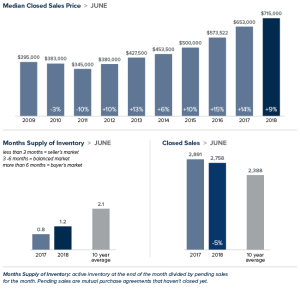

Local Market Update – July 2018

The local real estate market looks like it might finally be showing signs of softening, with inventory up and sales down. More sellers have opted to put their homes on the market. Inventory was up 47 percent in King County and price increases were in the single digits. Despite the increase in inventory and slowdown in sales, it’s still a solid seller’s market. Over half the properties purchased in June sold for more than list price.

Eastside

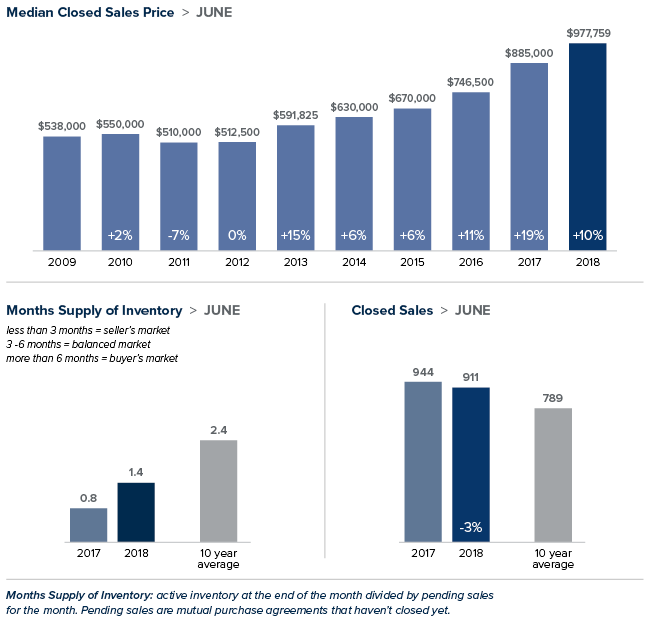

A booming economy offered little price relief for buyers looking on the Eastside. In a recent study of economic strength by state, Washington ranked number one in the country. An additional report targeting cities ranks the Seattle-Bellevue-Tacoma market as the nation’s fourth strongest economy. The median price of a single-family home on the Eastside rose 10 percent over a year ago to $977,759 setting another record. There is some good news for buyers. Inventory rose to its highest level in three years, with the number of homes for sale increasing 46 percent from the same time last year.

King County

The number of homes on the market in King County soared 47 percent from a year ago, the biggest increase since the housing bubble burst. Despite the increase, there is just over one month of available inventory, far short of the four to six months that is considered a balanced market. The median price of a single-family home increased 9 percent over last June to $715,000. That’s down 2 percent from the $726,275 median in May. Home prices haven’t dropped from May to June in King County since the last recession.

Seattle

Seattle trails only Bay Area cities when it comes to greatest profits for home sellers. That may help explain the surge in inventory in June. For example, the number of homes for sale in the popular Ballard/Green Lake area doubled from a year ago. Even though buyers are finally getting more choices, demand still exceeds supply. Homes sell faster in Seattle than in any other U.S. real estate market. That demand propelled the median price of a single-family home to $812,500; up 8 percent over last June and down from the record $830,000 set in May.

Snohomish County

The largest jump in home prices in the region came in Snohomish County. While higher-priced markets in King County are seeing increases slowing slightly, the median price of a single-family home here jumped 14 percent to $511,500, a new high for the county. Buyers willing to “keep driving until they can afford it” are finding Snohomish County an appealing destination.

This post originally appeared on the WindermereEastside.com Blog.

Local Market Update – June 2018

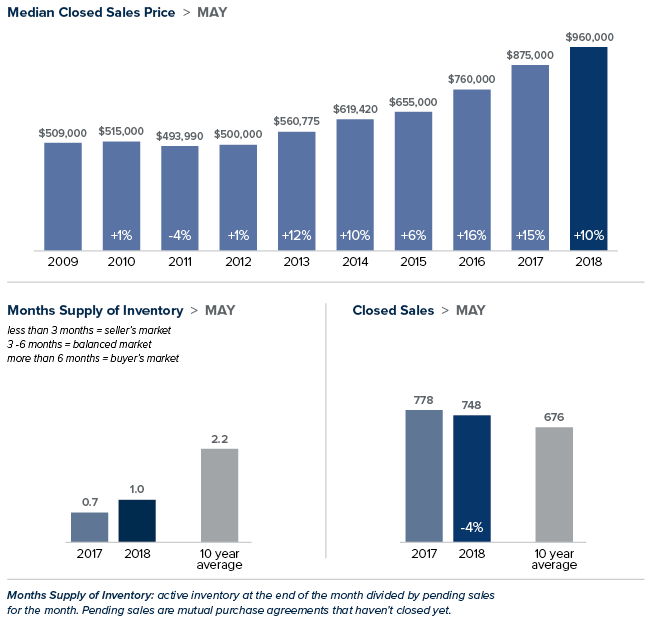

Last month brought some long-awaited, positive news for buyers with May posting the most new listings in over a decade. Despite the uptick in inventory, most homes are selling in less than a month. Prices haven’t been impacted either, with the majority of the region continuing to experience double-digit home price increases.

