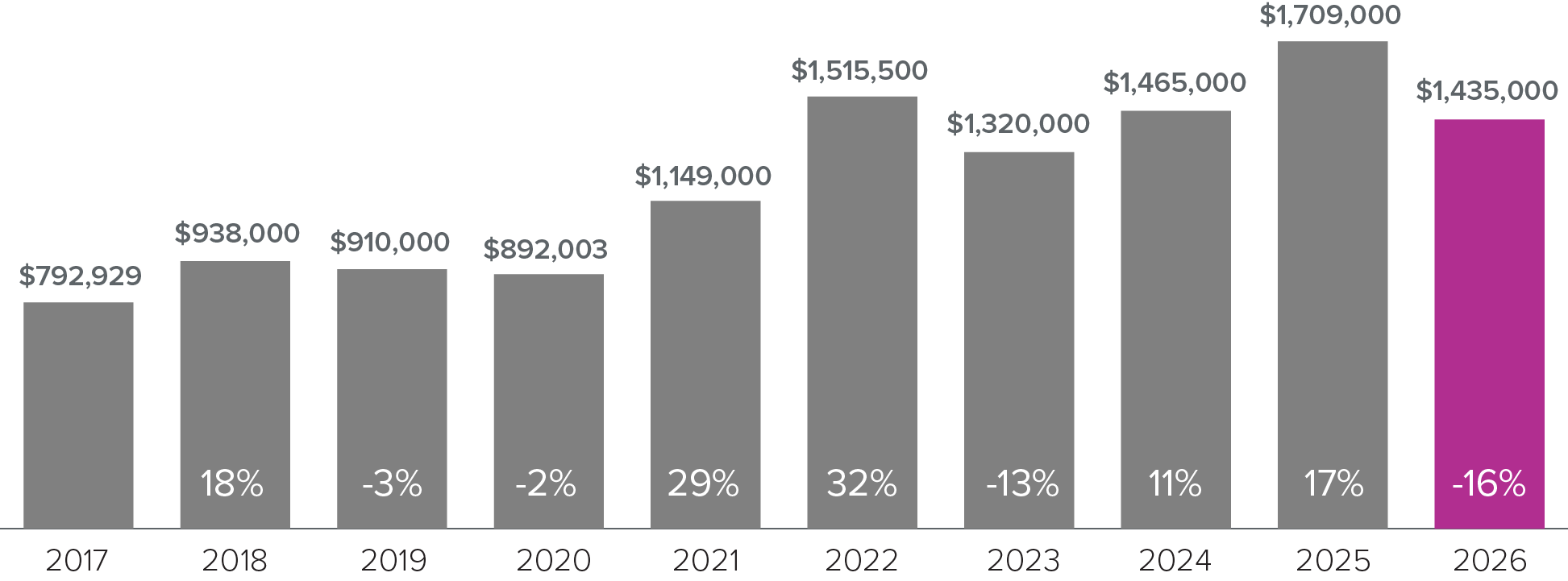

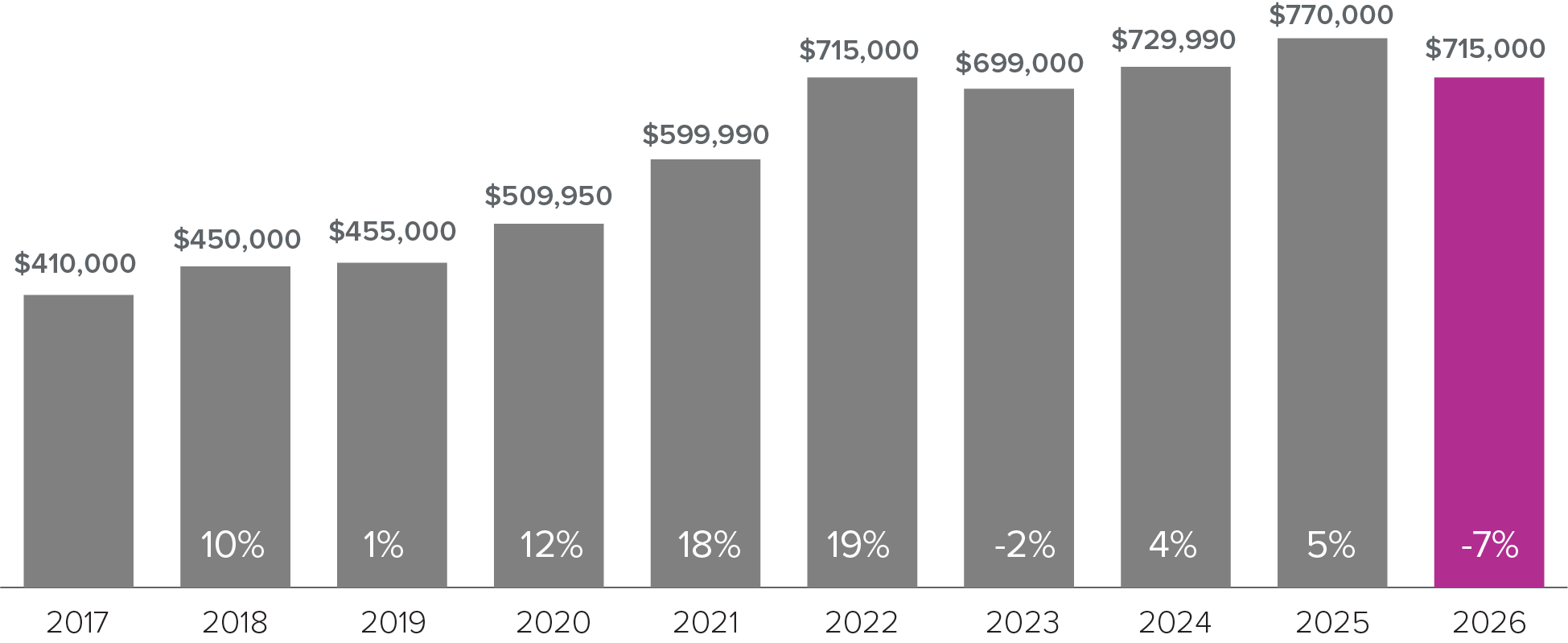

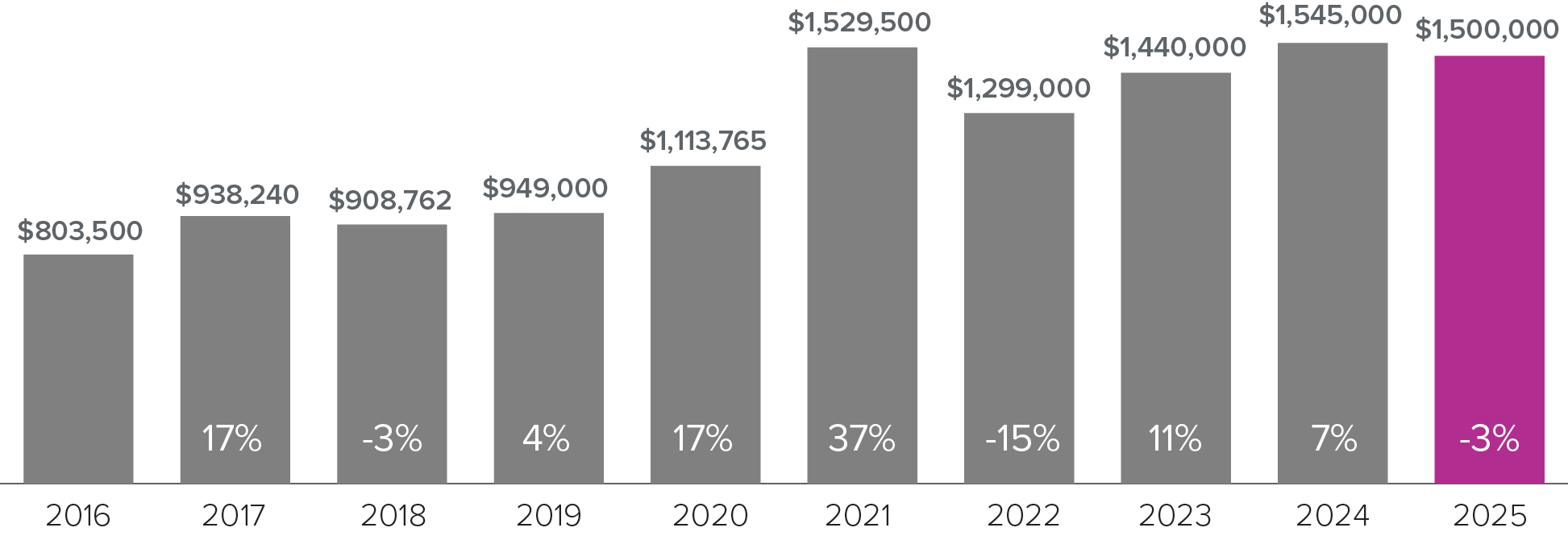

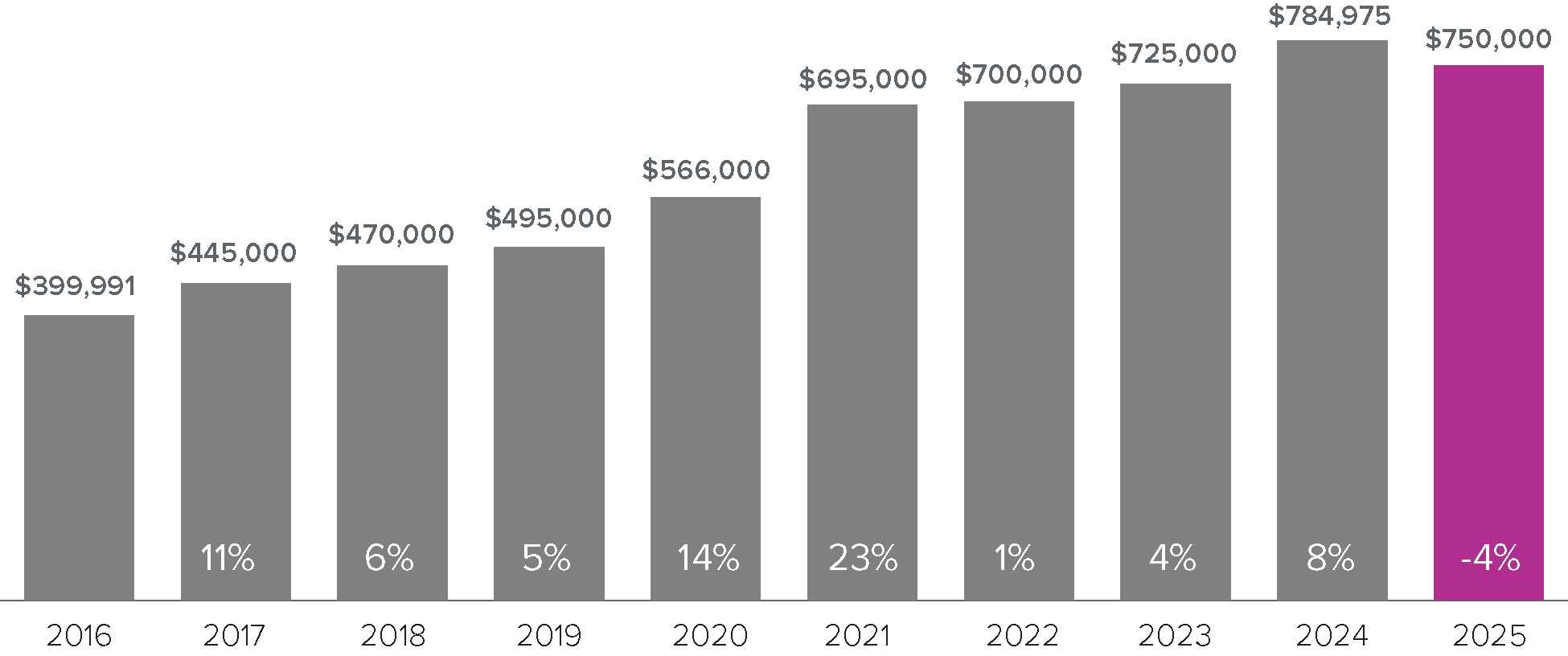

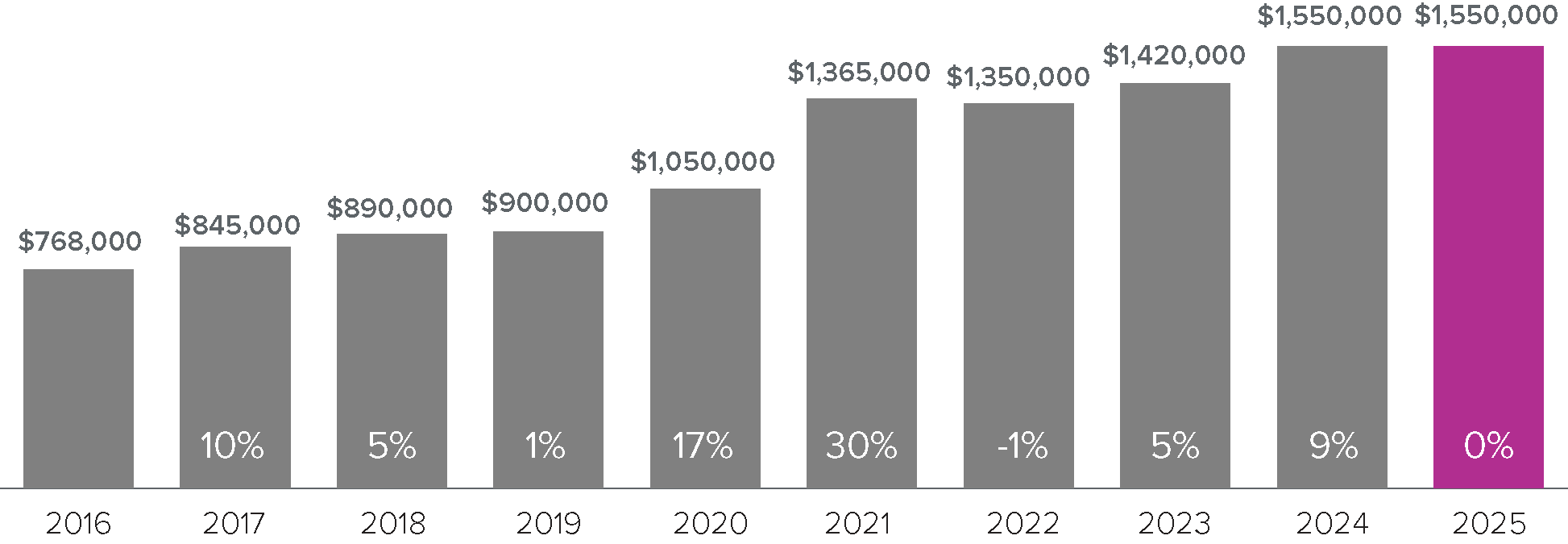

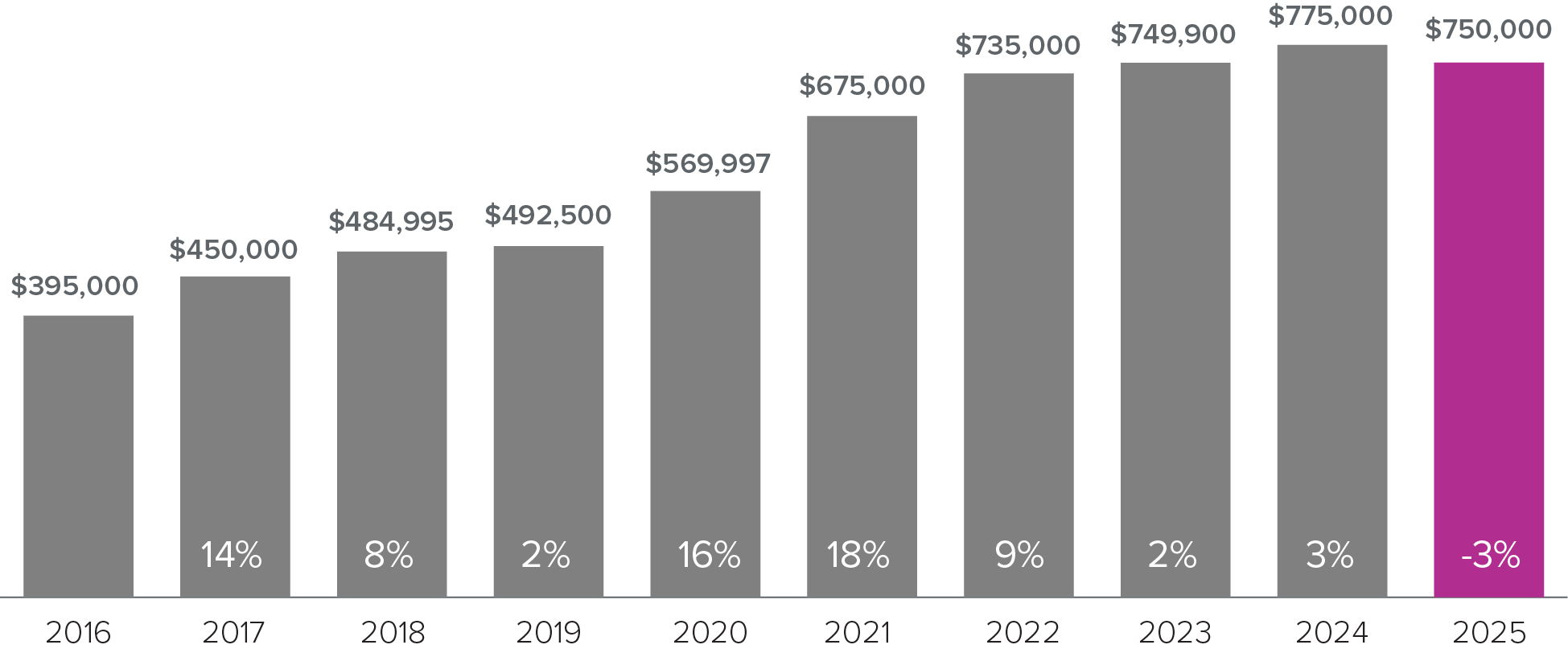

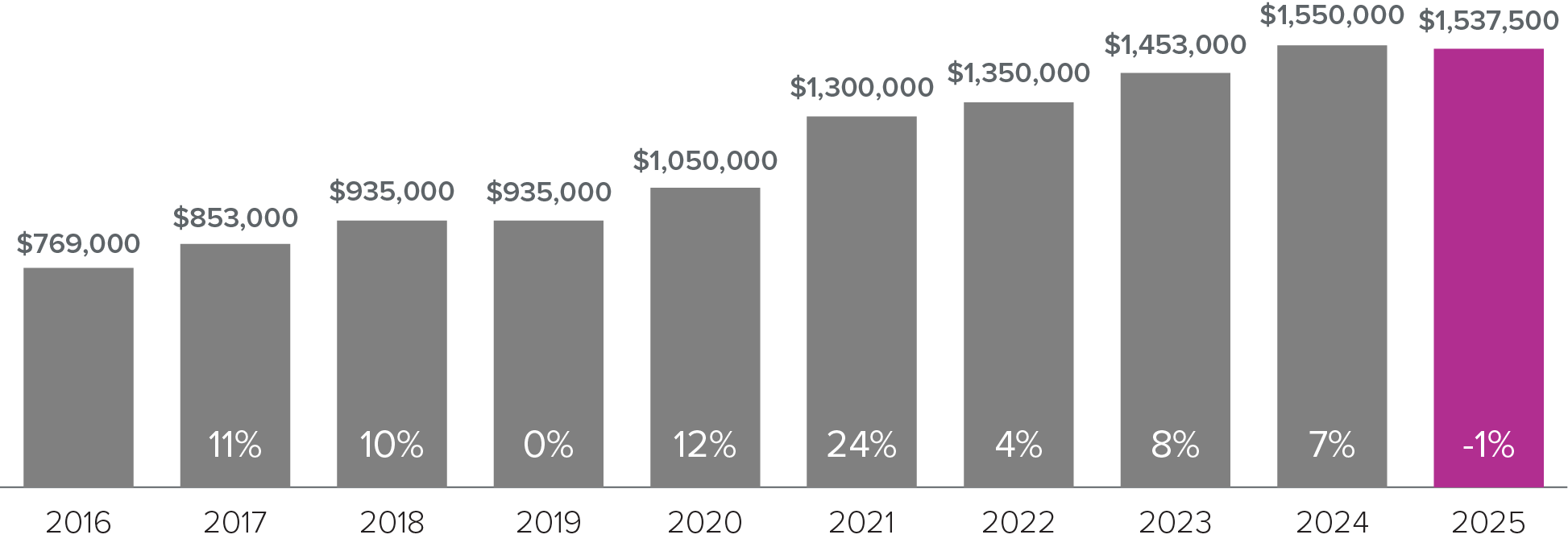

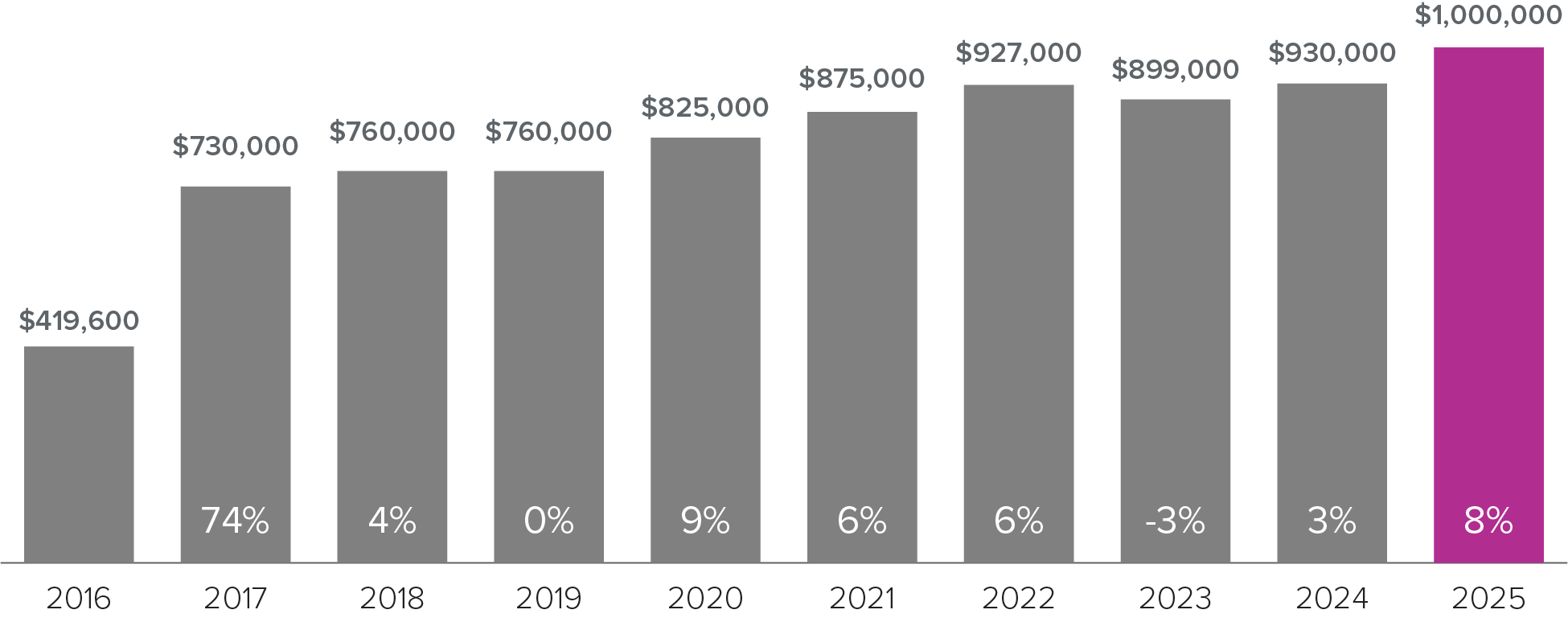

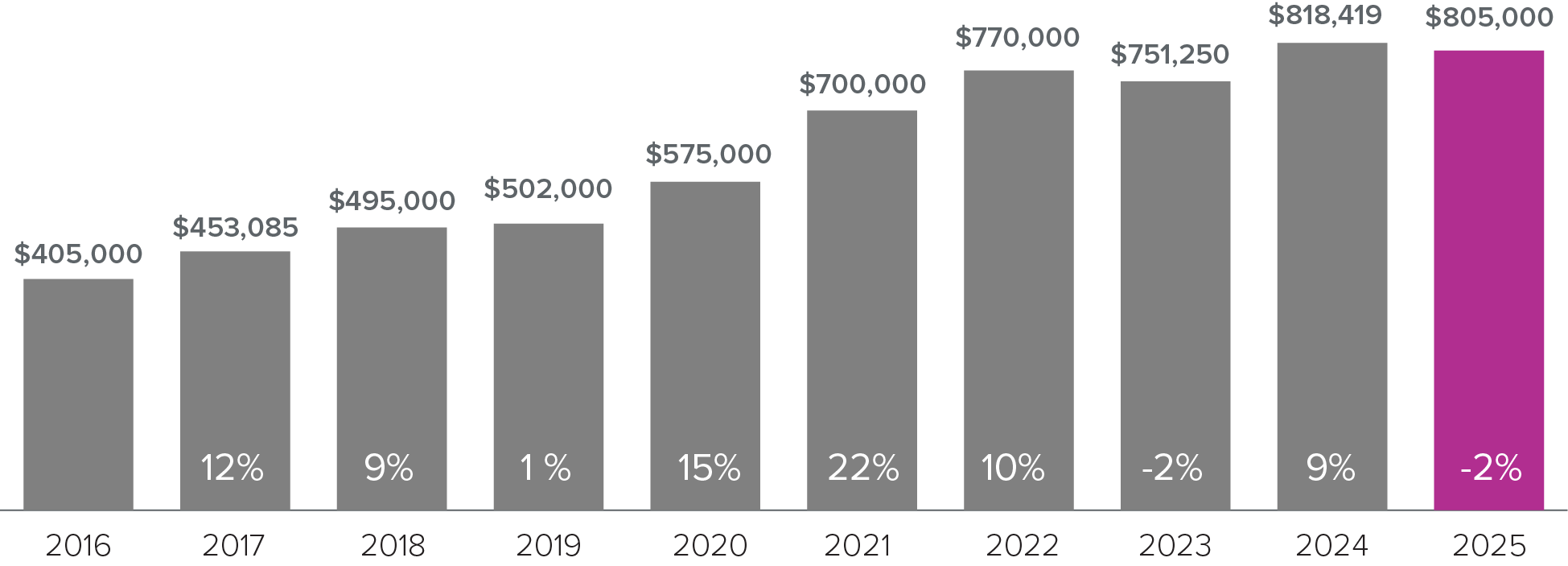

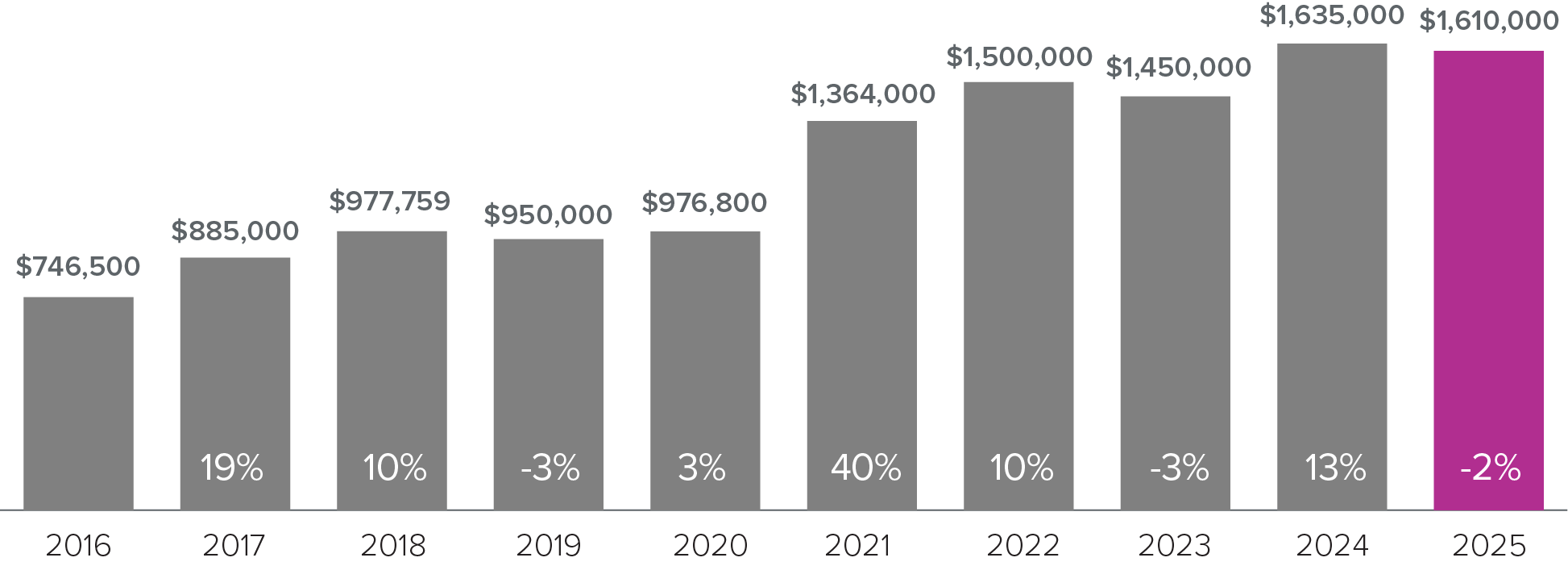

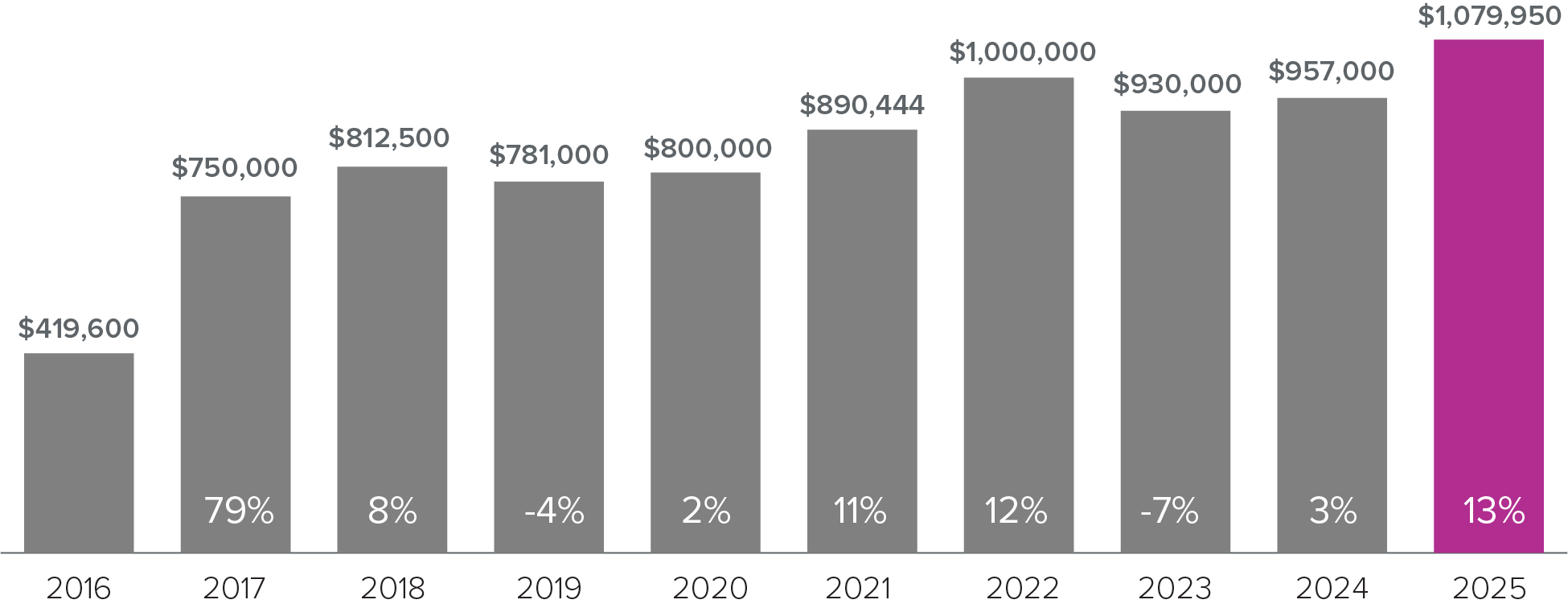

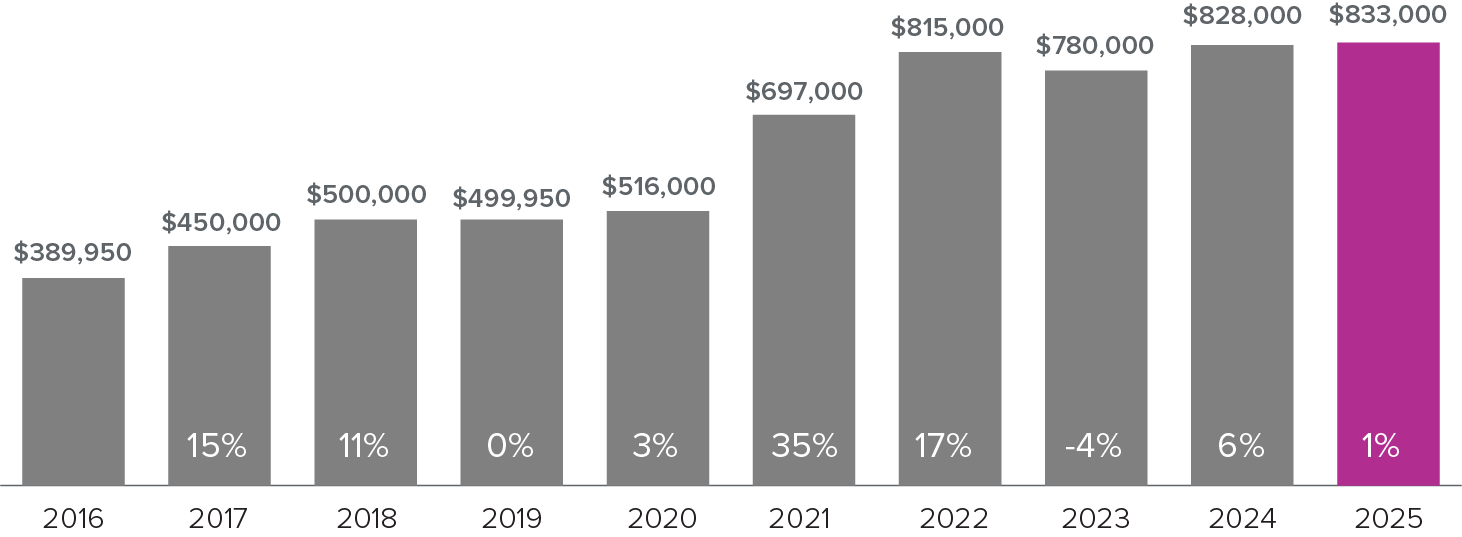

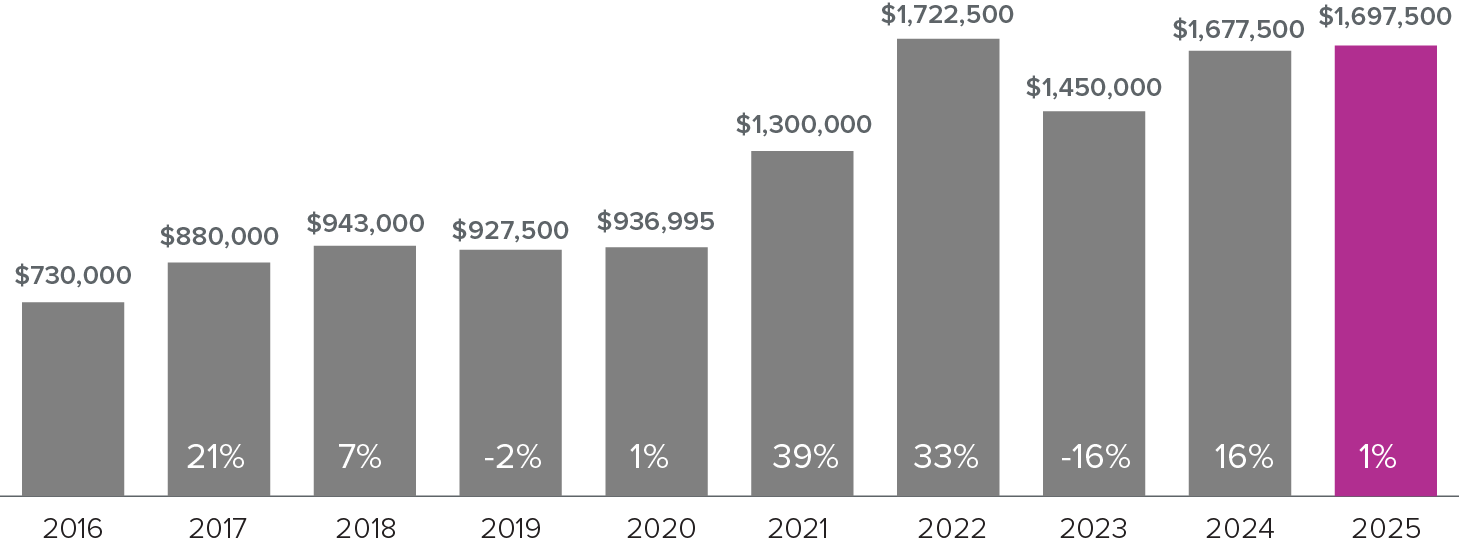

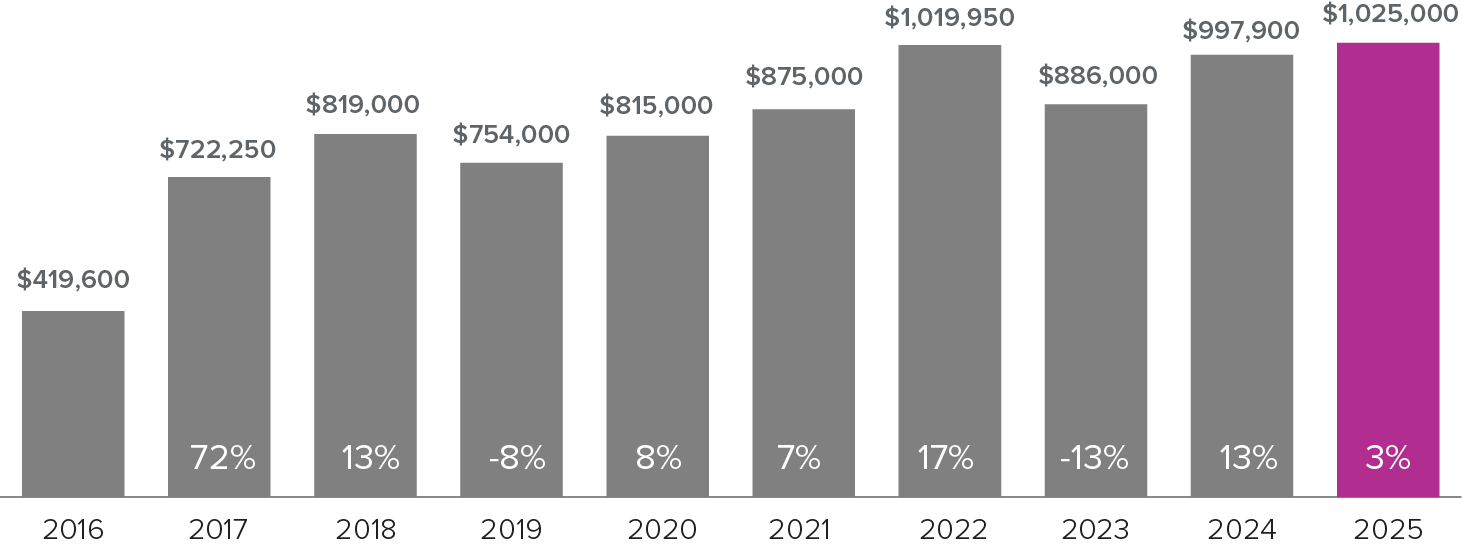

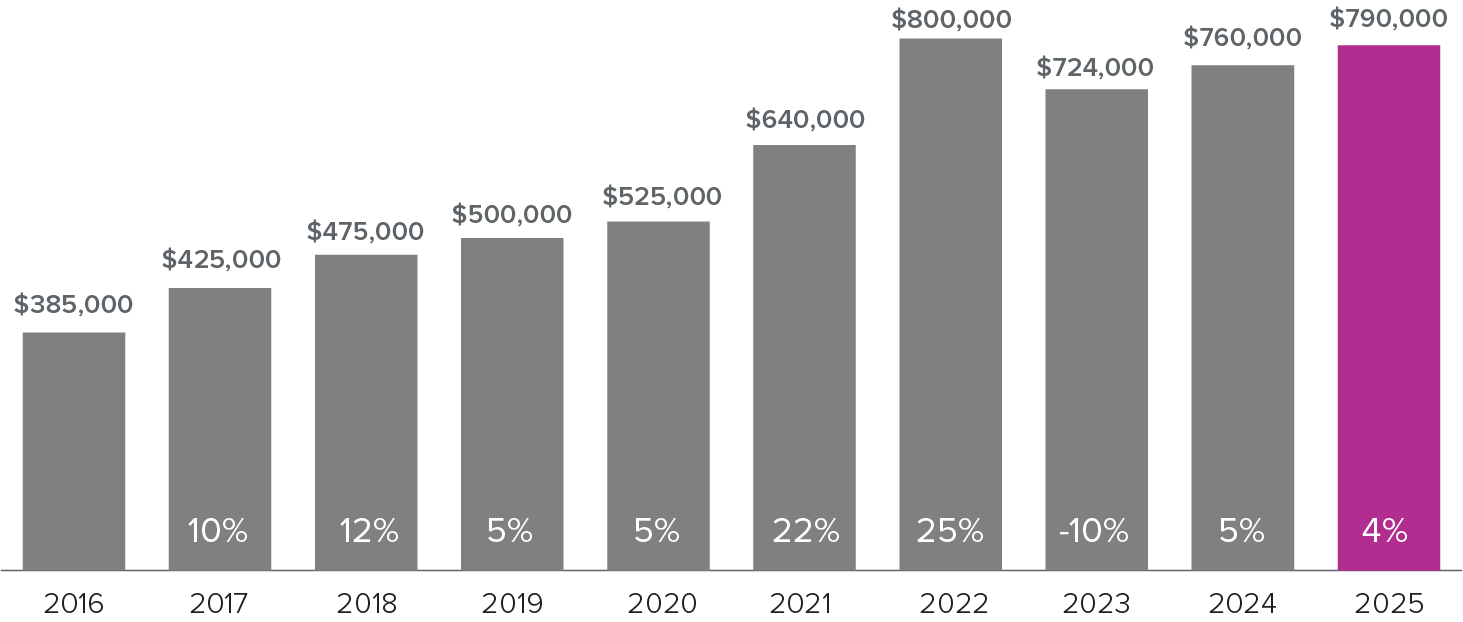

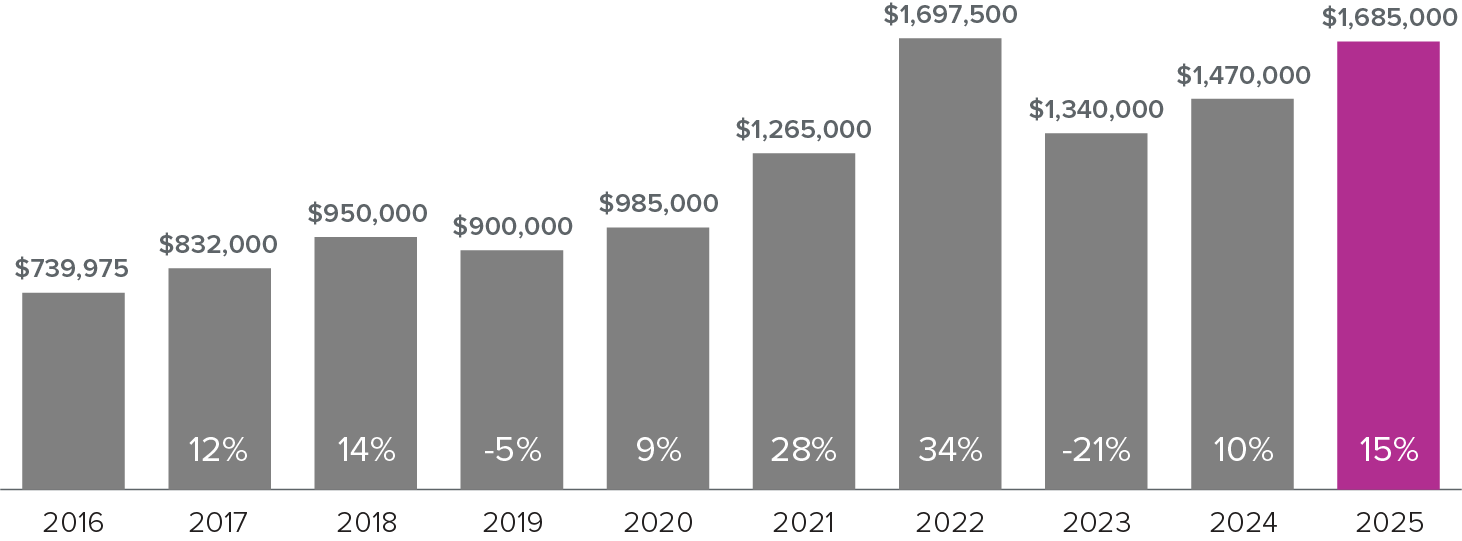

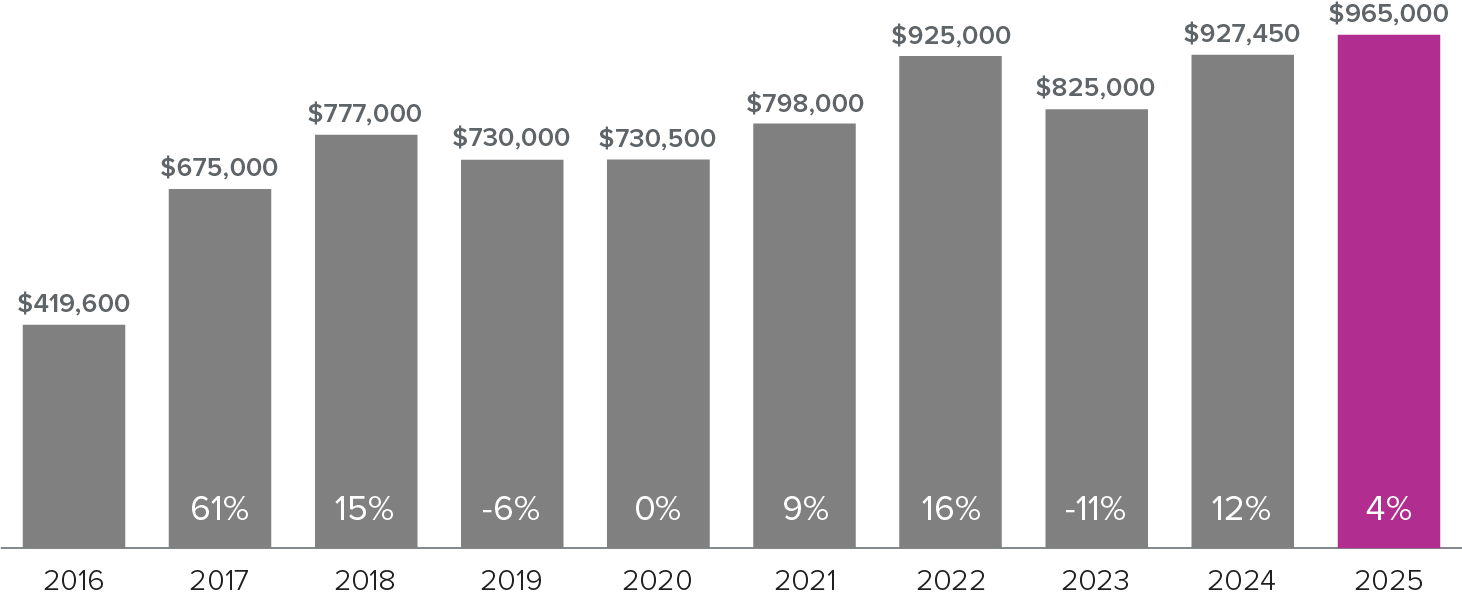

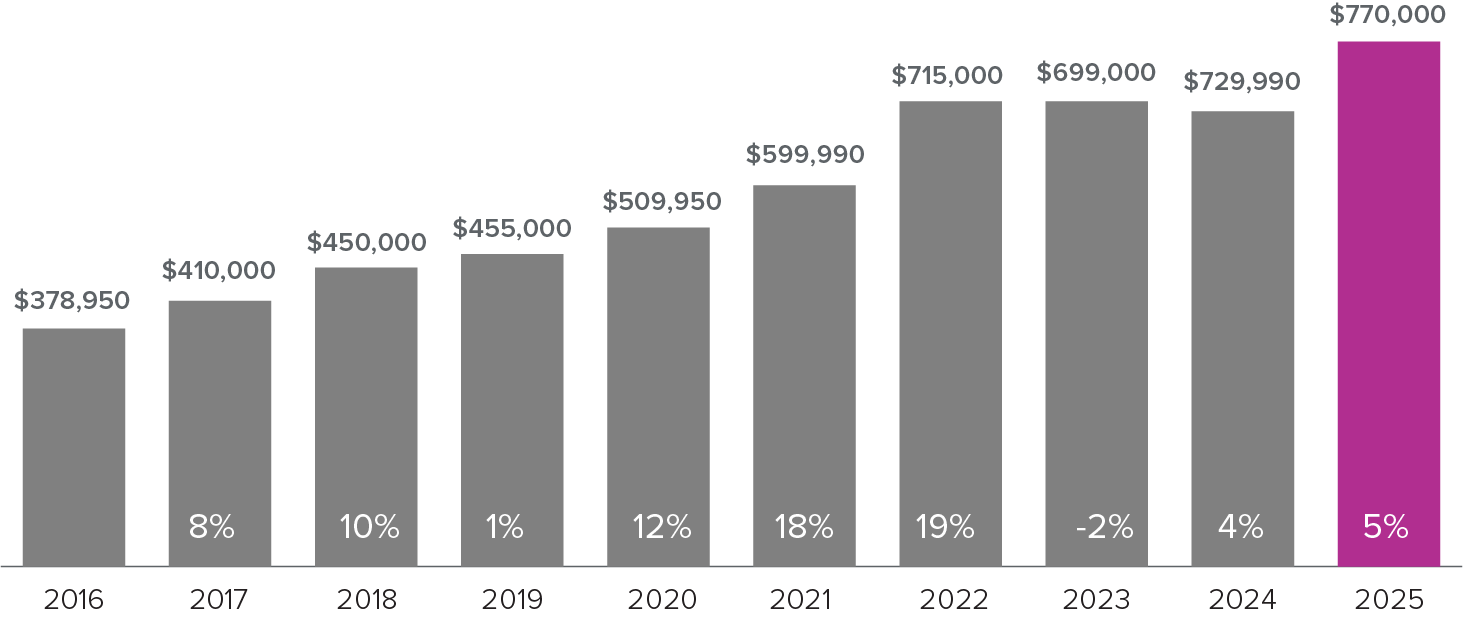

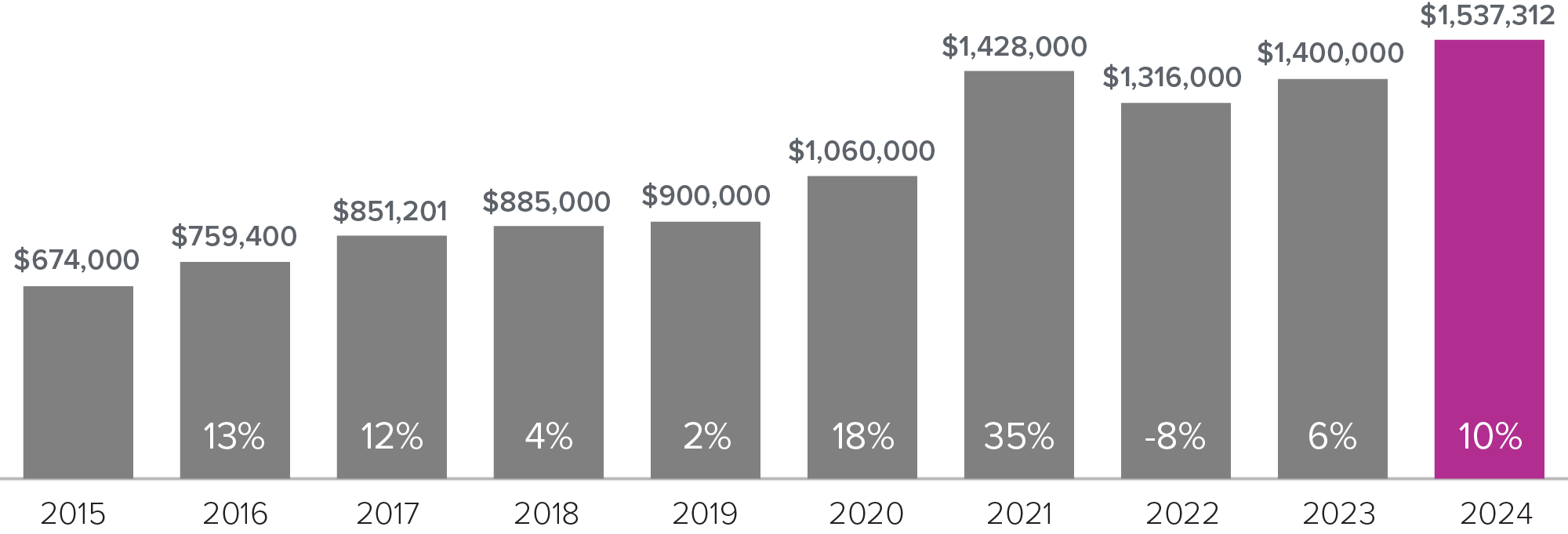

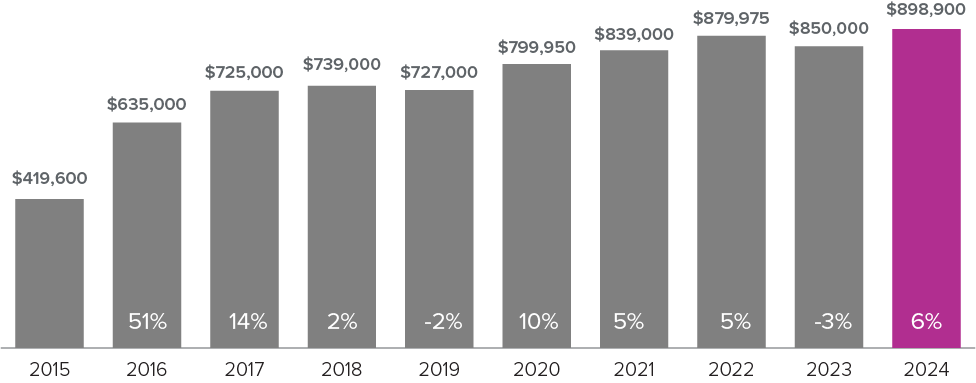

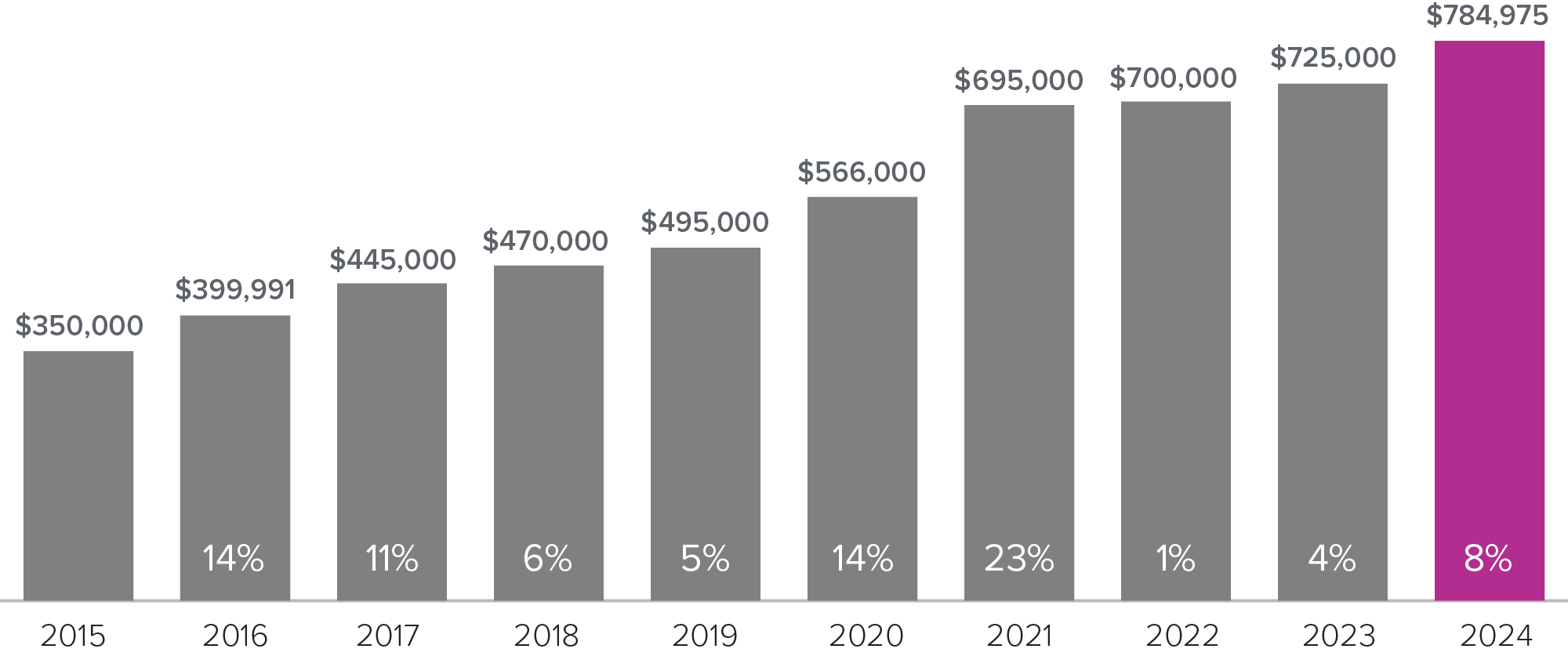

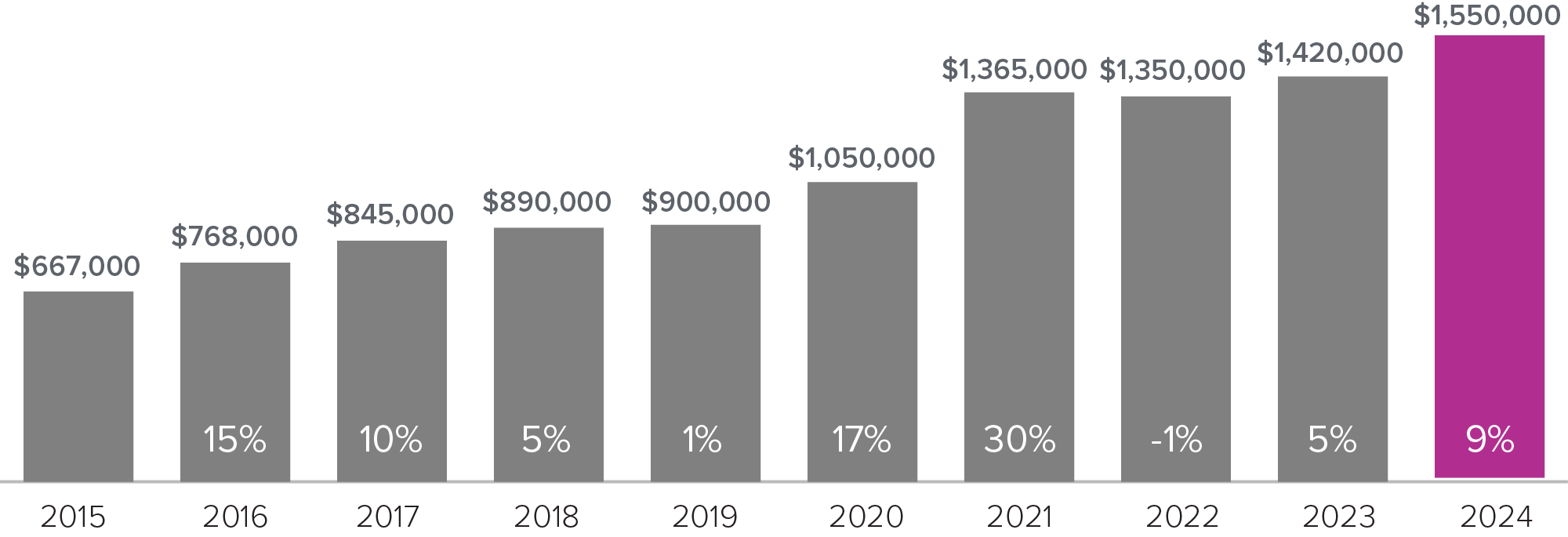

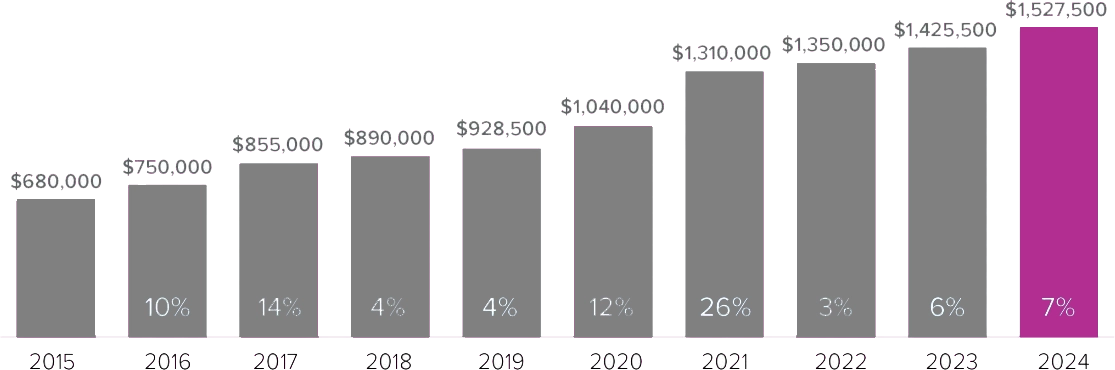

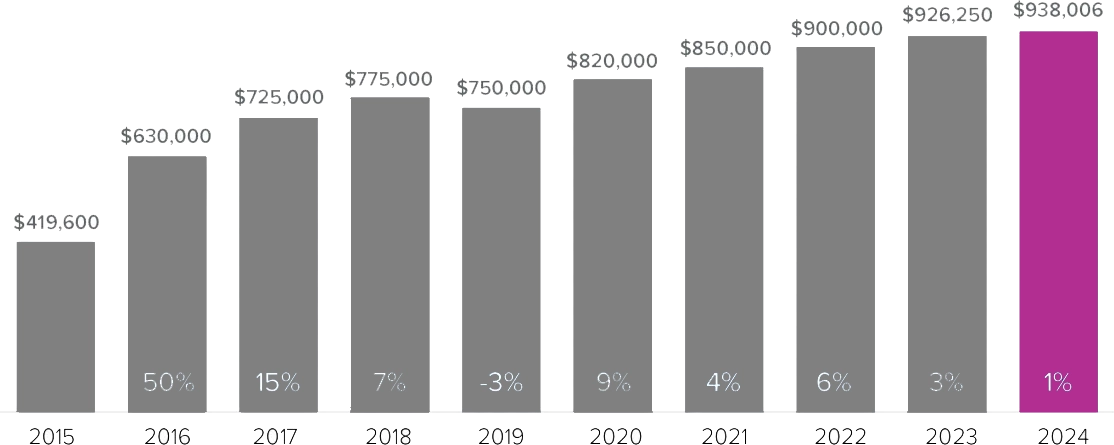

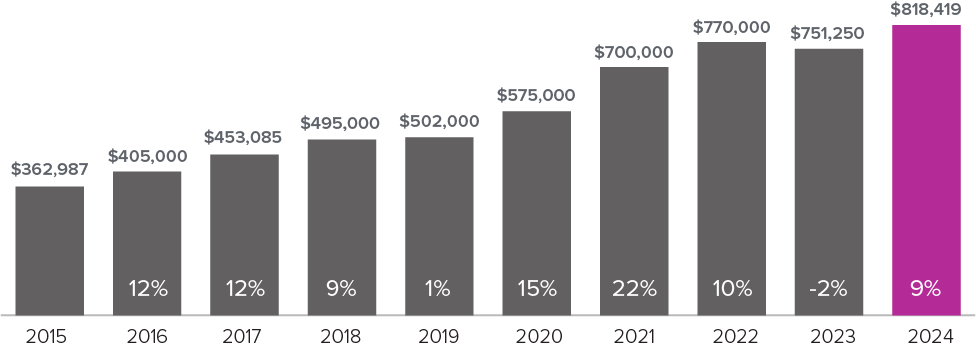

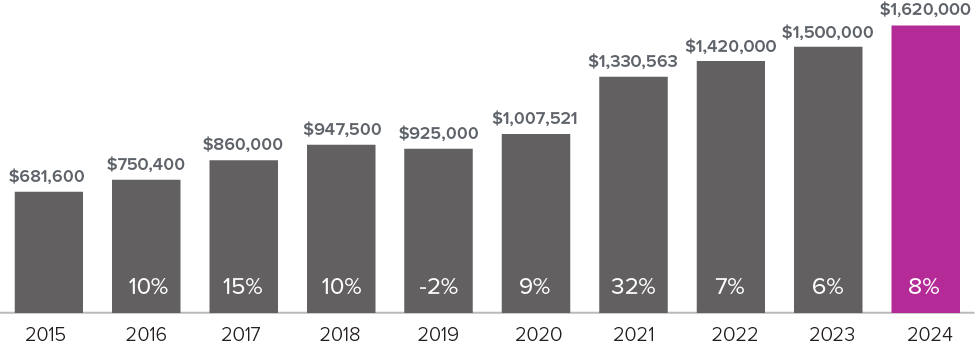

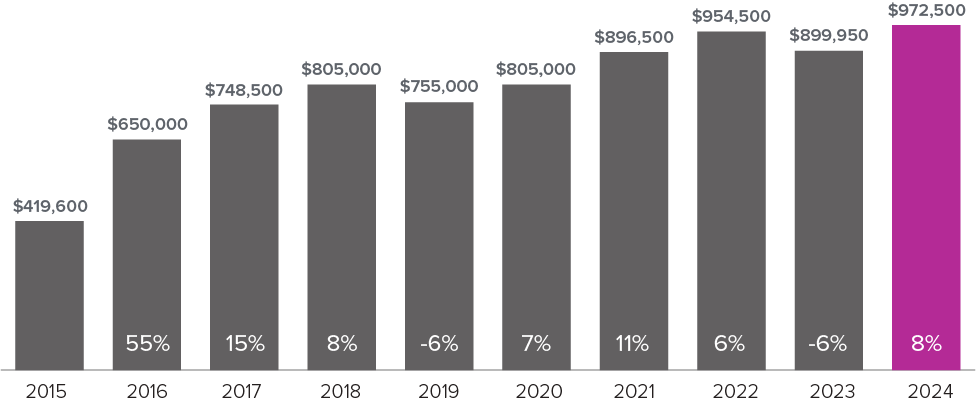

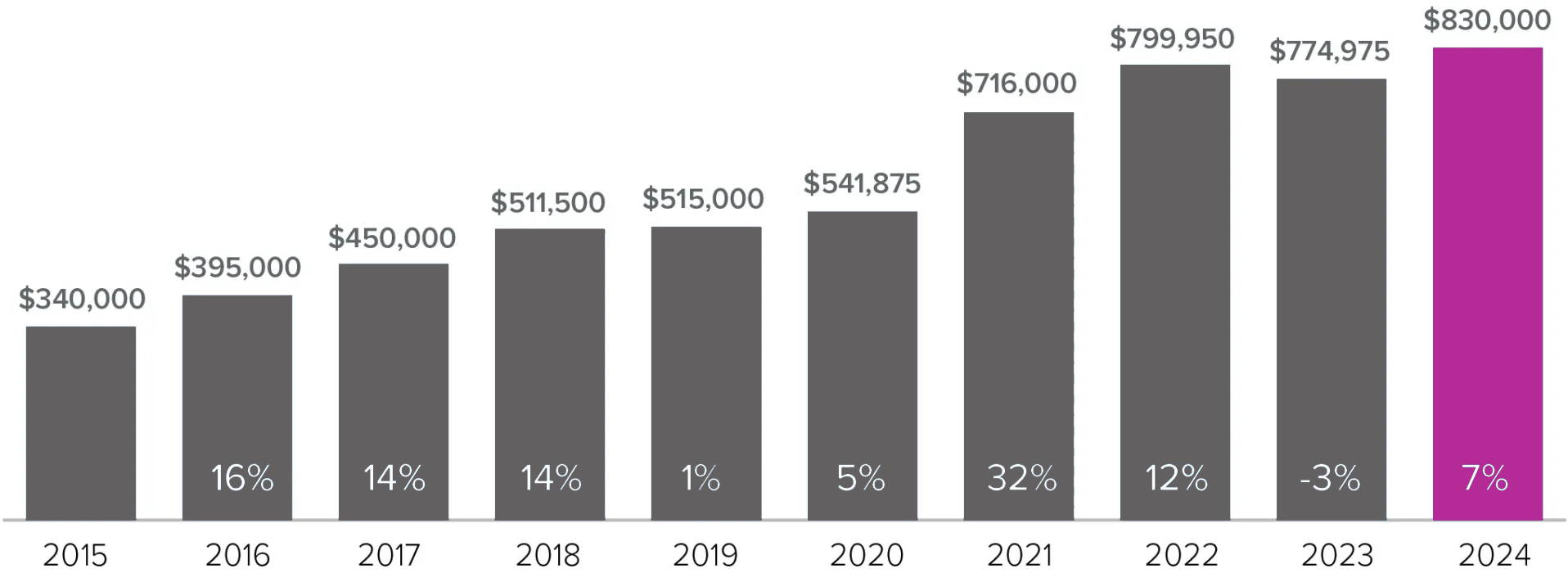

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

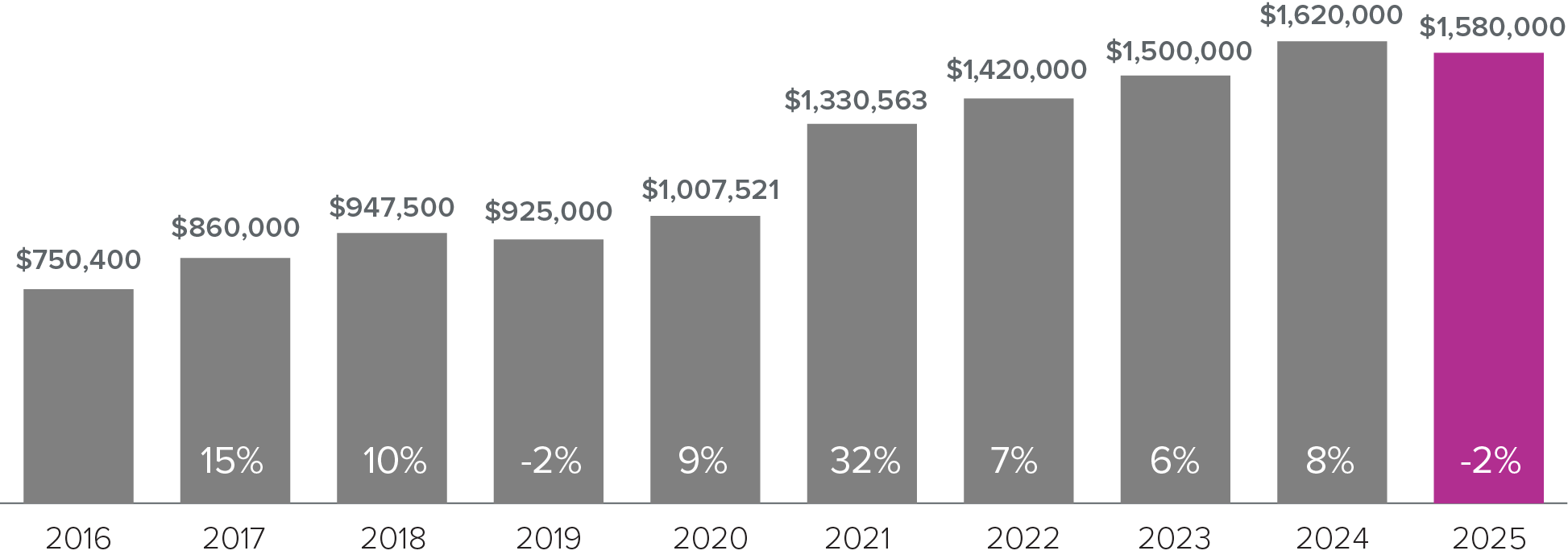

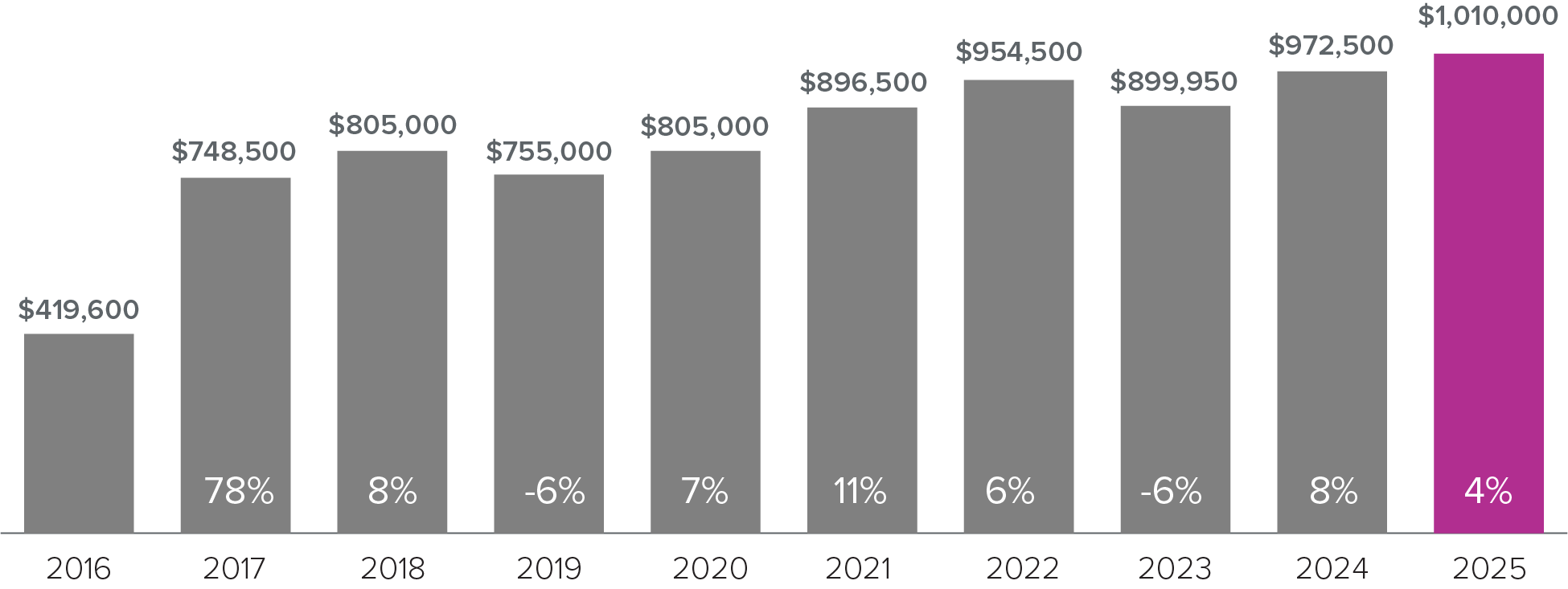

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

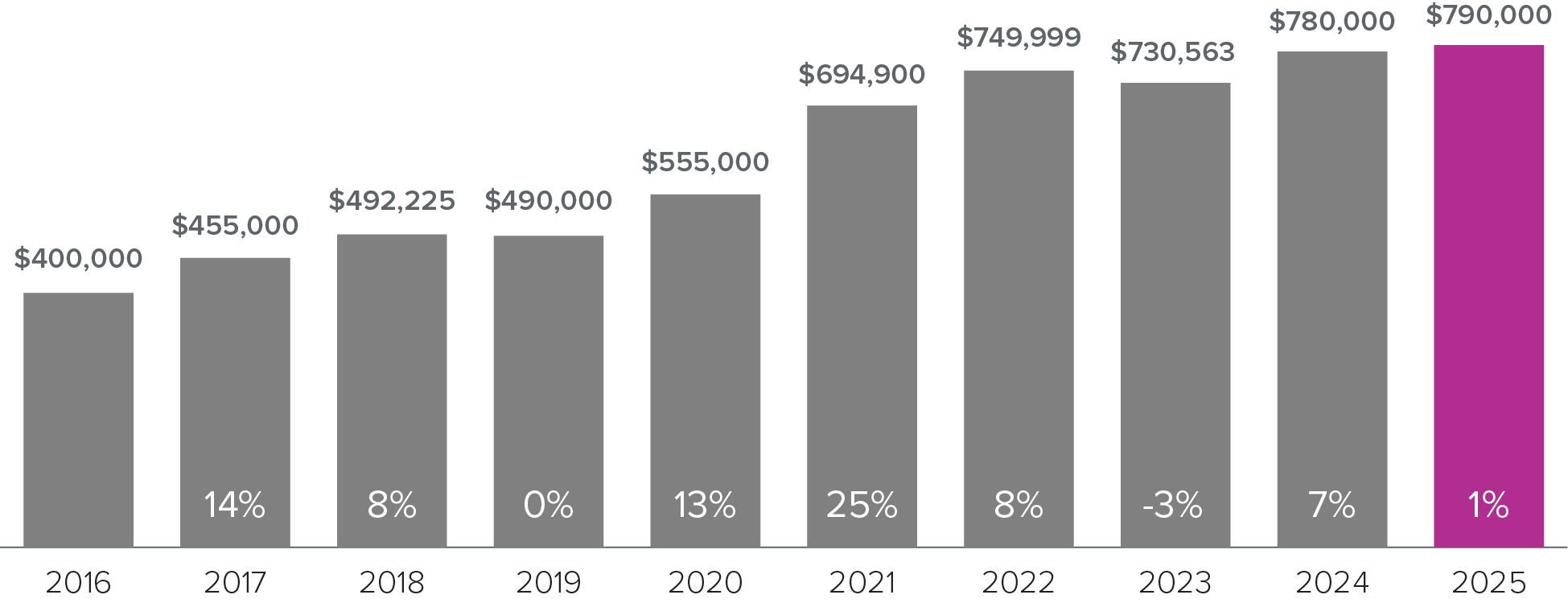

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

11%

OF HOMES SOLD ABOVE LIST PRICE

44%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

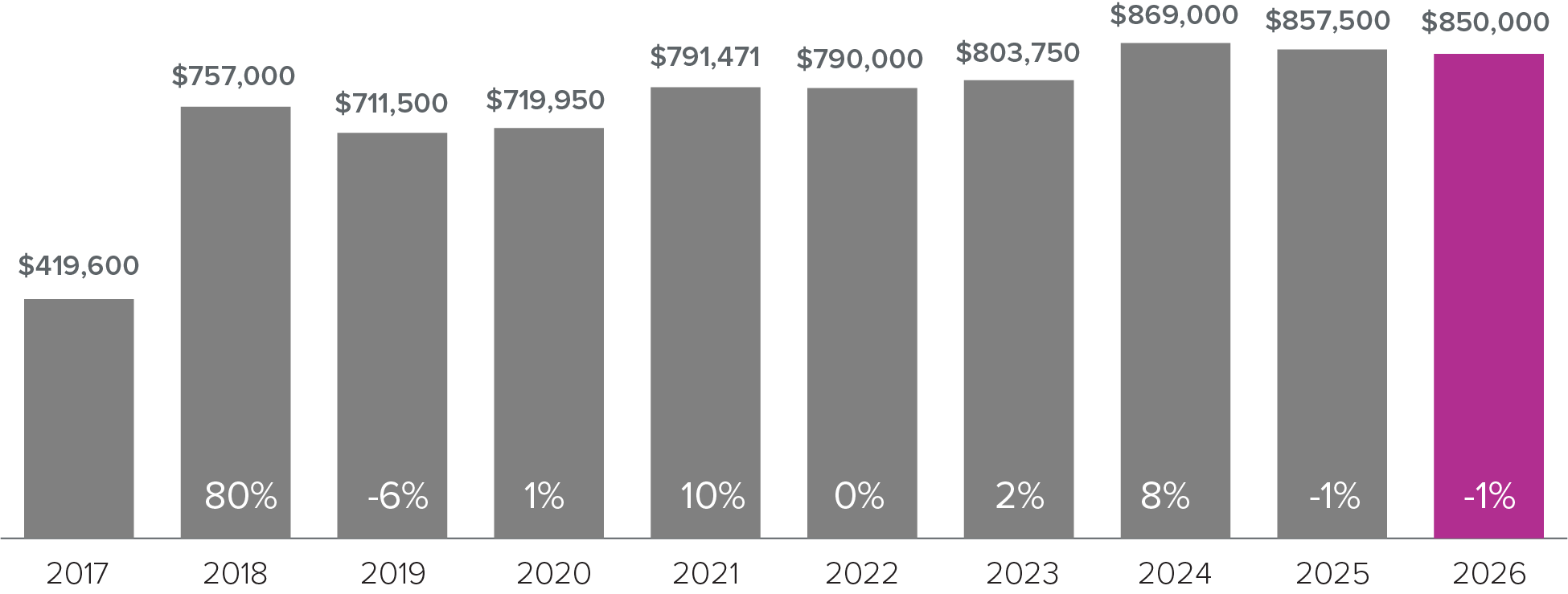

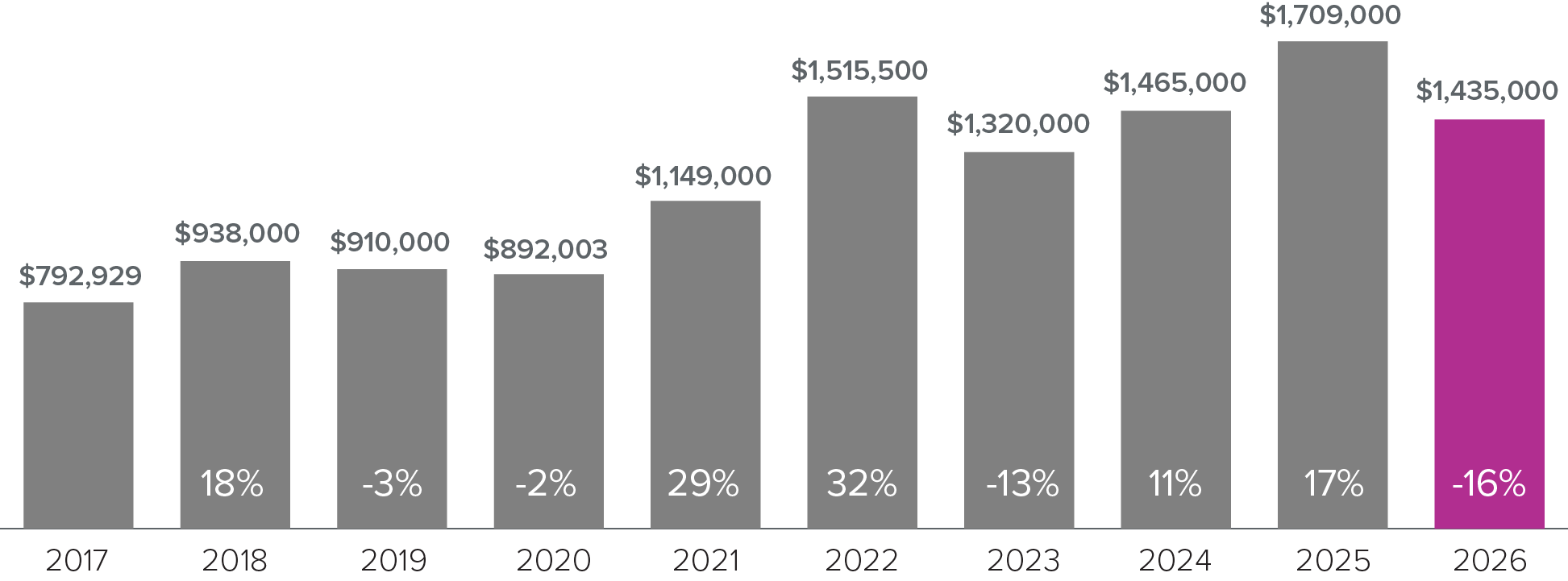

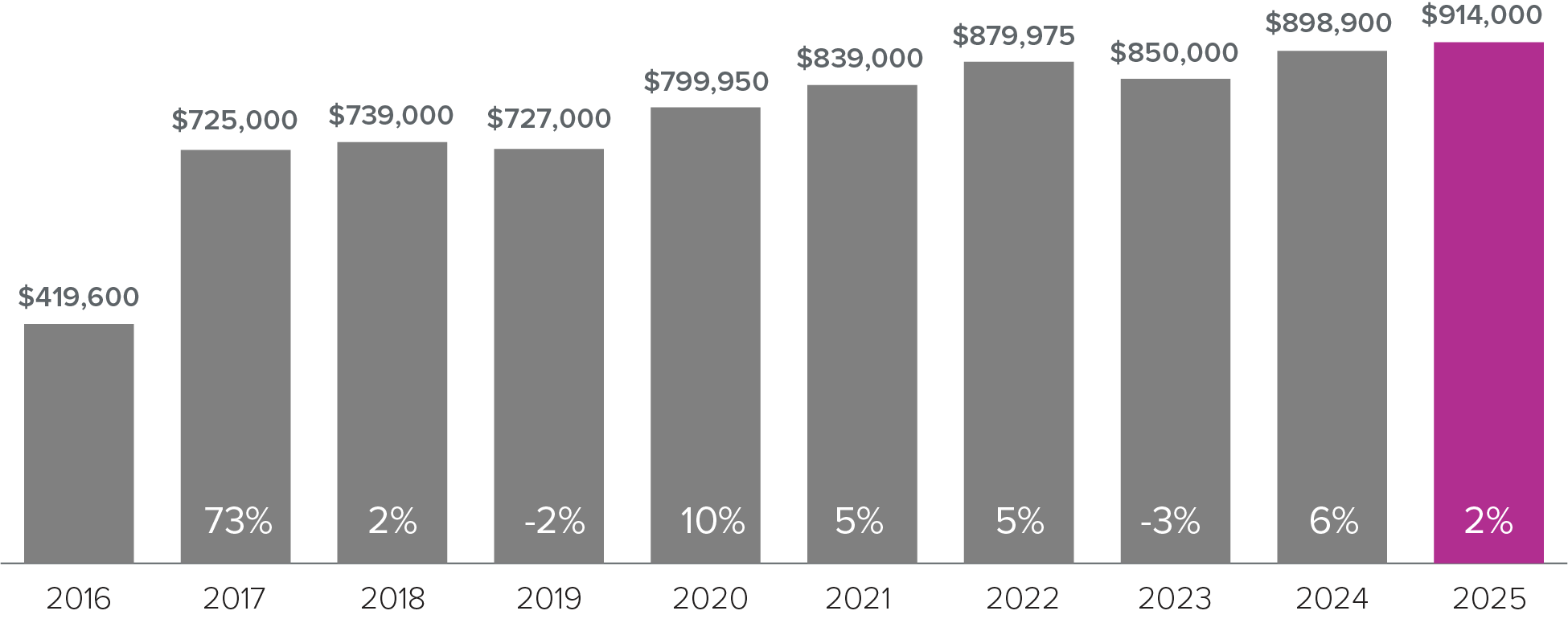

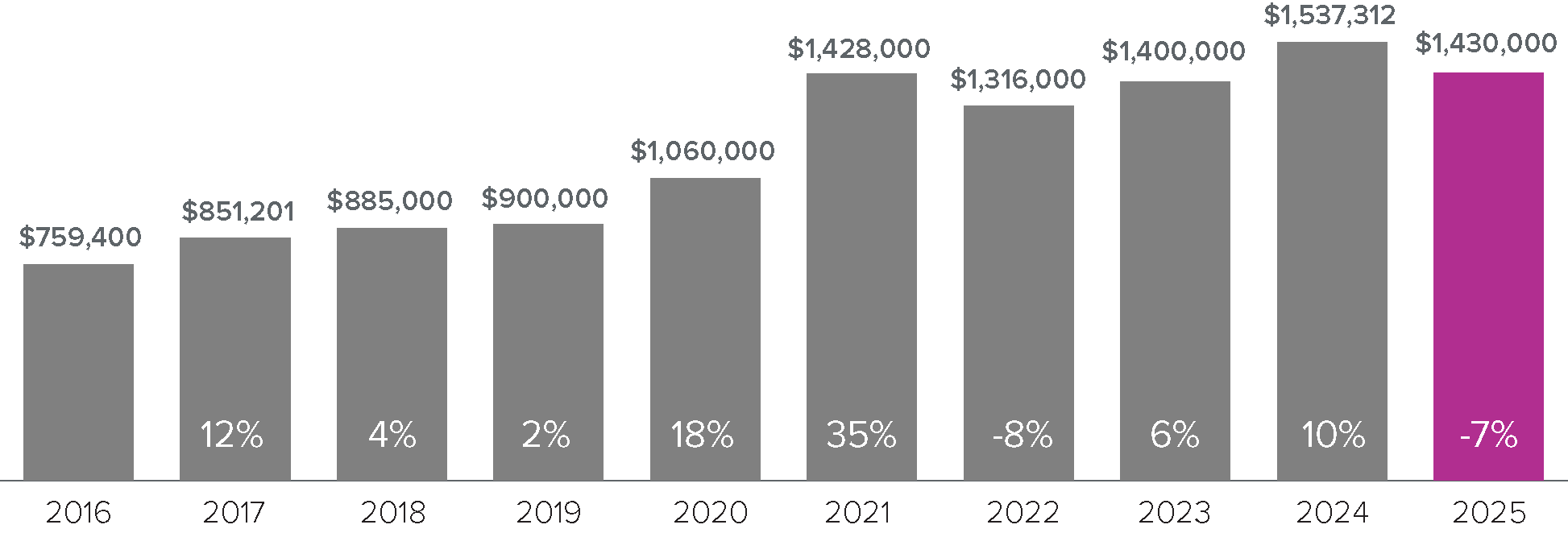

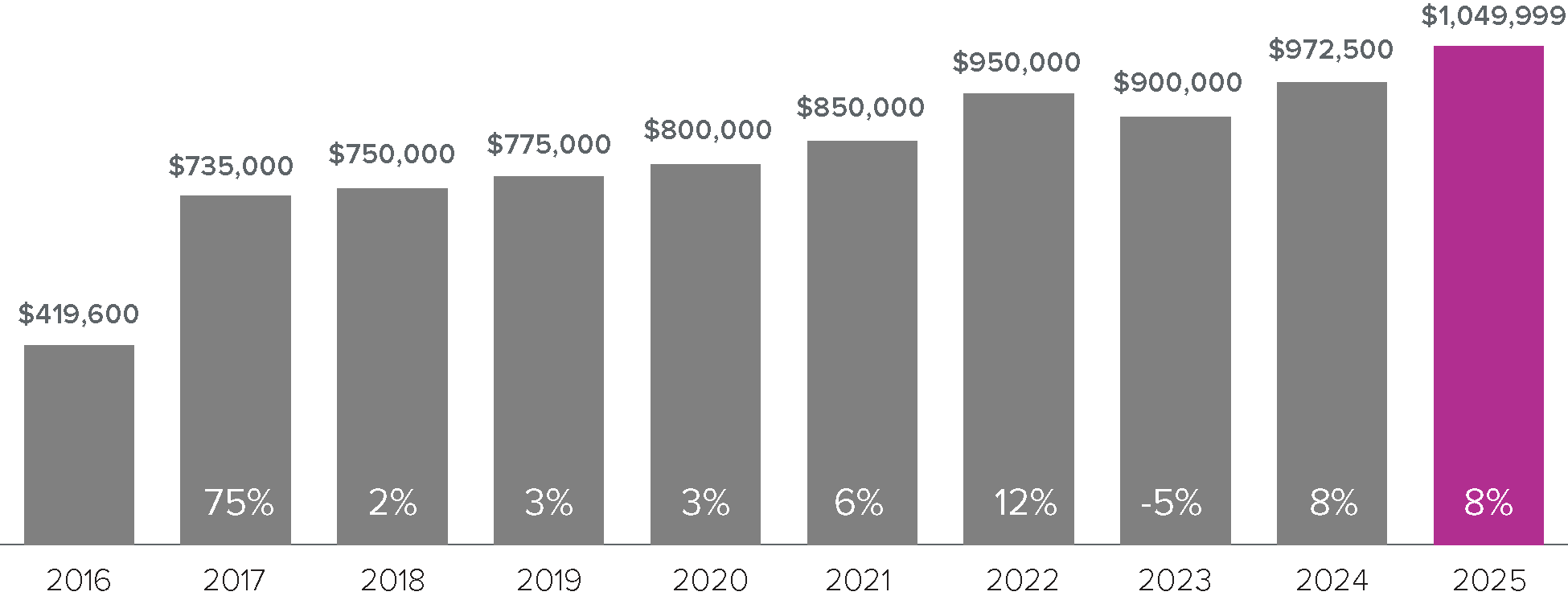

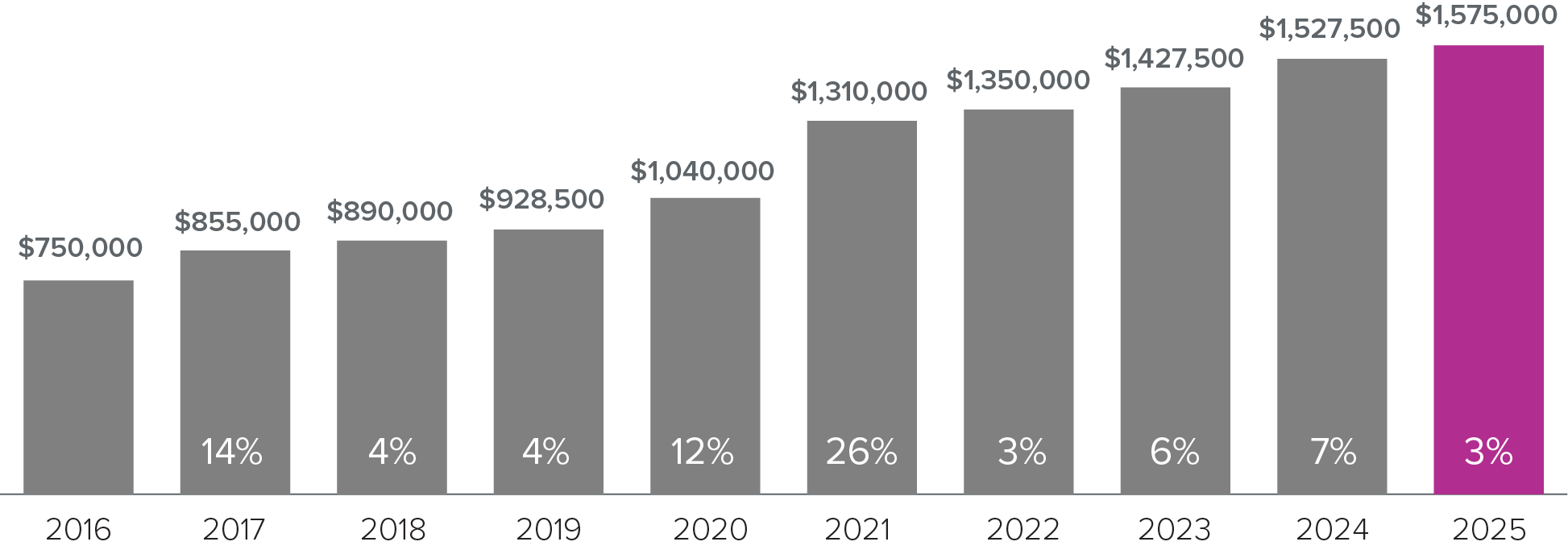

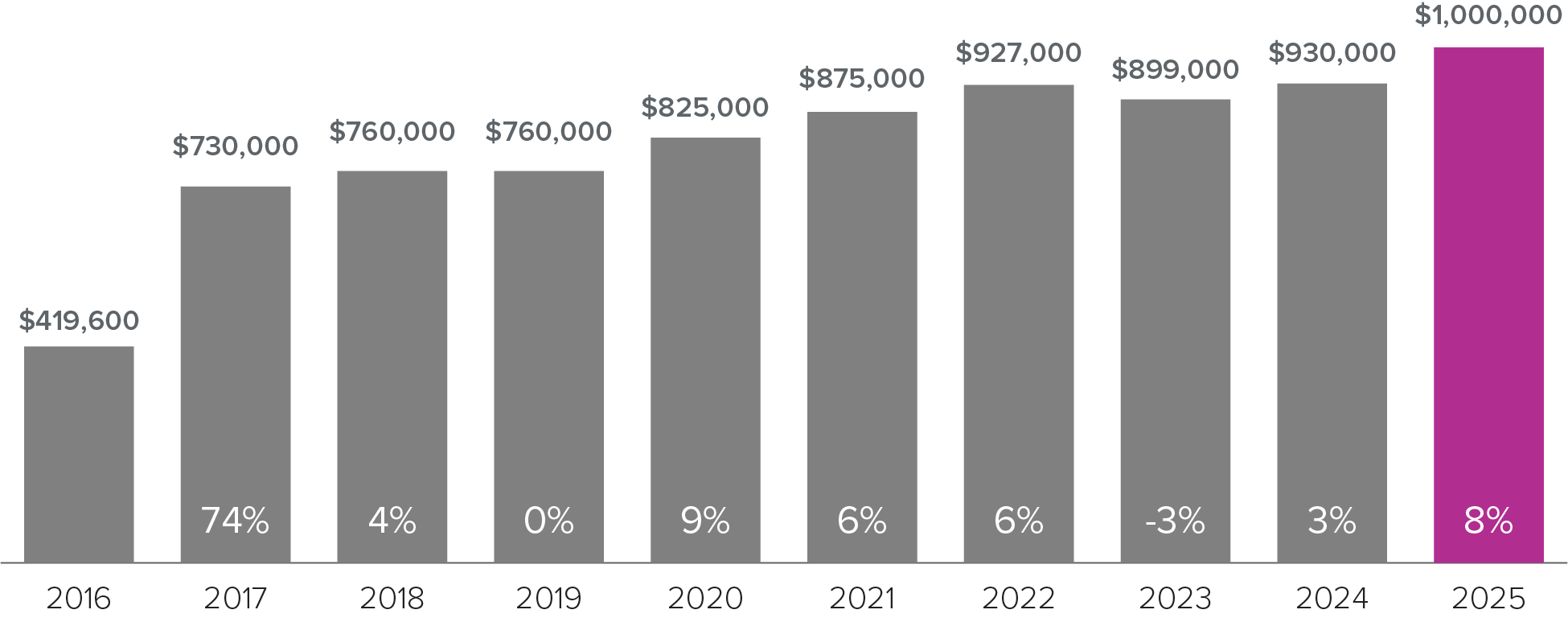

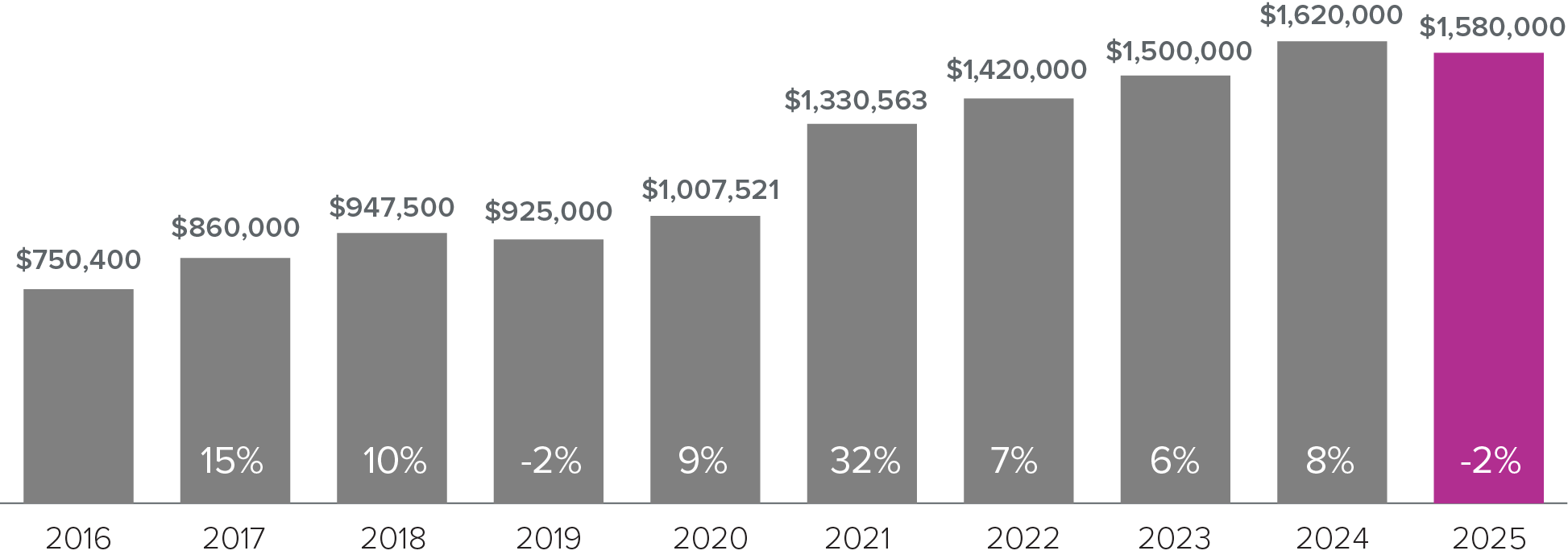

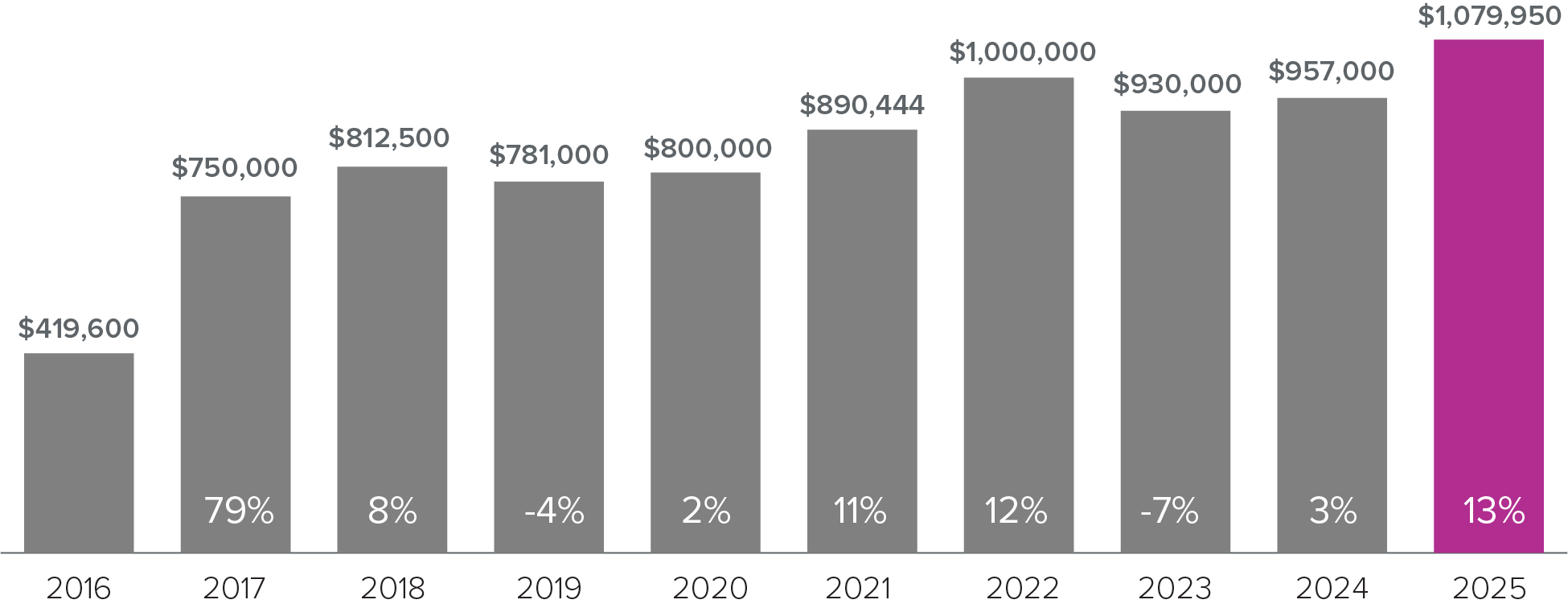

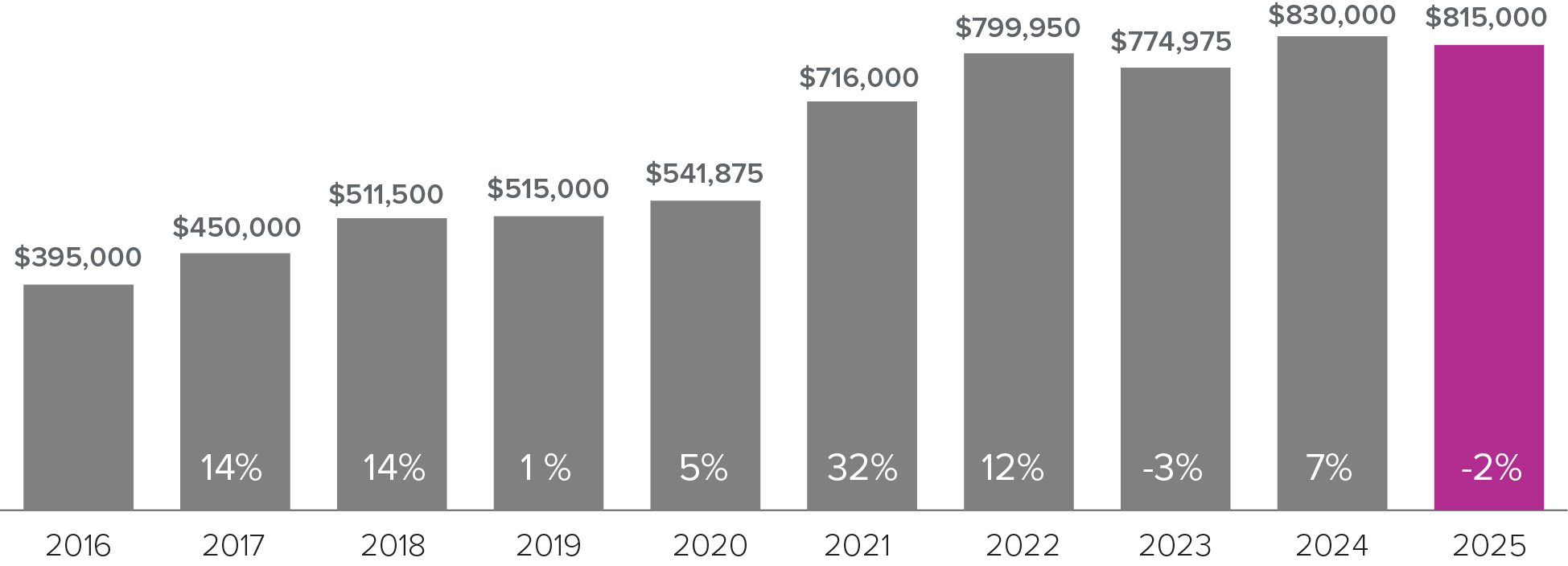

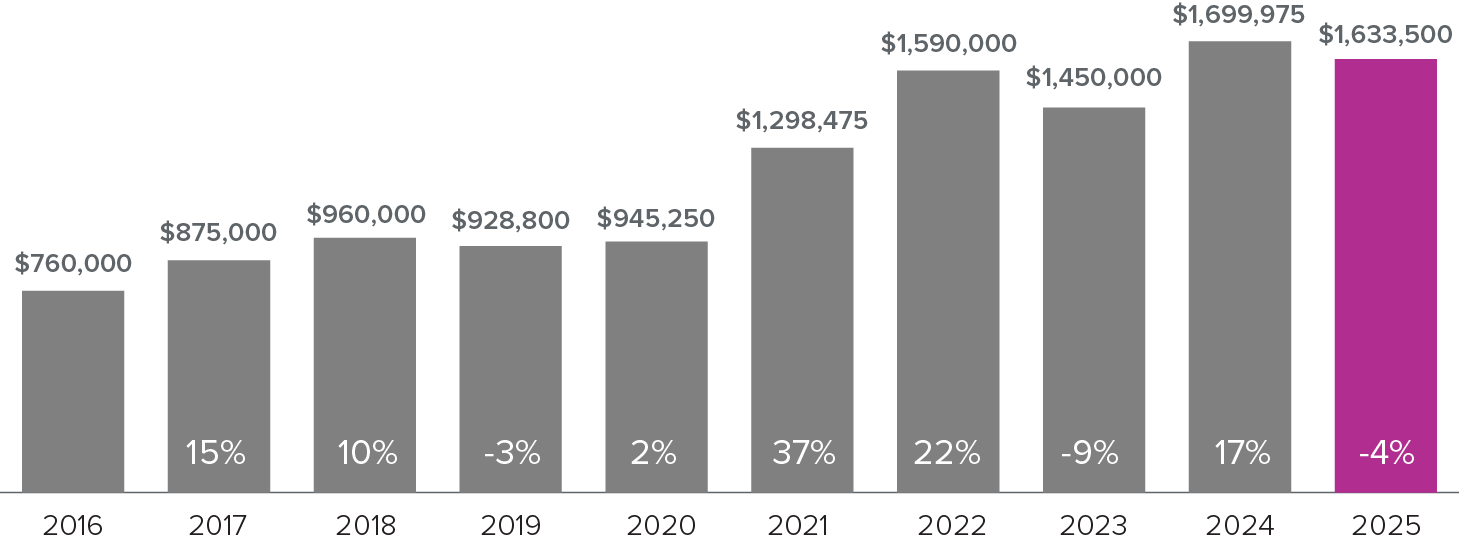

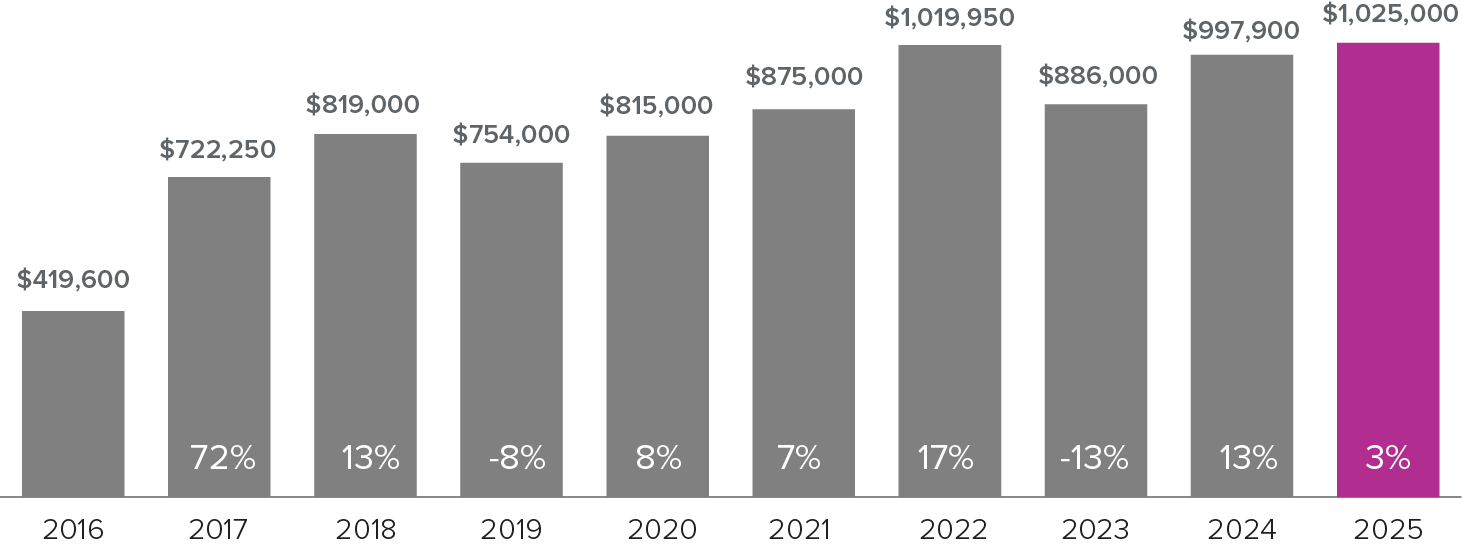

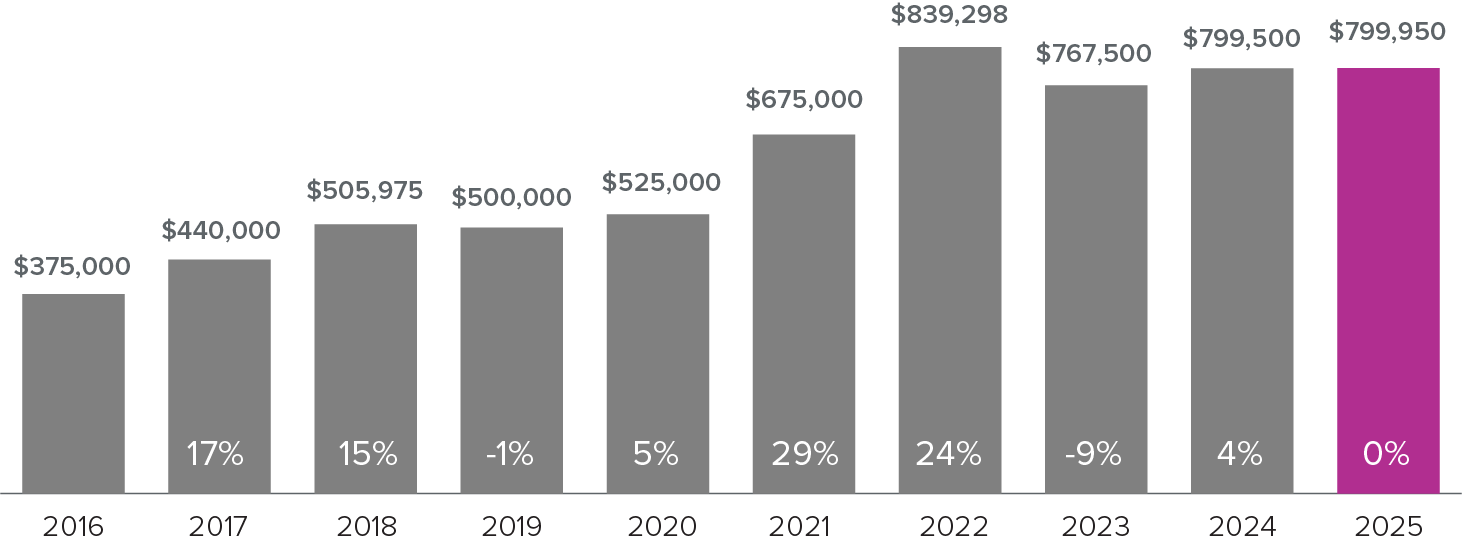

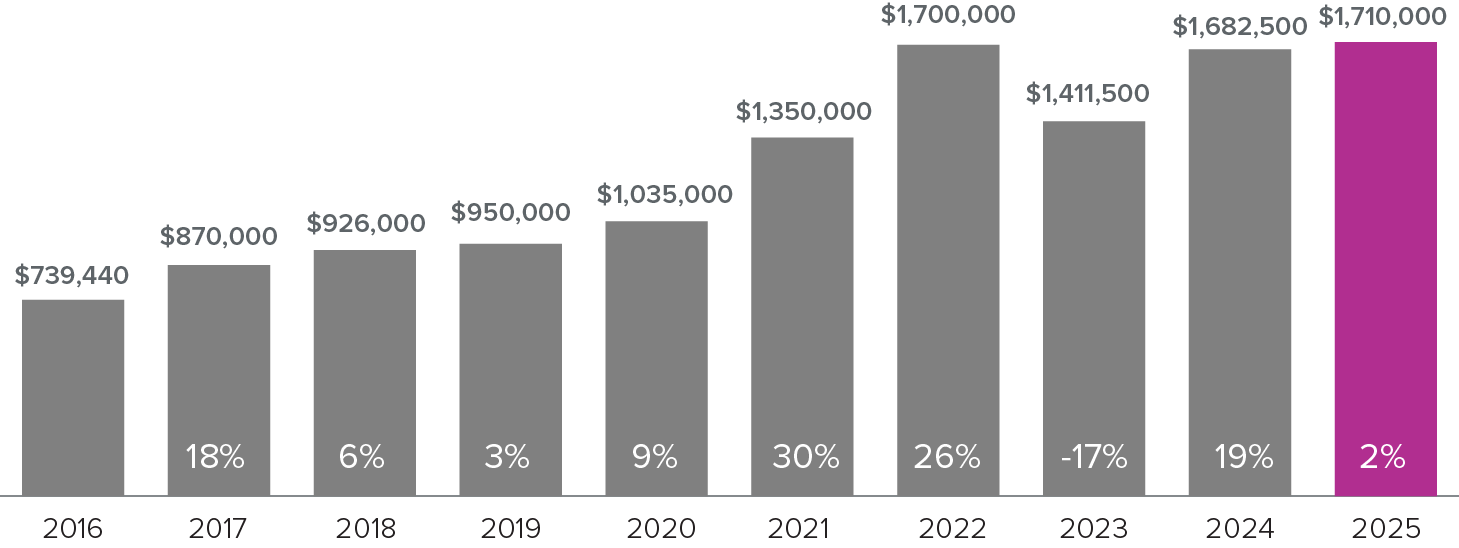

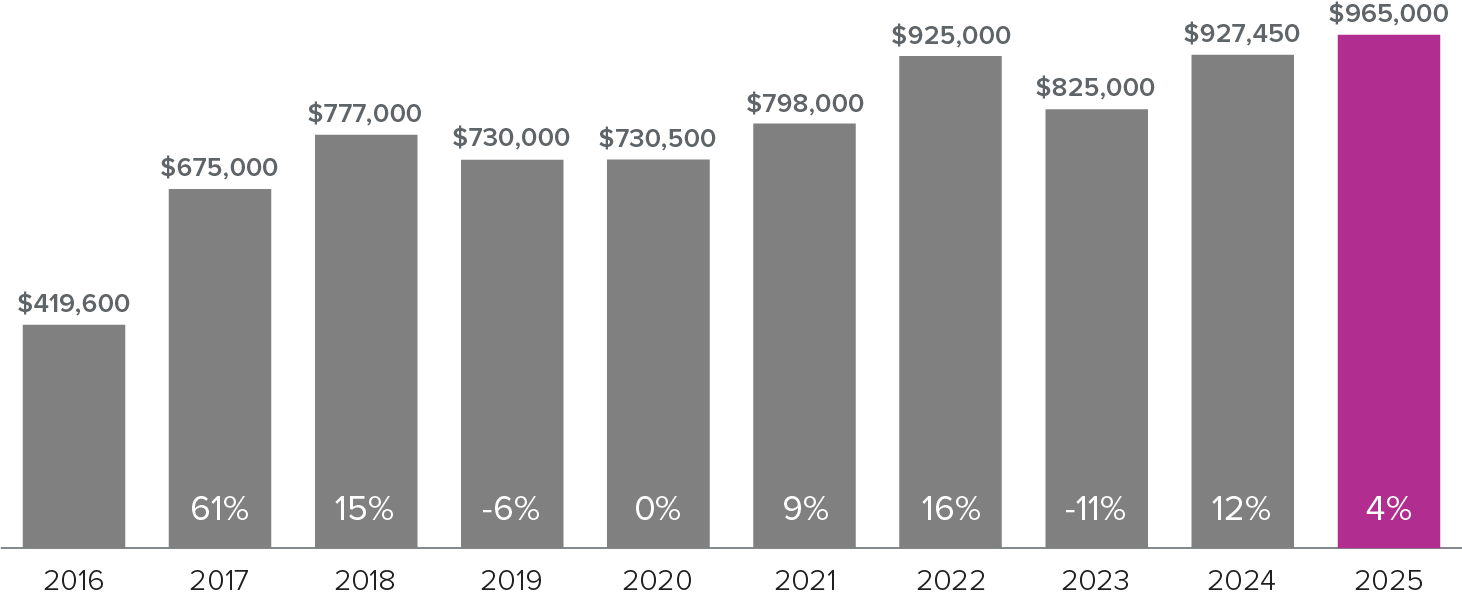

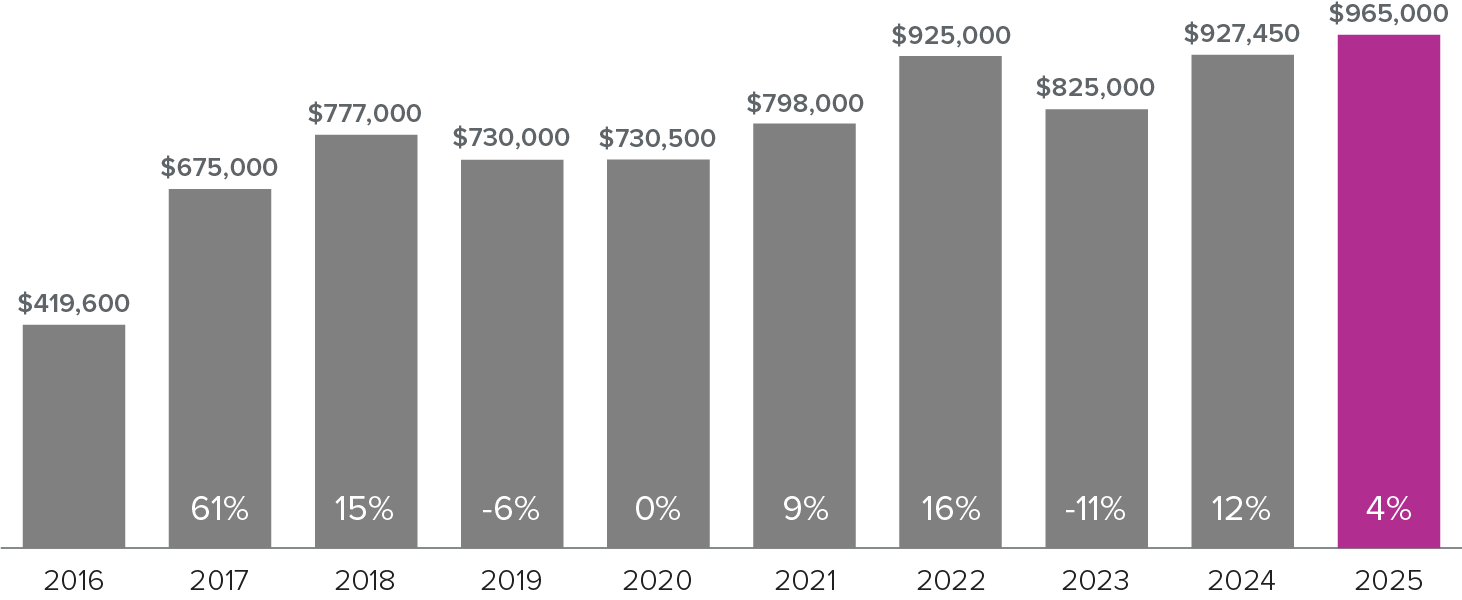

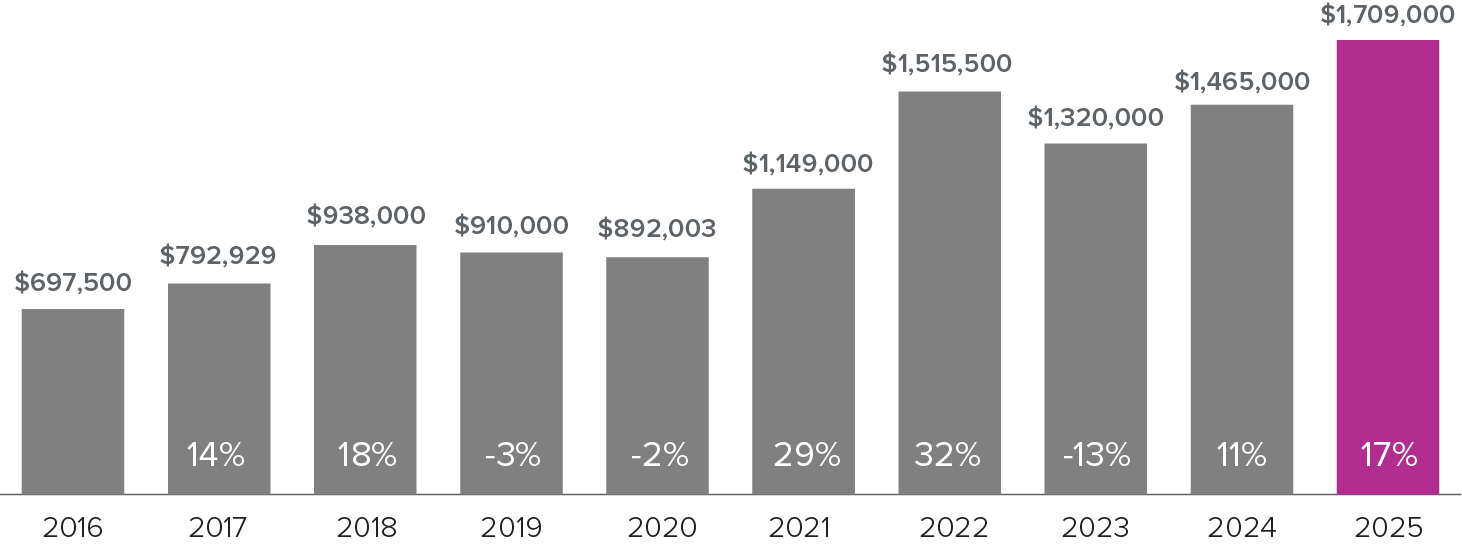

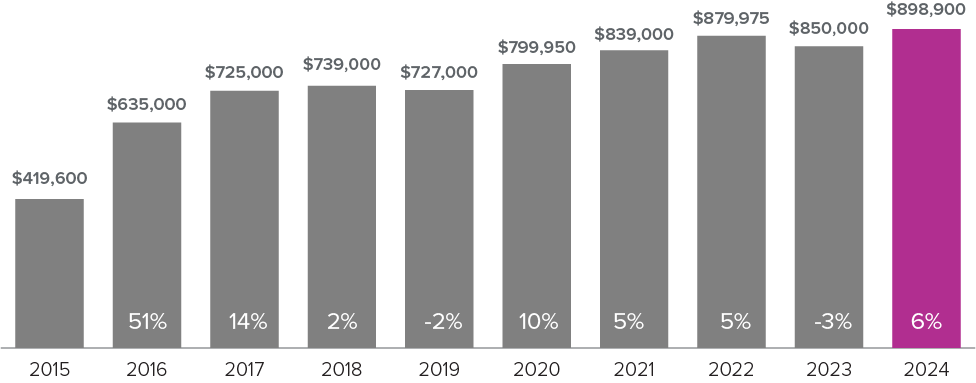

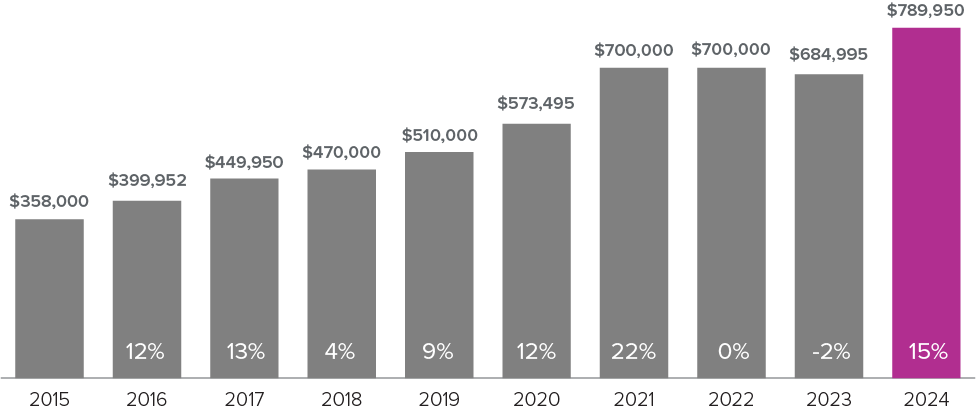

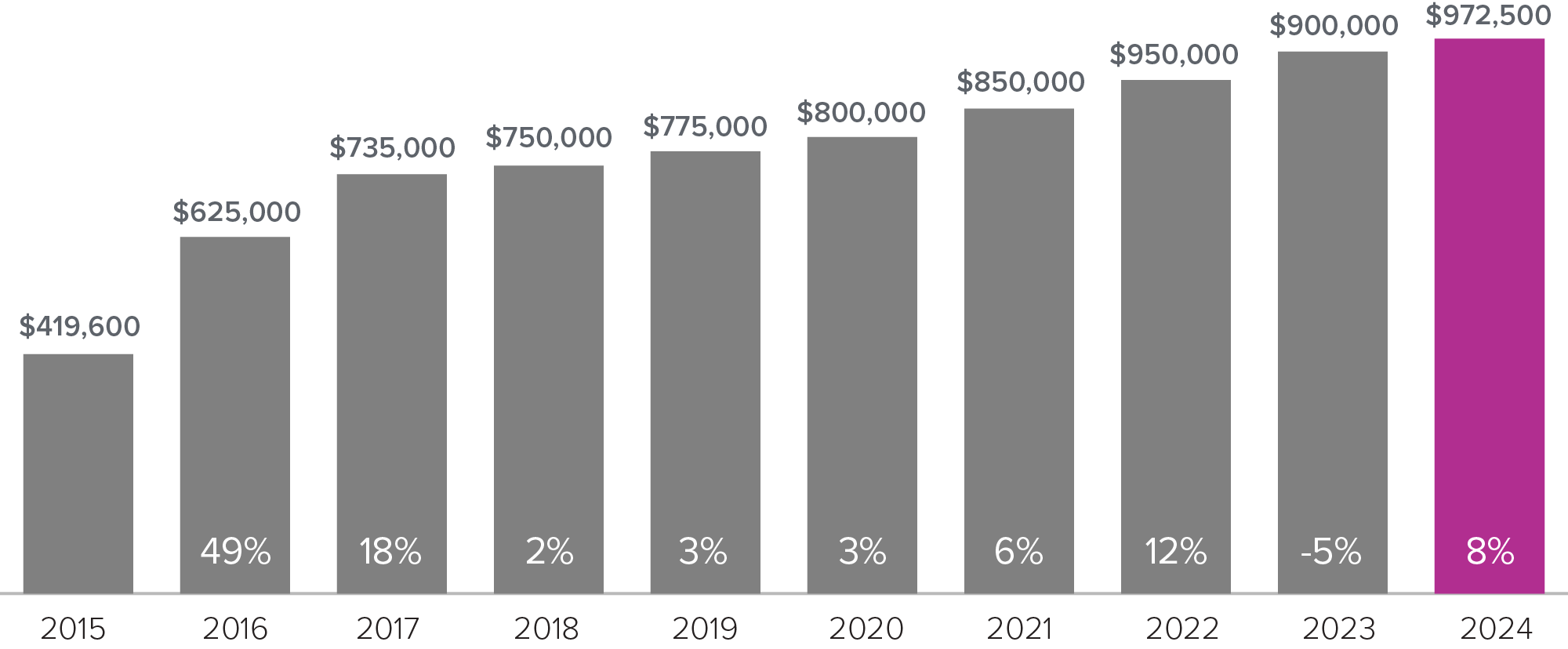

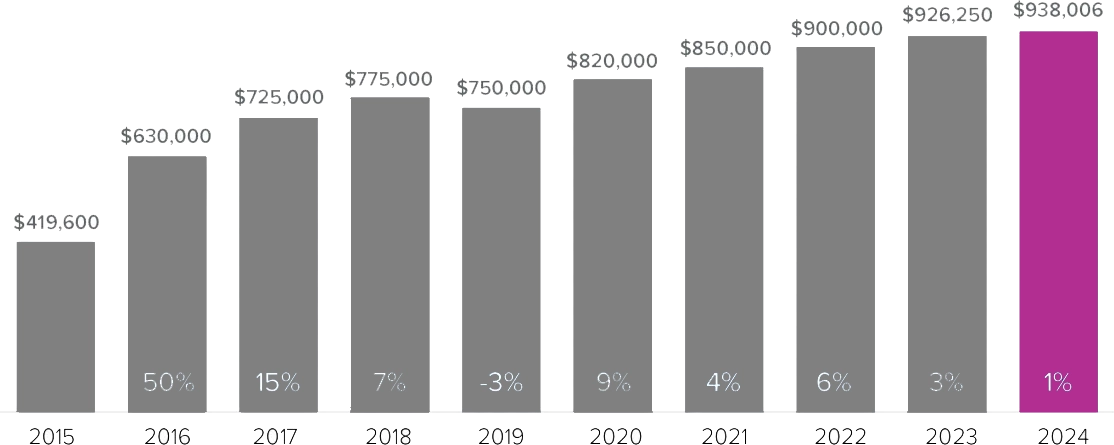

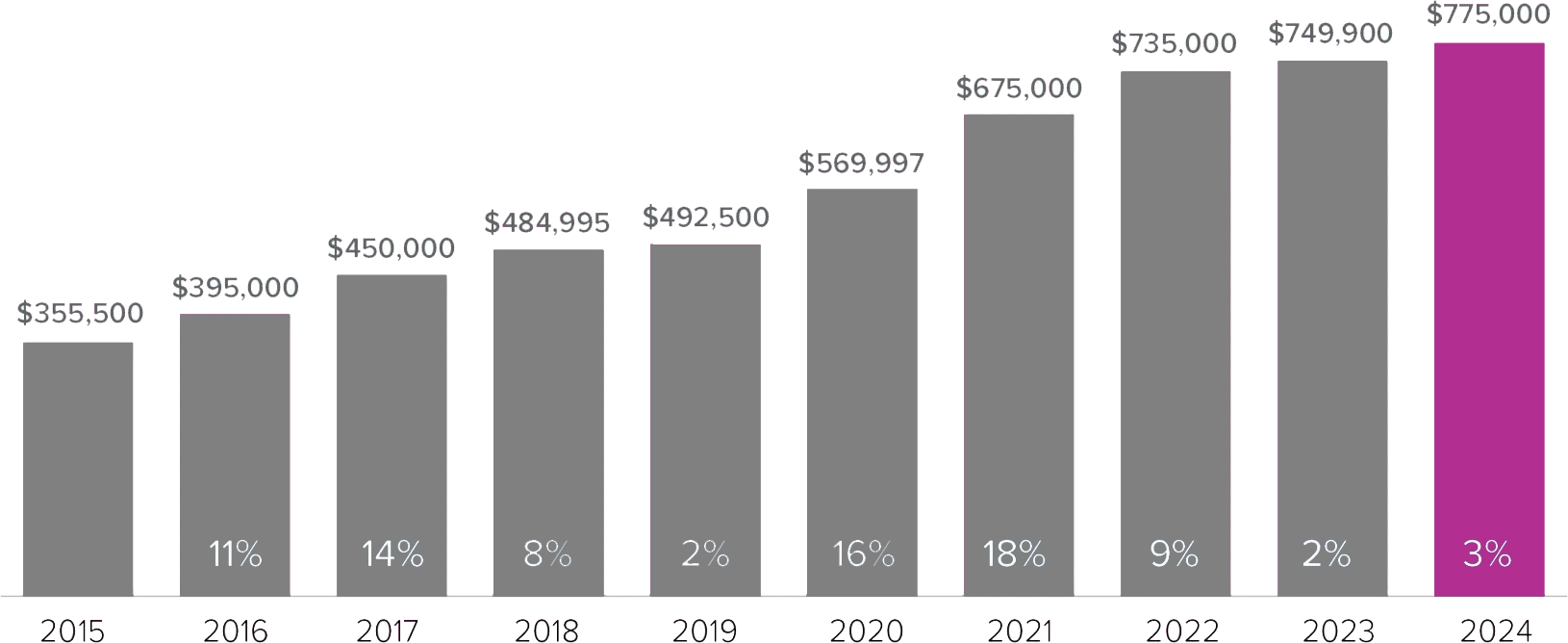

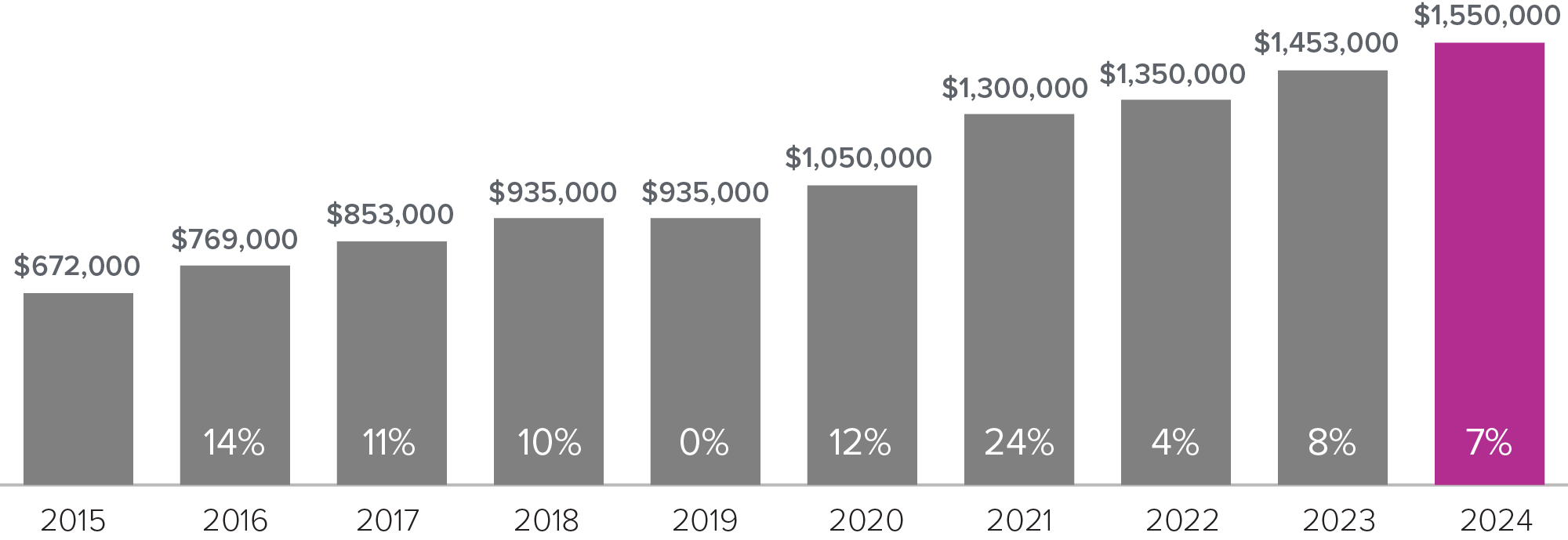

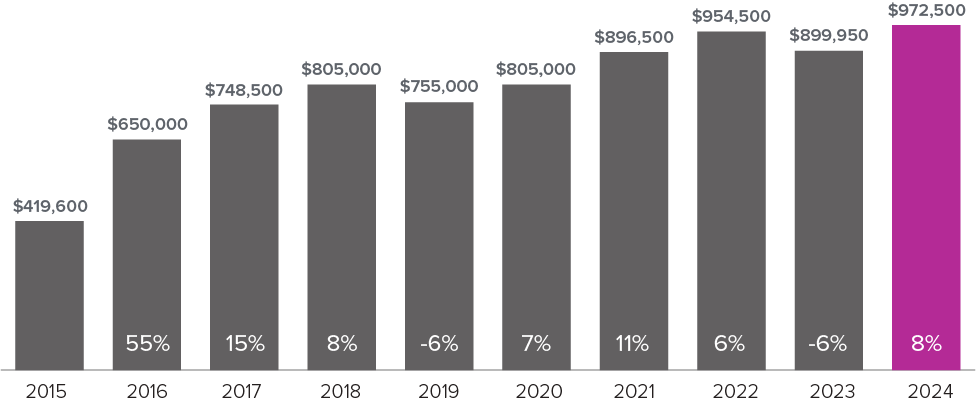

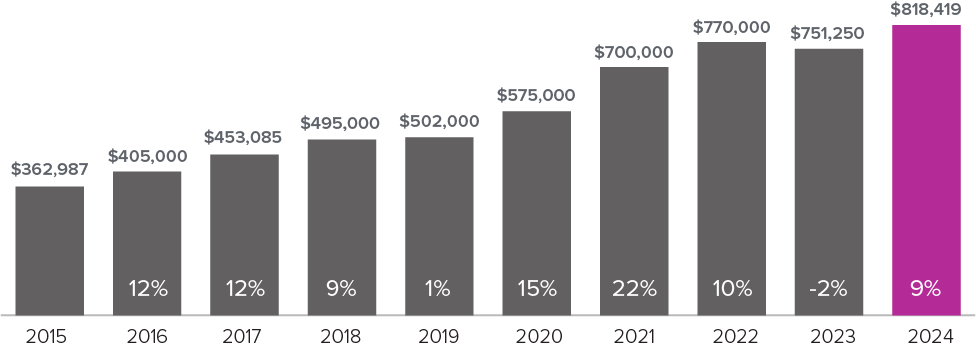

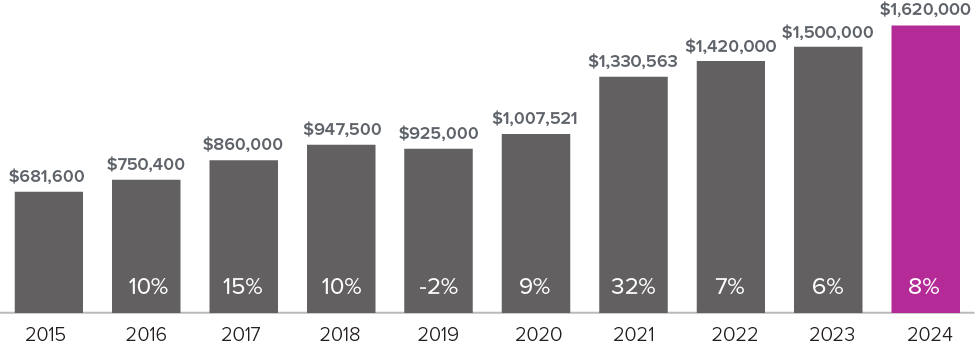

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

13%

OF HOMES SOLD ABOVE LIST PRICE

47%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.6

