Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What’s Really Happening in the Housing Market?

Our housing market is finally cooling a bit, from scorching hot to slightly-less-sweltering. While some alarmists are talking bubble or impending crisis, the statistics tell a different story. The market does appear to be shifting, and that’s good news! The steep price increases of the past few years are not sustainable, and also risk pricing buyers out of the market altogether.

Where The Market Is Today

- Inventory is up, but still far short of demand. Despite a considerable increase in inventory, King County has just six weeks of supply. Four to six months of inventory is what is considered a balanced market, and we’re far short of that.

- Homes are staying on the market a bit longer. New listings have increased in the past few months, but the increase in inventory is primarily due to homes staying on the market longer. With buyers accustomed to homes being snapped up in days, “longer” is a relative term. Homes in King County are taking an average of 15 days to sell.

- Prices appear to be moderating. While home prices are up compared to a year ago, the rate of increase is in the single digits rather than the double-digit surges of past months. Prices are down 4 percent from the record high reached this spring.

What This Means For The Housing Market

- The shift towards slower, consistent appreciation will result in a healthier market.

- Buyers have more choices and more time to make an informed decision.

- It’s still a seller’s market, but sellers need to have realistic expectations about pricing their homes as the market softens.

- More inventory is still needed to meet demand.

Whether you’re thinking about buying or selling, it’s important to have the most current information about the market. Our Windermere brokers can provide you with statistics about today’s market and answer any questions you may have.

This post originally appeared on the Windermere Eastside Blog.

2018 Windermere Eastside Kick-off

Every year over 500 brokers from Windermere offices across the Eastside gather to prepare for the new year at the annual Windermere Eastside Kick-Off Event at the Hyatt Regency Bellevue. Last week, several speakers shared their insights and advice to prepare our agents to better serve their clients for the 2018 housing market. Looking Ahead: What to Expect From the 2018 Housing Market

Matthew Gardner, Windermere Real Estate’s Chief Economist, shared his forecast for the 2018 housing market. Low inventory seems to be a problem stretching all the way to Ohio with many people living in their homes twice as long as past generations. Lack of skilled labor, available land and high material costs continue to make new construction an expensive option. Read more about his forecast.

Breaking Through The Noise

Understanding Your Client’s Story

Licensed marriage and family therapist, Tori Dabasinskas, shared her communication strategies to help our agents better connect with their clients. Addressing techniques for authentic listening, creating more meaningful connections and responding with emotion as well as logic, Tori emphasized taking time to truly understand the “story” of each individual client. With personal empathy and active appreciation, our agents can better anticipate the needs of their clients and what can be done to better serve them.

Law Of Attraction

Executive Vice President of HomeStreet Bank, Richard Bennion, reminded our agents that every client has a story. Their hopes, dreams and challenges are opportunities to listen, be attentive and show those clients their importance. Becoming an expert who is professional, authentic, self-aware and highly competent will attract people and help build your business’ sphere of influence. Taking a long-term approach in building client relationships will result in a strong business over time.

Growth, Support and The Power of Windermere

Brooks Burton, Chief Operating Officer for Windermere Services Company, opened the Kick-Off by sharing some exciting changes agents can look forward to in 2018. They included refreshed branding, offering more social media resources, improving technology and more resources based on agent feedback. Brooks also touched on the success of the Windermere Foundation which has raised over $35 million for local organizations since its inception in 1989 as well as how funds are allocated among those organizations.

Strategy and Determination

David Wasielewski, the Managing Partner of Northwest Din Tai Fung Partners, spoke about bringing the popular Chinese restaurant brand to the Seattle area. David shared that as a previous marketing veteran at Intel Corporation he had no restaurant experience prior to starting his own business. David’s approach to success? Strategy, action, and pacing himself. He flew to California for many weekends to work at another Chinese restaurant owned by Din Tai Fung’s owners without pay to prove his interest and dedication to his mission. Fast forward to today and he owns four restaurants in the Seattle region and his first Bellevue Square location has won the highest gross sales award from Kemper Development Company in each of the five years he has operated.

Getting in the Right Mindset: Pursuing Excellence

Tracie Ruiz Conforto, Olympic Medalist and Synchronized Swimmer of the Century, inspired us to find and pursue our passions, just as she did with swimming at the age of nine. She advised agents on three ways to achieve excellence – find your passion, use your competition to improve your skills, and surround yourself with a team who will support you. Tracie showed us that anything is possible when you combine passion, discipline, competition, and teamwork.