Eastside

The median home price on the Eastside hit an all-time high of $960, 000 in May; a 10 percent gain over the same time last year. While there were a third more homes for sale in May than a year ago, the area still had only about a month of available inventory. Three to six months is considered a balanced market. Redmond, a city with a population of 64,000, currently has only 51 single-family homes on the market.

King County

First the good news: Those looking to buy a home in King County in May had almost 1,000 more homes to choose from compared to the previous month. The bad news: That boost in inventory did little to moderate home prices. The median price for a single-family home jumped 15 percent to $726,275, up slightly from the record high set in April.

Seattle

A strong economy and desirable lifestyle have kept Seattle a leading destination for job-seekers. The ever-increasing demand for housing has sapped supply and sent prices soaring. For 19 months Seattle has led the nation in rising home prices. May saw the city set yet another record, with the median home price jumping 14 percent to $830,000.

Snohomish County

Soaring prices in King County combined with rising interest rates make Snohomish County an affordable alternative for those willing to extend their commute time. The typical home cost $500,000 in May, an increase of 11 percent over the previous year, and down very slightly from last month.

This post originally appeared on the WindermereEastside.com Blog.

W Collection Portfolio

Windermere Real Estate has a long tradition of genuine success — the W Collection program engages this very tradition with every detail. As a W Collection agent, I am trained to provide an extraordinary level of quality and service.

Signature marketing materials, international exposure, and dedication to perfection, ensure each W Collection property reaches the right buyers — both locally and globally. The combination of this vast global network and Windermere’s strength as the Northwest’s luxury-market leader, provides the ultimate platform to showcase truly outstanding properties or to find the dream home for the most discerning buyer.

You can find me the W Collection Portfolio in the May issue of the Puget Sound Business Journal! This insert showcases me along with my fellow W Collection agents as well as luxury listings, market statistics and Windermere’s partnership with Luxury Portfolio International and Juwai.com.

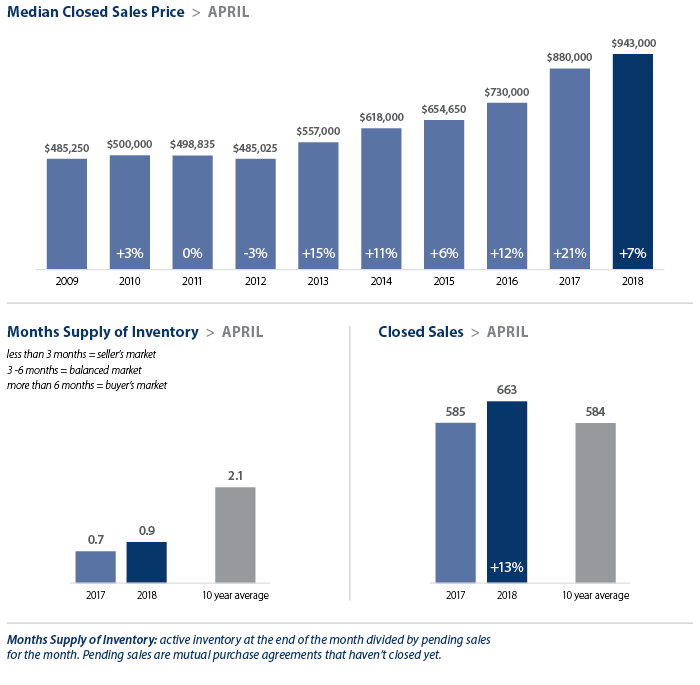

Local Market Update – April 2018

Despite the typical seasonal surge in new listings, supply in our area continued to fall far short of demand in March. With just two weeks of available inventory in every market, competition for homes is intense. The result was another month of double-digit price increases as compared to a year ago. The region has now led the country in home price increases for 17 months in a row. The prediction for the spring market: HOT with no signs of cooling.

Eastside

The median price of a single-family home was up 6 percent over last March to $926,000, down slightly from the record-setting price last month. Sales were brisk at every price, including the luxury market. Sales of homes priced at $2 million or more were up 23 percent in the first quarter of 2018 as compared to the previous year.