MONTHS SUPPLY OF AVAILABLE HOMES*

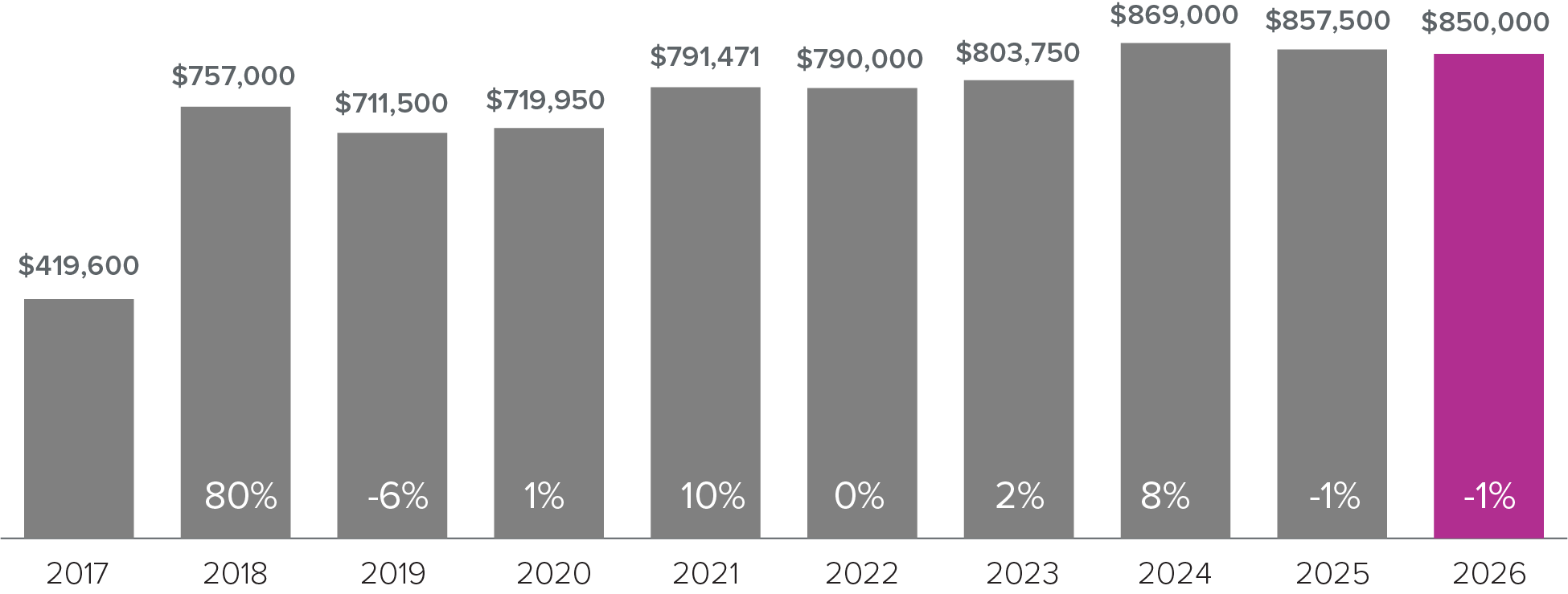

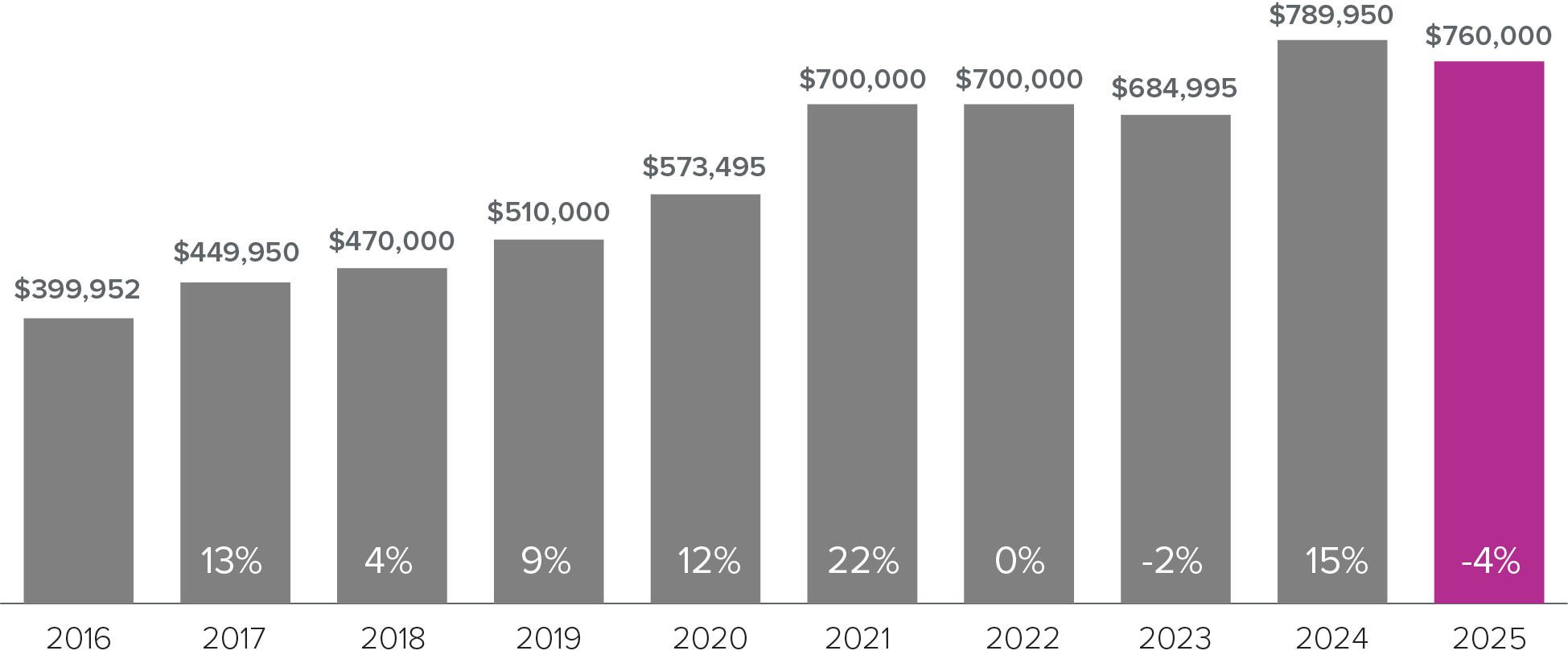

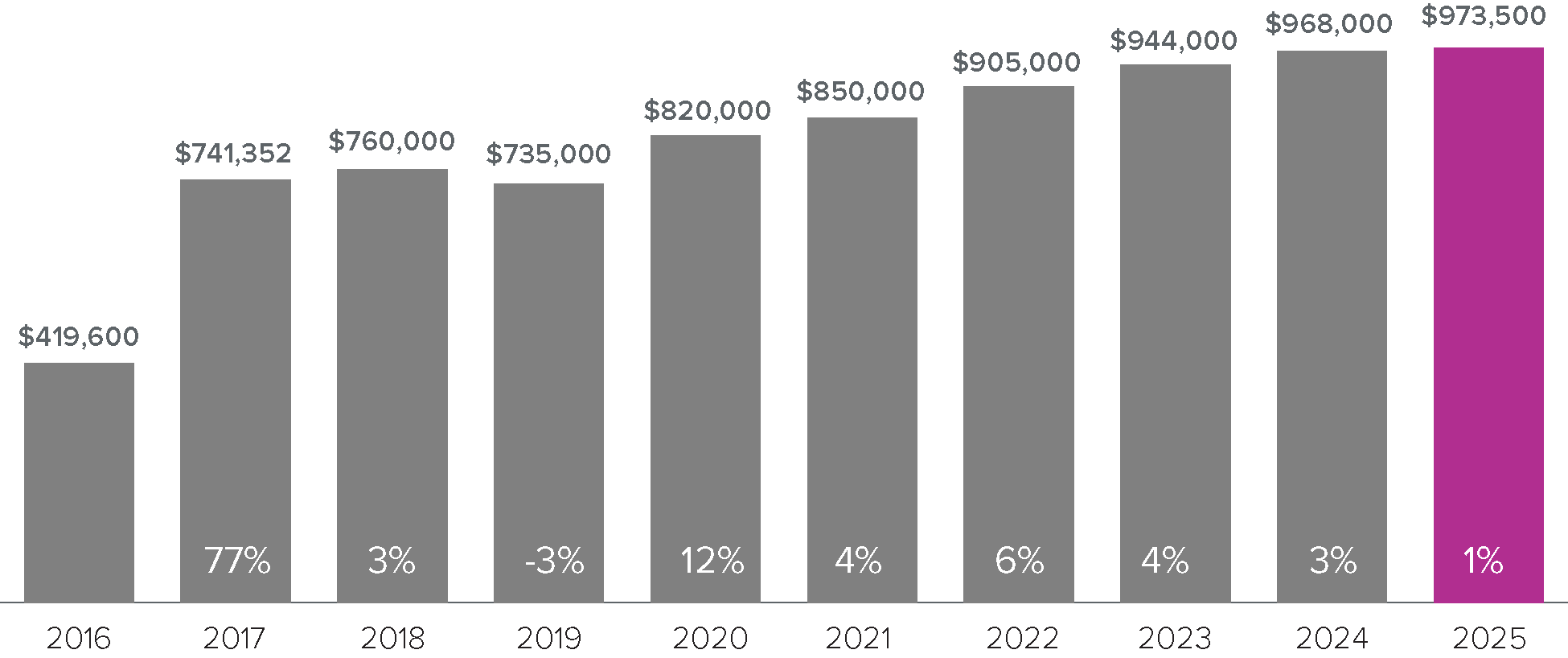

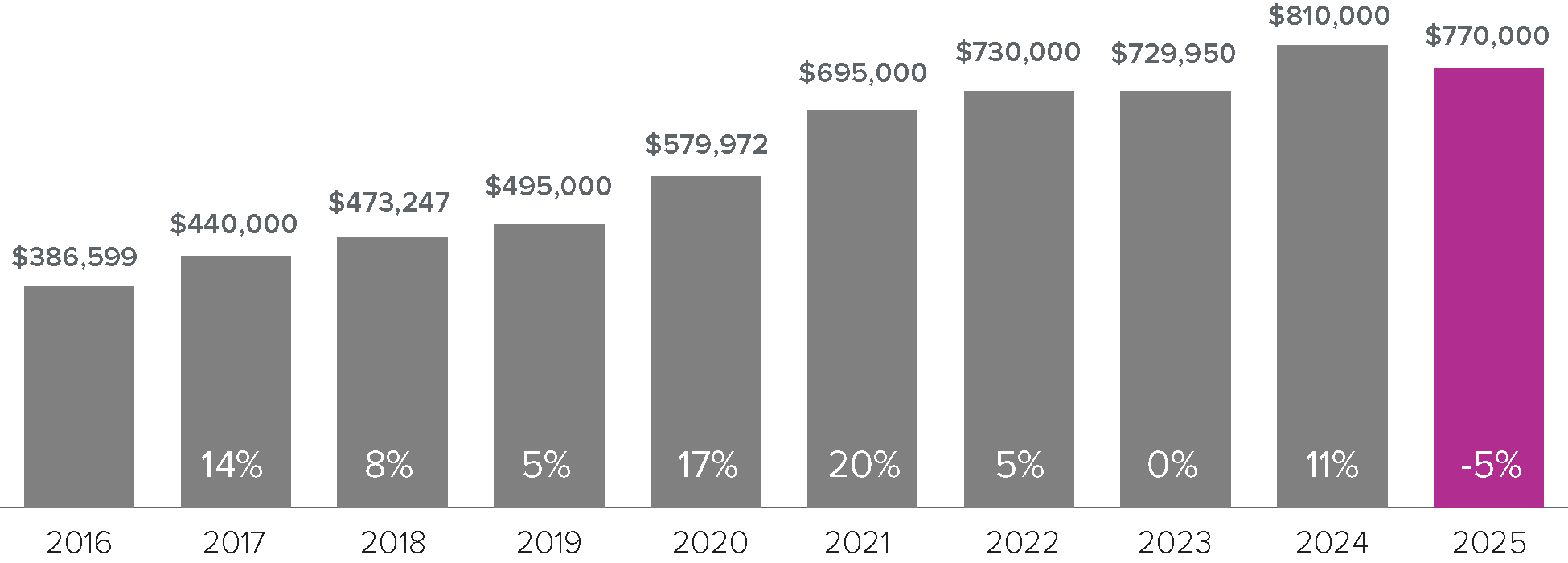

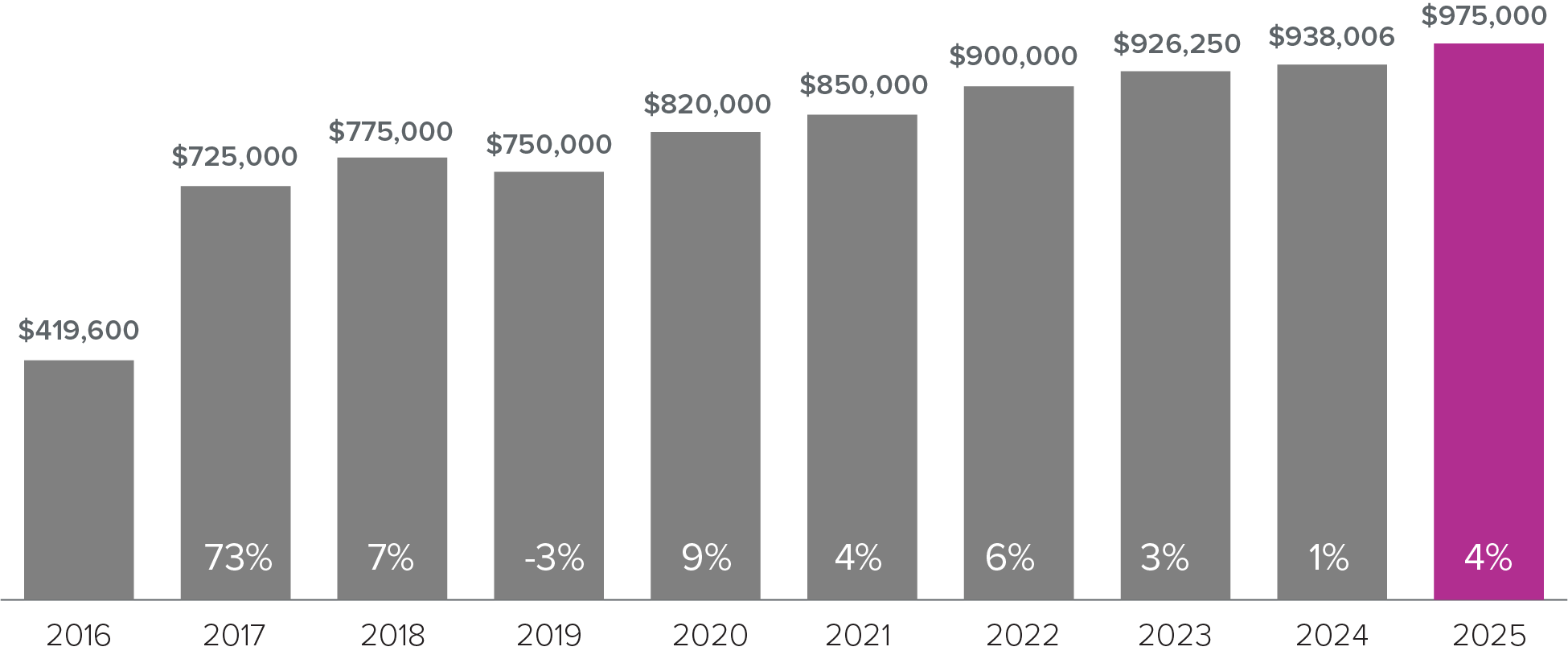

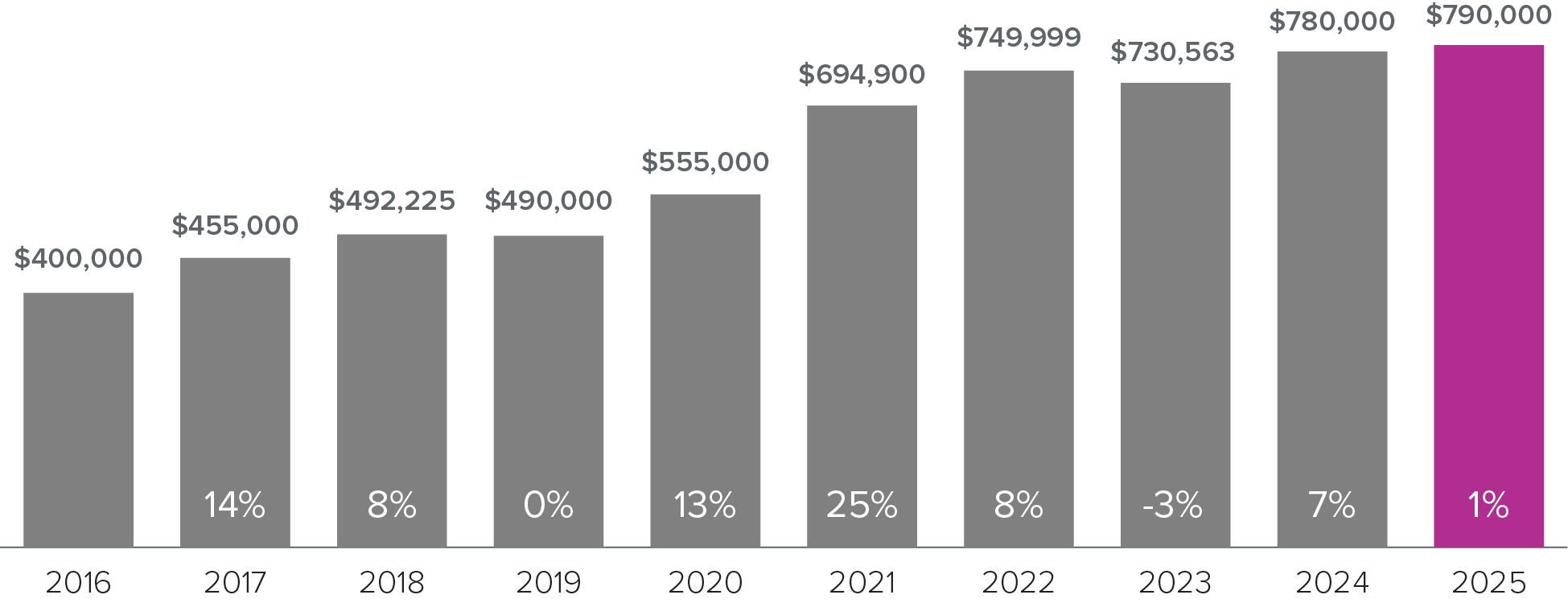

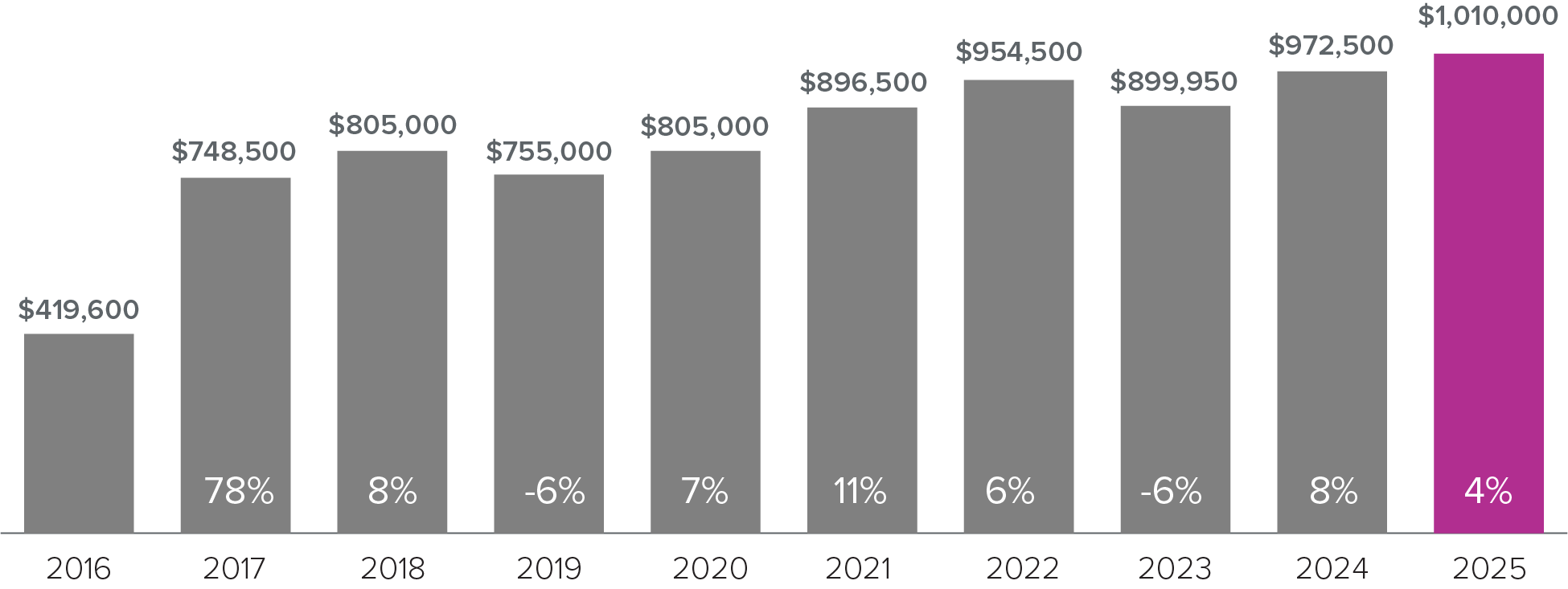

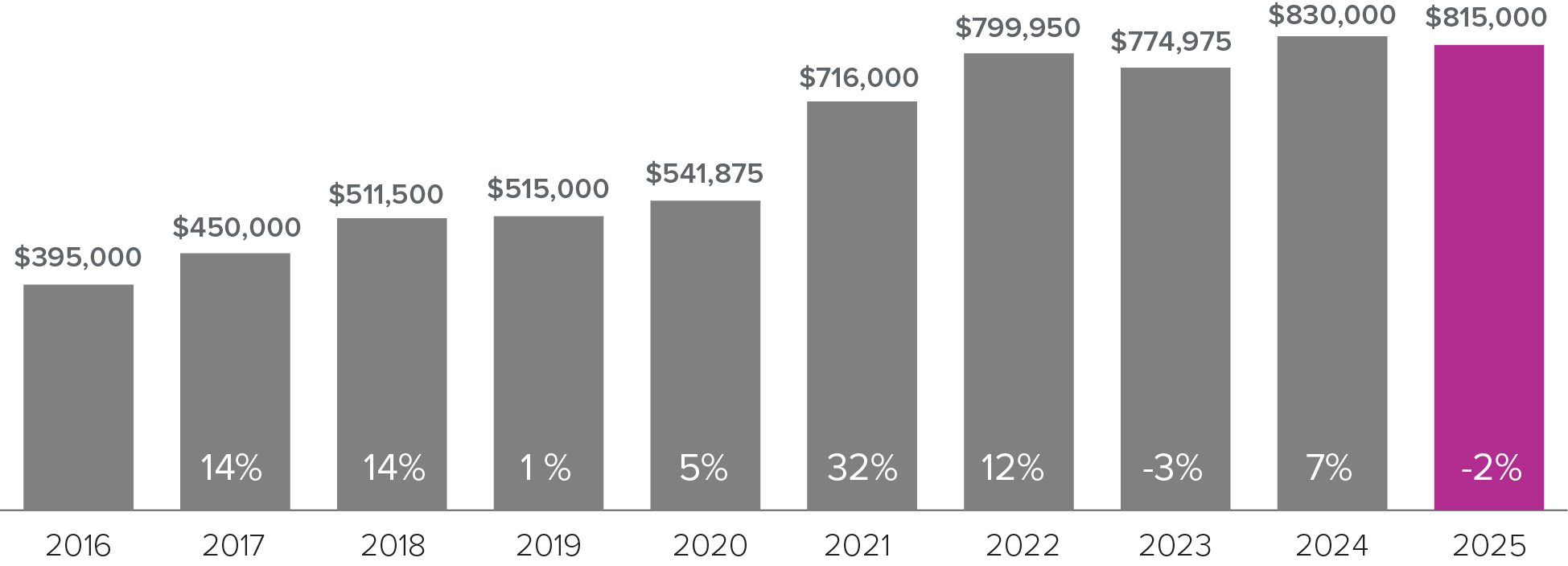

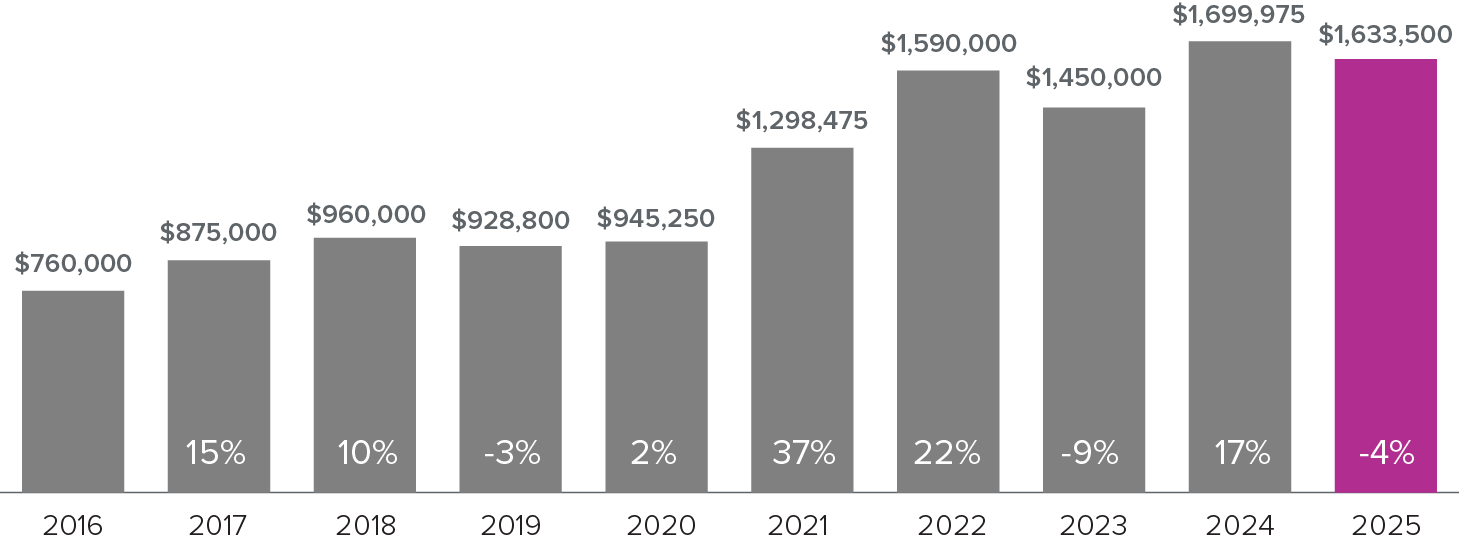

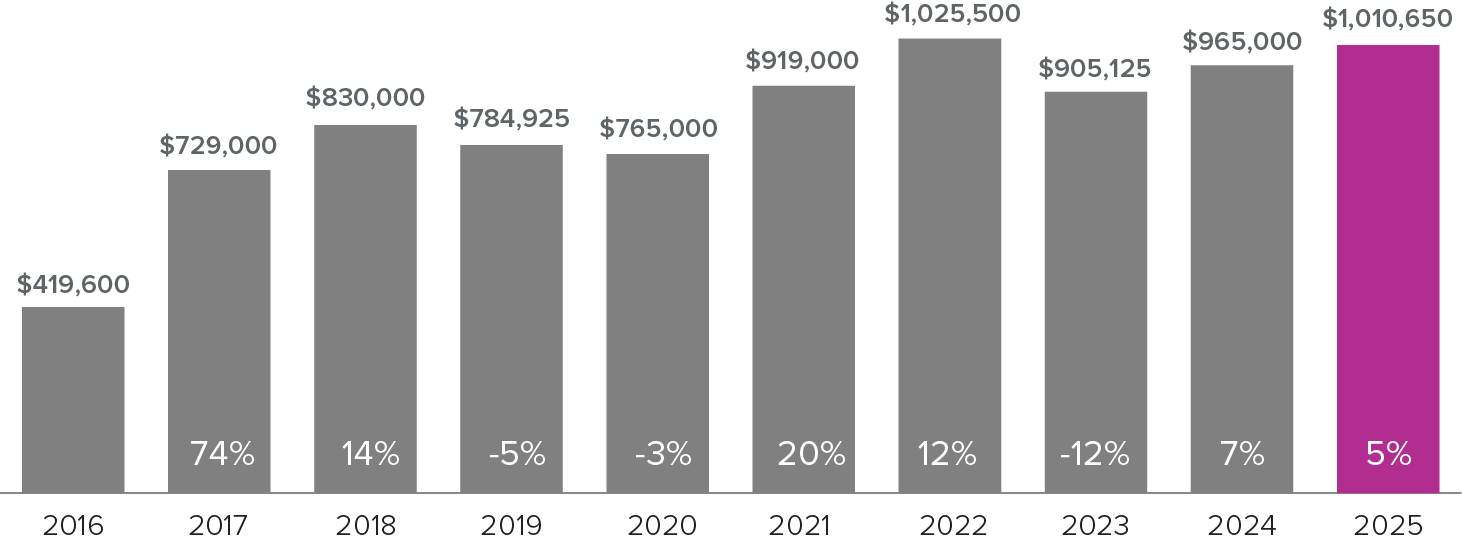

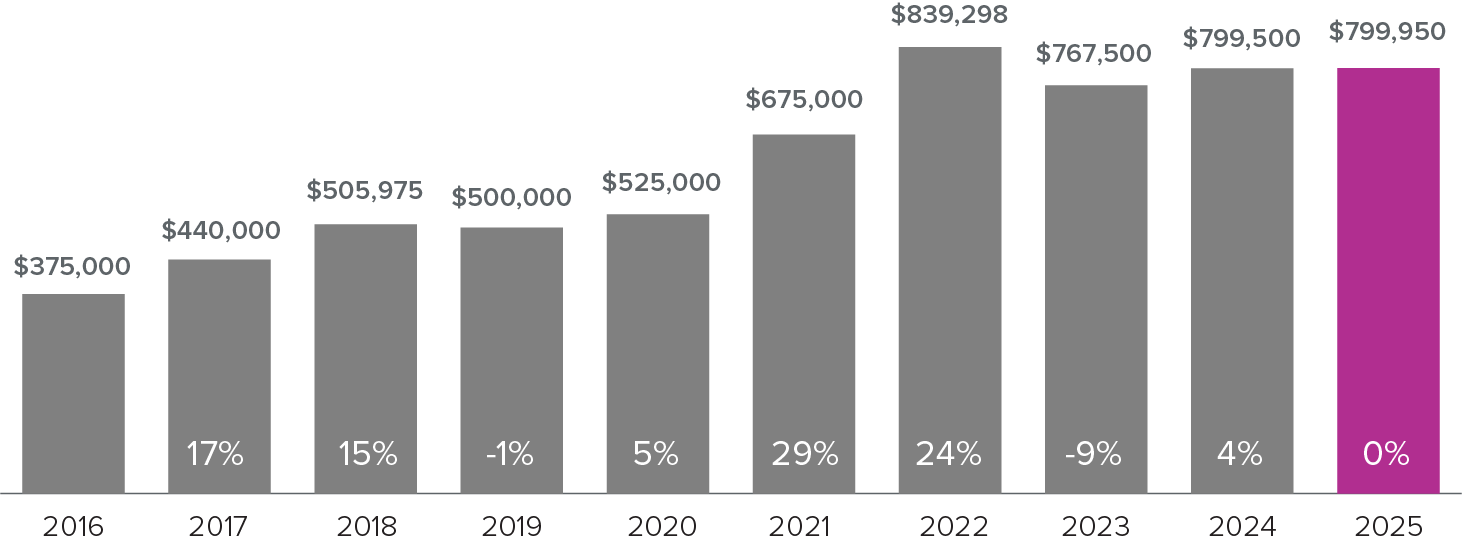

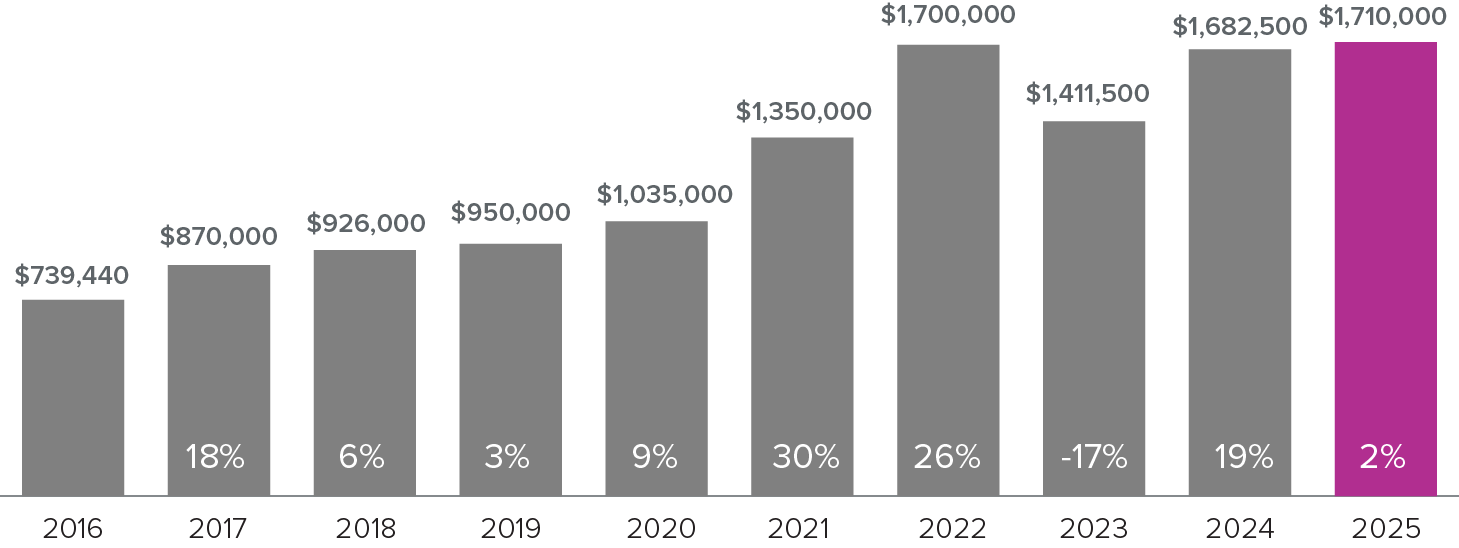

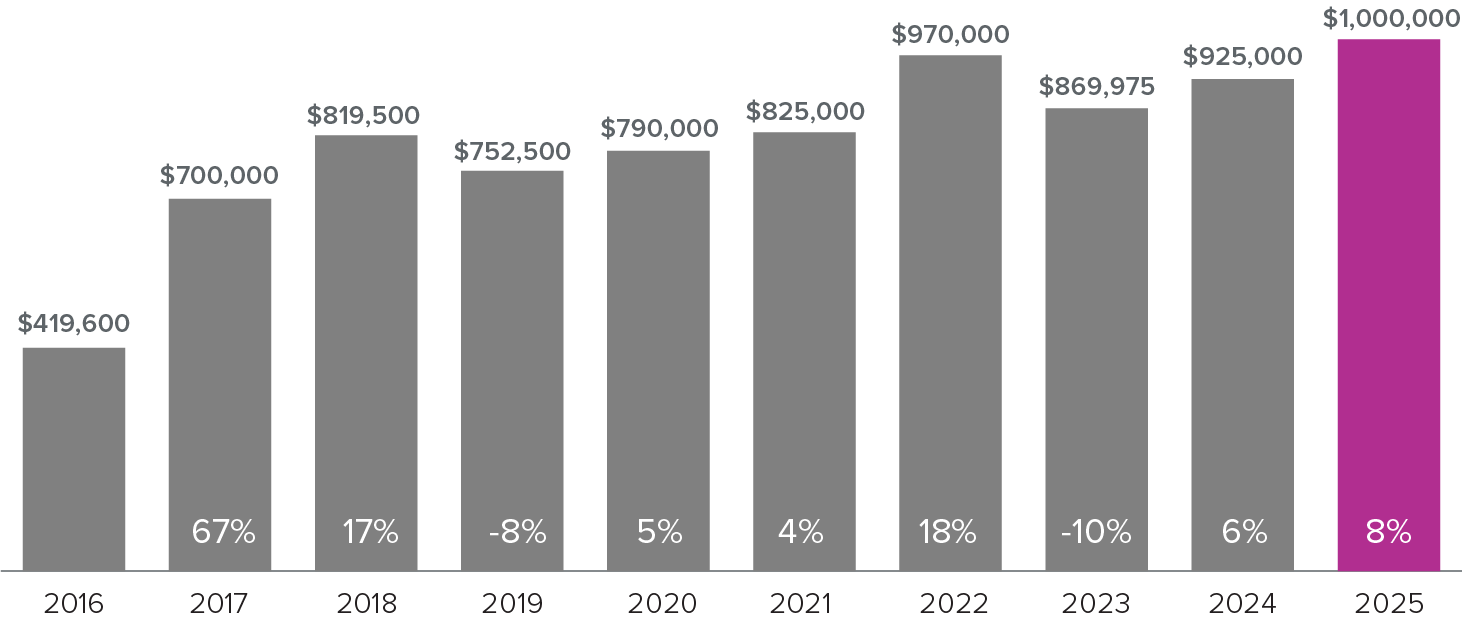

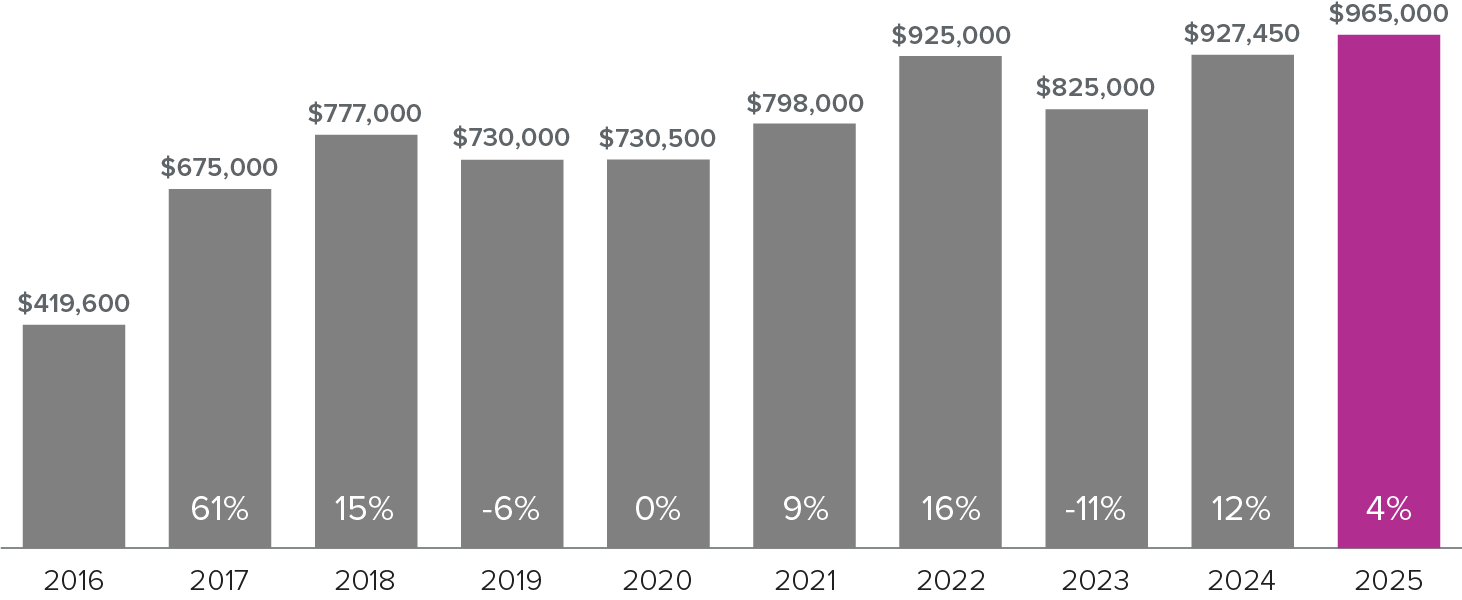

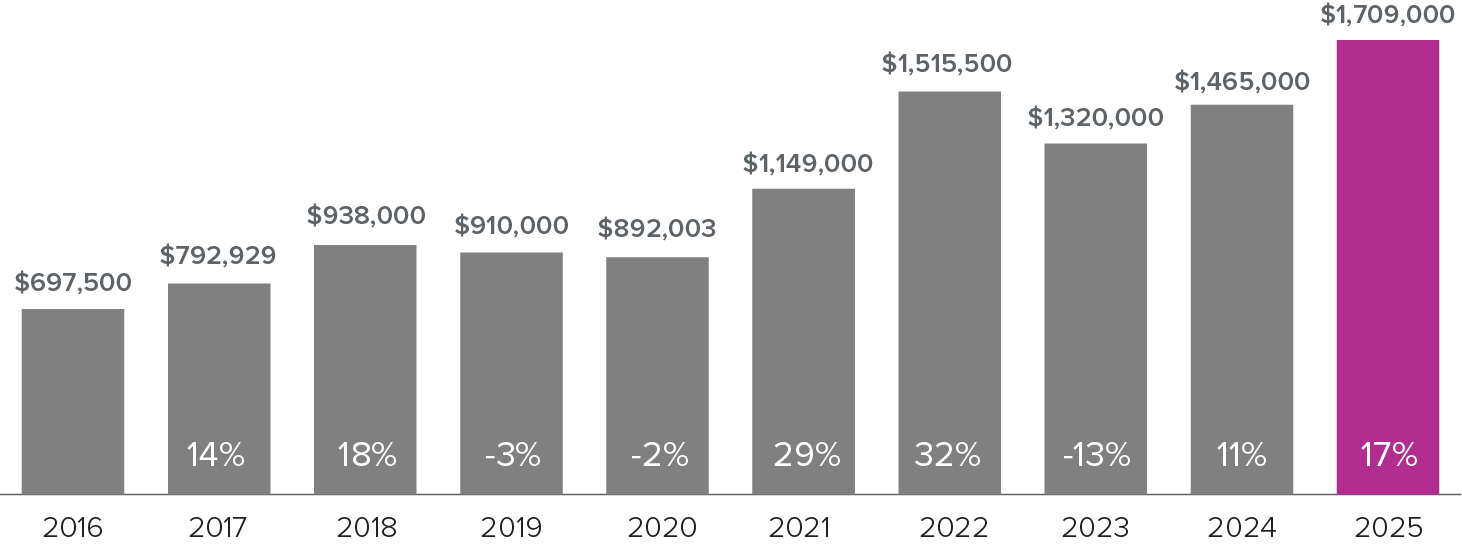

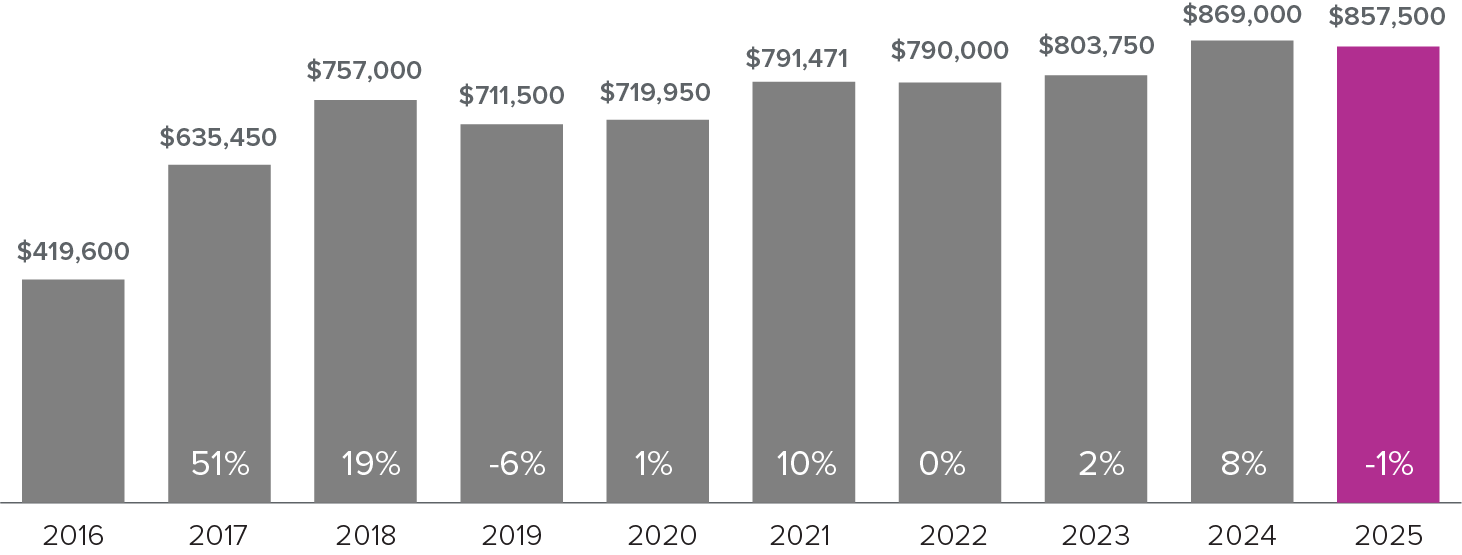

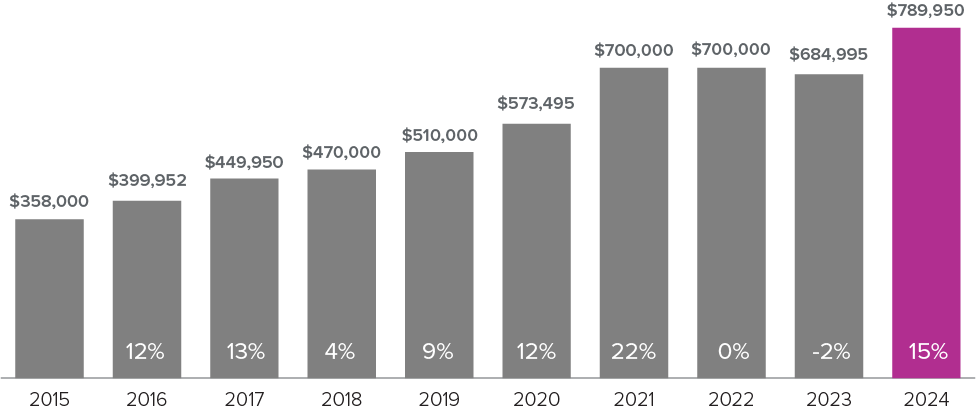

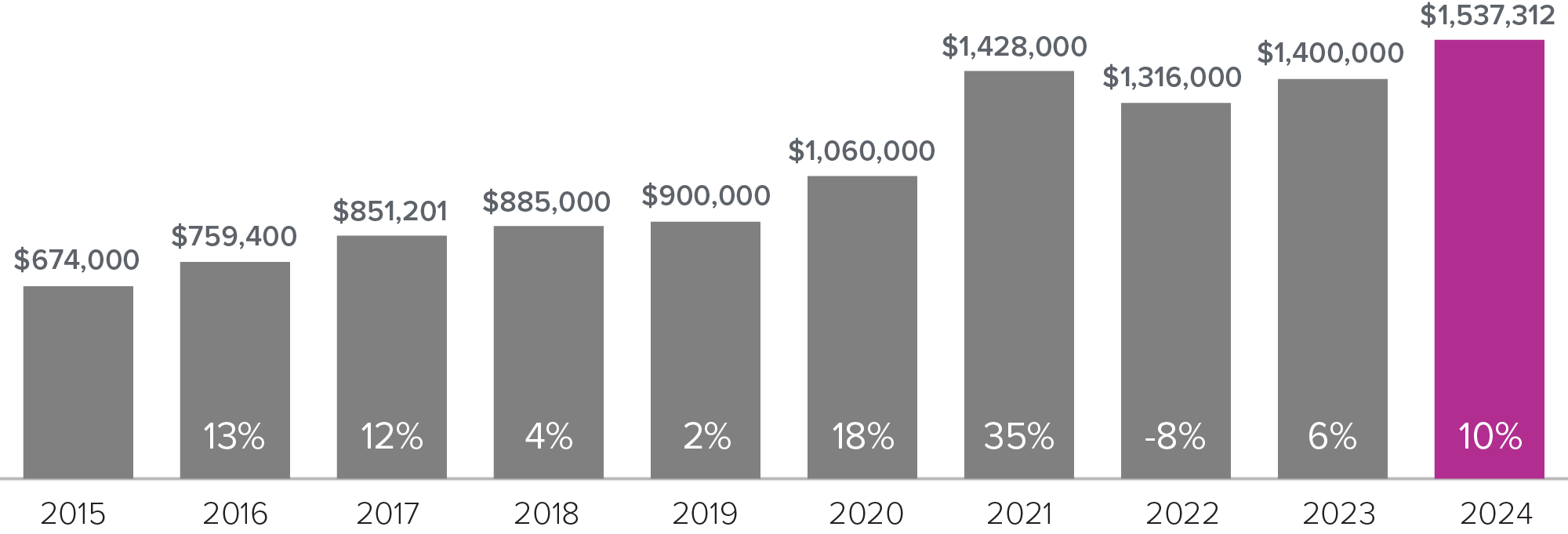

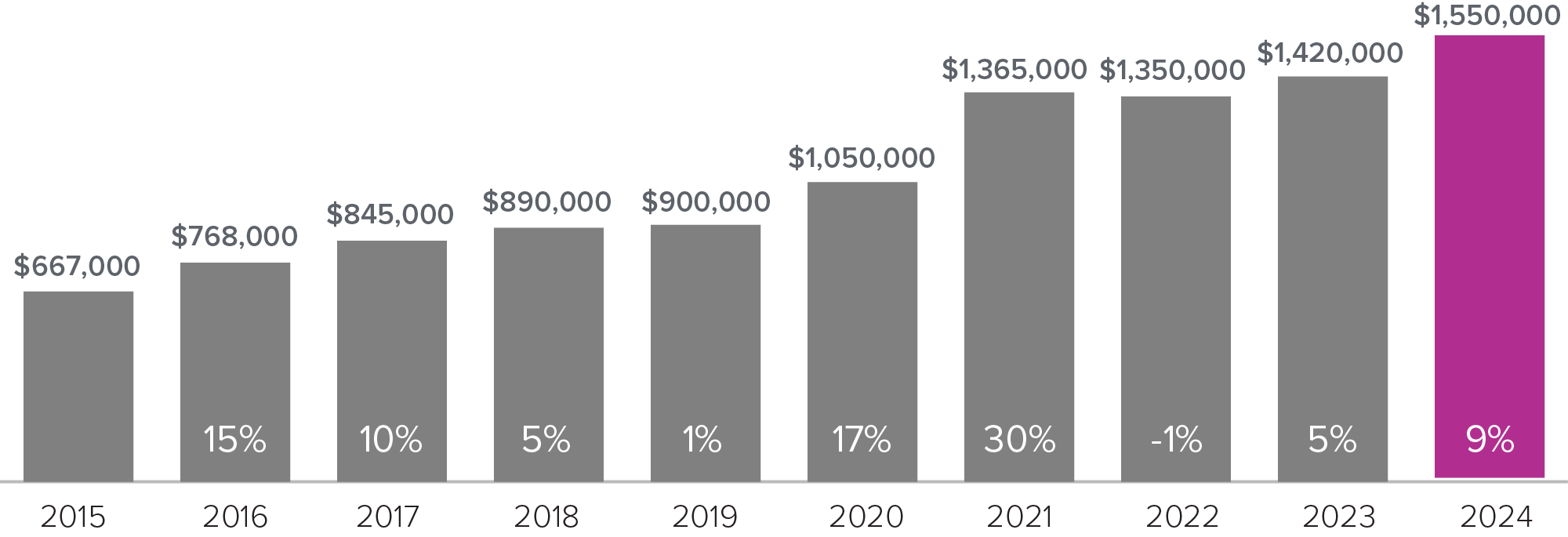

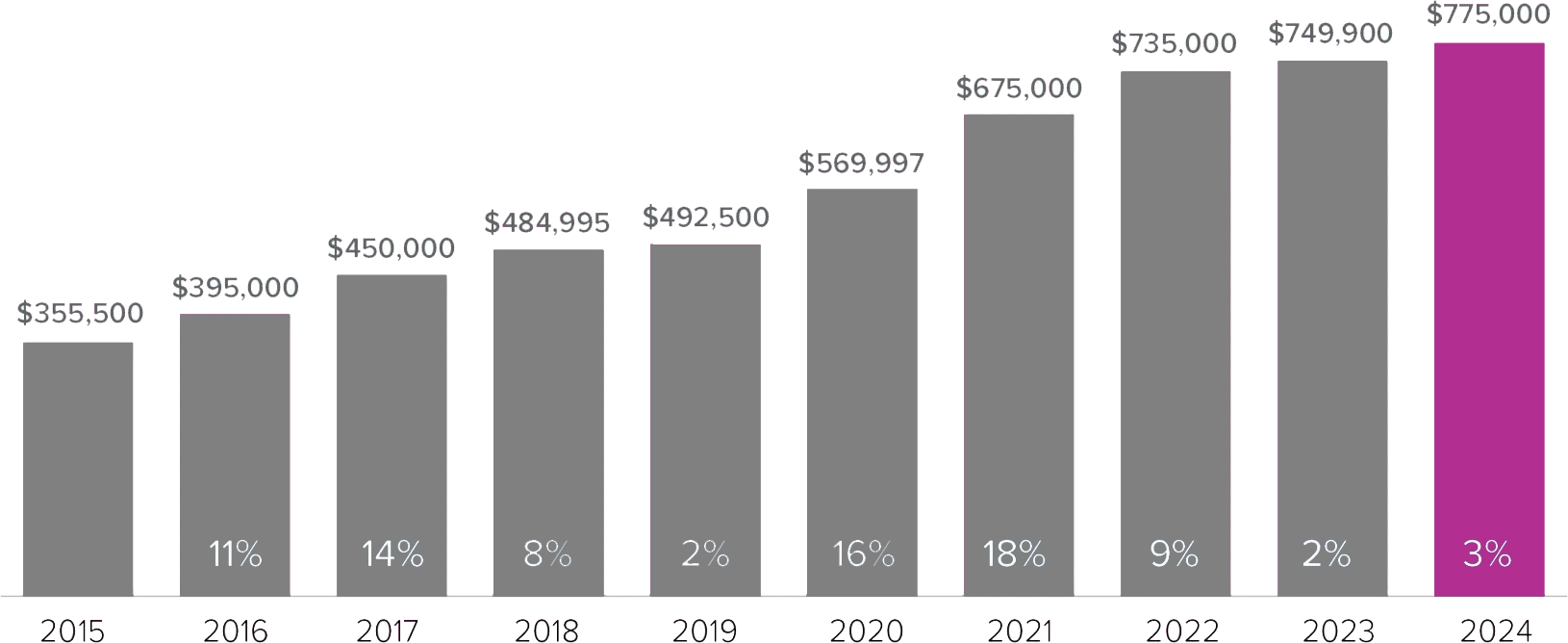

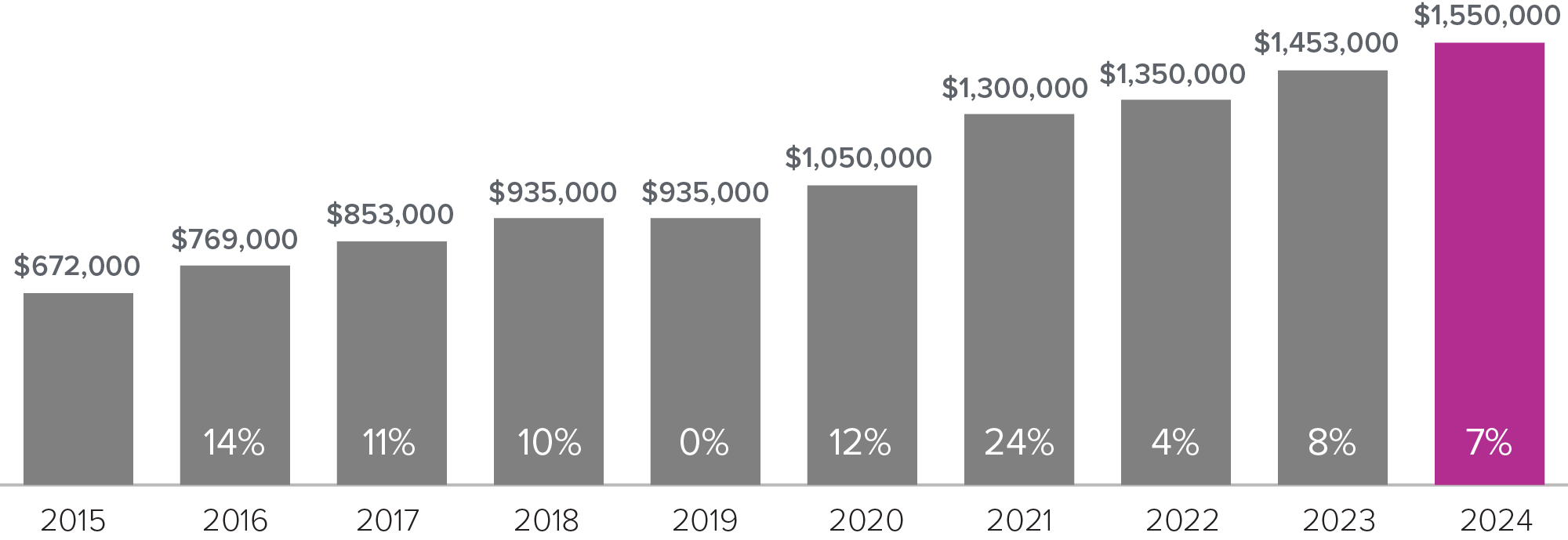

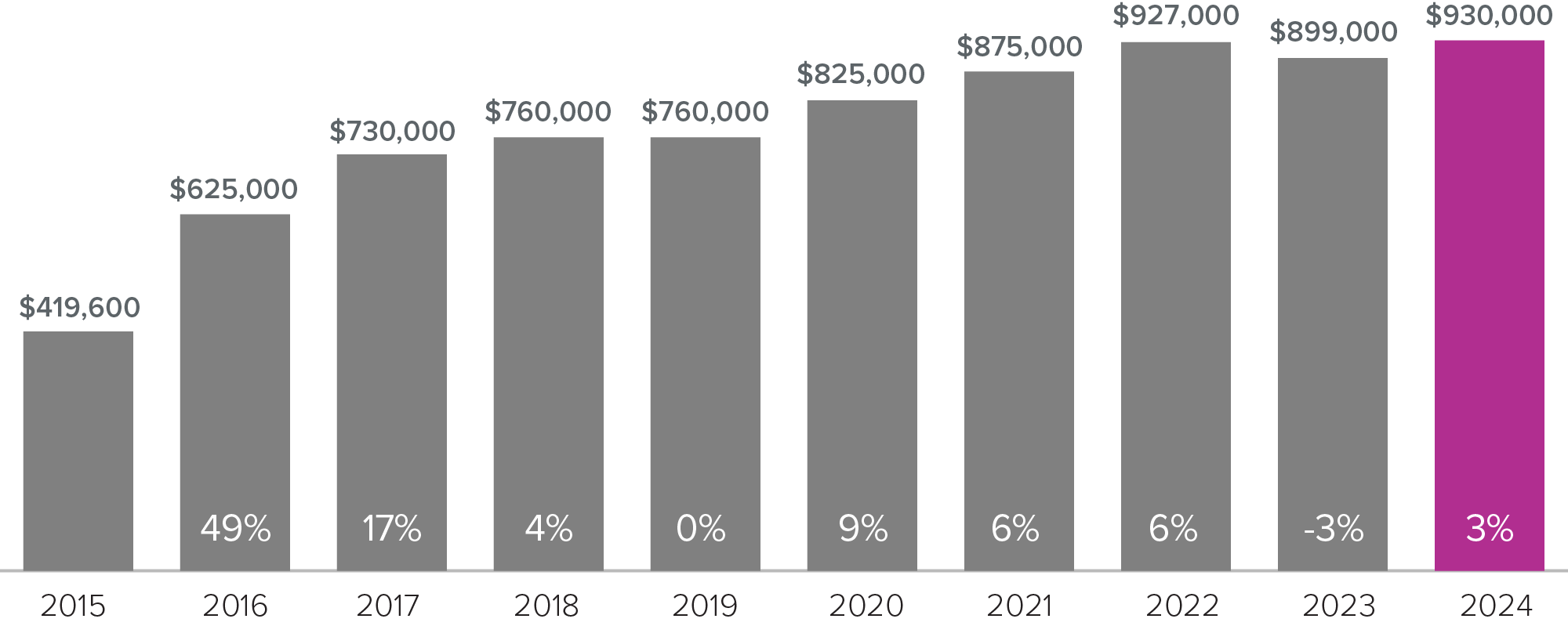

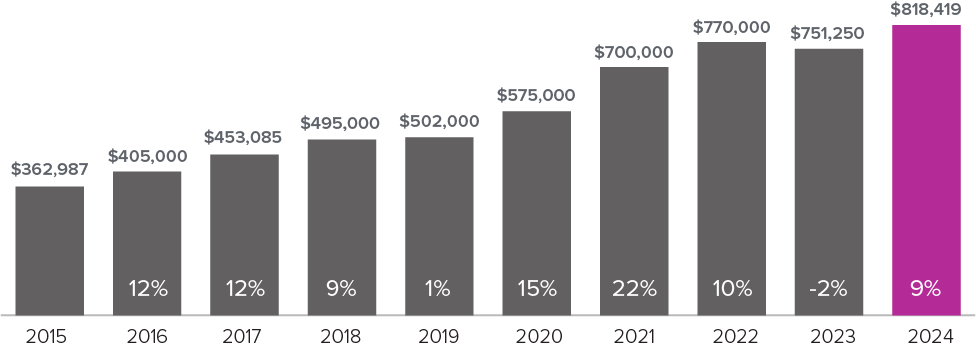

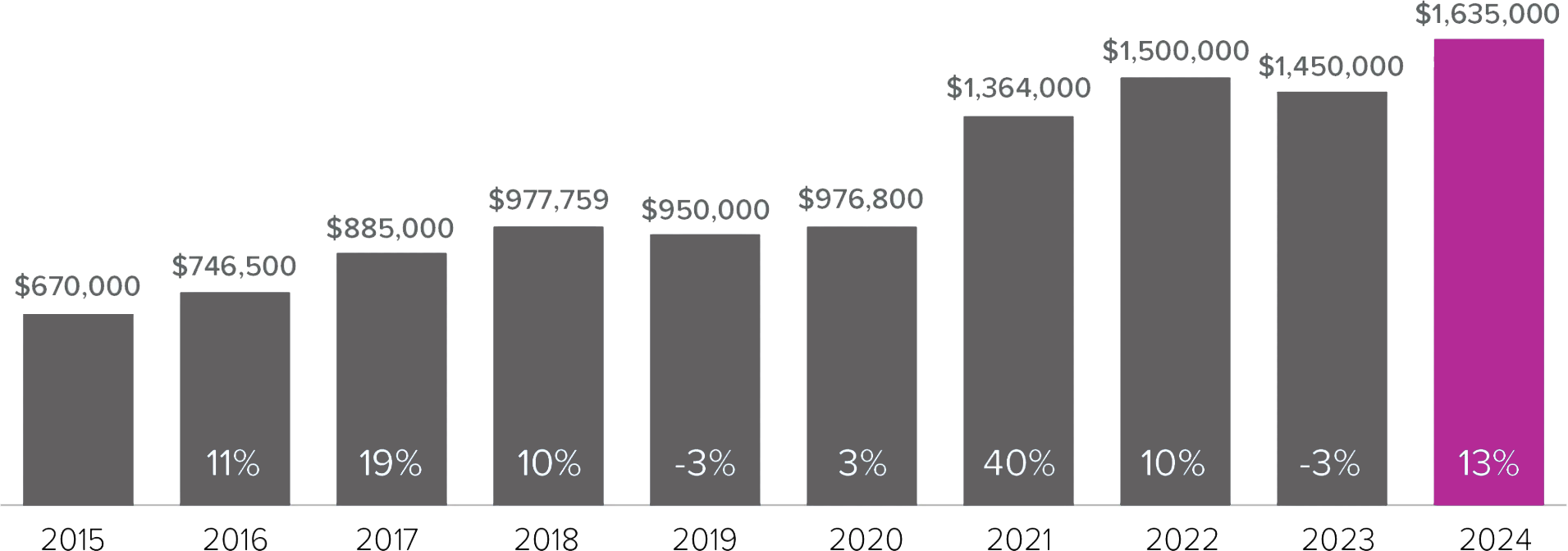

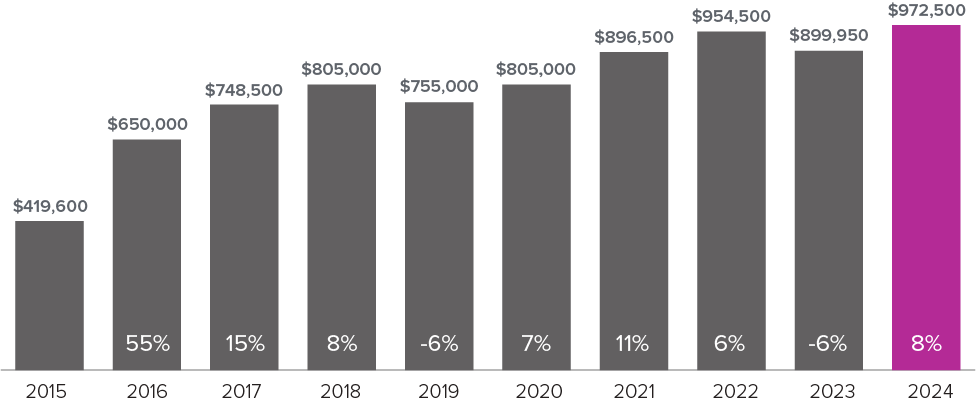

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

6%

OF HOMES SOLD ABOVE LIST PRICE

43%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.8

MONTHS SUPPLY OF AVAILABLE HOMES*

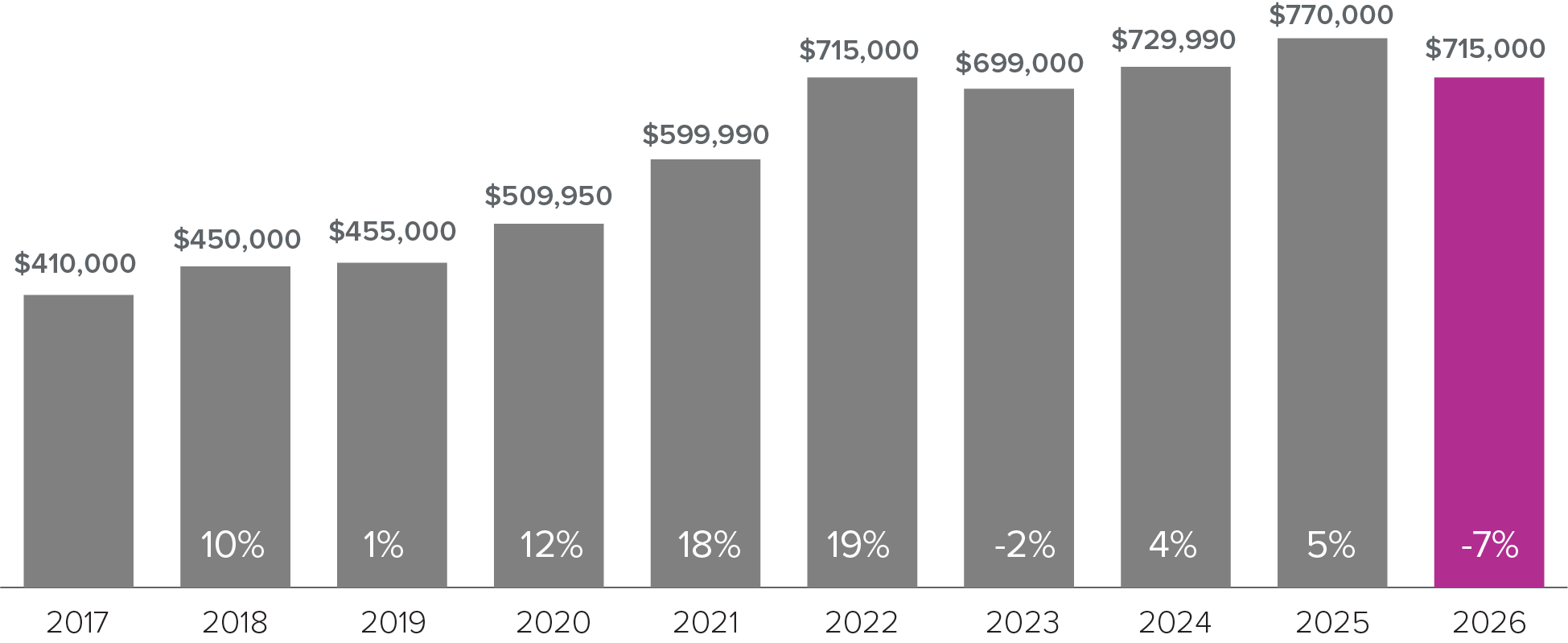

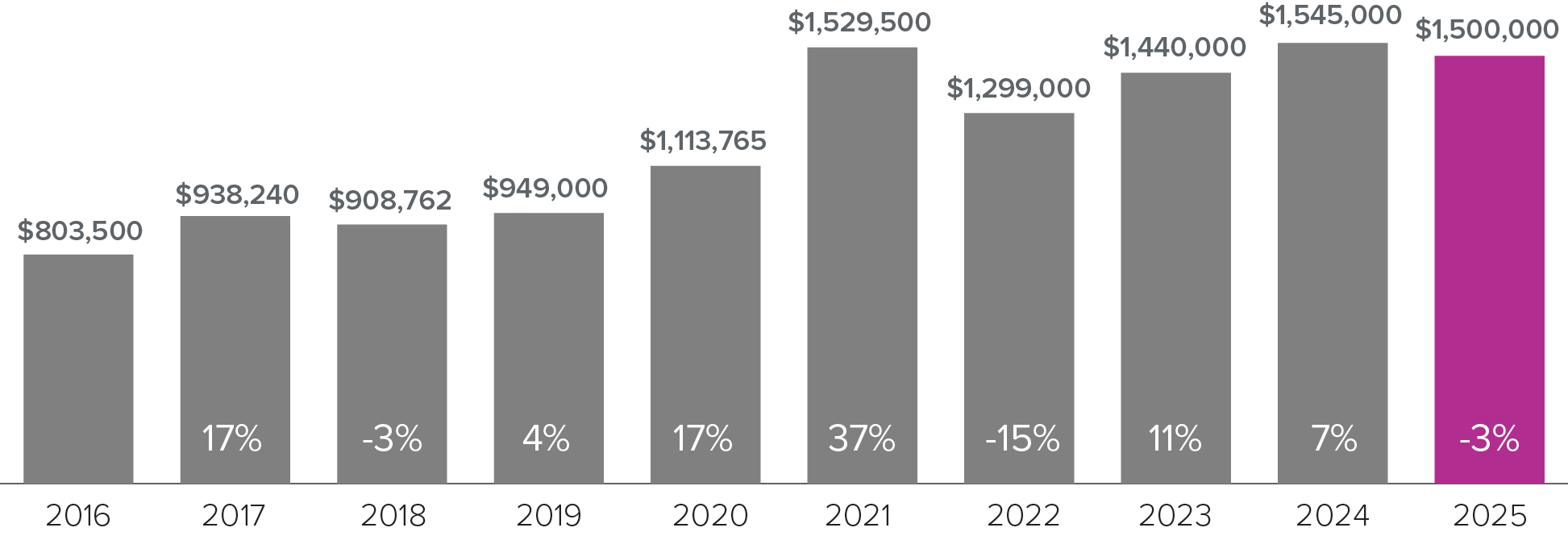

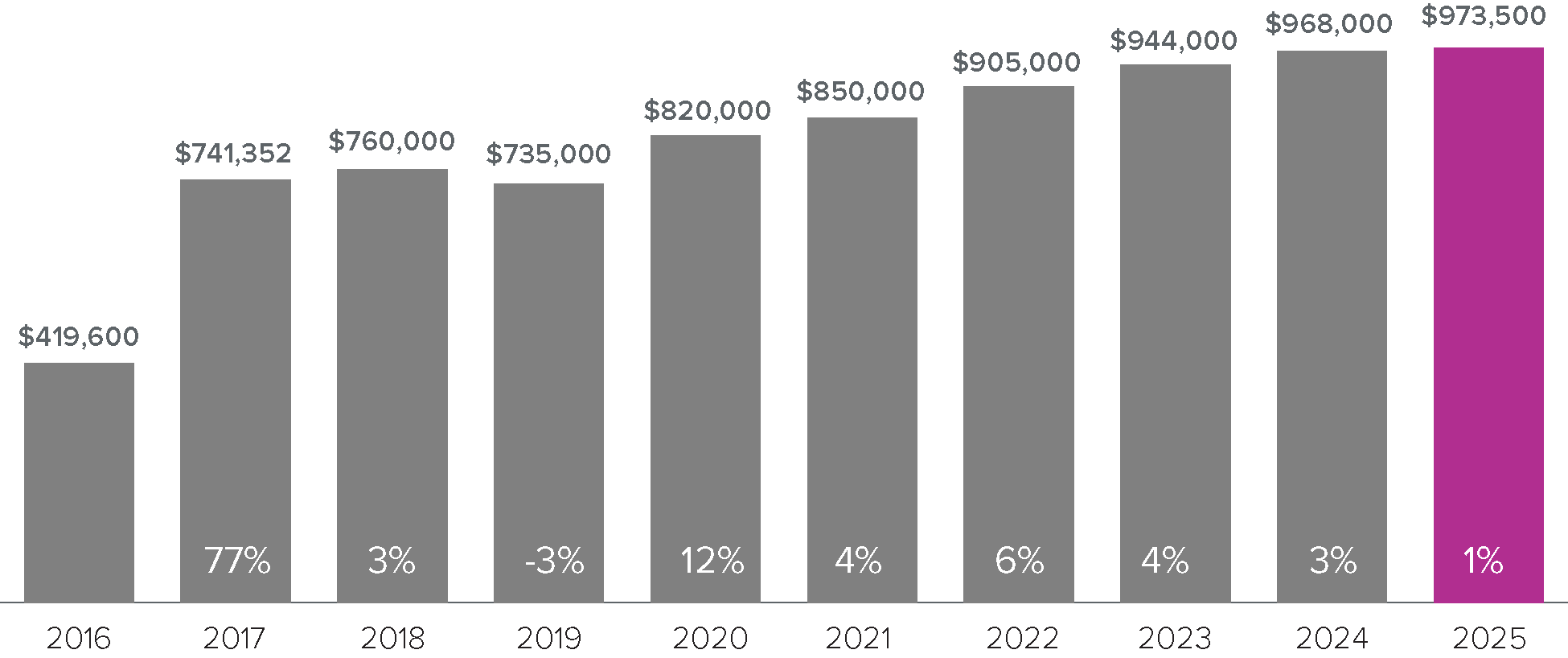

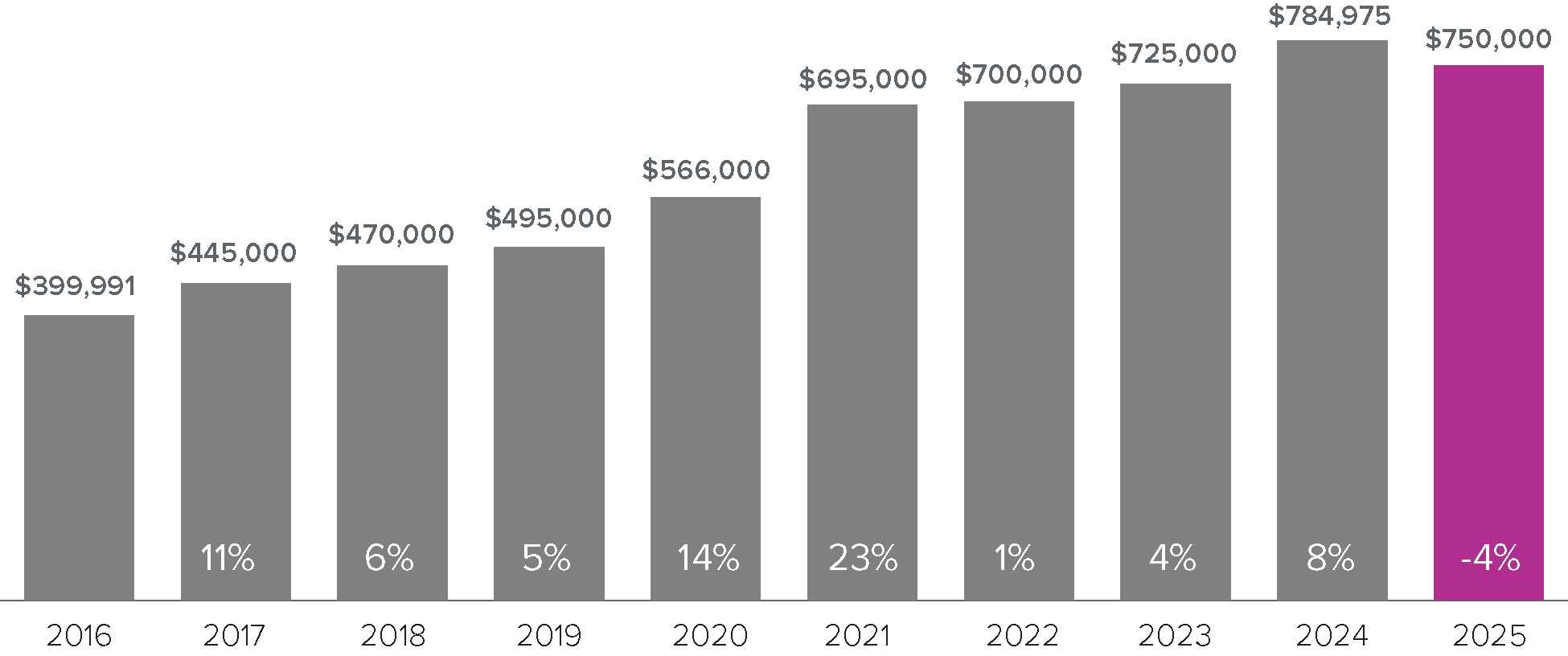

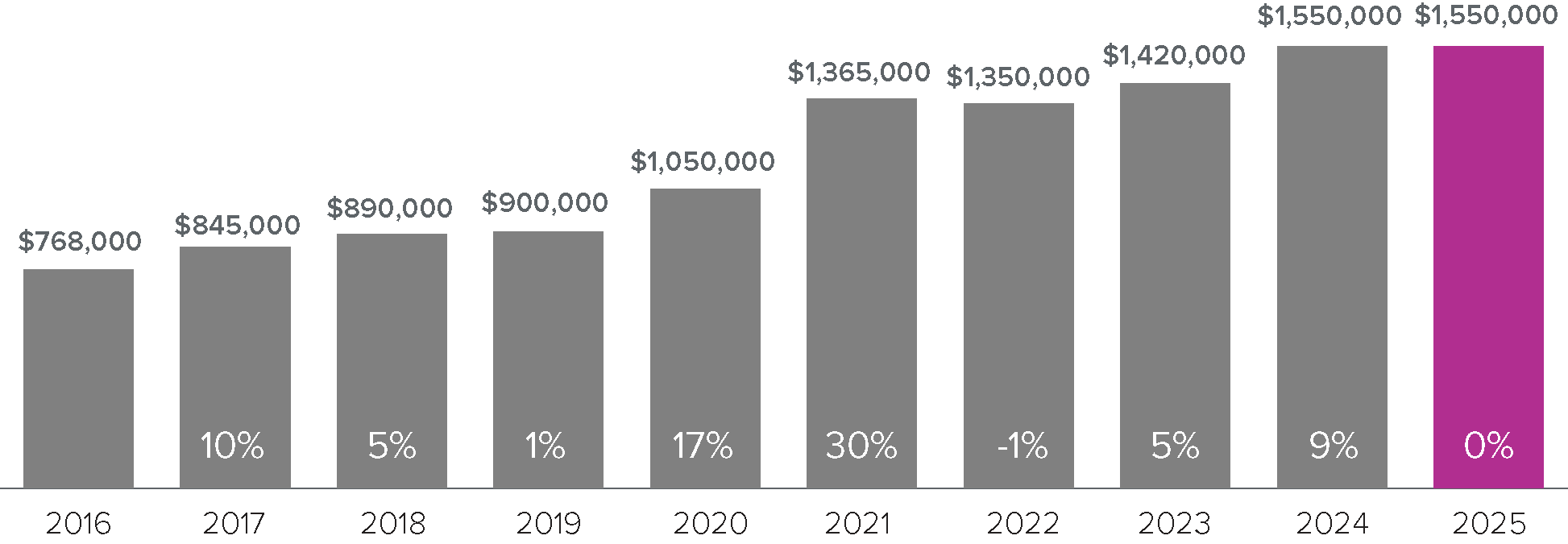

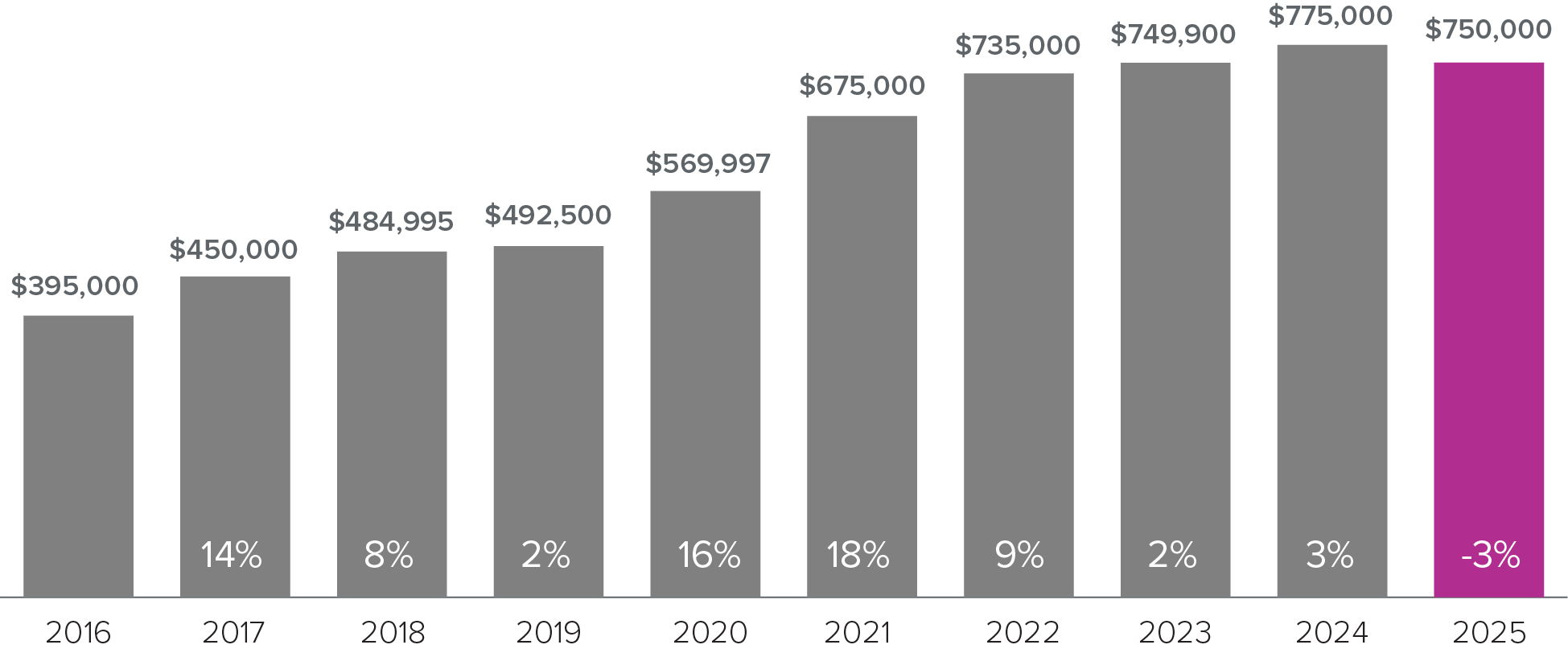

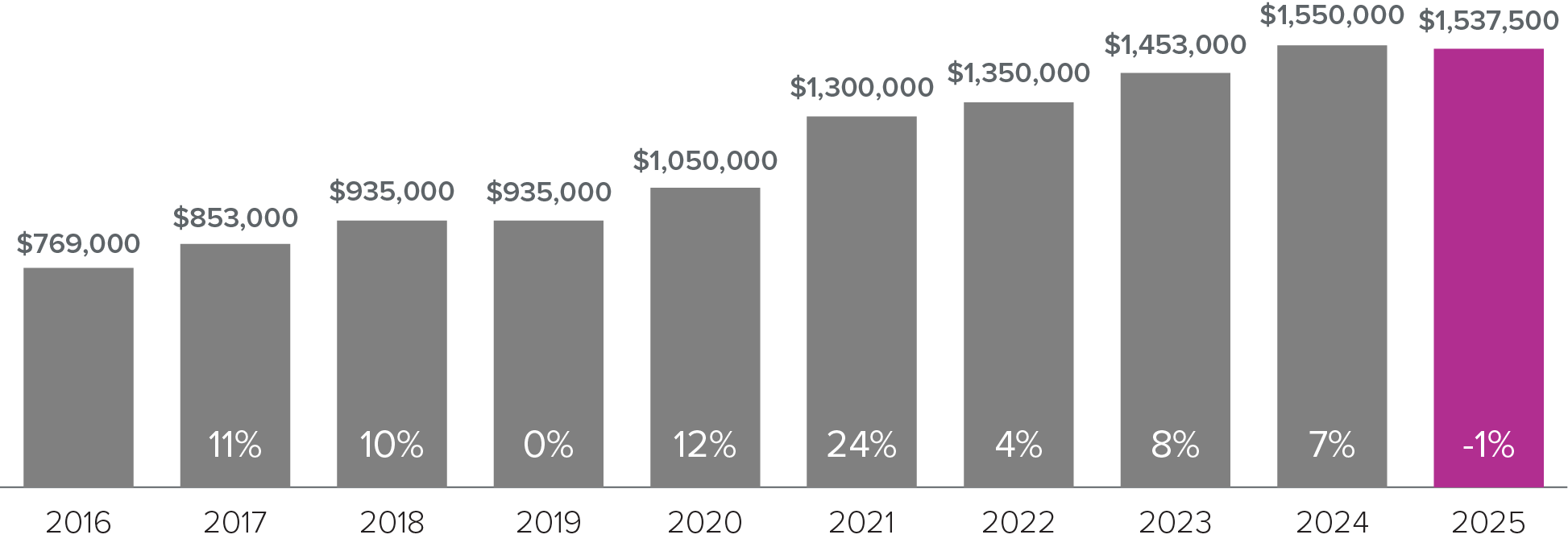

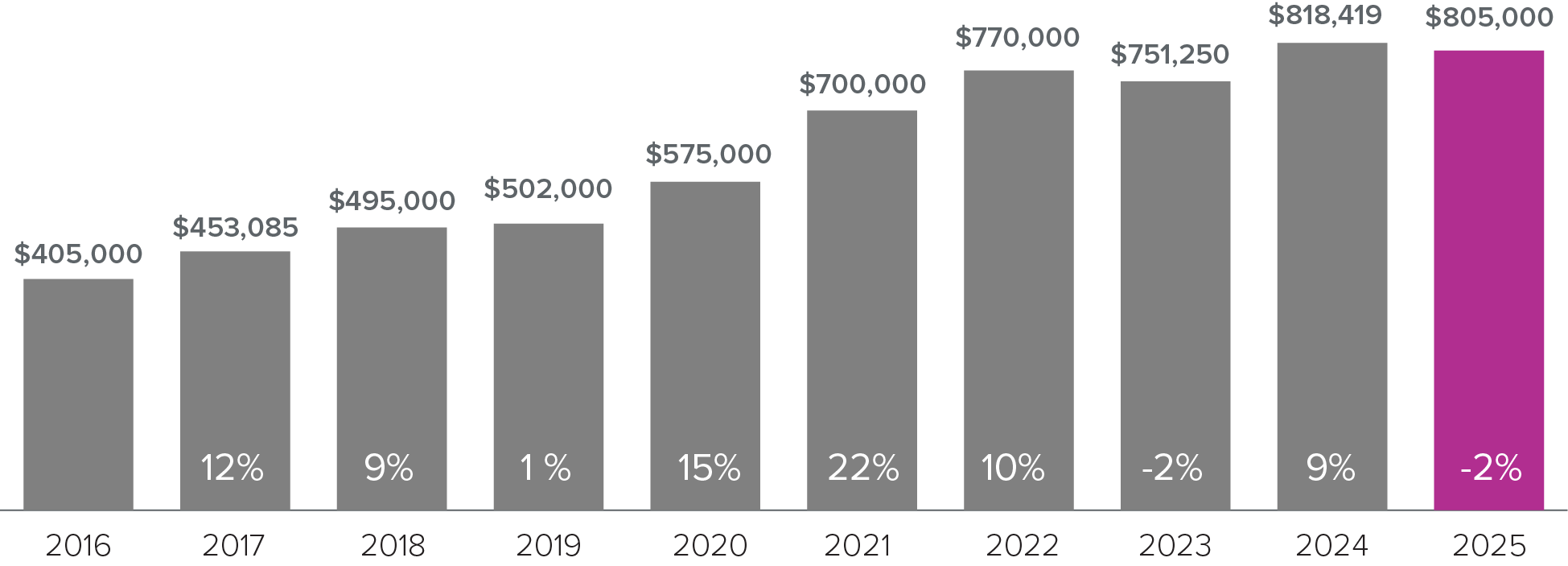

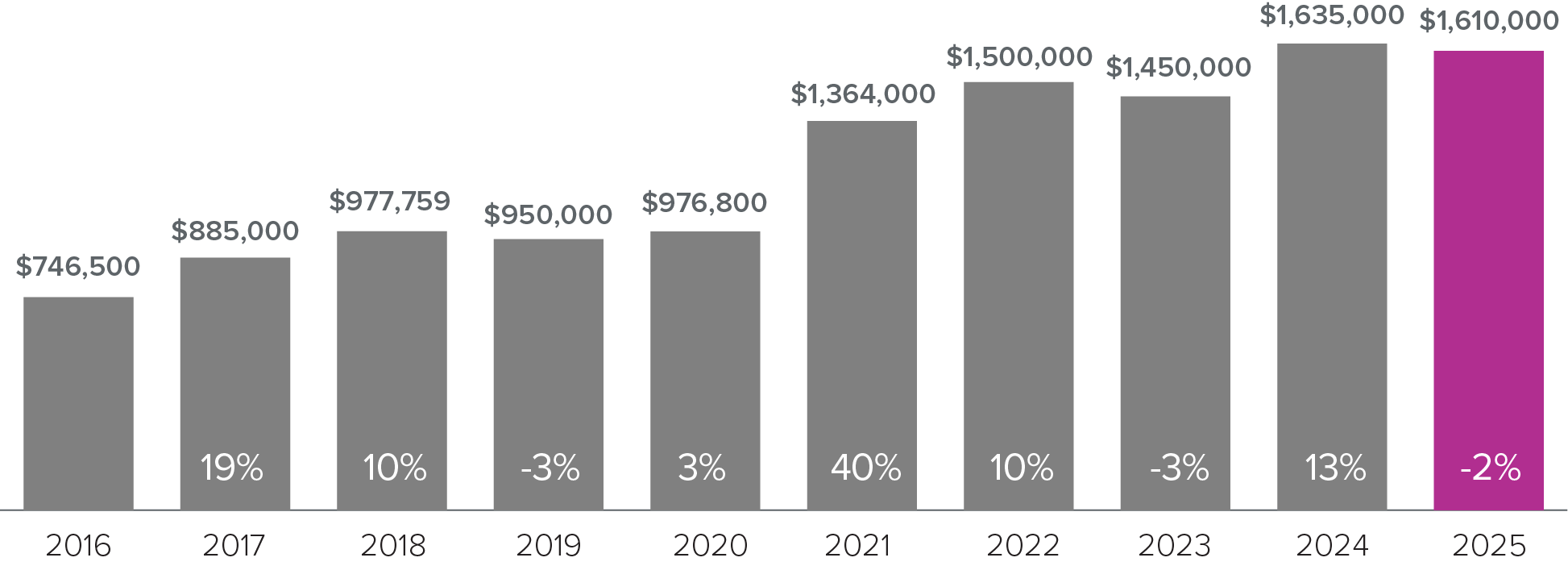

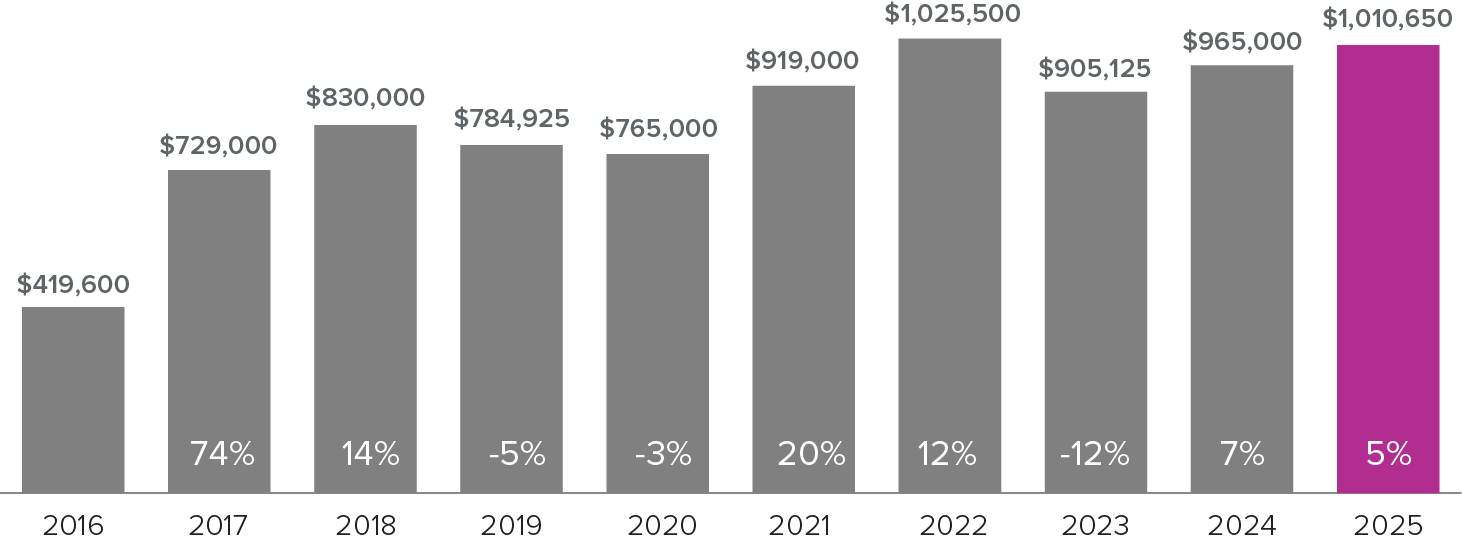

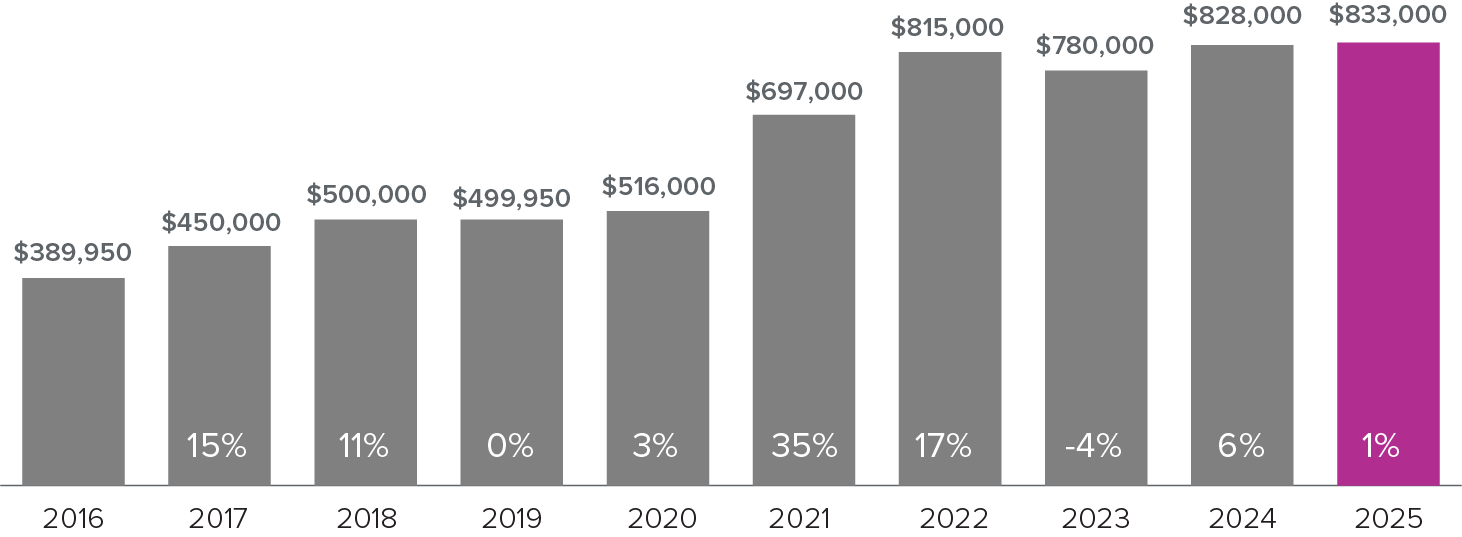

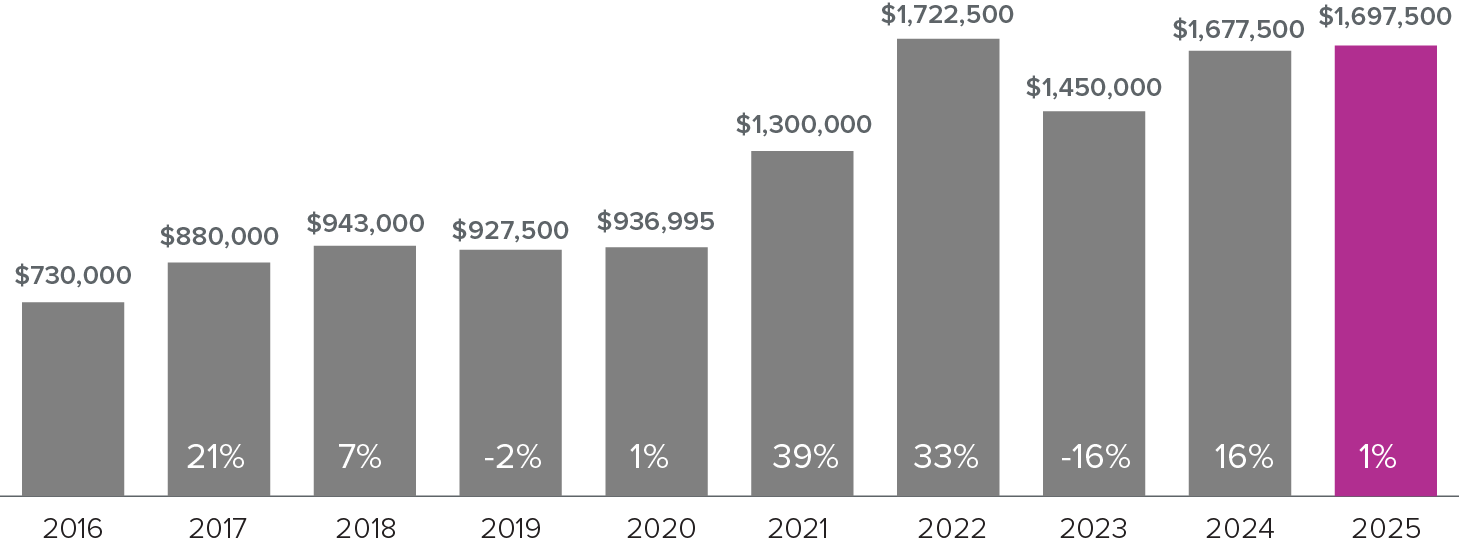

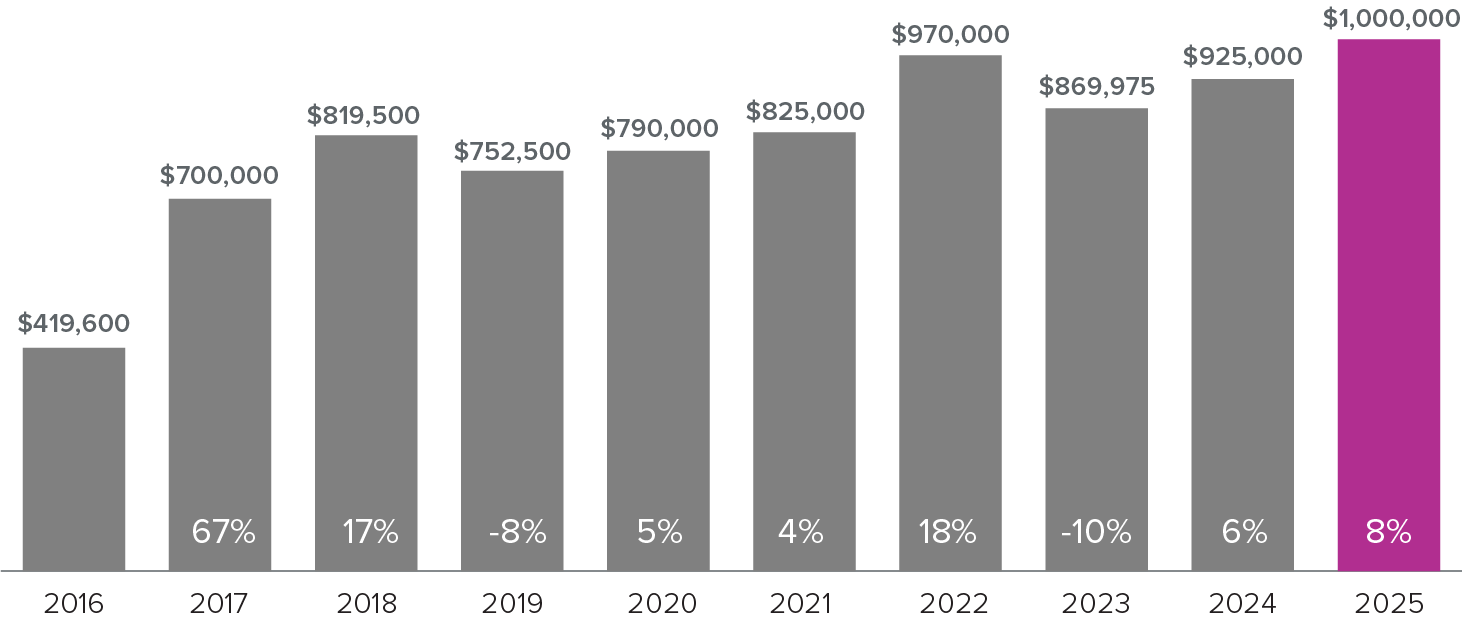

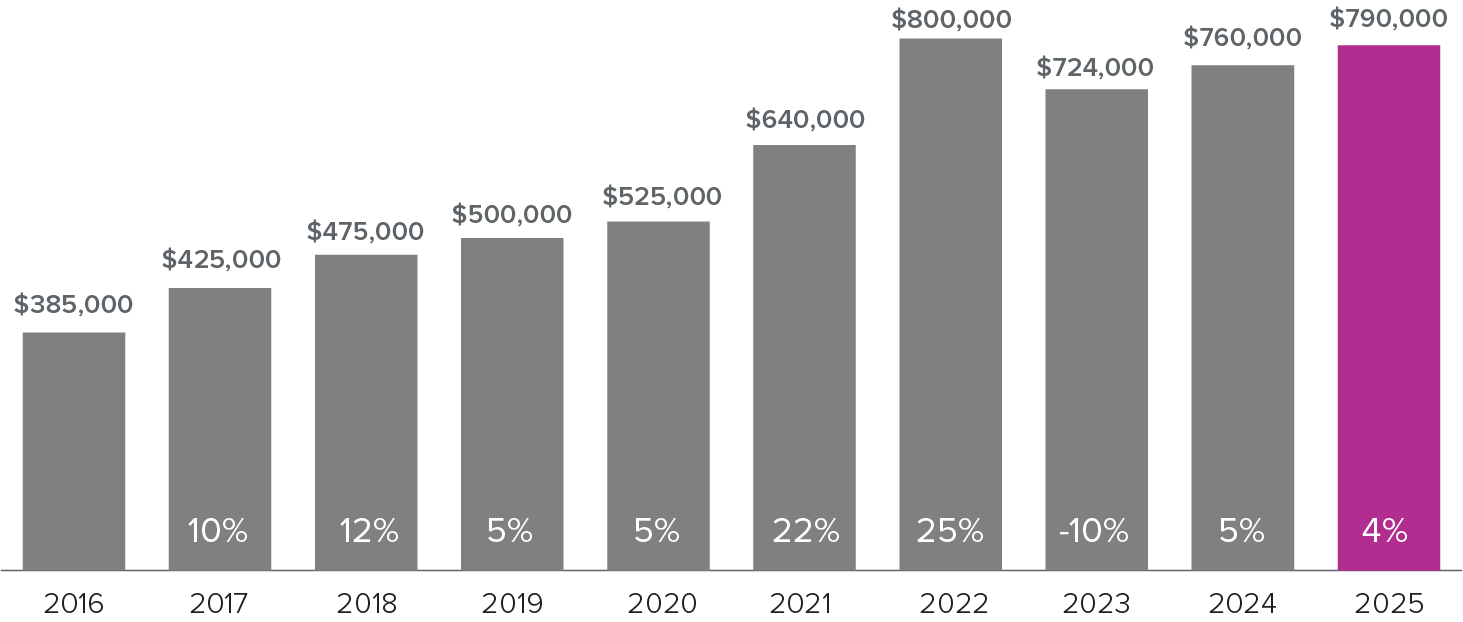

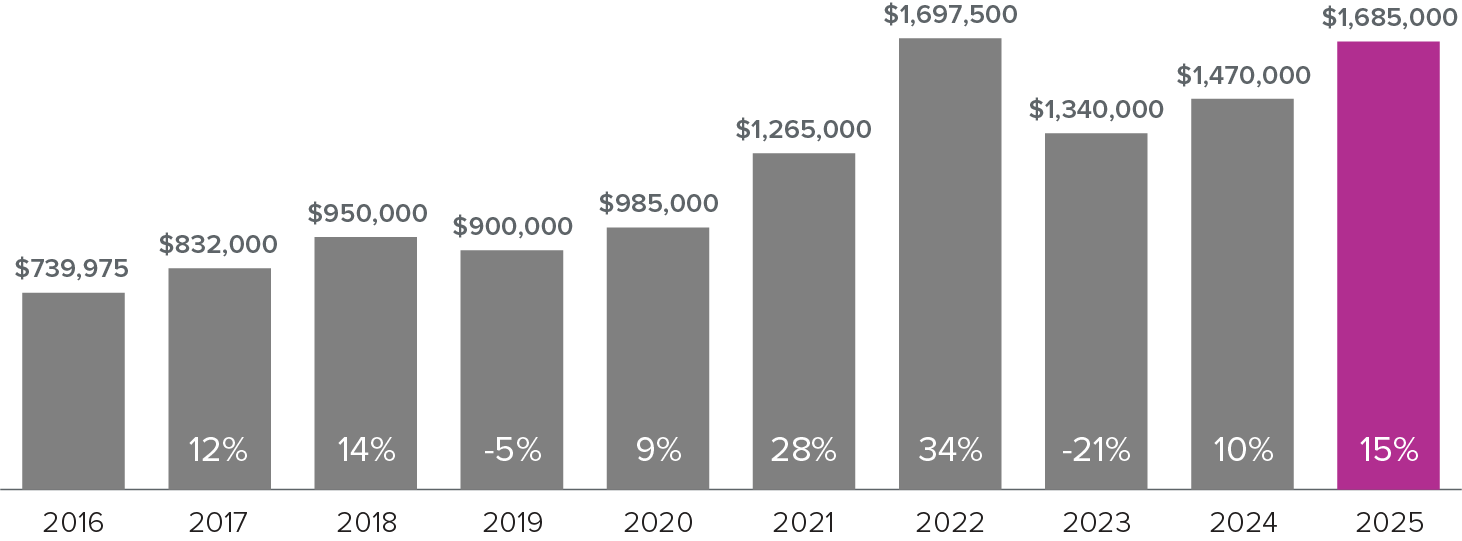

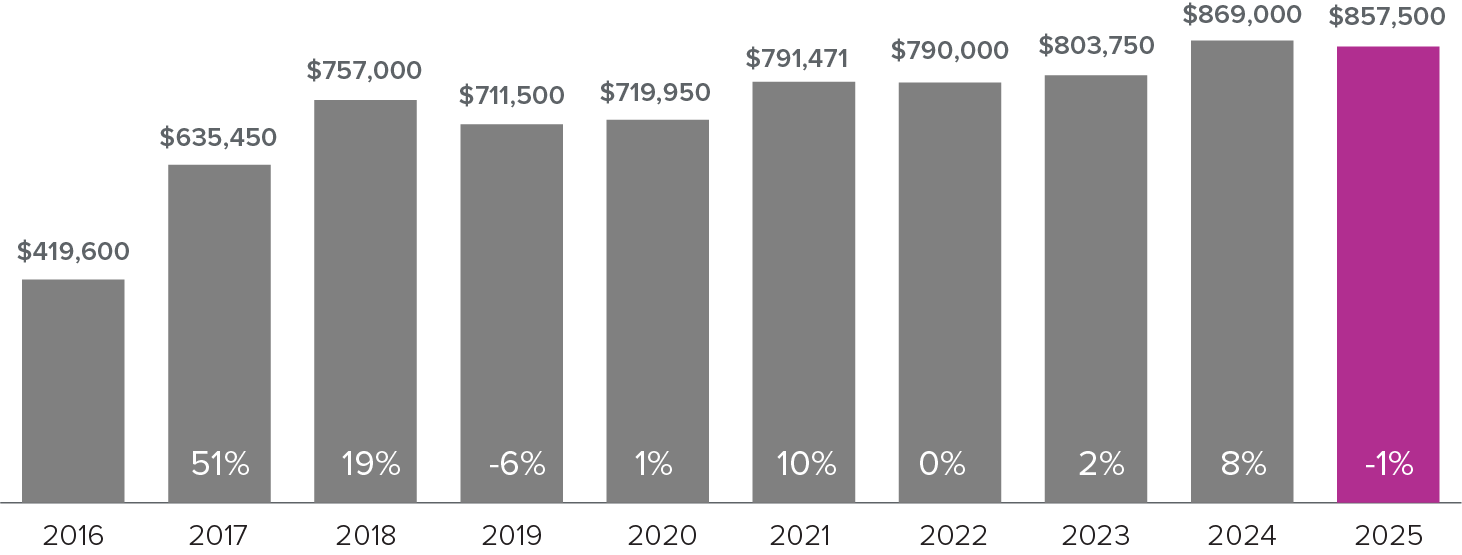

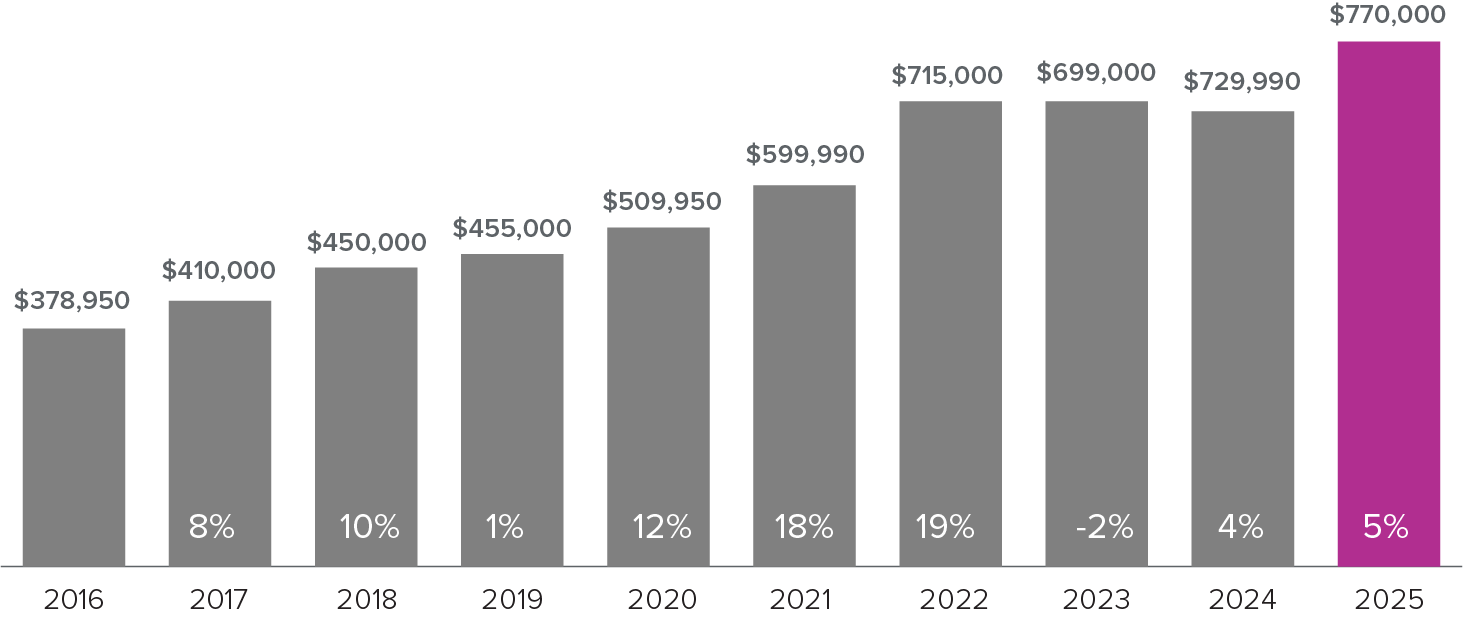

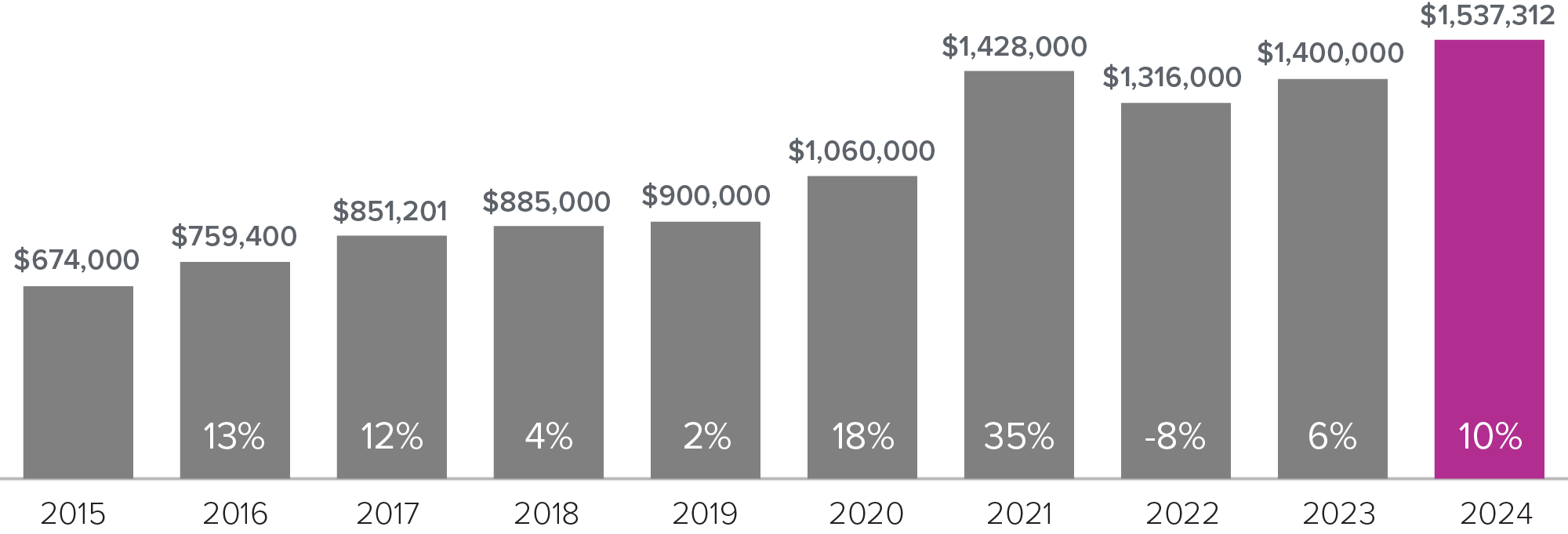

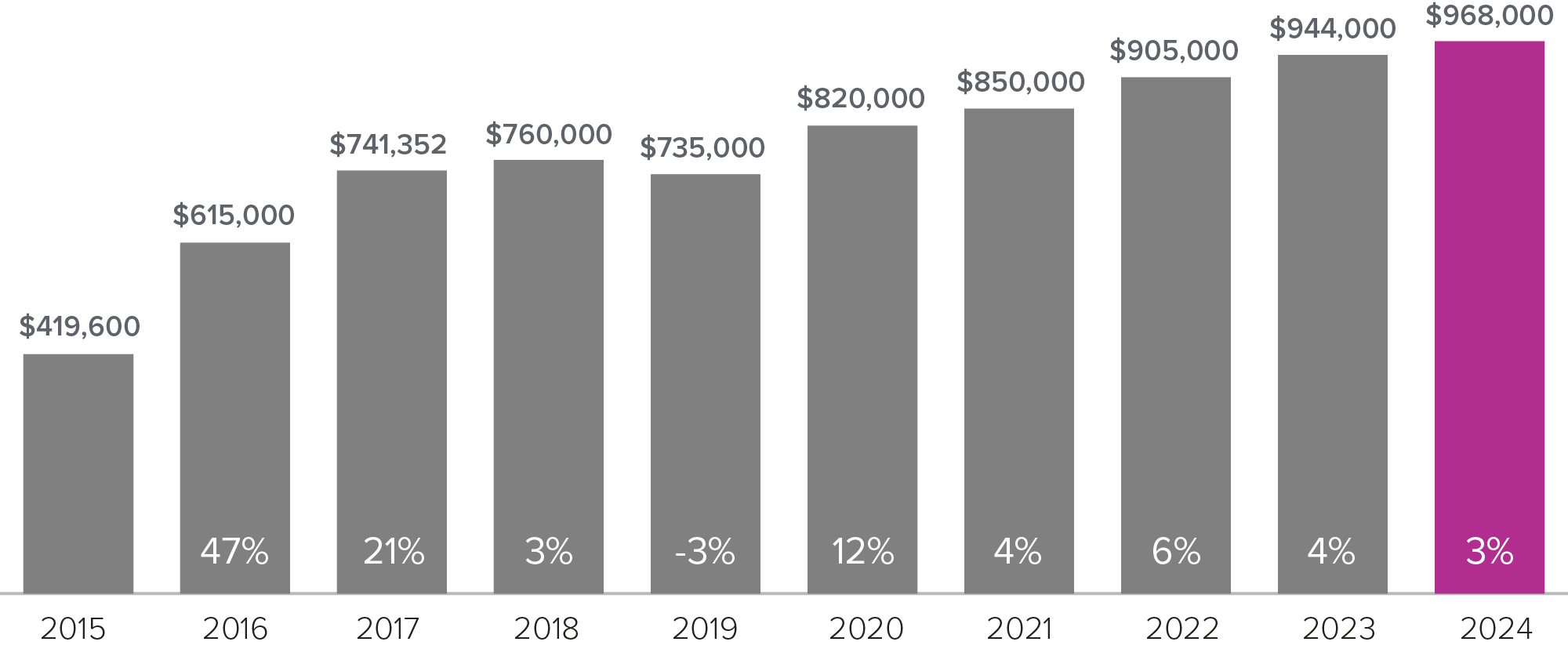

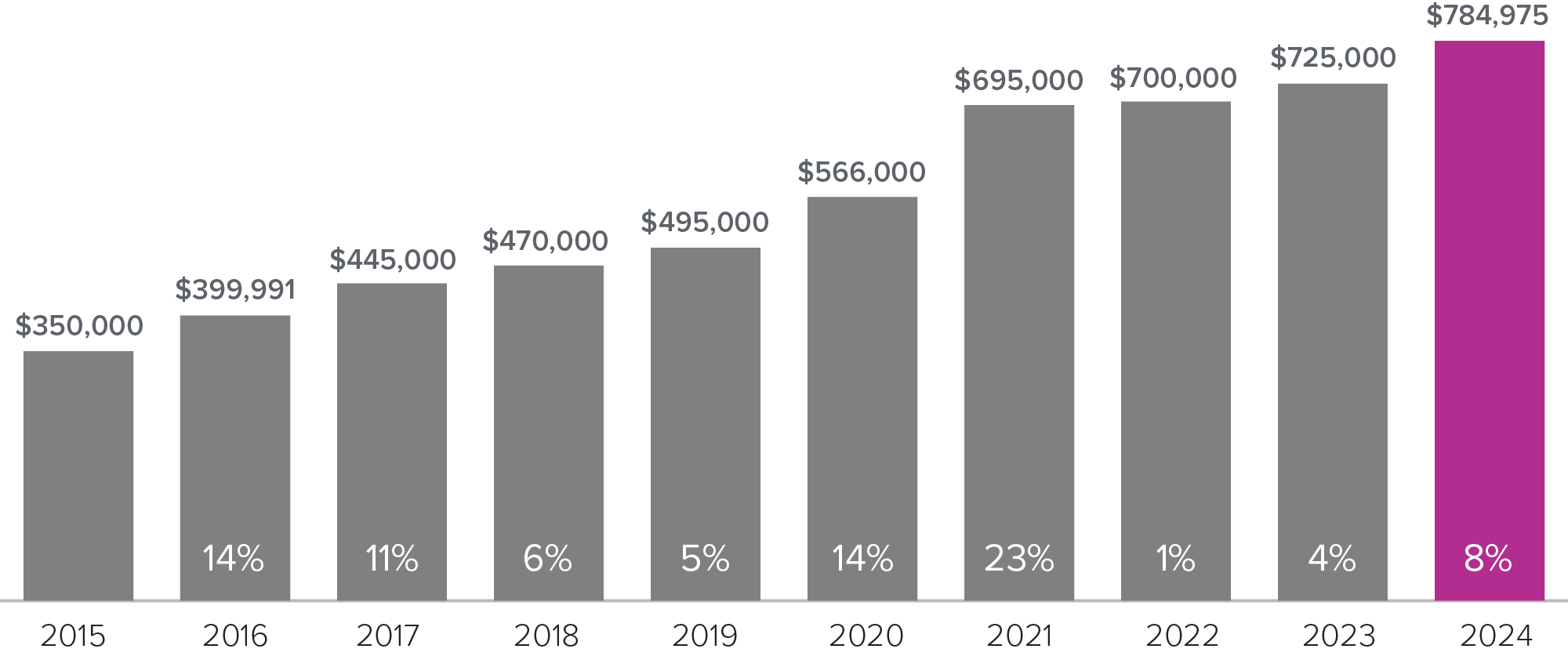

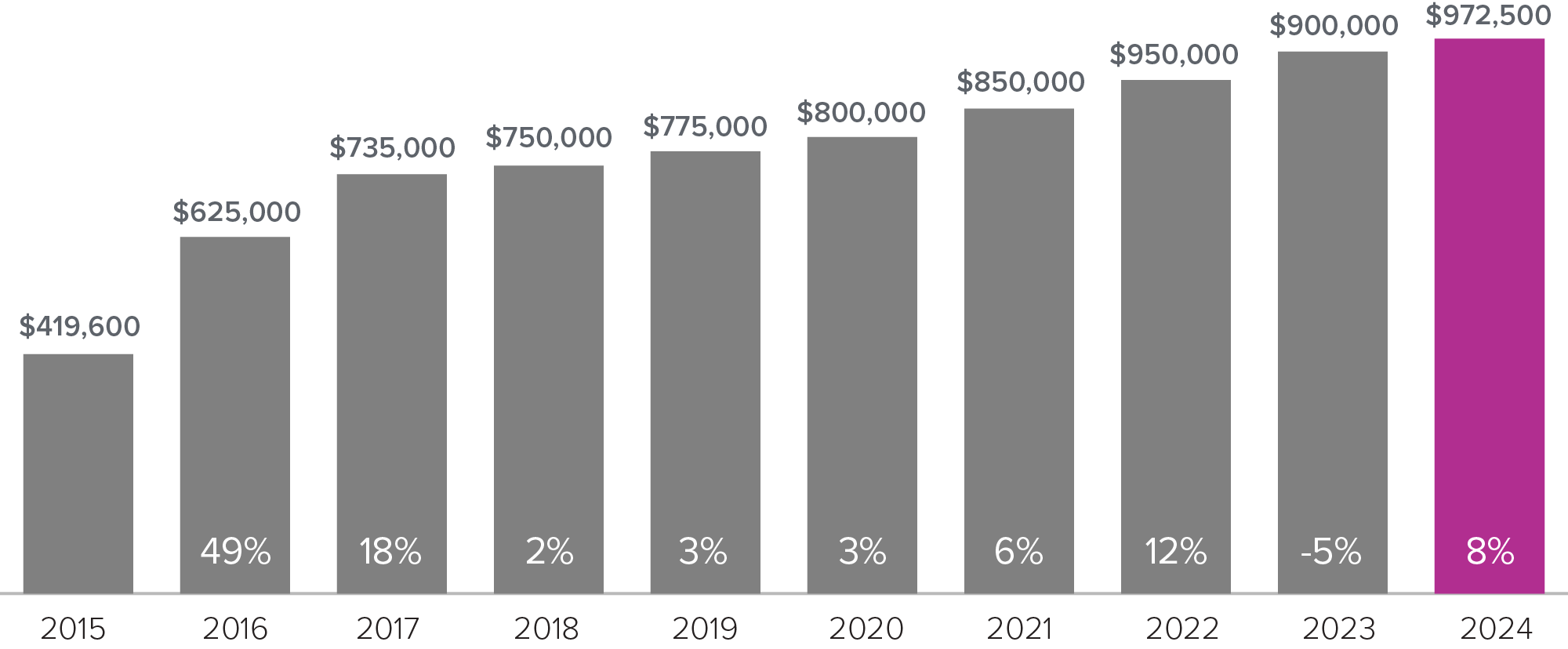

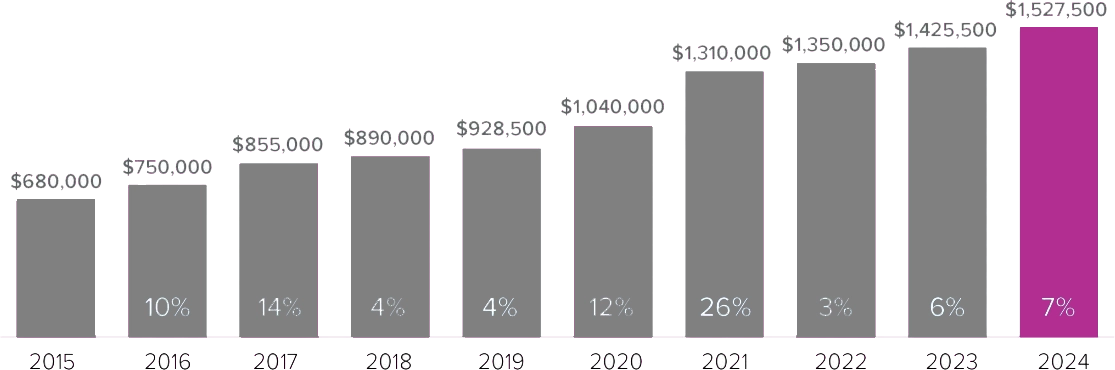

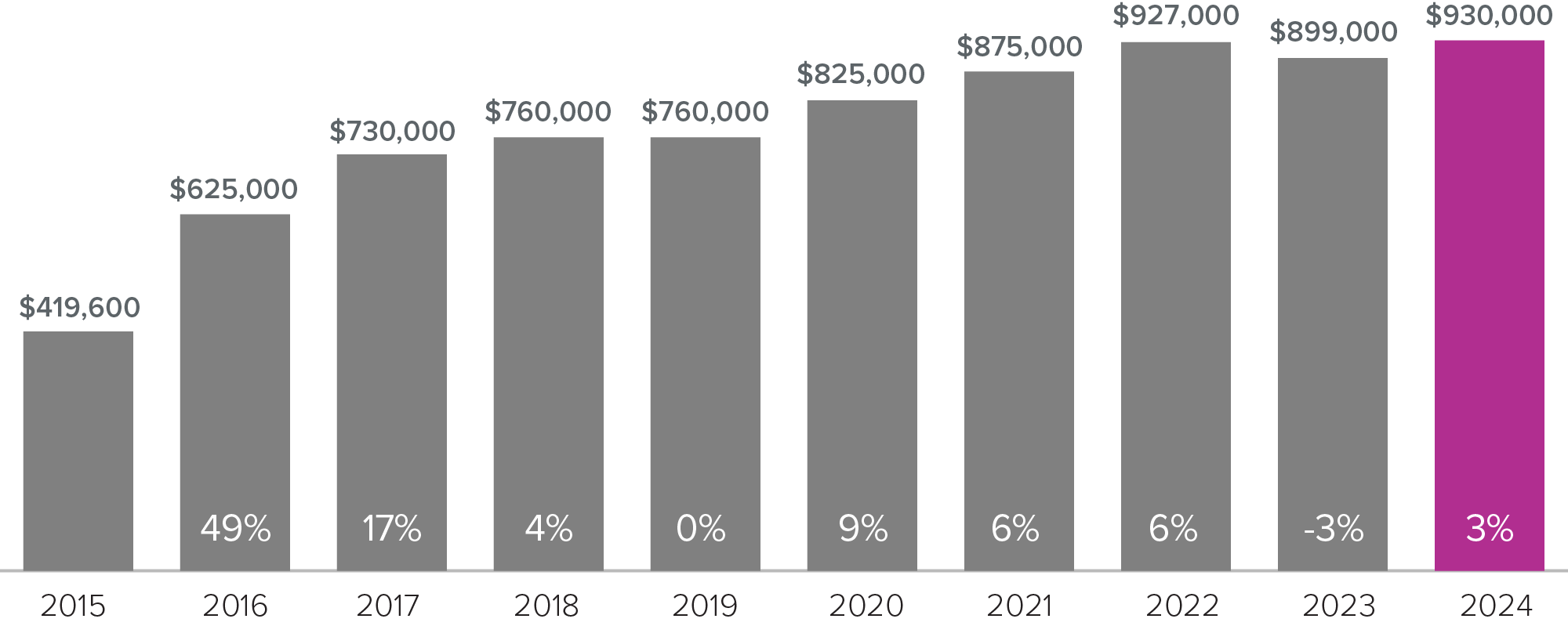

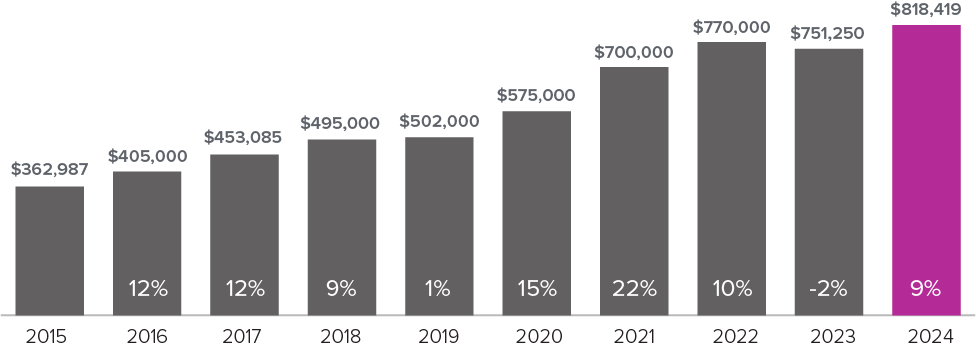

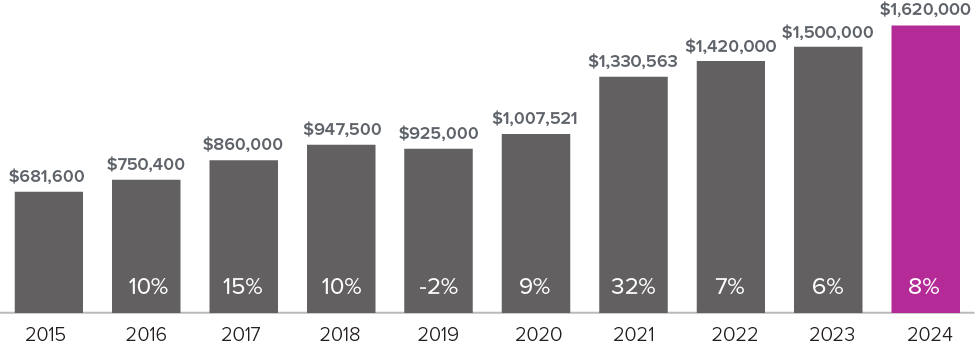

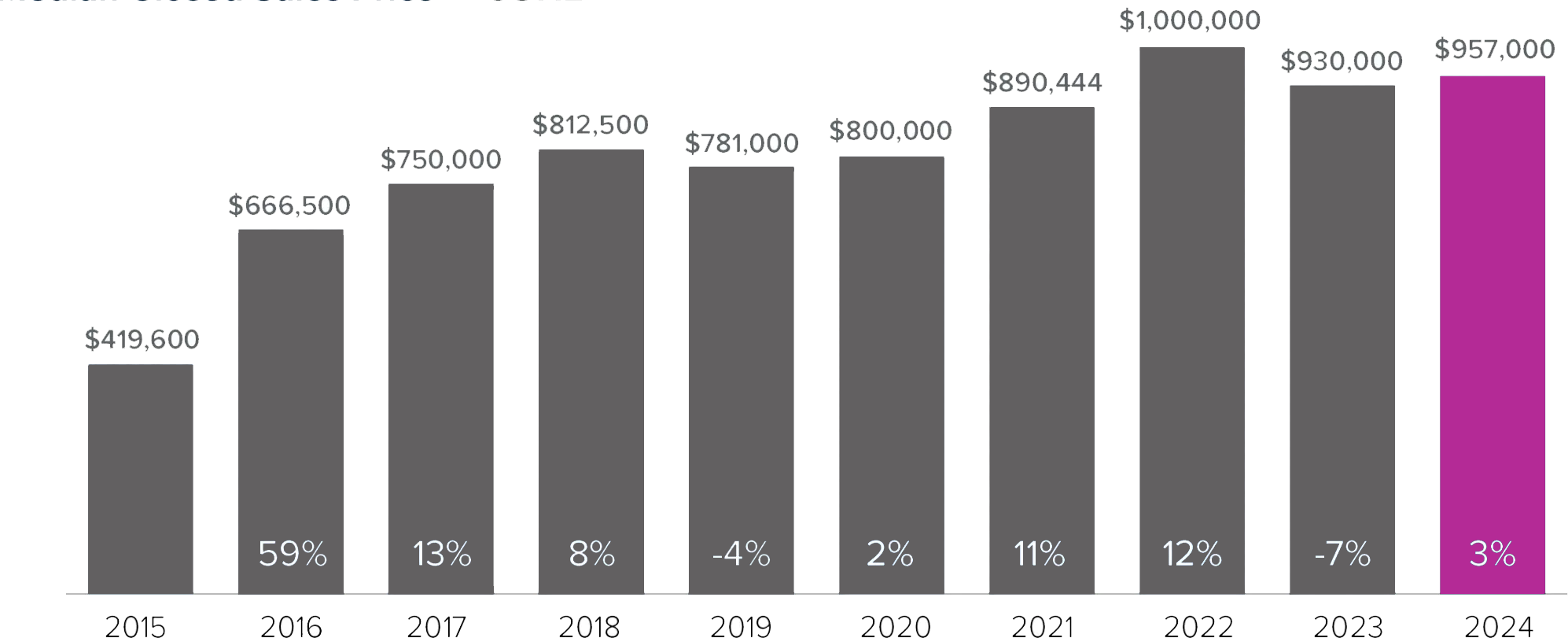

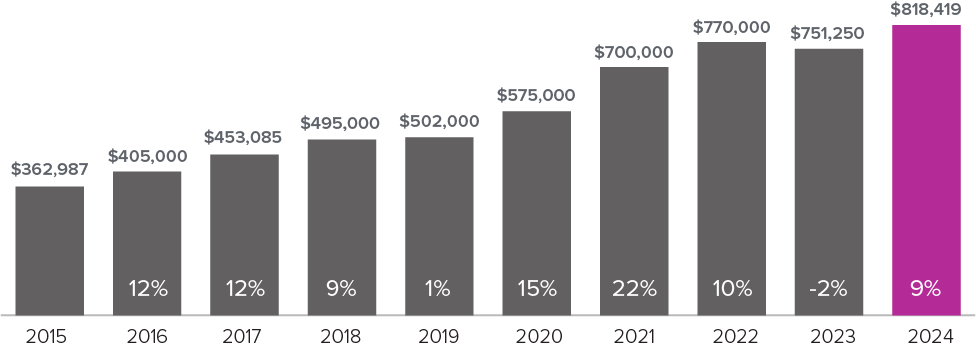

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

11%

OF HOMES SOLD ABOVE LIST PRICE

44%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

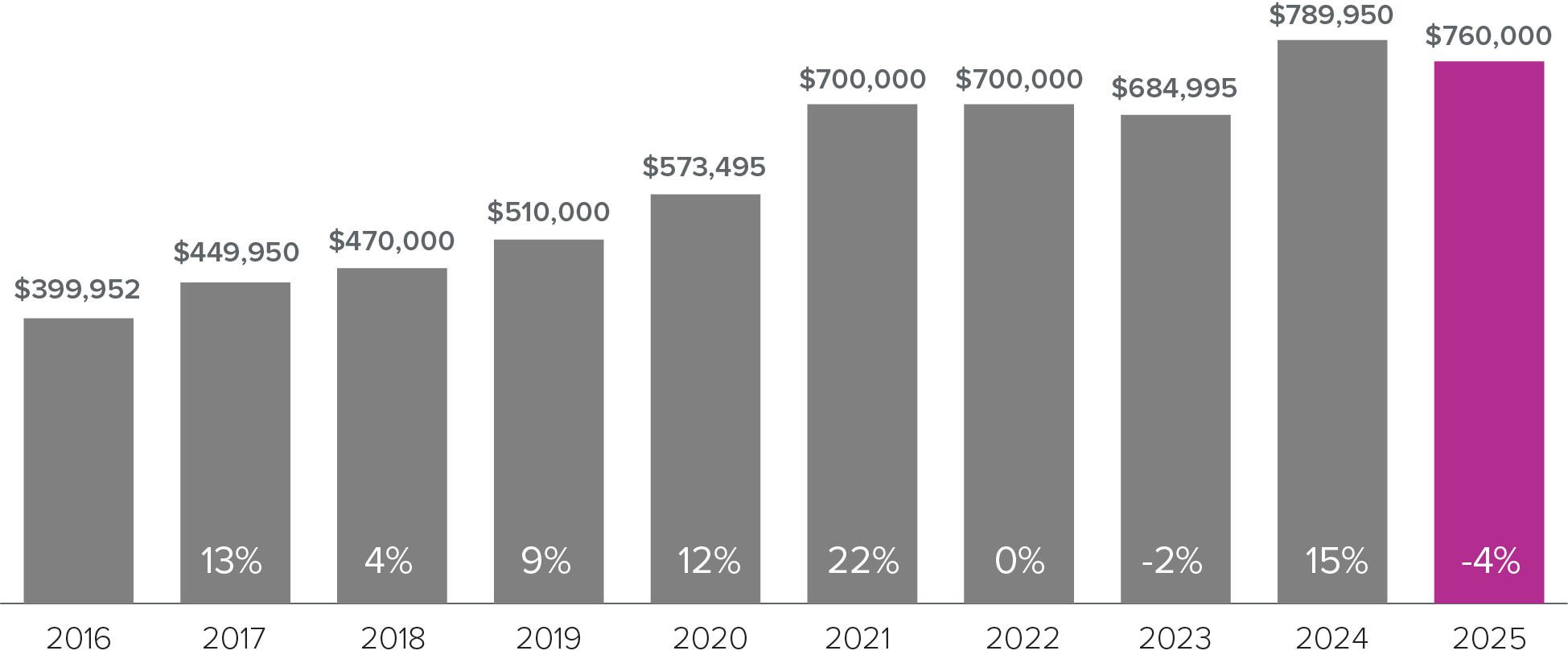

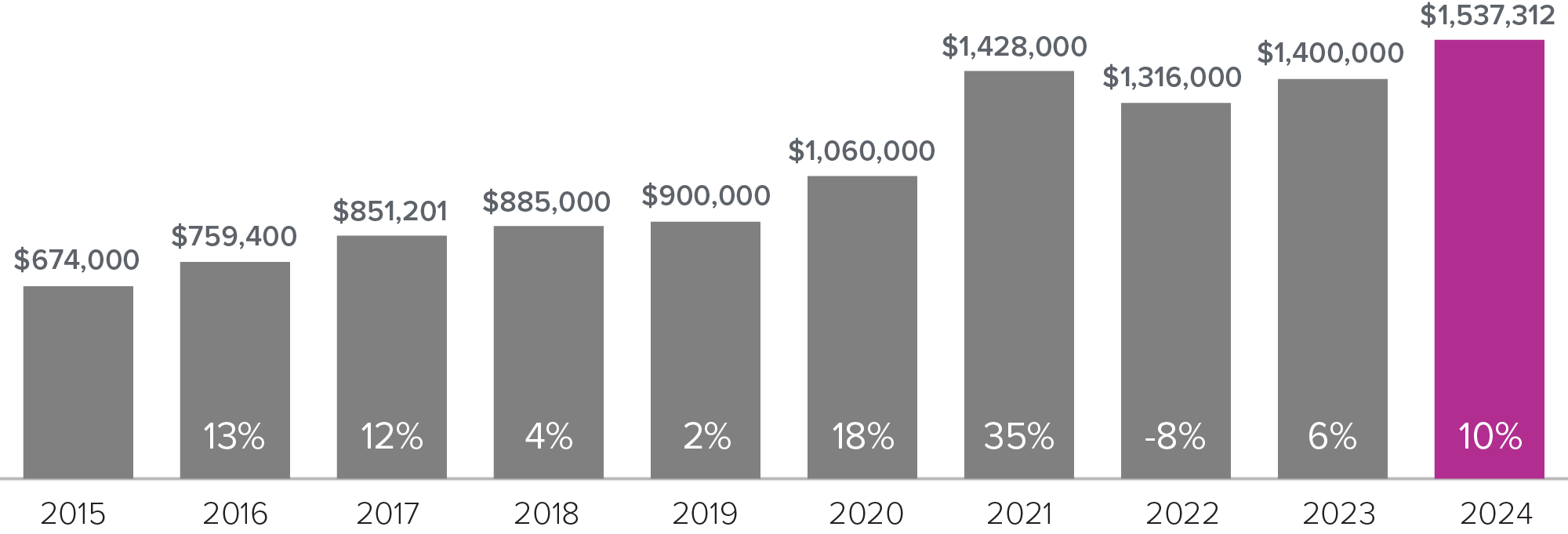

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

13%

OF HOMES SOLD ABOVE LIST PRICE

47%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.6

