The Washington Real Estate Excise Tax Change: How Will It Affect You?

The Washington real estate excise tax, otherwise known as REET is faced changes January 1, 2020. What are the changes and how will it affect you? If you are planning on buying, selling, or transferring real estate, these are questions you need to know the answers to. This is your guide to how REET is changing and everything you need to be aware of in 2020.

What is the Real Estate Excise Tax?

The real estate excise tax (REET) is simply a tax on real estate when it is sold or interests are transferred. The seller of the home or piece of property is typically the party responsible for paying REET. However, this is a mandatory tax that the buyer is obligated to if the seller doesn’t pay. REET must also be paid when 50% or more of controlling interests are transferred to a different party. In cases where interests of real estate are transferred, the person transferring their share is liable for the tax.

What Changes are Being Made to the Real Estate Excise Tax?

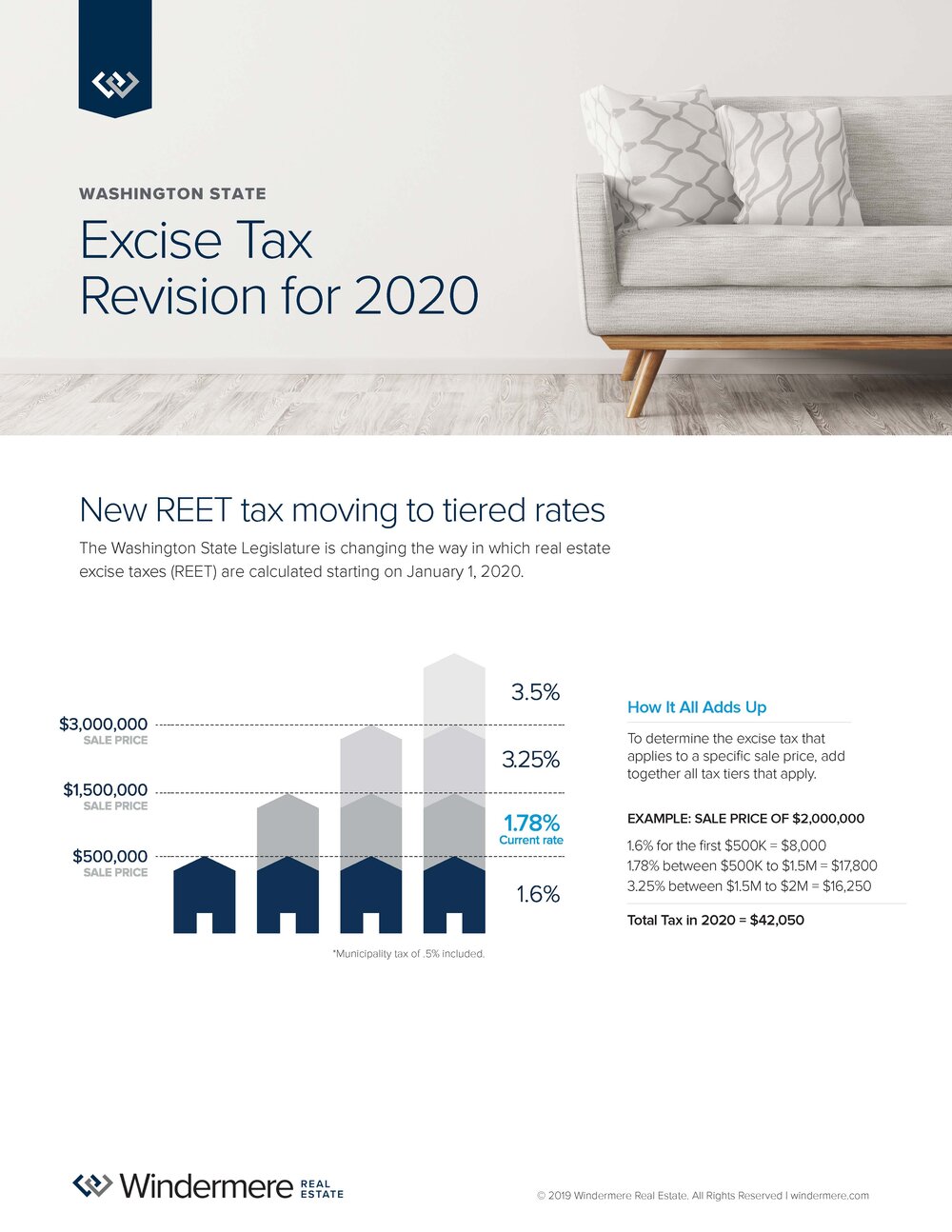

REET is facing monumental changes come the first of the year. The most important change to be aware of is the fee structure. There will no longer be a flat rate percentage for REET. Instead there will be a graduated tier that is as follows:

- Real estate sales of $500,000 and below will pay 1.60% in REET

- Real estate sales between $500,001 and $1,500,000 will pay 1.78% in REET

- Real estate sales between $1,500,001 and $3,000,000 will pay 3.25% in REET

- Real estate sales $3,000,001 and above will pay 3.5% in REET

It is important to mention that the municipality tax of 0.50% is included in the above rates.