The Windermere Eastside Kick-off was an inspiring and motivational event. Our brokers are more prepared than ever to provide valuable service for their clients and face the year ahead. We are excited to put this knowledge to good use as we help you navigate your real estate journey in 2018! This post originally appeared on the Windermere Eastside Blog. |

The Gardner Report – Fourth Quarter 2017

Economic Overview

The Washington State economy added 104,600 new jobs over the past 12 months. This impressive growth rate of 3.1% is well above the national rate of 1.4%. Interestingly, the slowdown we saw through most of the second half of the year reversed in the fall, and we actually saw more robust employment growth.

Growth continues to be broad-based, with expansion in all major job sectors other than aerospace due to a slowdown at Boeing.

With job creation, the state unemployment rate stands at 4.5%, essentially indicating that the state is close to full employment. Additionally, all counties contained within this report show unemployment rates below where they were a year ago.

I expect continued economic expansion in Washington State in 2018; however, we are likely to see a modest slowdown, which is to be expected at this stage in the business cycle.

Home Sales Activity

- There were 22,325 home sales during the final quarter of 2017. This is an increase of 3.7% over the same period in 2016.

- Jefferson County saw sales rise the fastest relative to fourth quarter of 2016, with an impressive increase of 22.8%. Six other counties saw double-digit gains in sales. A lack of listings impacted King and Skagit Counties, where sales fell.

- Housing inventory was down by 16.2% when compared to the fourth quarter of 2016, and down by 17.3% from last quarter. This isn’t terribly surprising since we typically see a slowdown as we enter the winter months. Pending home sales rose by 4.1% over the third quarter of 2017, suggesting that closings in the first quarter of 2018 should be robust.

- The takeaway from this data is that listings remain at very low levels and, unfortunately, I don’t expect to see substantial increases in 2018. The region is likely to remain somewhat starved for inventory for the foreseeable future.

Home Prices

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.- Economic vitality in the region is leading to a demand for housing that far exceeds supply. Given the relative lack of newly constructed homes—something that is unlikely to change any time soon—there will continue to be pressure on the resale market. This means home prices will rise at above-average rates in 2018.

- Compared to the same period a year ago, price growth was most pronounced in Lewis County, where home prices were 18.8% higher than a year ago. Eleven additional counties experienced double-digit price growth as well.

- Mortgage rates in the fourth quarter rose very modestly, but remained below the four percent barrier. Although I anticipate rates will rise in 2018, the pace will be modest. My current forecast predicts an average 30-year rate of 4.4% in 2018—still remarkably low when compared to historic averages.

Days on Market

- The average number of days it took to sell a home in the fourth quarter dropped by eight days, compared to the same quarter of 2016.

- King County continues to be the tightest market in Western Washington, with homes taking an average of 21 days to sell. Every county in the region saw the length of time it took to sell a home either drop or remain static relative to the same period a year ago.

- Last quarter, it took an average of 50 days to sell a home. This is down from 58 days in the fourth quarter of 2016, but up by 7 days from the third quarter of 2017.

- As mentioned earlier in this report, I expect inventory levels to rise modestly, which should lead to an increase in the average time it takes to sell a house. That said, with homes selling in less than two months on average, the market is nowhere near balanced.

Conclusions

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

This article originally appeared on the Windermere.com blog.

The Gardner Report – Fourth Quarter 2017

Economic Overview

The Washington State economy added 104,600 new jobs over the past 12 months. This impressive growth rate of 3.1% is well above the national rate of 1.4%. Interestingly, the slowdown we saw through most of the second half of the year reversed in the fall, and we actually saw more robust employment growth.

Growth continues to be broad-based, with expansion in all major job sectors other than aerospace due to a slowdown at Boeing.

With job creation, the state unemployment rate stands at 4.5%, essentially indicating that the state is close to full employment. Additionally, all counties contained within this report show unemployment rates below where they were a year ago.

I expect continued economic expansion in Washington State in 2018; however, we are likely to see a modest slowdown, which is to be expected at this stage in the business cycle.

Home Sales Activity

- There were 22,325 home sales during the final quarter of 2017. This is an increase of 3.7% over the same period in 2016.

- Jefferson County saw sales rise the fastest relative to fourth quarter of 2016, with an impressive increase of 22.8%. Six other counties saw double-digit gains in sales. A lack of listings impacted King and Skagit Counties, where sales fell.

- Housing inventory was down by 16.2% when compared to the fourth quarter of 2016, and down by 17.3% from last quarter. This isn’t terribly surprising since we typically see a slowdown as we enter the winter months. Pending home sales rose by 4.1% over the third quarter of 2017, suggesting that closings in the first quarter of 2018 should be robust.

- The takeaway from this data is that listings remain at very low levels and, unfortunately, I don’t expect to see substantial increases in 2018. The region is likely to remain somewhat starved for inventory for the foreseeable future.

Home Prices

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.- Economic vitality in the region is leading to a demand for housing that far exceeds supply. Given the relative lack of newly constructed homes—something that is unlikely to change any time soon—there will continue to be pressure on the resale market. This means home prices will rise at above-average rates in 2018.