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of January 2026.

Eastside stats for Single Family Residences (SFRs) show the median price dropped 4% to $1.435M in January, which is likely a correction to the previous month’s surprising 5% increase. I expect prices to stabilize now as we move into our busiest season. The Eastside condo market experienced a dramatic increase in inventory that translated into a significantly lower median price of $628k, a 15% decrease from the previous month. Condo financing continues to be challenging, which could also be having a dampening effect.

The greater Seattle area was harder hit by the seasonal slowdown with the SFR median price dropping 7% to $850k. The median price of a Seattle condo stayed relatively stable at $555k, though I do expect increasing condo inventory to exert downward pressure on pricing.

Overall, very few homes sold over list price in either area and an increasing number of homes experienced a price drop before selling. My experience is that buyers are being more selective than ever and are willing to wait for the “perfect home”. They are not typically interested in taking on deferred maintenance issues or making upgrades to a dated home. As a result, pricing and presentation have never been more important. Sellers hoping to get top dollar for a home that isn’t market-ready are likely to experience extended market times and price reductions. On the other hand, for the rare buyer willing to put in some sweat equity, there are opportunities to be had!

10%

OF HOMES SOLD ABOVE LIST PRICE

48%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.6

MONTHS SUPPLY OF AVAILABLE HOMES*

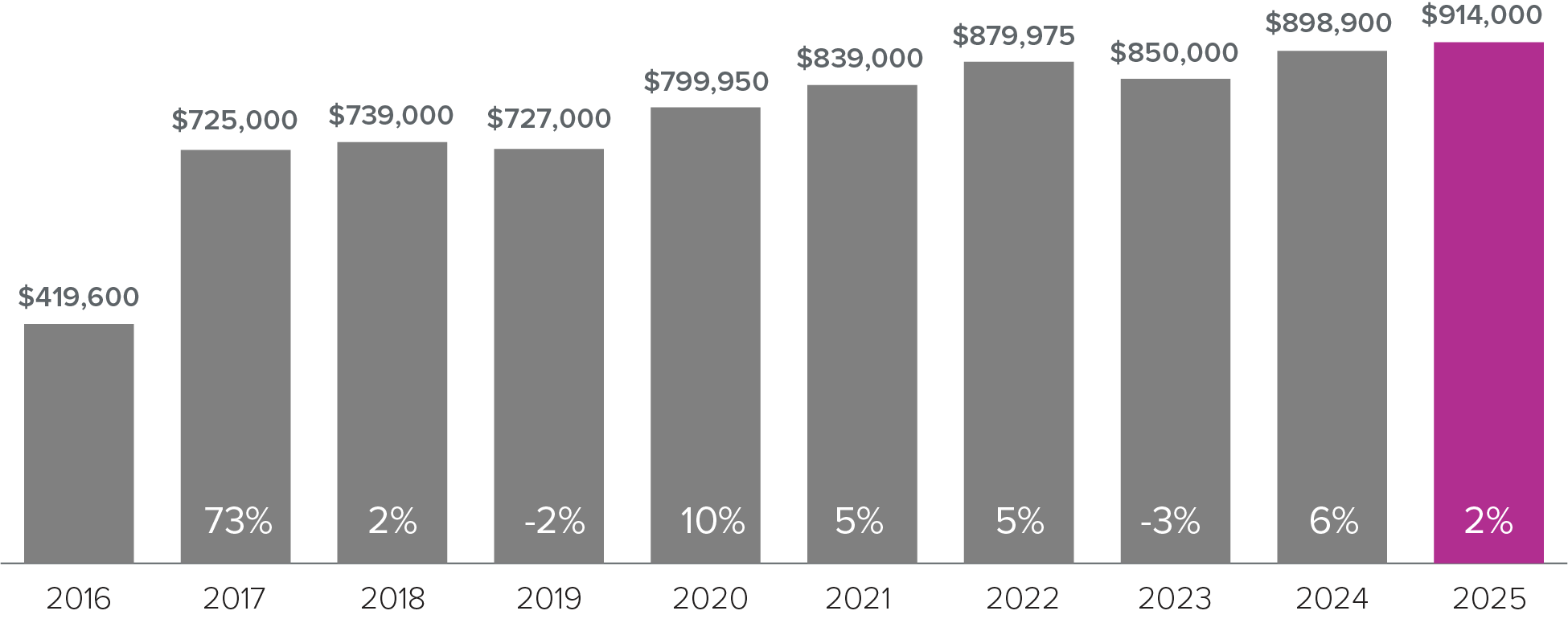

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

12%

OF HOMES SOLD ABOVE LIST PRICE

57%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

13%

OF HOMES SOLD ABOVE LIST PRICE

56%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

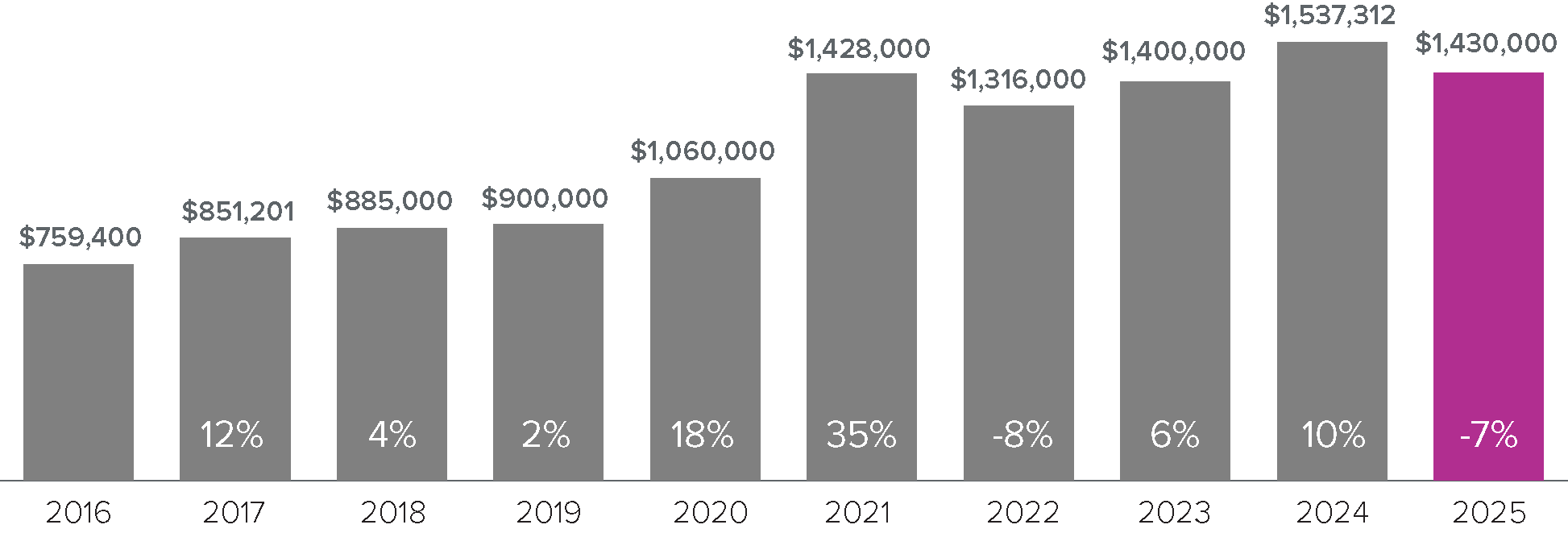

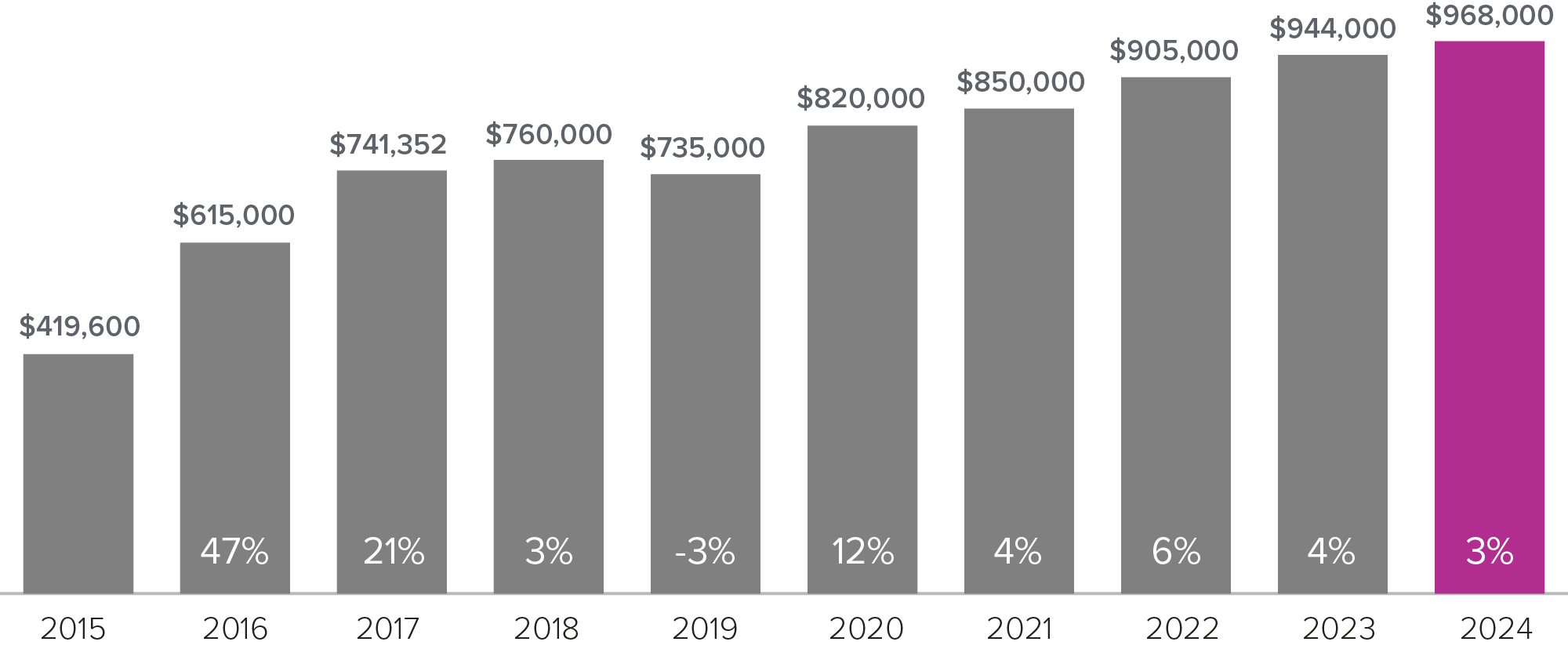

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

10%

OF HOMES SOLD ABOVE LIST PRICE

48%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.6

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

12%

OF HOMES SOLD ABOVE LIST PRICE

57%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

13%

OF HOMES SOLD ABOVE LIST PRICE

56%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of December 2025.

Eastside stats were a little surprising in that the median price for a Single Family Residence (SFR) increased ~5% to $1.5M, despite a slower market. The median price for a condo decreased 1% to $741,250, which is more what one would expect for December. Seattle’s SFR median price dropped 6% to $914,000 - the lowest since January 2025. The median price of a Seattle condo dropped 3% to $555,000.