Exemptions

Agricultural real estate and timberland are exempt from the new tiered structure. Real estate sales on these two types of properties will continue to remain at 1.28% for REET.

Controlling Interest Transfer Changes

The transfer period will be extended from 12 months to 36 months. The second change is that any transfers of 16% or more will have to be reported during the annual corporate renewal cycle.

How Will REET Changes Affect You?

The changes will have significant impacts on both the sale of real estate and the transfer of controlling interests. Concerning the sale of real estate, valuable properties will see a significant tax hike. Even though the seller is responsible for paying REET, buyers need to beware of purchasing properties with a hidden tax lien for failure to pay REET. As the owner, you may very well be responsible for the unpaid tax.

In order for REET to apply to a controlling interest transfer, 50% or more of the interests must be transferred. However, REET doesn’t apply to just the percentage of interests transferred. It actually applies to 100% of the property’s value.

The Bottom Line on the New REET Changes

How much REET affects the sale of real estate will in most cases depend on the value of the property. Sellers of more valuable properties will feel the changes more than sellers in the first two tiers. Controlling interest transfers are in the same boat as property sellers, meanwhile, agricultural and timberland properties will not feel the effects at all.

If you are buying, selling, and transferring real estate it is important to stay in the know on all changes concerning the real estate transactions. Send me a message to help navigate the changes in the market and get you the most from your next real estate transaction.

This post originally appeared on the RainerTitle.com Blog.

Local Market Update – December 2019

Favorable interest rates and soaring rents boosted activity in the housing market in November. More buyers competing for less inventory kept home prices strong. With the supply of homes far short of demand, sellers can expect well-priced properties to sell quickly this winter.

EASTSIDE

With just over a month of available inventory, demand on Eastside remains very strong. Sales are brisk, with 45% of single-family homes selling in 15 days or less and 20% of homes selling for over list price. The median single-family home price in November rose 2% from a year ago to $900,000 and was unchanged from October.

KING COUNTY

With more buyers vying for fewer homes, King County remains a solid seller’s market. While inventory traditionally shrinks in the winter, this November saw the number of new listings at historic lows. Demand was strong, with the number of closed sales up 12% over the same time last year. The median home price ticked up 3% over the prior year to $661,000 and was unchanged from October. The strong market sent prices higher in the more affordable price ranges, with some areas in South King County seeing double-digit increases.

SEATTLE

Activity in Seattle was very strong in November. The number of closed sales was up 29% over the same time last year. With just over one month of homes available for sale, the city is starved for inventory. Seattle homes prices have ebbed and flowed slightly from month to month for much of this year. The median price of a single-family home sold in November was off 3% from a year ago to $735,000.

SNOHOMISH COUNTY

With an increasing number of buyers driving to affordability, the Snohomish County housing market remains robust. Inventory is very tight and continues to fall. The county finished November with just over one month of supply. The median price of a single-family home rose 5% over a year ago to $495,000. That figure is unchanged from October.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Agent Trend Announces Sheri Putzke as Best In Real Estate Award Winner

Agent tend’s most recent award winner is Sheri Putzke, of Windermere Real Estate. Sheri is based out of Kirkland, but serves the Greater Seattle area. Sheri has demonstrated values that are important for winners of the Best in Real Estate award. Not only does she work with builders/developers in the area, but she is passionate about everyday people loving where they live. In August 2019, she was featured on the cover of Seattle Real Producers magazine.

Agent tend’s most recent award winner is Sheri Putzke, of Windermere Real Estate. Sheri is based out of Kirkland, but serves the Greater Seattle area. Sheri has demonstrated values that are important for winners of the Best in Real Estate award. Not only does she work with builders/developers in the area, but she is passionate about everyday people loving where they live. In August 2019, she was featured on the cover of Seattle Real Producers magazine.

BEST IN REAL ESTATE AWARD

The Best in Real Estate Award is the central focus and heart-beat of Agent Trend. The Best in Real Estate Award is awarded yearly to agents who excel in production, customer service, ethics, and peer reviews. This annual award helps to maximize real estate agents’ careers and propel them to move forward in a highly-saturated industry. We look to award and recognize agents that fight through the grey areas of the Real Estate industry with honesty and integrity.

