43%

OF HOMES SOLD ABOVE LIST PRICE

87%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.2

MONTHS SUPPLY OF AVAILABLE HOMES*

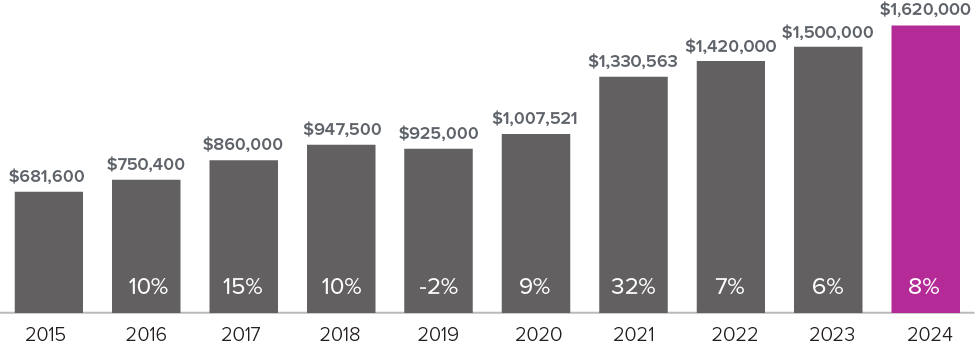

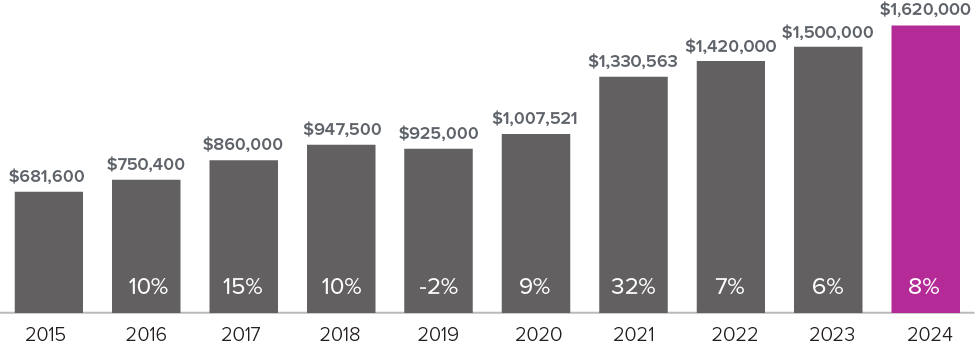

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

34%

OF HOMES SOLD ABOVE LIST PRICE

82%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.0

MONTHS SUPPLY OF AVAILABLE HOMES*

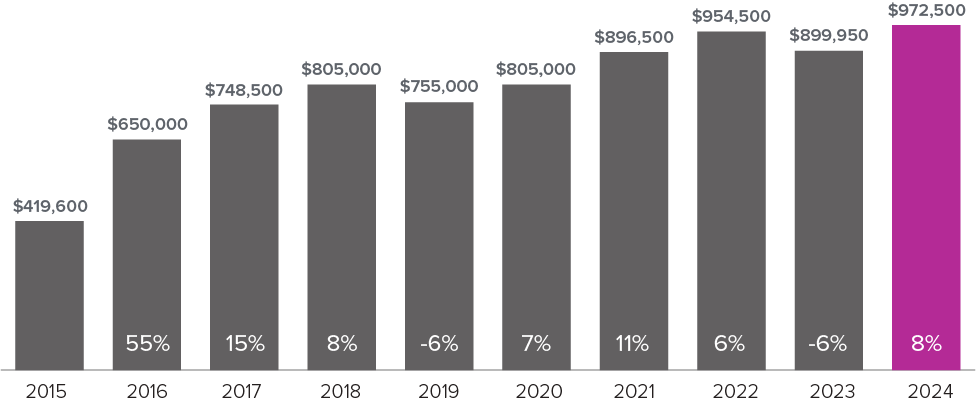

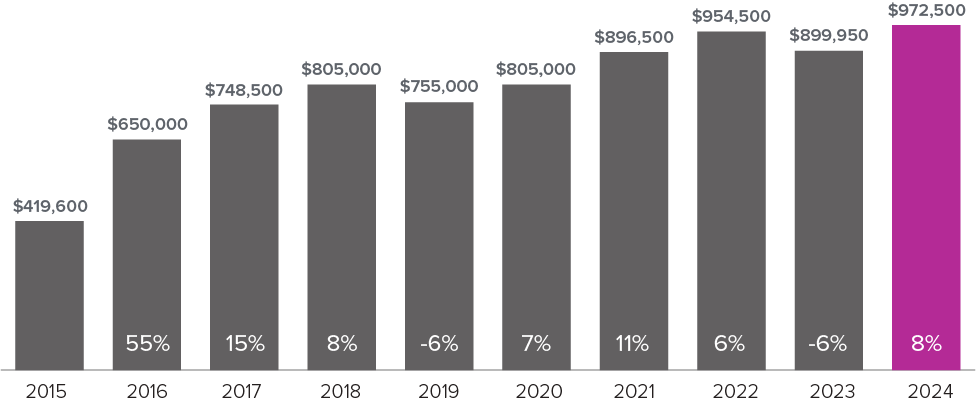

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

35%

OF HOMES SOLD ABOVE LIST PRICE

83%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.3

MONTHS SUPPLY OF AVAILABLE HOMES*

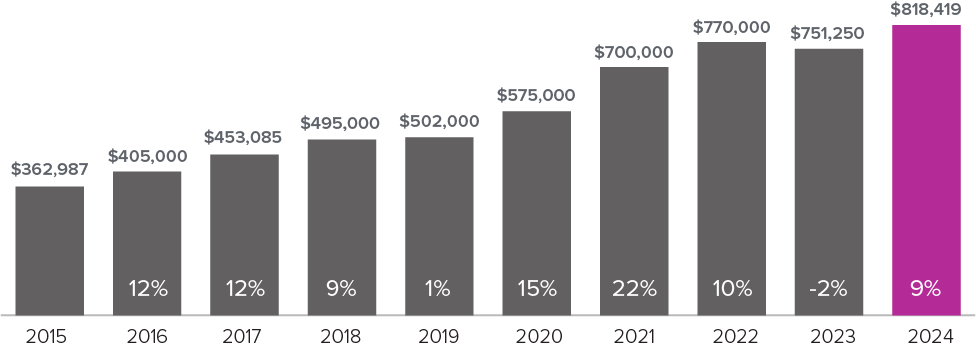

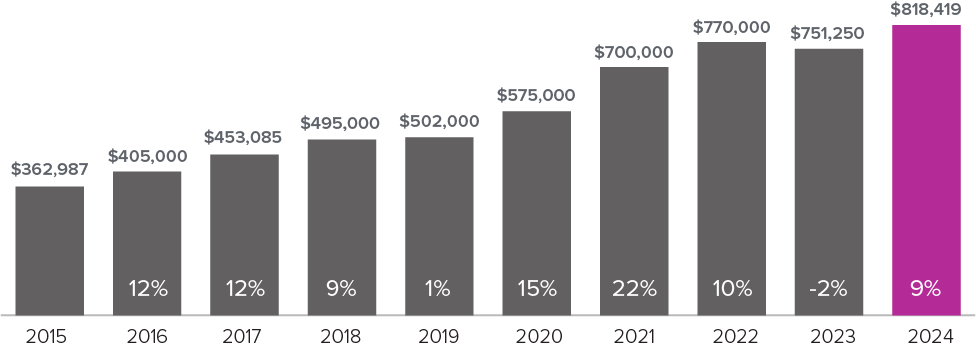

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

43%

OF HOMES SOLD ABOVE LIST PRICE

87%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.2

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

34%

OF HOMES SOLD ABOVE LIST PRICE

82%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

2.0

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

35%

OF HOMES SOLD ABOVE LIST PRICE

83%

OF HOMES SOLD WITHIN 30 DAYS OR LESS

1.3

MONTHS SUPPLY OF AVAILABLE HOMES*

Median Closed Sales Price

*Months supply of available homes is calculated by dividing active inventory at the end of the month by pending. Pending sales are mutual purchase agreements that haven't closed yet.

**Graphs were created using data provided by Windermere Real Estate and NWMLS, but the information was not verified or published by NWMLS. Data reflects all new and resale single-family home sales, which include townhomes and exclude condos, for the month of July 2024.