As we enter our busy first quarter, I expect inventory and buyer activity to increase significantly, particularly given the recent lower interest rates. Buyers should act quickly and Sellers should be preparing now to take advantage of the Spring market as soon as possible.

Days are getting longer and daffodils are popping up, a sure sign that Spring is around the corner. Consider adding a pop of color to your front porch with pansies!

13%

OF HOMES SOLD ABOVE LIST PRICE

62%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.4

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

20%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.5

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

16%

OF HOMES SOLD ABOVE LIST PRICE

59%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

13%

OF HOMES SOLD ABOVE LIST PRICE

62%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.4

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

20%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.5

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

16%

OF HOMES SOLD ABOVE LIST PRICE

59%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of November 2025.

Our typical late-Fall slowdown continues, with inventory dropping as homes sell or come off the market to wait for the busier 1st quarter. On the Eastside, the median price of a Single Family Residence (SFR) dropped $112k to $1,430,000 – the lowest level since 2023. In the greater Seattle area, the SFR median price dropped $76k to $973,500. Condo prices were more stable. On the Eastside, the median condo price went up a few thousand dollars to $750k and in Seattle it decreased a few thousand dollars to $573,500.

Lower prices combined with favorable interest rates, make December and early January excellent times to buy. (I’ve had great success helping buyers negotiate their dream home purchase this past year and I’d love to do the same for you and yours!) I expect the usual surge in inventory and buyer-interest in late January/February/March so I’m encouraging my sellers to come on the market as early as possible next year.

Need help figuring out how to get the most for your home? I’m happy to come by and help you determine what needs to be done to optimize your return. If a move out of the area is in your future, I can provide you with a referral to a trusted agent wherever you are headed.

17%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.6

MONTHS SUPPLY OF AVAILABLE HOMES*

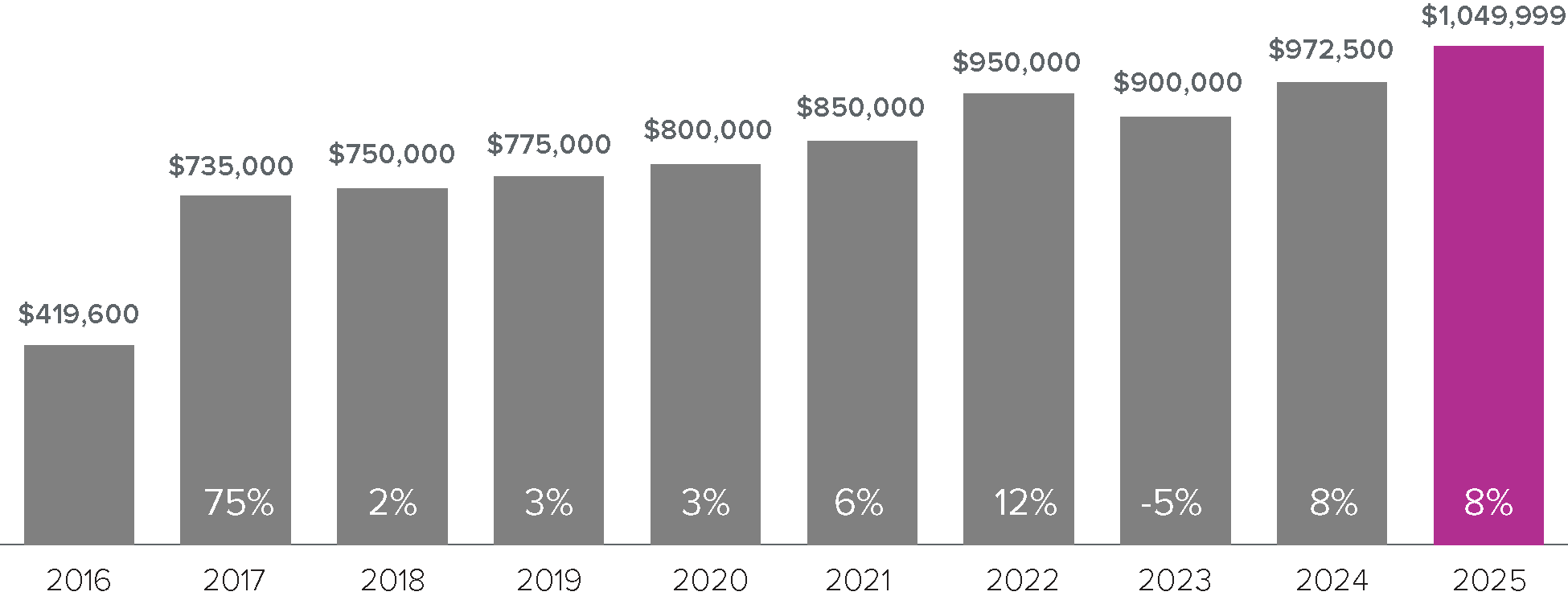

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

26%

OF HOMES SOLD ABOVE LIST PRICE

76%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

15%