- Compared to the same period a year ago, price growth was most pronounced in Lewis County, where home prices were 18.8% higher than a year ago. Eleven additional counties experienced double-digit price growth as well.

- Mortgage rates in the fourth quarter rose very modestly, but remained below the four percent barrier. Although I anticipate rates will rise in 2018, the pace will be modest. My current forecast predicts an average 30-year rate of 4.4% in 2018—still remarkably low when compared to historic averages.

Days on Market

- The average number of days it took to sell a home in the fourth quarter dropped by eight days, compared to the same quarter of 2016.

- King County continues to be the tightest market in Western Washington, with homes taking an average of 21 days to sell. Every county in the region saw the length of time it took to sell a home either drop or remain static relative to the same period a year ago.

- Last quarter, it took an average of 50 days to sell a home. This is down from 58 days in the fourth quarter of 2016, but up by 7 days from the third quarter of 2017.

- As mentioned earlier in this report, I expect inventory levels to rise modestly, which should lead to an increase in the average time it takes to sell a house. That said, with homes selling in less than two months on average, the market is nowhere near balanced.

Conclusions

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

This article originally appeared on the Windermere.com blog.

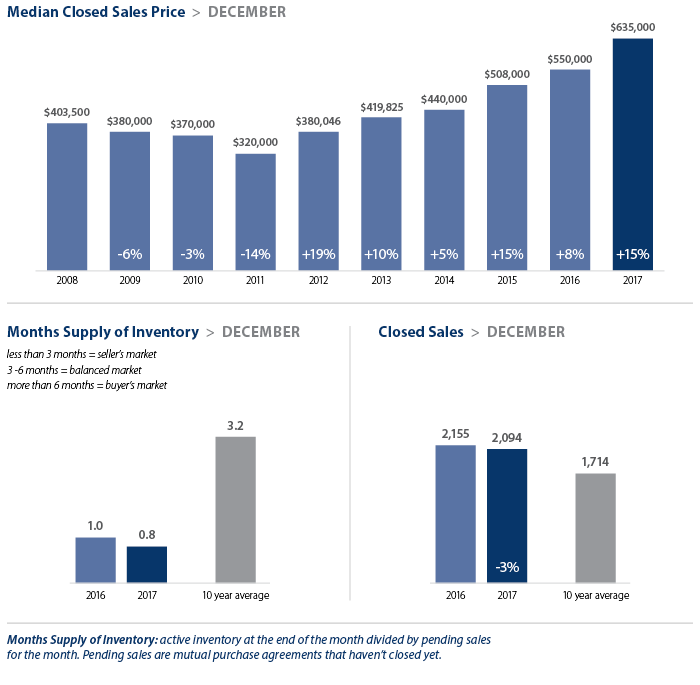

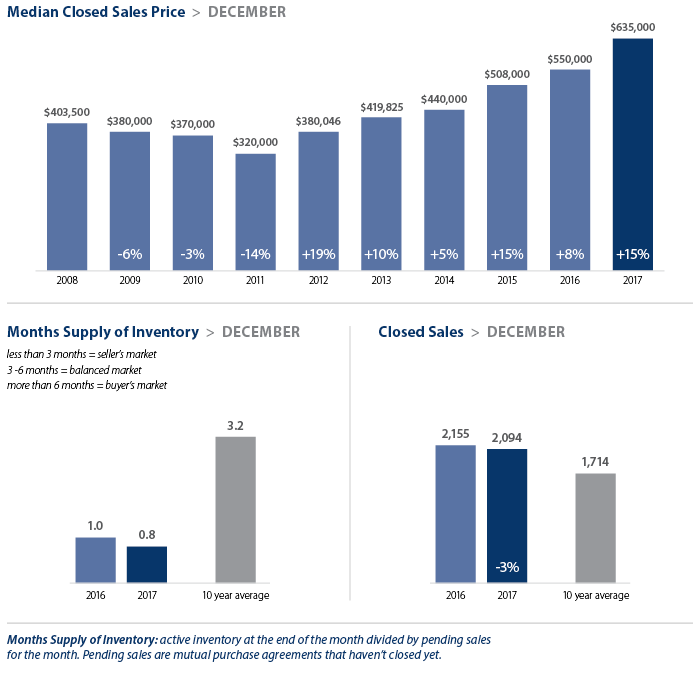

Local Market Update – January 2018

2017 closed out the year with historically low inventory and record-breaking price gains. A strong local economy and brisk population growth has helped fuel a steep discrepancy between supply and demand. As long as this imbalance remains, 2018 is on track to remain a very strong seller’s market.