There were no major changes, statistically, in our local real estate market from June to July. On the Eastside, both Single Family Residence (SFR) and condo median prices dipped slightly. This was expected as inventory typically goes up and buyer activity slows in summer. However, despite the same seasonal situation in Seattle, the median prices of SFRs and condos both increased 1.6% in July. Though not a large difference, it’s particularly surprising for Seattle condos which now have 4 months of inventory, indicating a “buyer’s market” is forming. I believe Seattle’s median price increases are an anomaly and I expect that we will see an adjustment next month.

The big news in real estate this month is the recent decrease in interest rates! We reached a 15-month low based on expectations that the Fed will decrease rates when they meet in September. This has created great opportunities for buyers to take advantage of better rates AND more inventory to choose from before the market heats up again. Waiting for further interest rate drops is a gamble, but it’s certain that if they continue to improve more buyers will enter the market and competition will increase. Now is also an excellent time for those considering purchasing a second home to start searching as that market tends to have more inventory. (If you’re buying out of the area, I can refer you to an excellent colleague to help with your search.)

Our real estate market typically picks up in early Fall as vacations end and school starts. I encourage sellers looking to take advantage of that market to get in touch now to discuss how to maximize their efforts. As always, I’m happy to help!

Stay up to date on our local real estate market and discover fun events with my monthly newsletter delivered right to your inbox!

Terms of Use | Privacy Policy | Fair Housing Notice

Windermere Real Estate, East Inc. | © Copyright 2021 Windermere Real Estate