OF HOMES SOLD ABOVE LIST PRICE

62%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

17%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.6

MONTHS SUPPLY OF AVAILABLE HOMES*

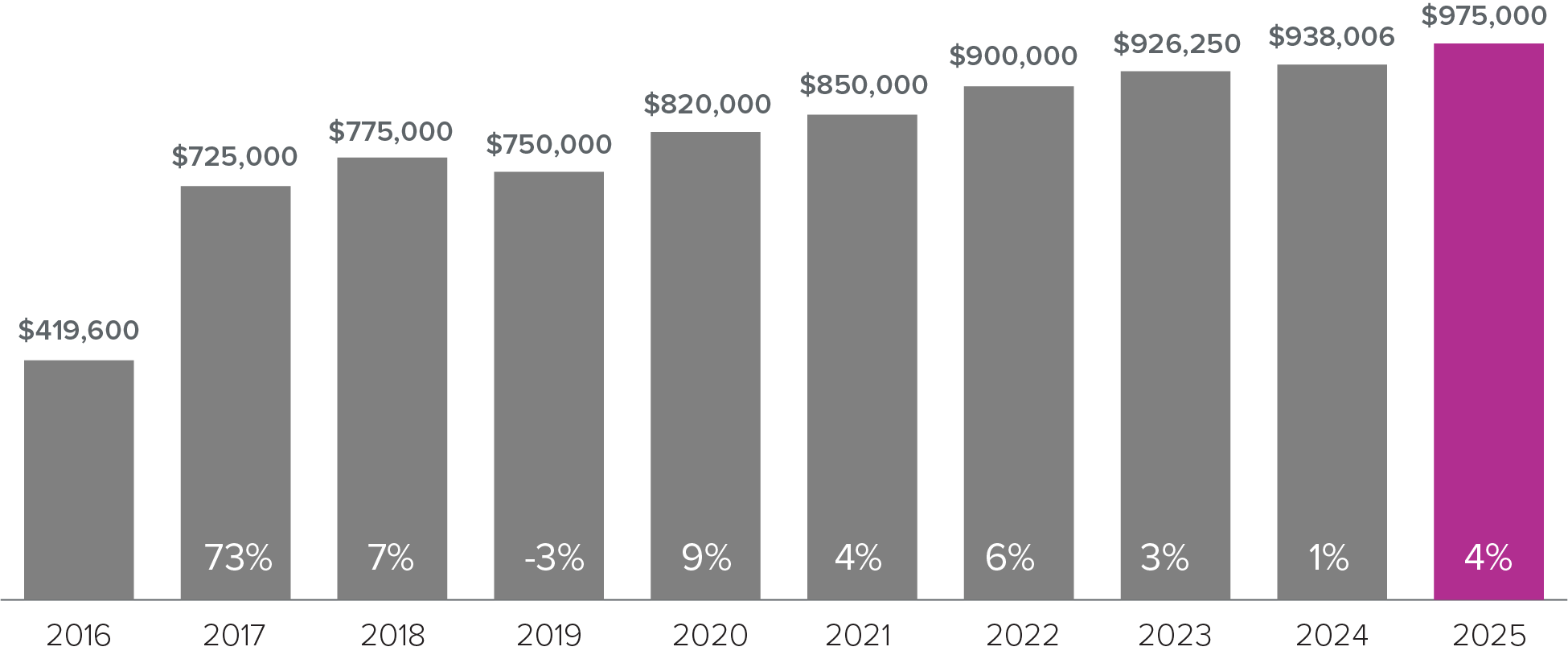

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

26%

OF HOMES SOLD ABOVE LIST PRICE

76%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

15%

OF HOMES SOLD ABOVE LIST PRICE

62%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of October 2025.

October was a bit of a mixed market – the first half was very busy (which is typical), then sales slowed down the second half. Eastside statistics reflect that duality with a modest $25k drop in the median price of a single family residence (SFR) to $1.55M. (This is exactly what the SFR median price was a year ago.) Interestingly, the median price of an Eastside condo increased over $16K to $746,701. This may be due to the drop in interest rates last month, which tends to impact lower-priced buyers more, increasing competition.

Seattle real estate stats were the big surprise – the median price of an SFR increased $75,000 (nearly 8%) to $1,049.999 which is the second highest median price on record! The condo median price rose over 10% to $577,562. Here, too, affordability may have been the driver.

As is normal this time of year, the number of new listings decreased in both areas. There are still fantastic opportunities for buyers, but that window is closing as more sellers pull their listings off the market until the 1st quarter. Combined with fewer listings coming on the market, inventory will likely shrink more than usual through the end of the year.

Recent cold temps are a reminder that winter is right around the corner. It’s a great time to clean gutters, cover hose spigots, and have your furnace serviced. Let me know if you need any referrals – I have trusted resources for home maintenance. Just send me a text or give me a call if there is anything I can do to help you and yours with your real estate needs.

14%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

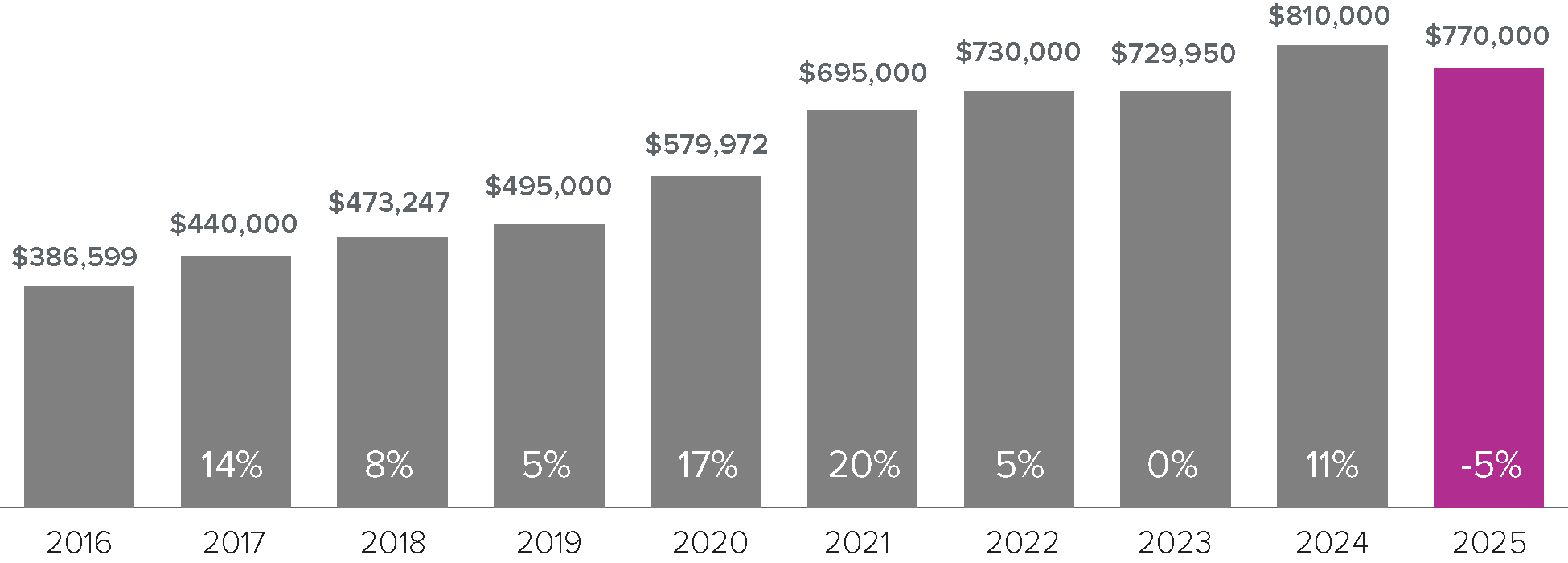

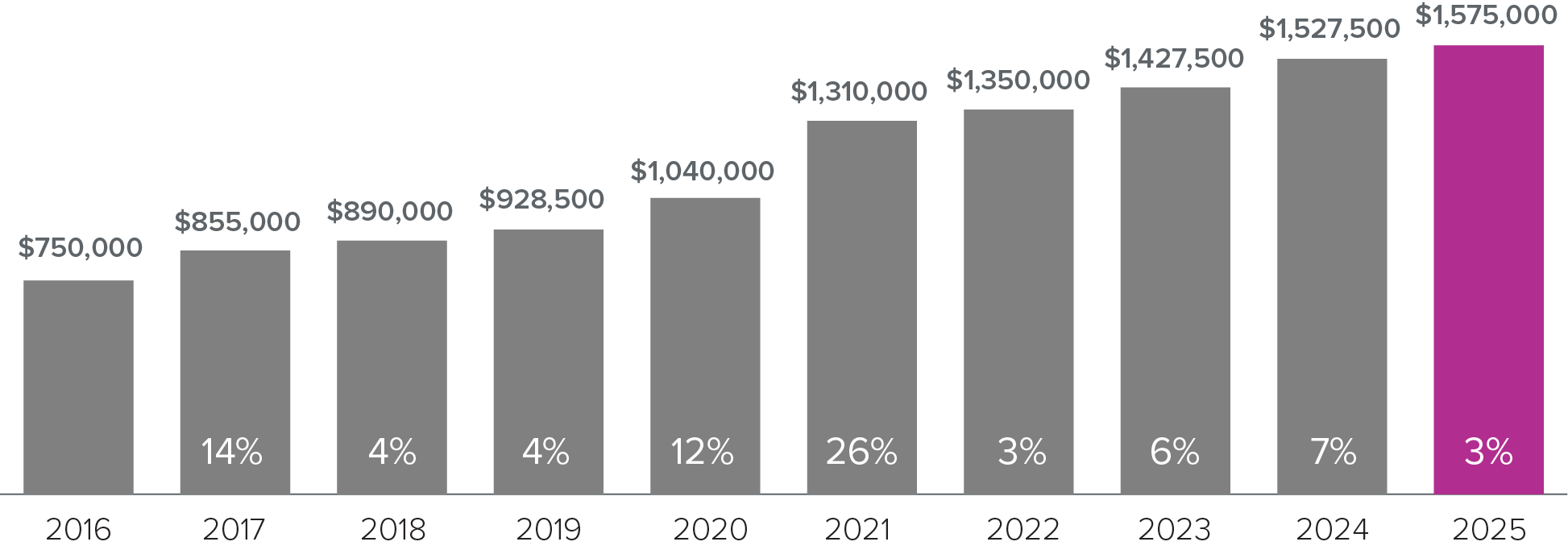

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

21%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

17%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

14%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

21%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

17%

OF HOMES SOLD ABOVE LIST PRICE

63%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.9

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of September 2025.