King County

A booming economy combined with insufficient inventory propelled prices to an all-time high in March. The median price of a single-family home in King County jumped 15 percent to $689,950. Multiple offers remain the norm. Buyers here need to plan on moving very quickly and working with their agent on strategies to navigate bidding wars.

Seattle

The median home price in Seattle set a new record of $819,500 in March, up a whopping 17 percent from a year ago. Homes are selling within days of being listed. Only 19 single-family homes are currently on the market in Ballard and just 24 in Queen Anne. South Seattle, traditionally the most affordable part of the city, has seen the greatest increase in prices. Home values in these neighborhoods have nearly tripled since the recession ended, while home values in the rest of the city have doubled.

Snohomish County

Once a less competitive market than King County, Snohomish County now has the lower amount of inventory of the two. The median price of a single-family home grew 12 percent over a year ago to $475,000. Prices here remain significantly lower than in King County and many buyers priced out of that market are trading a longer commute time for the opportunity of ownership.

This post originally appeared on the WindermereEastside.com blog.

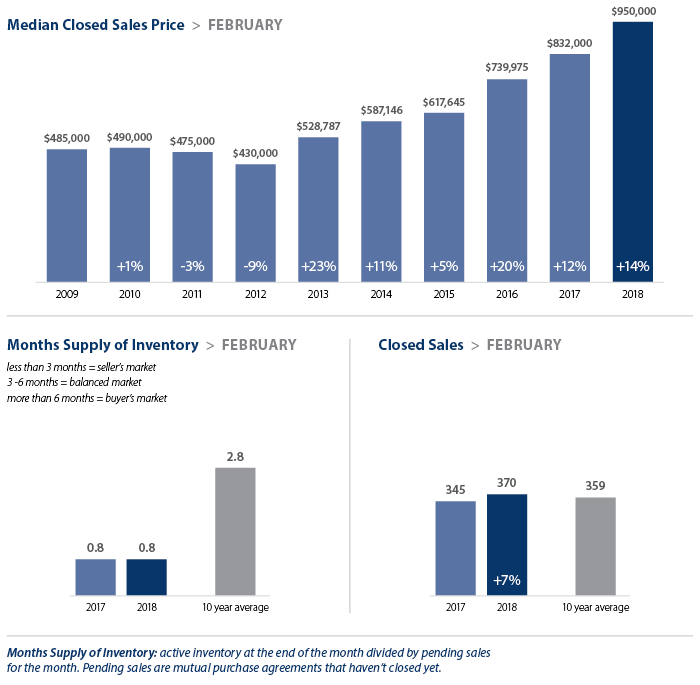

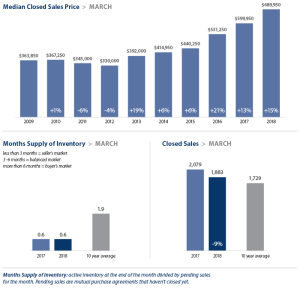

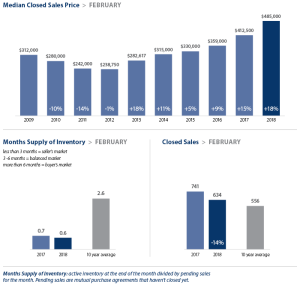

Local Market Update – March 2017

The local real estate market set new home price records in many parts of the region in February. Prices here have grown faster than anywhere else in the country for the last 16 months in a row. Demand remains high and inventory very low. Brokers are hoping the normal seasonal increase in listings this spring will help give buyers some relief.

Eastside

With home prices soaring on the Eastside, it’s not a matter of whether the median price will exceed a million dollar, but when. February brought the market very close to that milestone. The median price of a single-family home increased 14 percent to a record $950,000 on the Eastside, surpassing the previous peak recorded in December.

King County

The red-hot job market in King County continues to outpace nearly every area in the nation. Well-paid workers looking to buy close to city centers have fueled a growing competition for a shrinking number of homes. That demand boosted the median price of a single-family home up 16 percent over a year ago to $649,950.

Seattle

The median price of a single-family home in Seattle hit a new high of $777,000 in February, $20,000 more than the previous record set in January and up 14 percent from the same time last year. Despite the sharp increase in prices, multiple offers have become the norm for most properties. It remains to be seen if recent interest rate hikes will have a moderating effect on home values.

Snohomish County

After several months of moderating growth, Snohomish County set a new record for home prices in February. The median price of a single-family homes jumped 18 percent to an all-time high of $485,000. Inventory is down from a year ago, with less than a month’s supply of homes available for sale.

If you are considering buying a home in today’s market, here are three things to consider:

- Make sure you can afford the payments.

- Choose a location that will appeal to you long-term.

- Be committed to living there for a minimum of five to seven years.

This post originally appeared on the WindermereEastside.com blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.