ABOUT AGENT TREND

Agent Trend is a company dedicated to recognizing top agents from around the nation. Agent Trend is an award-based company for agents who excel in sales and leadership within the real estate industry. Agent Trend is a platform where real estate agents can be nominated to receive our Best in Real Estate Award, which is awarded yearly. We believe production Real Estate Agents fighting through the grey with honesty and integrity deserve to be recognized. In an industry that affects the very pulse of America, we strive to recognize and promote these agents that meet Agent Trends values. Agent Trend values consist of strong ethics, customer service, valued reputation, and consistent sales production.

Local Market Update – November 2019

A steady influx of buyers continued to strain already tight inventory throughout the area in October. Home sales were up, as were prices in much of the region. With our thriving economy and highly desirable quality of life drawing ever more people here, the supply of homes isn’t close to meeting demand. Homeowners thinking about putting their property on the market can expect strong buyer interest.

EASTSIDE

As the Eastside continues to rack up “best places” awards, it’s no surprise that the area is booming. Development is on the rise, fueled primarily by the tech sector. The appeal of the Eastside has kept home prices here the highest of any segment of King County. The median single-family home price in October was stable as compared to the same time last year, rising 1% to $900,000.

KING COUNTY

King County’s 1.74 months of available inventory is far below the national average of four months. Despite the slim selection, demand in October was strong. The number of closed sales was up 5% and the number of pending sales (offers accepted but not yet closed) was up 11%. The median price of a single-family home was down 2% over a year ago to $660,000. However, some areas around the more reasonably-priced south end of the county saw double-digit price increases.

SEATTLE

Seattle home prices took their largest year-over-year jump in 12 months. The median price of a single-family home sold in October was up 3% from a year ago to $775,000, a $25,000 increase from September of this year. Seattle was recently named the third fastest-growing city in America. Real estate investment is surging. A growing population and booming economy continue to keep demand for housing –and home prices—strong.

SNOHOMISH COUNTY

Both the number of home sales and home prices were on the rise in Snohomish County in October. Overall homes sales increased 7%, and the median price of a single-family home rose 5% over a year ago to $495,000. Supply remains very low, with just six weeks of available inventory.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

The Gardner Report – Third Quarter 2019

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Economic Overview

Washington State employment has softened slightly to an annual growth rate of 2%, which is still a respectable number compared to other West Coast states and the country as a whole. In all, I expect that Washington will continue to add jobs at a reasonable rate though it is clear that businesses are starting to feel the effects of the trade war with China and this is impacting hiring practices. The state unemployment rate was 4.6%, marginally higher than the 4.4% level of a year ago. My most recent economic forecast suggests that statewide job growth in 2019 will rise by 2.2%, with a total of 88,400 new jobs created.

Home Sales Activity

- There were 22,685 home sales during the third quarter of 2019, representing a slight increase of 0.8% from the same period in 2018 and essentially at the same level as in the second quarter.

- Listing activity — which rose substantially from the middle of last year — appears to have settled down. This is likely to slow sales as there is less choice in the market.

- Compared to the third quarter of 2018, sales rose in five counties, remained static in one, and dropped in nine. The greatest growth was in Skagit and Clallam counties. Jefferson, Kitsap, and Cowlitz counties experienced significant declines.

- The average number of homes for sale rose 11% between the second and third quarters. However, inventory is 14% lower than in the same quarter of 2018. In fact, no county contained in this report had more homes for sale in the third quarter than a year ago.

Home Prices

- Home price growth in Western Washington notched a little higher in the third quarter, with average prices 4.2% higher than a year ago. The average sales price in Western Washington was $523,016. It is worth noting, though, that prices were down 3.3% compared to the second quarter of this year.

- Home prices were higher in every county except Island, though the decline there was very small.

- When compared to the same period a year ago, price growth was strongest in Grays Harbor County, where home prices were up 22%. San Juan, Jefferson, and Cowlitz counties also saw double-digit price increases.

- Affordability issues are driving buyers further out which is resulting in above-average price growth in outlying markets. I expect home prices to continue appreciating as we move through 2020, but the pace of growth will continue to slow.

Days on Market

- The average number of days it took to sell a home dropped one day when compared to the third quarter of 2018.

- Thurston County was the tightest market in Western Washington, with homes taking an average of only 20 days to sell. There were six counties where the length of time it took to sell a home dropped compared to the same period a year ago. Market time rose in six counties, while two counties were unchanged.

- Across the entire region, it took an average of 38 days to sell a home in the third quarter. This was down 3 days compared to the second quarter of this year.