On the Eastside, the median price of a Single Family Residence (SFR) increased slightly to $1,575,000 in September, reflecting that increased buyer activity offset higher inventory. The median price of an Eastside condo also increased a small amount to $730,000. In Seattle, the median price of an SFR decreased again to $975,000. Seattle condos remain in a buyer’s market with an excess of inventory resulting in a 12% decrease to the median price. In both areas market times lengthened, which is normal for this time of year.

September traditionally marks a peak in inventory, with the number of new listings decreasing monthly until January. With current inventory and favorable interest rates, I am finding excellent opportunities for my buyers. Recently, I was able to secure wonderful homes for 2 of my VA buyers at excellent prices and with significant seller concessions. VA loans allow zero down and can be less appealing to sellers versus more traditional financing. This can make it challenging for VA buyers in a more competitive market. If you’re considering a real estate purchase, I strongly recommend acting now. The market remains competitive for well-priced, updated, professionally marketed homes in desirable areas, so buyers need to be prepared to act when they find the right property.

For sellers, if you are unable to list by the end of October, you may be better off waiting until mid-January. It often surprises people to learn that the best time to sell a home in our area is the first quarter of the year. It seems logical that selling when the weather is better, in late Spring/Summer would be best, but that is not the case. Our market begins to slow in May and, other than a typical rally between Labor Day and the end of October, the slowdown continues through the end of the year.

19%

OF HOMES SOLD ABOVE LIST PRICE

67%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.5

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

25%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.2

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

16%

OF HOMES SOLD ABOVE LIST PRICE

65%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.0

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

19%

OF HOMES SOLD ABOVE LIST PRICE

67%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.5

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

25%

OF HOMES SOLD ABOVE LIST PRICE

71%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.2

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

16%

OF HOMES SOLD ABOVE LIST PRICE

65%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.0

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of August 2025.