Eastside

Defying the usual winter slow-down in home prices, December broke new records on the Eastside. The median price of a single-family home soared 17 percent over a year ago to $938,240 – an all-time high for the region. Appreciation in higher-end areas, like West Bellevue and Mercer Island, topped 20 percent. Homeowners, especially those considering downsizing, may want to take advantage of the sharp increase in equity.

King County

King County recorded the lowest inventory since records began in 2000, and demand just keeps rising. As a result, the price of a single-family home jumped 15.5 percent over the same time last year to $635,000. Those looking buy a condo as a more affordable option were out of luck. The median price tag of $402,000 is a relative bargain when compared to a single-family home, but there are only about 200 condos on the market, another record low.

Seattle

While below the high point last summer, the median price of a home in Seattle jumped 14 percent year over year to $725,000. Supply and demand is again the culprit. There are just two weeks of available inventory on the market. Not only are homes here selling quickly, but fewer people are putting their homes up for sale. Most economists are predicting a moderate slowdown in cost increases here in 2018, with prices still rising but not as sharply as they did in 2017.

Snohomish County

Prices in Snohomish County continue to rise at a apid pace. The median price of a single-family home here grew 12.5 percent from a year ago to $449,950. With less than a month of available inventory, prices are projected to remain high.

This post originally appeared on the Windermere Eastside Blog.

Local Market Update – January 2018

2017 closed out the year with historically low inventory and record-breaking price gains. A strong local economy and brisk population growth has helped fuel a steep discrepancy between supply and demand. As long as this imbalance remains, 2018 is on track to remain a very strong seller’s market.

Eastside

Defying the usual winter slow-down in home prices, December broke new records on the Eastside. The median price of a single-family home soared 17 percent over a year ago to $938,240 – an all-time high for the region. Appreciation in higher-end areas, like West Bellevue and Mercer Island, topped 20 percent. Homeowners, especially those considering downsizing, may want to take advantage of the sharp increase in equity.

King County

King County recorded the lowest inventory since records began in 2000, and demand just keeps rising. As a result, the price of a single-family home jumped 15.5 percent over the same time last year to $635,000. Those looking buy a condo as a more affordable option were out of luck. The median price tag of $402,000 is a relative bargain when compared to a single-family home, but there are only about 200 condos on the market, another record low.

Seattle

While below the high point last summer, the median price of a home in Seattle jumped 14 percent year over year to $725,000. Supply and demand is again the culprit. There are just two weeks of available inventory on the market. Not only are homes here selling quickly, but fewer people are putting their homes up for sale. Most economists are predicting a moderate slowdown in cost increases here in 2018, with prices still rising but not as sharply as they did in 2017.

Snohomish County

Prices in Snohomish County continue to rise at a rapid pace. The median price of a single-family home here grew 12.5 percent from a year ago to $449,950. With less than a month of available inventory, prices are projected to remain high.

2018 Housing Forecast: Where are we headed?

What lies ahead for the local housing market in 2018? We sat down with Windermere Chief Economist Matthew Gardner to get his thoughts. Here are some highlights:

Home prices will continue to increase, but at a slower pace

The strong local economy, high demand and very low inventory will continue to boost home values in 2018, according to Gardner. However, he believes that the double-digit growth of 2017 will moderate, and predicts home prices in King County will rise by 8.5% in the new year.

Mortgage interest rates will rise slightly.

Gardner admits that interest rates continue to baffle forecasters. The rise that many economists have predicted the past few years has yet to materialize. His forecast for 2018 sees interest rates increasing modestly to an average of 4.4% for a conventional 30-year fixed-rate mortgage.

More Millennials will enter the housing market.

Despite the relatively high cost of homes in our region, Gardner expects more Millennials to buy homes in 2018. They are getting older and more established in their careers, enabling them to save more money for a down payment. Many are also having children and are looking for a place to raise their family.

The tax reform bill will have a limited effect on our housing market.

The recent changes to the income tax structure will have an impact on homeowners, but Gardner does not believe that impact will be significant here.

-

-

The mortgage interest rate deduction will be capped at $750,000 – down from $1,000,000. But according to Gardner, just 4% of the mortgages in King County exceeded $750,000 in 2017. Most buyers of more expensive homes have been making larger down payments, or buying homes for cash.

-

Since the $1,000,000 mortgage deduction cap is grandfathered in for those who have already purchased a home, some homeowners may opt to stay put rather than move. That could result in fewer homes being placed on the market.

- The tax bill eliminates the deduction for interest on home equity loans. This is bound to slow down the trend of homeowners choosing to remodel their home rather than trying to find a new home our inventory-deprived market.

-

Bottom Line

The increase in home prices may moderate, but inventory will still be very tight. 2018 is on track to be a strong seller’s market.

This post was originally featured on the Windermere Eastside Blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.