- Market time remains below the long-term average across the region and this trend is likely to continue until more inventory comes to market, which I do not expect will happen until next spring.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am leaving the needle in the same position as the first and second quarters, as demand appears to still be strong.

The market continues to benefit from low mortgage rates. The average 30-year fixed rates is currently around 3.6% and is unlikely to rise significantly anytime soon. Even as borrowing costs remain very competitive, it’s clear buyers are not necessarily jumping at any home that comes on the market. Although it’s still a sellers’ market, buyers have become increasingly price-conscious which is reflected in slowing home price growth.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog.

The best place to see the sunset in Kirkland- Neighbor in the Know

Kirkland isn’t just Costco’s brand name- it’s got imaginative coffee shops, a charming downtown and incredible sunsets.

Kirkland has a wealth of places to visit, from picturesque parks to hip coffee spots to a quickly-growing downtown. There are way too many cool spots to document all in one place, but here are few locations to visit.

Sheri Putzke, Windermere real estate agent in the area, knows a thing or two about Kirkland. One of her favorite spots for coffee is urban COFFEE lounge, which serves up both coffee and alcohol, along with unique drinks like the chai-der. Yes, that’s chai and hot apple cider, combined to create a very cozy autumnal drink. Strange concept, but highly recommended!

Downtown Kirkland is another favorite spot of Sheri’s- specifically, Park Lane, arguably the focal point in DT Kirk. Am I allowed to call it DT Kirk? We’ll see if it catches on.

In the summer, Park Lane becomes a hub of activity. On Sundays in the summer, Park Lane is closed to cars, so pedestrians can stroll, browse and dine in the sunshine. It’s a great way to take full advantage of the vibrant street.

Marina Park Pavilion is also a favorite spot of Sheri’s- especially when there’s a radiant sky like the one below. It’s her favorite spot to sit back and watch sunsets.

If you’re a foodie, Kirkland, of course, has some incredible restaurants as well. Lilac Cafe and Cafe Juanita are there for your Italian food needs, while Bottle & Bull is a swanky 21-and-up restaurant that serves drinks based on the life and times of Ernest Hemingway.

This article originally appeared on KING 5’s Evening.

Local Market Update – October 2019

While fall usually brings a decrease in sales activity, the opposite was true in September. The number of listings on the market dropped by double digits and home sales rose. It is still a seller’s market, however prices have stabilized. With interest rates near historic lows and employment levels at historic highs, the housing market is expected to stay strong throughout the fall and winter.

EASTSIDE

Long the most affluent area of King County, the Eastside continues to record the highest home prices in the region. The median price of a single-family home on the Eastside was $928,500 in September, an increase of 4% from a year ago and a decrease of less than 1% from August. The Eastside construction boom continues, indicating that developers remain confident in the strength of the local economy.

KING COUNTY

The number of homes on the market in King County fell by almost 20% in September when compared to a year ago. However, last fall saw an increase in inventory that was unusual for the time of year. The median price of a single-family home was $660,000, down just 1% from the same time last year. Cities in King County, outside of Seattle, all saw price increases. Sales were up 7% indicating no shortage of buyers.

SEATTLE

Prices remained relatively stable, with the median price of a single-family home in September dipping 3% over a year ago to $750,000. As tech companies continue to recruit top talent to the area, Seattle’s population keeps booming and demand for housing remains high. While home sales traditionally dip in the fall, the city saw sales increase by 12% in September as compared to last year. Rising rents may push more buyers into the market.

SNOHOMISH COUNTY

Buyers continue to be drawn to Snohomish County thanks to a strong economy and housing costs that are considerably more affordable than King County. That influx of buyers is also driving up prices. The median price of a single-family home in September was $492,500, up from $484,995 the same time last year. At $167,500 less than the median price in King County, it’s a relative bargain.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Kirkland community features award-winning floor plans

Distinguished by a sought-after Kirkland address, Crosswater is a boutique community of 16 luxury townhomes characterized by contemporary architecture and a private setting.

The community, built by Toll Brothers, just opened for presales, offering interested homebuyers the chance to get in early and personalize their homes to their style and taste.

The homes range in size from 1,941 to 2,194 square feet. All of the plans have 3.5 baths.

“One popular design that we’re featuring here is our Burke plan,” says Sheri Putzke, community sales manager. “Its incredible great room surrounded by impressive floor-to-ceiling windows has made this an award-winning design. All of our floor plans are thoughtfully designed with efficient layouts appreciated by homeowners. Flex spaces on the lower level offer versatility as an office, bonus room or guest suite.”