August stats reflect the expected continuing summer slowdown as attentions turned toward final summer vacations and back-to-school preparation. The median price of a Single Family Residence (SFR) on the Eastside went down 2.7% to $1,537,500 and the median price of a Seattle SFR decreased a more significant 9% to $1,000,000. I did, personally, see a rally in the last week of August as 3 of my listings sold - 2 within 3 days of coming on the market! I anticipate an interest rate drop later this month and with it, the opportunity to negotiate both price and terms will likely diminish as more buyers enter the market.

Condo prices continue to be erratic. On the Eastside, the median price was $717, 500, up 14% from July after a 19% drop June to July. Similarly, the median price of a Seattle condo increased 8% to $595,000 after a 7% decrease the previous month. It remains a buyer’s market in Seattle for condos with a lot of inventory and sluggish sales. As I mentioned last month, HOA dues and deferred maintenance require due diligence to discern a good deal from a potential moneypit.

As Fall approaches, it’s a great time to get your furnace serviced to avoid potentially expensive emergency calls when the temps drop. It’s also a good time to schedule winterization of your outdoor sprinkler system, ahead of the rush. Let me know if you need any referrals or if I can be of assistance with your real estate needs.

19%

OF HOMES SOLD ABOVE LIST PRICE

75%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.4

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2025.

Though inventory did not increase as much as usual in July, our normal seasonal slowdown is reflected in longer market times and increasing price reductions. On the Eastside, the median cost of a Single Family Residence (SFR) decreased slightly (less than 2%) to $1.58M in July. Seattle experienced over a 6% drop in the SFR median price to $1.01M, but they also had a big increase last month, so some of that adjustment is to be expected.

One surprise was the 19% drop in the Eastside condo median price to $629,000 from June to July. The Seattle condo median price decreased almost 7% to $550k. While the significant drop on the Eastside may be somewhat of an anomaly, I do believe that the more stringent underwriting guidelines for condo insurance and mortgages are having an impact. HOAs are facing huge increases in their insurance costs and there is little they can do about it. A property manager recently told me that insurance costs for one of the complexes she manages has gone up 8-fold in the past couple of years! Similarly, a review of the finances for one of my recent condo listings revealed that over 40% of the operating budget was being spent on insurance. The increase in dues necessary to offset these costs makes condos less affordable, which is putting downward pressure on sales prices. Older complexes are particularly vulnerable as they often have deferred maintenance and low reserves which lenders are no longer willing to overlook. The moral of this story is that, if you’re considering purchasing a condo, it’s critical to use an experienced agent who can ensure you receive all the information needed to assess the financial health of the complex. If you already own a condo, it’s important to be active in your HOA and stay informed when maintenance and financial issues are being discussed or voted on.