The Burke is one of the floor plans available at Crosswater. The community’s three- and four-bedroom townhomes range from 1,941 to 2,194 square feet.

All Toll Brothers homebuyers are offered two complimentary consultations with a designer at the Kirkland Design Studio. At these sessions, buyers can select hardware, paint colors, lighting, cabinets and countertop surfaces, as well as many other design touches to distinguish their home.

As part of the builder’s national sales event, homebuyers who purchase by Sept. 29 receive 50% off Design Studio options up to $30,000, plus additional vendor incentives.

“These appointments are a big hit with our buyers and a huge perk of working with Toll Brothers,” says Putzke. “Buyers have an opportunity to touch and feel the finishes, and select options for their home based on their personal taste. Even if they choose to stay within the included features, they still have choices. It’s not like they’re limited to just A, B or C color schemes. At the same time, if they do choose to upgrade, they have even more options. Agents are welcome to accompany their customers to help select items that might offer a better return on investment in the long run.”

Residents living at Crosswater will appreciate the central Kirkland location, with nearby casual and fine dining and convenient shopping. Juanita Beach Park is nearby, providing easy access to water activities on Lake Washington, and Juanita Village is 2 miles away.

The community is located close to I-405 and major employment centers in Bellevue, Redmond and Seattle. Children living at Crosswater can attend schools in the highly rated Lake Washington School District.

“The quiet location really distinguishes the community as it’s set back from the road,” says Putzke. “There’s a lot of vegetation and it’s situated in a peaceful, lush setting.”

CrosswaterPrices: From the low $800,000s |

This article originally appeared in on SeattleTimes.com

Local Market Update – September 2019

A decrease in inventory coupled with an increase in sales activity led to fewer options for home shoppers in August. There is some good news for would-be buyers as mortgage rates have dropped to their lowest level in three years. Demand remains high but there simply aren’t enough homes on the market. Brokers are hoping to see the traditional seasonal influx of new inventory as we move forward.

EASTSIDE

The median price of a single-family home on the Eastside was $935,000 in August, unchanged from a year ago and up slightly from $925,000 in July. New commercial and residential construction projects are in the works. Strong demand for downtown condos has prompted plans for yet another high-rise tower to break ground next year.

KING COUNTY

Home prices in King County were flat in August. The median price of a single-family home was $670,000, virtually unchanged from a year ago, and down just one percent from July. Southeast King County, which has some of the most reasonable housing values in the area, saw prices increase 9% over last year. Inventory remains very low. Year-over-year statistics show the volume of new listings dropped 18.5% in King County.

SEATTLE

Homes sales were up 12% in Seattle for August, putting additional pressure on already slim inventory. There is just over six weeks of available supply. There are signs that prices here are stabilizing as the median home price of $760,000 was unchanged from a year ago and up less than one percent from July. With its booming economy, demand here is expected to stay strong.

SNOHOMISH COUNTY

Buyers looking for more affordable options outside of King County pushed pending sales, mutually accepted offers, up nearly 16% over a year ago. Home prices have softened slightly. The median price of a single-family home in August was $490,000, down slightly from the median of $492,225 the same time last year.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – August 2019

The real estate market continued to moderate in July. Inventory rose and home values softened, providing buyers with increased selection and more favorable pricing. With strong job growth and interest rates holding at below 4 percent, brokers expect the market to remain solid through fall.

EASTSIDE

The market remains strong on the Eastside. The current tech boom continues to fuel demand, buoyed by Google’s recent plans to build out another office in Kirkland. An increase in inventory gives buyers more time to find the right home for their budget. The median price of a single-family home on the Eastside was $925,000 in July, down 2 percent from the same time last year.

KING COUNTY

Home prices in King County continued to ease. Buyers took advantage of lower prices and new inventory to boost home sales in July. The median price of a single-family home was $680,000, a 3 percent decline from the same time last year. More moderately-priced areas in the south end of the county saw continued price growth.

SEATTLE

It’s no surprise that Seattle is the top city in the country where millennials are moving. Apple plans to add 2,000 jobs in Seattle. The first of 4,500 Expedia employees will start moving into Interbay soon. While demand here is expected to stay strong, prices continue to cool. The median price of a single-family home was $755,000, down 6 percent from a year ago and a decrease of 3 percent from June. Southeast Seattle, which generally has more affordable homes, saw the median home price rise 9 percent over the same time last year.

SNOHOMISH COUNTY

Inventory remains very tight in Snohomish County. The number of listings on the market were up 6 percent over last year, and the county has only six weeks of available supply – far short of the four to six months that is considered balanced. The median price of a single-family home in July was $502,000 – up slightly from the median of $495,000 a year ago.

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link