As always, I’m happy to help you with your real estate needs and/or to discuss the market – just text, email or call me!

27%

OF HOMES SOLD ABOVE LIST PRICE

81%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.1

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2025.

Though inventory did not increase as much as usual in July, our normal seasonal slowdown is reflected in longer market times and increasing price reductions. On the Eastside, the median cost of a Single Family Residence (SFR) decreased slightly (less than 2%) to $1.58M in July. Seattle experienced over a 6% drop in the SFR median price to $1.01M, but they also had a big increase last month, so some of that adjustment is to be expected.

One surprise was the 19% drop in the Eastside condo median price to $629,000 from June to July. The Seattle condo median price decreased almost 7% to $550k. While the significant drop on the Eastside may be somewhat of an anomaly, I do believe that the more stringent underwriting guidelines for condo insurance and mortgages are having an impact. HOAs are facing huge increases in their insurance costs and there is little they can do about it. A property manager recently told me that insurance costs for one of the complexes she manages has gone up 8-fold in the past couple of years! Similarly, a review of the finances for one of my recent condo listings revealed that over 40% of the operating budget was being spent on insurance. The increase in dues necessary to offset these costs makes condos less affordable, which is putting downward pressure on sales prices. Older complexes are particularly vulnerable as they often have deferred maintenance and low reserves which lenders are no longer willing to overlook. The moral of this story is that, if you’re considering purchasing a condo, it’s critical to use an experienced agent who can ensure you receive all the information needed to assess the financial health of the complex. If you already own a condo, it’s important to be active in your HOA and stay informed when maintenance and financial issues are being discussed or voted on.

As always, I’m happy to help you with your real estate needs and/or to discuss the market – just text, email or call me!

21%

OF HOMES SOLD ABOVE LIST PRICE

73%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.0

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2025.